Justin Sullivan

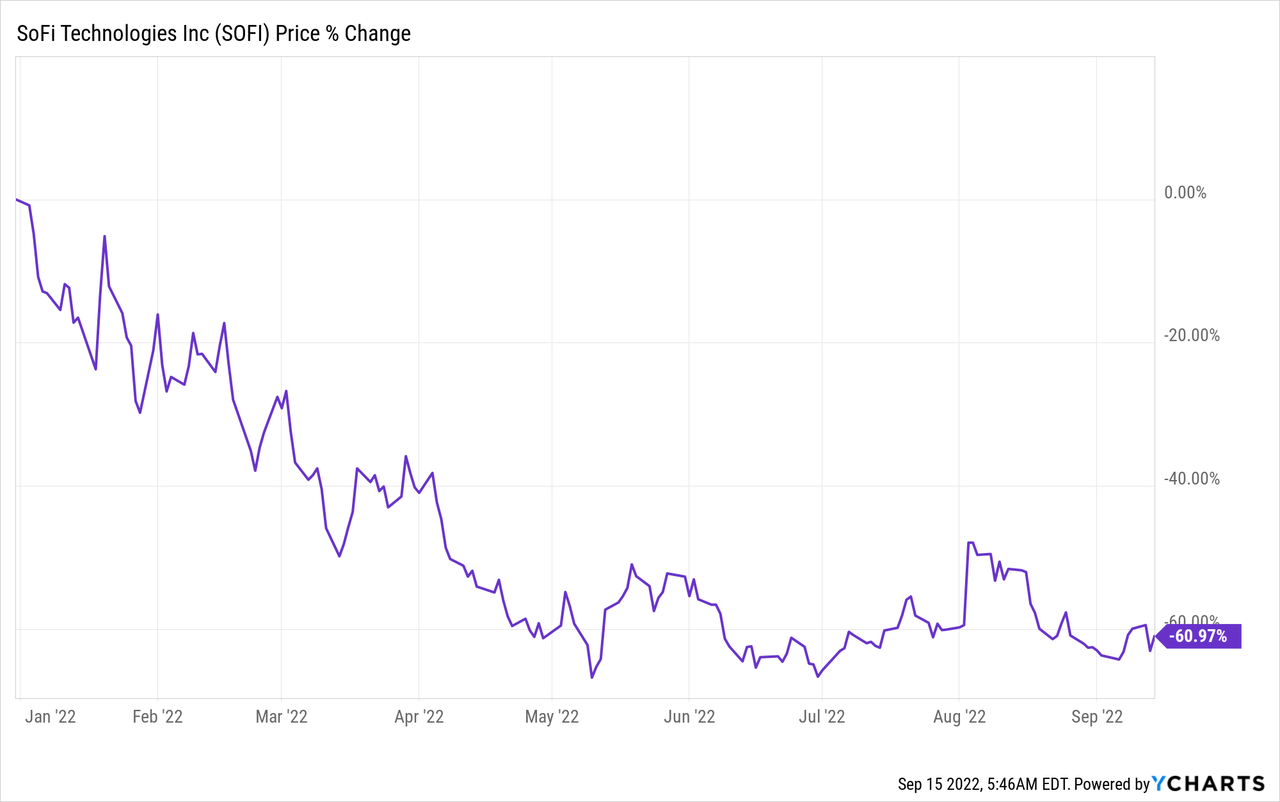

An investment in SoFi (NASDAQ:SOFI) has been a big disappointment in FY 2022. Year to date, shares in SoFi have lost 61% of their value due chiefly to challenges regarding the Federal Student Loan Payment Moratorium and moderating member growth post-pandemic… both of which resulted in a lowered guidance for FY 2022. However, with student loan payments set to resume in FY 2023, SoFi could see a rebound in its student loan origination business which only recently has been outperformed by personal loan originations. I estimate that SoFi could generate $200M in adjusted EBITDA in FY 2023, a near-doubling of estimated FY 2022 profits. While the stock is not totally cheap, the personal digital finance company’s growth is set to remain robust going forward!

Slowing growth, but still growing rapidly

The headline is not a contradiction. Companies can grow at high double-digits annually for a while before growth starts to moderate. The COVID-19 pandemic obviously was a huge benefit for SoFi during which the company tripled its member base.

