Stockfoo

It’s been about 21 months since I wrote my bearish piece about Twitter Inc. (NYSE:TWTR), and in that time the shares are down about 19% against a gain of ~14.4% for the S&P 500. I thought I’d check on the name again for a few reasons. First, and most importantly by far, I love to highlight my wins because that gives me a chance to brag. I’m a small man, and I revel in this childish, deeply insecure behavior. Second, the company is about to report earnings again, so I thought I’d try to work out whether or not it makes sense to buy at current prices. After all, a stock trading at $39.5 is, by definition, a less risky investment than when that stock’s trading at $49. I’ll make that determination by looking at the most recent financial performance here, paying particular attention to the valuation allowance that I highlighted in my previous work on this name. In addition, I want to look at the stock as a thing distinct from the underlying business.

We’re all busy. I imagine all of you have to decide whether to take your private planes to Necker Island or Lake Como for the weekend. I also imagine you’re all trying to decide which supermodel to take to dinner tonight. For my part, I’ve got a long day of cat videos and Young and the Restless ahead of me, so we all have an incentive to get this done quickly. For that reason, I’m going to distill my thoughts as neatly as possible in this “thesis statement” paragraph. This paragraph is for people who want a bit more than the title and bullet points above, but a great deal less of the “Doyle mojo” than is contained in the entire article. Here goes. I’m of the view that the financial performance here has been bad, and management is telegraphing further weakness as evidenced by the expanded valuation allowance. You may recall that I made a big deal of the valuation allowance in my previous article, and it’s even larger now. Further, I think management overpaid to retire stock to the treasury during the first part of the year. In spite of all of this, the valuation remains elevated, so I think this investment makes no sense at current levels. For those who want to speculate on the possibility that Musk will be obliged to buy this company, I think call options make much more sense than shares. These give you most of the upside “flavor” at far less risk “calories.” If, as I expect, the shares continue to languish from current levels, you won’t be out by as much. If the shares rise in price from here, you’ll capture most of that upside. Thus, I think calls are the superior investment for bulls at this point because of this asymmetric payoff.

My Biases And What Not to Expect Here

In my experience, trying to decide how a legal case will work out is a fool’s errand. I’ve listened to dozens of learned legal scholars debate and come to diametrically opposed perspectives on a given issue. For that reason, I don’t put much faith in people who talk about what will inevitably happen in a court case between a billionaire and a multi billion dollar corporation. There are plans within plans that, quite frankly, none of us are privy to. For instance, I came upon an interesting suggestion that Musk used the potential purchase as a way to sell Tesla stock without spooking the market. According to this analysis, he was always planning on walking away from the deal, and the walkaway fee was a cost of selling Tesla stock in a manner that would keep Tesla shareholders mollified. Maybe so, maybe not. Either way, the reasonableness of this thesis suggests it’s perilous trying to predict the outcome of the legal skirmish here.

Also, I confess that I just don’t find Elon Musk all that interesting, so I have even less interest in chronicling the drama here. It’s nothing against Musk per se, but I never found business moguls very interesting. In a previous life I had the opportunity to meet a few famous business moguls and the cult of personality around these people struck me as strange. This is because I quickly formed the impression that the ones I met had all of the charm, insight, and charisma of a three day old ham sandwich you’d buy at a small town bus terminal. I particularly don’t get our collective fascination with business moguls.

So, I’m going to work out whether or not this is a good investment based only on what’s known at the moment. As I suggested above, if people want to speculate about the Musk-Tesla deal, I would recommend calls.

