Murilo Gualda /iStock via Getty Images

Written by Nick Ackerman. A version of this article was published to members of the Cash Builder Opportunities on May 23rd, 2022.

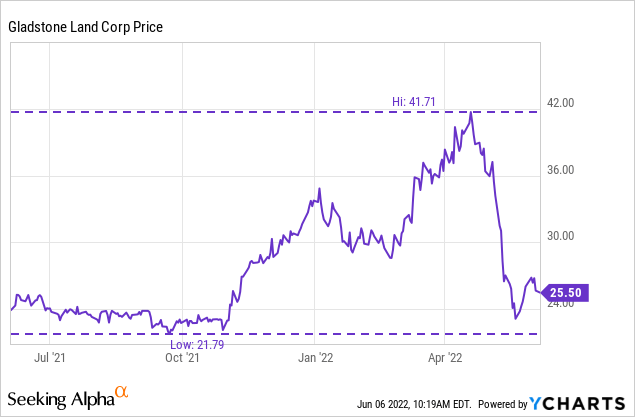

Gladstone Land Corporation (NASDAQ:LAND) seemed to have driven investors to go mad as they pushed the price way ahead of any decent valuation. Shares have fallen considerably from those loftier levels. It could still be argued that it is on the more expensive side but is much more reasonable at current levels than where we recently were.

Due to the underlying operations of owning, well, land, it could make sense in a high inflationary environment to give it some premium pricing. The REIT also pays out a monthly and growing dividend, that’s always worth a bit of a premium for income investors too.

Several years ago, my original purchase was picking up LAND at under $15. As it went over $30, I felt it was getting too rich and ended up closing my position with a GTC trailing stop order. It triggered at $30.36 in January of this year. It then continued to rise much more from there. So I ended up selling way too early but was still happy to lock in the profit.

What is LAND?

This REIT is fairly simple but unique at the same time. They invest in farmland all across the U.S. There aren’t too many publicly-traded REITs that I know of that specialize in this interesting area of the market. Farmland Partners (FPI) is another for investors to check out.

In the case of LAND, they “primarily target fruit and vegetable cropland in regions with established rental markets and strong operations.” Their goal is to “build the premier farmland real estate company focused on the ownership of high-quality farms and farm-related properties that are leased on a triple-net basis to tenants with a strong operating history and deep farming resources. All our farms have abundant water sources and are currently 100% occupied.”

This is all fairly straightforward, and most of the wording you would expect. The important points here are the triple-net basis and 100% occupied. These are actual data points and tell us more about LAND.

Additionally, having abundant water sources is important as that can be a real issue for some areas. With the general statement of “abundant” being subjective, it doesn’t give us a clear metric to work with, but management seems confident anyway. With the latest earnings, they made these comments:

We believe this reflects strongly on our pre-acquisition due diligence process, which always starts with a comprehensive water analysis. We continue to actively monitor the ongoing drought in the western U.S., and all of our farms continue to have sufficient water at this time.

Overall, LAND isn’t a massive REIT. The market cap comes in at less than a billion even – at around an $800 million market cap. Of course, this was recently meaningfully larger when the price touched over $42. This is similar to its competitor FPI at around a $740 million market cap.

At the end of 2021, they had 164 farms with total acres of 112,542 and farm acres of 93,326. The majority of the farms are in California, but a fair number are in Florida and Michigan as well.

Latest Earnings

With a bit of a background on this REIT, we can take a look at the latest quarter. They announced the results on May 10th. Diluted FFO came to $0.192, and the diluted AFFO came to $0.185. This was a 9.2% and 6.8% decrease from the prior quarter, respectively. However, it was still an increase from the year-ago period.

They posted operating revenue that was $19.943 million, a decline of 12.5% from the previous quarter. A primary reason for the revenue decline was the $3.4 million of participation rents recorded during the prior quarter. Looking back at the same quarter a year ago, it marked a 24.38% increase.

They are looking at more participation rents coming later this year.

We’re coming off a year in which we reported $5.2 million of participations from our last — from last rents and we have a few more farms with participation rents provisions scheduled to come online for this year that we didn’t have last year. So we’re optimistic of being able to report a good result for 2022.

The NAV per common share came to $15.54. That’s a fairly big gap from where shares are currently trading, but again, getting much closer with the latest decline.