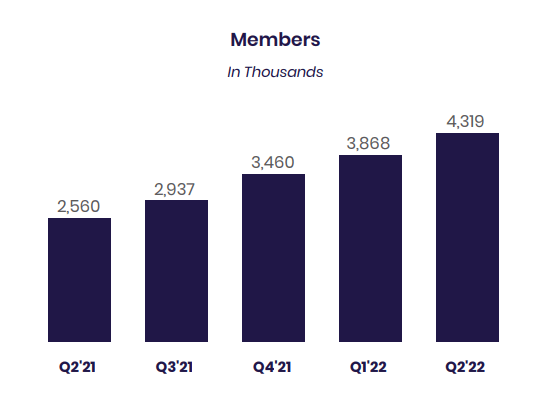

At the end of the second-quarter of 2022, SoFi had 4.3M customers in its ecosystem, showing 298% growth since the end of Q1’20 which saw just about 1.1M members using the SoFi platform. SoFi’s member growth peaked in Q2’21 at 113% year over year but since then growth has gradually slowed down. Still, in Q2’22 SoFi grew its member base 69% year over year and I believe the company could grow to close to 5M accounts on its platform by the end of the year.

SoFi: Member Growth

End of student loan moratorium set to increase SoFi’s earnings power

While the rate of membership growth will remain an important factor for SoFi’s top line and profit growth, the end of the Federal Student Loan Payment Moratorium, which is now widely expected to end in December 2022, clears the path for the resumption of student loan repayments and a higher share of student loans originations in SoFi’s business.

Due to the Federal Student Loan Payment Moratorium, SoFi’s student loan originations have dropped off sharply in 2022, but the drop was at least partly compensated for by higher originations in the personal loan category.

SoFi’s student loan originations dropped to just about $400M in Q2’22, which was less than half the origination volume in the year-earlier quarter and 25% below the average pre-pandemic volume. Originations of personal loans soared 91% year over year in the second-quarter, in part due to high inflation which is forcing a lot of people turning to credit to pay for necessities.

|

Originations ($m) |

Q2’21 |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Y/Y Growth |

|

Student Loans |

$859.5 |

$967.9 |

$1,461.4 |

$983.8 |

$398.7 |

-53.6% |

|

Personal Loans |

$1,294.4 |

$1,640.6 |

$1,646.3 |

$2,026.0 |

$2,471.8 |

91.0% |

|

Home Loans |

$792.2 |

$793.1 |

$657.3 |

$312.4 |

$332.0 |

-58.1% |

|

Total |

$2,946.1 |

$3,401.6 |

$3,765.0 |

$3,322.2 |

$3,202.5 |

8.7% |

(Source: Author)

As the moratorium ends, however, SoFi is likely to see a strong rebound in loan originations which has been a key driver of the platform’s growth before the pandemic. Since management assumed a resumption of student loans payments earlier this year, management thought it was possible to achieve adjusted EBITDA of around $180M. With student loans now expected to resume in FY 2023, SoFi’s earnings could reset to this level. Together with strong personal loan originations, I estimate that SoFi could generate $200M in adjusted EBITDA next year.

SoFi has guided for up to $109M in adjusted EBITDA in FY 2022 on net revenues of up to $1,513 million. The adjusted EBITDA margin is expected to be 6-7%, indicating that SoFi’s margins compared to FY 2021 are set to double… despite the student loan moratorium hurting profitability this year.