Financial Snapshot

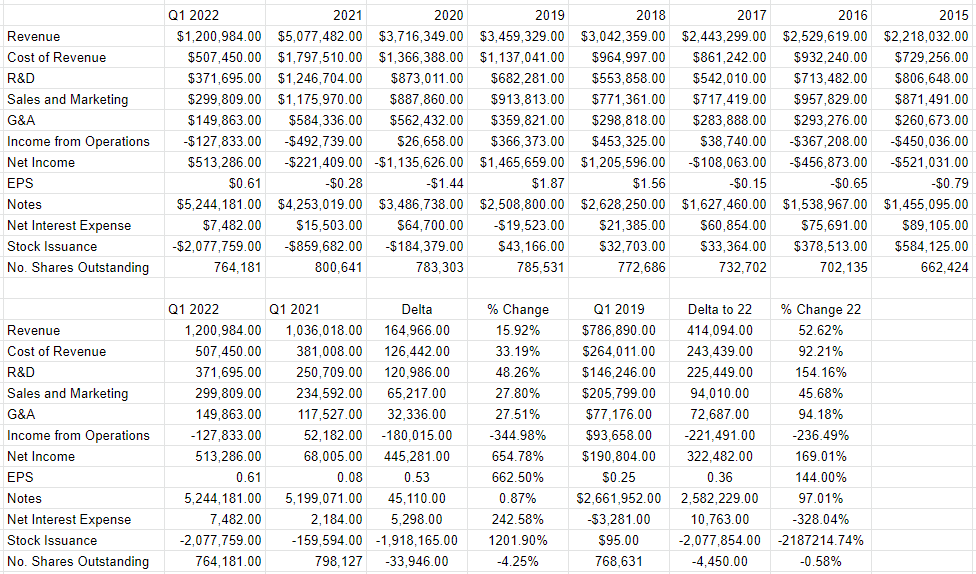

In my estimation, the financial performance over the most recent quarter is fairly bad. In spite of the fact that revenue is about 16% higher this quarter relative to the same period a year ago, income from operations has swung from a $52.2 million gain to a $127.8 million loss. To be fair, net income jumped from $68 million to $513 million, but that was largely the consequence of a $970.4 million gain on an asset sale. In my view, a disconnect between revenue and net income is always concerning, because it raises a very reasonable question: if growing sales doesn’t lead to growing net income, what does? At this point I’d like to remind investors here that they’re compensated with earnings and not revenue. Owners (i.e. shareholders) are compensated with whatever’s left over after suppliers, employees, governments, landlords etc. are paid. In case you’re concerned that I’m comparing the most recent quarter to an outlier year, fret no further. In order to put the current quarter into greater context, I compared the most recent quarter to the same period in 2019. I went this far back in time in order to scrub any impact of the pandemic. When compared to the same period in 2019, things look equally dire in my view. While revenue in 2022 was ~53% higher than it was in 2019, income from operations was about $221.5 million lower. To add salt to the wound, while they were losing money, the company spent ~$2.077 billion of owner wealth buying back stock.

The Buyback

According to the cash flow statement of the latest 10-Q, the company spent $2.077 billion repurchasing stock during the first quarter alone. We see from the first page of the same document that on April 22 there were 764,180,688 shares outstanding. We see from the first page of the latest 10-K that as of February 10, 2022, there were 800,641,166 shares outstanding. Employing one of the skills not so lovingly imparted to me by the nuns at Holy Spirit School many, many, many decades ago reveals to me that between February 10 of 2022, and April 22 of 2022, the company retired 36,460,478 shares to treasury. Using another arithmetic skill that was beaten into me somewhat later, I’ve been able to work out that the company spent an average of about $56.98 per share to retire each of these. In fairness, the timing here doesn’t line up perfectly. The amount spent was in the period January 1 to March 31. The beginning and ending stock amounts were offset by a few weeks. Thus, the $56.98 figure is only approximate, but I think it’s approximately correct.

I’m different from some investors in that I don’t judge a buyback as being ‘good” if it happened at an average price below the current market price, and I don’t judge it as “bad” if the opposite is true. After all, we’re all here on a site whose reason for existing is to call into question the wisdom of the current market price. Thus, I don’t think it makes sense to anchor on the current price when judging these. I’ll judge whether this was a good use of owner capital by looking at the valuation at which these shares were retired. I’ll do that in the “stock” section below, so for now please put a pin in the $56.98 number.

