Galeanu Mihai

Everybody wants to buy into company with a great outlook and a cheap valuation, but those opportunities are either exceedingly rare or even non-existent. Dealing with uncertainty is the name of the game, and in the words of Warren Buffett, it’s better to be approximately right than the be precisely wrong.

Unfortunately, that has been the case for many growth stocks, as many were priced for perfection, with everything having to go right for them for the investment thesis to work out.

This brings me to HP Inc. (NYSE:HPQ), which is seemingly in a tough business, but may actually prove to be a rewarding investment for those with a long-term outlook. This article highlights why the recent share price weakness presents a good entry point on the stock, so let’s get started.

Why HPQ?

HP Inc. is a leading provider of personal computers, printers, and related supplies. It came to its present form after the original Hewlett-Packard was split into HP Inc. and Hewlett Packard Enterprise (HPE), which focuses on products and services for enterprises.

It currently has a leadership position in the personal computer and printing markets. However, to be clear, HP is not without its challenges. The company is in the midst of a turnaround, and it’s going up against some tough competition, particularly from Apple (AAPL) in the premium notebook segment. Other headwinds include increasing adoption of mobile devices and fewer printing tasks being performed for technological and environmental concerns.

Nonetheless, PC demand has been more stable than expected, and HP Inc. has been gaining market share. This is being driven by its focus on premium notebooks, gaming laptops and 2-in-1s, which offer higher margins.

While volumes were down compared to robust work-from-home related sales last year, HP has been able to offset this with a continued mix shift towards commercial and premium models, which command higher prices. This is reflected by total revenue growing by 3.9% YoY (4.9% on a constant currency basis) during the second quarter (ended April 30, 2022), driven by Personal Systems revenue growing by 9% YoY (11% constant currency).

Looking forward, hybrid work environments may continue to drive strong commercial PC demand. HPQ may also see continued traction in the desktop-as-a-service as companies seek to offload hardware management duties, as noted by Morningstar in its recent analyst report.

The company’s growth focus areas of device-as-a-service, or DaaS, and expanding its gaming and premium product offerings should help stem losses from its core expertise of selling basic computer systems. Contractual service offerings like HP’s DaaS are alluring to businesses since IT teams can offload hardware management, receive analytics to proactively mitigate computer issues, and pay monthly instead of facing unpredictable large capital expenditures.

Moreover, HP Inc. isn’t just a pure-play on the consumer business, as some would believe, as it has a significant presence with commercial customers, which represent well over half of its revenue mix. This is a trend that’s increasing and HPQ may benefit from upcoming Windows 11 refresh cycle, as noted by management during the recent Bank of America (BAC) 2022 Global Technology Conference:

We see commercial now driving around 65% of our revenue mix, which is I think, a really good trend. And I would call it a trend because it’s actually increasing. And there are some really important drivers of that trend. The first is just the commercial refresh cycle that’s going on. We have, I don’t know, if you know, we’ve got about 400 million Win 10 PCs that are more than four years old.

So obviously, there’s a significant refresh opportunity for commercial there. And secondly, we’ve got Win 11, which has started to gather momentum. So we expect that all of that is going to drive the commercial. And then on top of that, I think what’s most exciting is really the hybrid secular trend, that’s clearly here to stay. I mean, I think we’re all generally landing on the fact that people are in the office about two to three days a week.

And so the need for commercial equipment and the need for commercial refresh, it’s going to get compounded through hybrid. And we see that as I said, we see that as a secular trend, that’s not going to go away, that’s going to become just the way of working in the norm of the future.

Meanwhile, HP Inc. maintains a solid BBB rated balance sheet and is aggressively returning cash to shareholders, with $1.3 billion in combined share repurchases and dividends in the fiscal second quarter alone. The 3.1% dividend is well-covered by a 21.5% payout ratio, and comes with a respectable 12.6% 5-year CAGR.

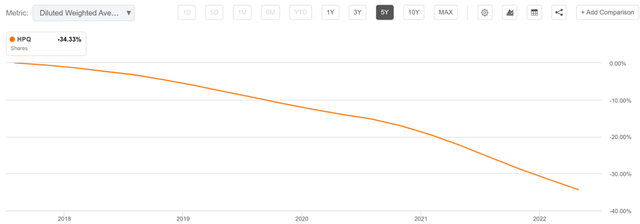

I find share repurchases to be rather accretive at the current share price of $32.11 with a forward PE of 7.4. This translates to an attractive earnings yield of 13.5%. As shown below, HPQ has reduced a staggering 34% of its outstanding shares over the past 5 years.

HPQ Shares Outstanding (Seeking Alpha)

HP stock has seen material weakness in recent weeks, falling from a high of $40 in early June. At the current price of $32, investors are getting a discount from the $34 handle that it traded at just before Berkshire Hathaway (BRK.A)(BRK.B) announced its 11.4% stake in the company. Lastly, sell side analysts have a consensus Buy rating on HPQ with an average price target of $36.69, implying a potential one-year 17% total return including dividends.

Investor Takeaway

HP Inc. has an enviable position atop the personal computing market, and it’s seeing promising trends in its commercial market. The company is aggressively returning cash to shareholders via share repurchases and dividends, and is trading at a discount to where it was just before Berkshire Hathaway announced its stake. As such, I find HP Inc. to be an interesting value proposition at the current share price.

Be the first to comment