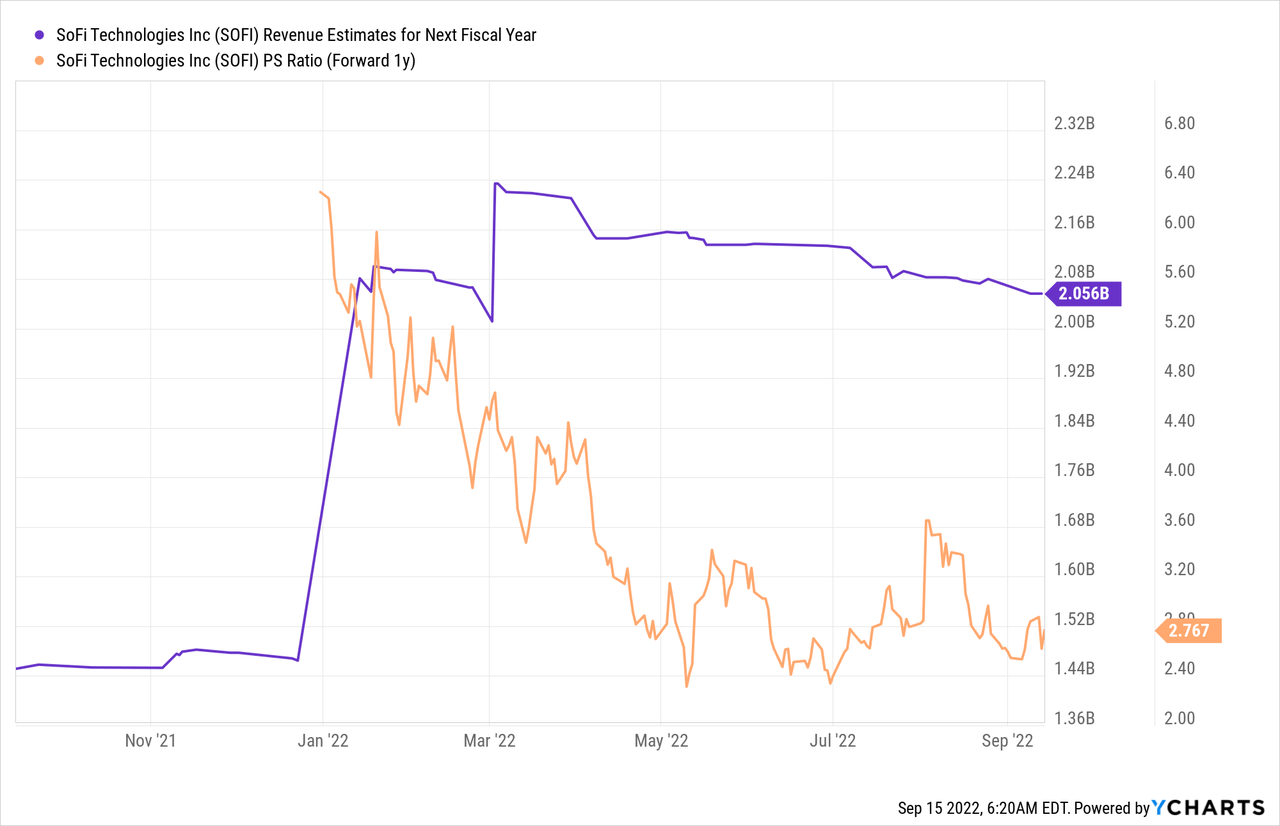

SoFi is widely expected to meet its revenue target in FY 2022. For next year, forward annual revenue estimates call for $2.1B in revenues, implying a 37% revenue growth rate year over year. With $200M in adjusted EBITDA, SoFi would be looking at an EBITDA margin of ~10%.

SoFi’s has a P-S ratio of only 2.8 X and the firm has a major case for upside revaluation related to the resumption of student loan repayments in FY 2023.

Risks with SoFi

SoFi’s two biggest risks are a slowdown in member growth which may decelerate more rapidly than expected. Secondly, another extension of the student loan moratorium (as unlikely as it is) would delay SoFi’s expected adjusted EBITDA growth and push it out further into the future.

There is also a risk regarding the increase in SoFi’s personal loan originations. If borrowers were to default on these personal loans, then SoFi would have to deal with a credit issue as well. This is not a problem for the personal finance company right now, but it could become one if consumers continue to feel the pressure from soaring inflation rates and default on their payment plans.

Final thoughts

The end of the Federal Student Loan Payment Moratorium at the end of the year could lead to a huge upswing in the personal digital finance company’s adjusted EBITDA next year. Because of the earnings catalyst, I doubled my dollar investment in SoFi. If the moratorium ends for good, SoFi could see up to $200M in adjusted EBITDA in FY 2023 which is about double what the firm is estimated to make this year!

Be the first to comment