The NAV was also an increase of 8.6% from the prior quarter and a 22.5% increase from the year-ago NAV of $12.69 in Q1 2021.

One way that REITs grow since they pay out the majority of their earnings is through more debt and equity. There was plenty of debt activity for the quarter as they received $5.1 million in new long-term borrowings. They have an “effective interest rate of 3.46% and are fixed for the next 9.2 years.” Given the current interest rate environment, that seems quite attractive. They have also raised their credit facility size by another $100 million long-term note.

On the equity side of the equation, they had sold 1,548,931 shares of their 6% Series C Cumulative Redeemable Preferred Stock, raising $35.2 million. The at-the-market program raised 310,055 shares common for proceeds of $10.3 million.

Interestingly, the Series C preferred doesn’t trade on the public markets. However, they also have 6% Series B Cumulative Redeemable Preferred Stock (LANDO) and 5% Series D Cumulative Term Preferred Stock (LANDM) that are available for trading throughout the day. Both are trading above their face value but have also recently come down a bit.

Looking For LAND Below $25

My primary target for picking up a position that I’m comfortable with is LAND at below $25. We briefly dipped below that level recently, but it came back up swiftly. It is down around 39.5% from its 52-week high, and at the $42.10, it was giving us a P/FFO of nearly 57 to give some context of where we are now.

Morningstar provides a fair value of $32.90. However, this is through an algorithm and not one of their analysts actually taking a look. One of the things I noticed when this is the case is that changes are generally brought about by its current price. Just on April 25th, 2022, Morningstar put the fair value of LAND at $36.93. So, taking this measurement here with a grain of salt.

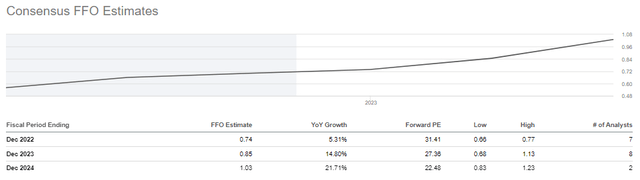

Going forward, analysts anticipate that LAND will grow FFO quite aggressively. That makes the forward P/FFO estimates much more attractive, which is why the stock can trade at a bit of a premium. If this growth is achieved, it won’t take too long for the earnings to catch up with the price. That is assuming it doesn’t jump up aggressively in price again. Despite the rest of the broader growth category of the market, LAND is in a different situation since it can be a natural defense against inflation.

LAND FFO Estimates (Seeking Alpha)

Adding LAND below $25 is attractive, but below $20 is possible here with the current market volatility. Even at $20, we are looking at a P/FFO of 27 times.

Conclusion

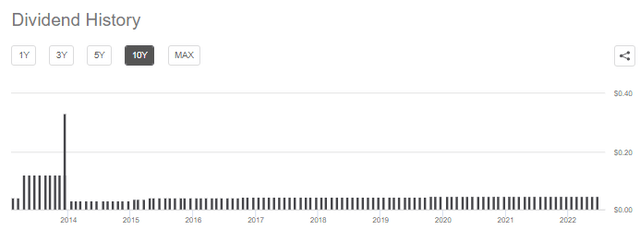

LAND has a monthly dividend that has been growing since 2014. The latest monthly amount is $0.0454. Annualized, that dividend comes out to $0.5448. Against the $0.70 FFO they’ve provided over the last rolling four quarters, we get a payout ratio of 77.8%.

LAND Dividend History (Seeking Alpha)

From the chart above, it might appear a bit strange that they cut massively in 2013. However, this was explained when they initiated the monthly $0.03 dividend starting in 2014.

The Company had previously been paying a monthly dividend of $0.12 per share during 2013 in order to distribute its historic accumulated earnings and profits so it would be eligible to declare status as a real estate investment trust. All such historical accumulated earnings and profits have now been fully distributed.

This is also why LAND paid out a one-time distribution of $0.33. This means 7 years of continuous growth. While it hasn’t been staggering growth, it has been growth nonetheless.

LAND is getting back to a much more reasonable valuation again. The stock had run up to nosebleed levels. While it is still on the more expensive side, it is much more reasonable closer to $25. Ideally, I would want to pick up shares under $25 and get a great deal at around $20. The latest earnings and outlook all appear quite attractive, in my opinion.

Be the first to comment