luza studios

Investment Thesis

Catalent, Inc. (NYSE:CTLT) is a developer and manufacturer of consumer wellness, gene and cell therapy, protein-based biologic drugs, and pharmaceuticals drugs. The company has recently expanded its primary packaging capabilities at its clinical supply facility in Shiga, Japan. I believe this agreement could be a primary growth catalyst in the company’s revenue growth.

Company Overview

CTLT creates and produces goods for consumer wellness, gene and cell therapy, protein-based biologic drugs, and pharmaceuticals on four continents. The company offers its services to businesses in the pharmaceutical, biotechnology, and consumer health sectors, as well as companies in medical equipment, veterinary medicine, and personal care products. The company operates through four segments: Biologics, Oral & Specialty Delivery, Softgel & Oral Technologies, and Clinical Supply Services. The Biologics segment contributes the most significant chunk of 53.3% of the total revenue, while the second largest segment is Softgel & Oral Technologies, which constitutes 25.4% of net sales. Oral & Specialty Delivery generates 12.9% of the total revenue, and Clinical Supply Services is the smallest contributor with 8.4%. The Biologics segment is experiencing high demand due to the covid-19, and Softgel & Oral Technologies’ revenue growth is driven by the rising demand for prescription products & consumer health products and Bettera acquisition. The Clinical Supply Services segment’s growth is driven by the expansion in production and packaging offerings in North America. Oral & Specialty Delivery is experiencing high demand for early phase development programs.

Recently the company announced a new operating structure in which the company has consolidated the four segments into two: Biologics and Pharmaceuticals & Consumer Health. The company decided to make this change to provide streamlined and integrated services. I think this restructuring will give more operational flexibility, and synergized commercial strategies can accelerate the company’s growth in the coming period. The company has also made some leadership changes. Jonathan Arnold will serve as Senior Vice President, Chief Commercial Officer, and Head of Transformation instead of President, Oral & Specialty Delivery. Steven Fasman will be Executive Vice President and Chief Administrative Officer, and Karen Flynn will retire from her role as Catalent’s Senior Vice President and Chief Commercial Officer.

The corporation invests $175 million to develop its Kentucky production facility for large-scale oral dosage forms. According to the company, this development will increase capacity for various activities, such as dual fill encapsulation and pan coating, packaging, and analytical services. It has also spent $160 million to acquire a production facility under construction for the biologics segment. The company has also expanded its primary packaging capabilities in Japan which can act as primary growth factor in coming years.

Expansion of Primary Packaging Capabilities

Recently, the company announced that its clinical supply facility in Shiga, Japan, has expanded its primary packaging capabilities. The company has added a high-speed blister packaging line which will align with the current automated bottling line. The new blister packing machinery is the same as that used throughout Catalent’s ecosystem of medical supply services, giving customers working on this project anywhere in the world the most flexibility and access. Now, the company can offer a comprehensive and customizable range of services in the Asia-Pacific medical supply services system and target the rising demand for primary packaging in Japan. I think the newly added capabilities can strengthen the company’s hold in the global market. I believe this expansion might act as a primary growth factor for the company’s future growth as it can significantly grow its earnings in the coming years.

Key Risk Factor

High Debt: The size of CTLT’s long-term debt obligation could have a detrimental impact on the company’s future performance. It had $4.15 billion in long-term debt as of March 31, 2022. High debt levels result in a heavier burden of interest payments. Due to the recent rate increases, there will be more interest to pay, which will reduce profit margins. In the future, I think the company will need to deal with this problem to guarantee efficient operations and higher profit margins.

Quant Rating and Valuation

Seeking Alpha

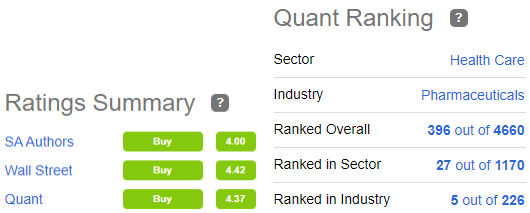

Seeking Alpha has a Quant rating of buy for CTLT. The Quant ratings align with my recommendation of a buy for CTLT. Wall Street also has a buy rating for the stock, further strengthening my thesis. I also want to highlight that the company is ranked 5 out of 226 as per Quant rankings. I believe the company has growth factors that will help it sustain these ratings in the coming years.

CTLT has a market cap of $20 billion and is currently trading at a price of $108.75, a YTD decline of 12.7%. It is trading at a PE multiple of 28x, with the market’s FY22 EPS estimates of $3.80. I believe the market EPS estimates are conservative, and I estimate FY22 EPS to be $4.10-$4.20. The company might seem expensive on the PE multiple, but the company has a PEG ratio of 1.74x as against the sector median of 2.02x. PEG ratio is generally calculated for the growth companies, and CTLT is trading at a cheaper valuation in terms of PEG multiple. We can see a significant upside in the stock price from current price levels.

Conclusion

The expansion of primary packaging capabilities in Japan is expected to drive significant growth for the company in coming years. CTLT is trading at an attractive valuation in terms of PEG multiple. I believe the company is a good growth investment opportunity in the market. I assign a buy rating for CTLT after considering all the risk and growth factors.

Be the first to comment