The Valuation Allowance

As I’m sure you remember from the trauma of accounting class, a valuation allowance is a reserve account that’s used to offset the value of a deferred tax asset. That account is established when management has good reason to believe that the deferred tax asset in question will not be realized. This is typically because the company will not generate sufficient future profit to benefit from the deferred tax assets. It’s a bad sign in my estimation because it telegraphs the fact that management itself is not confident about the future. The bigger the valuation allowance, the larger the problem. As of March 31, the company had a valuation allowance of $1.42 billion. This is up slightly from the end of 2021 when the valuation allowance was $1.41 billion. When I last wrote about the business, the valuation allowance was valued at ~$1.1 billion. In case you’re less comfortable with the idea of valuation allowances, there are some great online resources that offer very clear refreshers.

All of the above suggests to me that the shares will need to be quite cheap to get me excited.

Twitter Financials (Twitter investor relations)

The Stock

Some of you who follow me for some reason know that this is the point in the article when I turn into even more of a “Debbie downer” than usual. It’s here where I start writing about risk-adjusted returns, and how even the stock of a decent business can be a terrible investment at the wrong price. A company can make a great deal of money, but the investment can still be a terrible one if the shares are too richly priced. This is because all businesses are essentially just organizations that take a bunch of inputs, add value to them, and then sell products or services (hopefully) for a profit. The stock, on the other hand, is an instrument whose changing prices reflect more about the mood of the crowd than anything to do with the business. The stock price is governed by a pretty capricious crowd, and moves up and down much more rapidly than what you’d expect if it were a perfect proxy for the business. Additionally, the stock gets thrown around based on people’s changing views of the market for stocks in general. In my experience, the only way to make money investing in stocks over the long haul is to spot discrepancies between expectations about future performance and current price. You want to buy stocks where the expectations are particularly sour, because when the company surprises on the upside, the stock pops in price. Put another way, you want to buy stocks when they are cheaply priced relative to their future potential.

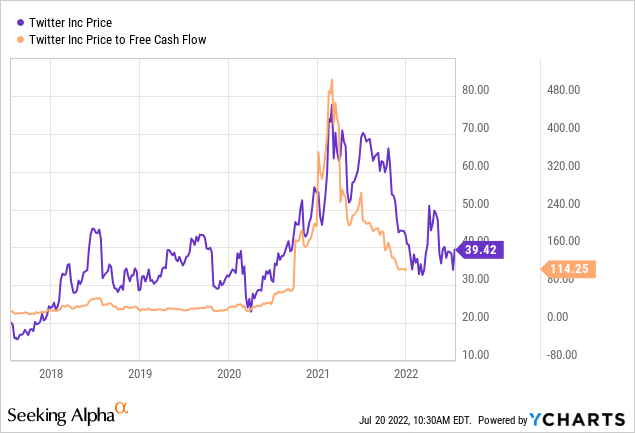

My regulars readers know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive, I recommended avoiding this name because the price to free cash flow was sitting around 80 times. We see from the following that the last time the company had positive cash flow, the shares were even more excessively priced.

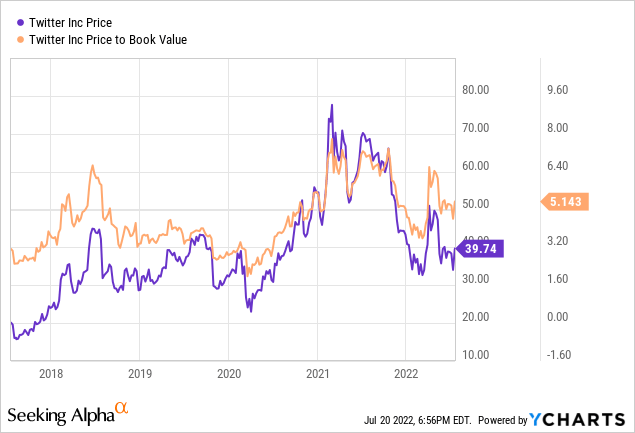

Additionally, we can see from the following that the shares are neither overly cheap nor overly expensive per the following:

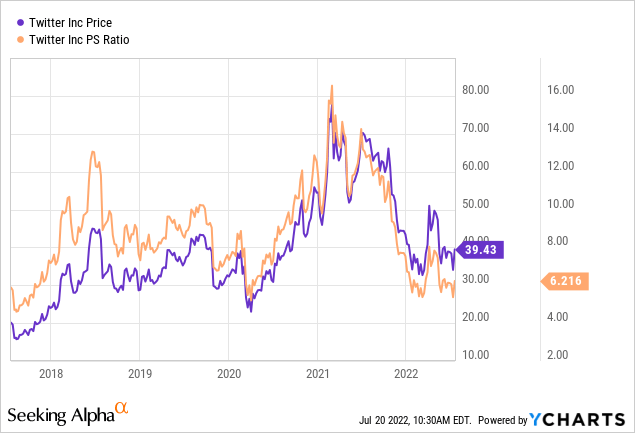

In fairness, the shares are relatively cheap on a price to sales basis, but the fact is that the market is still paying about $6.22 for $1 of sales for this company. That is very rich relative to the overall market in my view.

Given the above, I can’t recommend buying at current prices, and would recommend investors continue to eschew this name until either the shares drop massively in price, and/or the company starts earning a great deal of money.

Reviewing the Buyback

You may recall that I determined that the company spent ~$2.77 billion buying back shares at an average price of approximately $56.98. Given that we’ve just reviewed valuations, it’s time to consider this purchase price, to see if management retired shares at a “good” or “bad” price.

That figure works out to a price to sales ratio of about 9 times, and a price to book ratio of about 7.4 times. Given this, I’m of the view that the company spent way too much money on buybacks during the first quarter. This owner capital could have been much more effectively deployed elsewhere. This is yet another reason why I don’t happen to like these shares at current prices.

Options As Alternative

Just because I don’t think this investment makes sense, and just because I see evidence that management is telegraphing that earnings will go down with these valuation allowances, doesn’t mean the crowd can’t drive the shares higher. I’m of the view that it’s a free country, and if you want to buy this stock based on the possibility that someone will be obliged to pay $44 billion for this company. Just because I’m too much of a cynic to put too much weight on the word of someone who stands to benefit handsomely from a deal consummating doesn’t mean you should be. I would humbly suggest that if that’s your reason for investing in this money losing enterprise, though, you’ve moved from the domain of “investing” into the domain of “speculation.” If speculation is your thing, have I got the product for you: call options.

In my view, call options are the perfect vehicle for people who see some upside here because they’re confident about legal outcomes. Such people may recognize that legal battles are unpredictable, though, so they may not want to risk too much capital. Call options are perfect for this position because they give the holder most of the upside “flavor” at a fraction of the risk “calories.”

My favorite of these at the moment is the October call with a strike of $40. These are currently priced at $4.30-$4.95. So, for about 12.5% of the capital, an investor will capture most of any upside from this stock over the next three months. If the shares drop in price, the loss will be less painful. Thus, I think if you insist on taking a long position here, I would recommend these as an alternative. While I won’t buy any of these myself, I would recommend that people who insist on staying long here buy these calls in lieu of shares. They offer similar upside at much less downside.

Conclusion

I don’t think there’s much reason to buy this stock at current prices. The company continues to lose money, and management is telegraphing likely continued losses via the valuation allowance. Further, the company overpaid to retire shares to treasury during the first part of the year. In spite of the fact that the company’s operating income is lower now than it was in both 2021 and 2019, the shares remain richly priced. That said, there’s always a chance that the crowd will drive these shares higher based on the legal zigs and zags between Mr. Musk and the company. If people are bullish based on that, I would recommend employing calls rather than stock. The calls give much of the upside at much lower risk.

Be the first to comment