Noah Sauve/iStock Editorial via Getty Images

Intro & Thesis

Whenever I want to go to the movies, I always look for an IMAX Corporation (NYSE:IMAX) theatre. IMAX is hands down the best movie experience. I think IMAX has a fantastic moat. “Invest in what you know & use” has been written countless times. In many instances, this would be true. I shop at Costco (COST) & have subscribed to Netflix (NFLX) since 2004. I drink Celsius (CELH) every week, which I wrote about here. But just because I drive a Mustang doesn’t mean I want to own Ford (F).

My research into the company left me disappointed. Currently, IMAX is priced as a company that is growing. But when compared to the pre-Pandemic levels, the company is not growing. In fact, it has not yet even recovered. Prior to the Pandemic, the company was not growing its top line significantly either. I could consider adding IMAX to my portfolio, but not at its current price. IMAX does have some tailwinds in its favor. So even though the company isn’t a buy, it’s also a risky short as well. I will explain how below.

The Company

IMAX partners with various movie outlets to deliver the best movie experience. These partners include names such as AMC Entertainment (AMC), Cineworld Group (OTCPK:CNNWF), Regal & others. Although the company operates is in the movie business, it has far less exposure to its fluctuations.

As stated in their 10-K, movie theatre attendance comprises only a piece of their revenue whereas its partners such as AMC are much more dependent on it. Theatre companies purchase equipment from IMAX as well as share its revenue. This B2B position puts IMAX in the expense column of the movie business. Therefore, it has limited upside when the movie business thrives. Since IMAX doesn’t own any movie theaters or buildings, it has far less exposure to any declines in movie ticket sales.

Financials

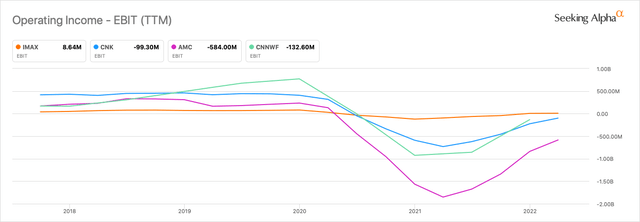

It is no surprise that the company was badly damaged from COVID 19. Although the company appears to be growing, the TTM revenue is still -30% of 2019 revenue. I was surprised by how much worse other movie theater company’s financials performed. The chart below shoes IMAX’s income compared to other publicly traded movie stocks before, during & after the Pandemic. For the last 10 quarters, operating income recorded a loss in 8 of them.

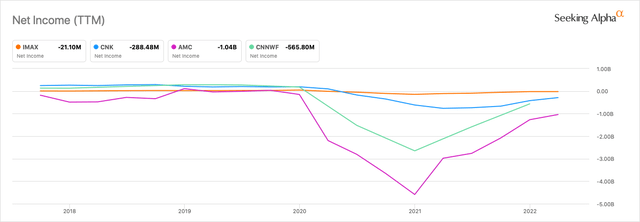

However, the business model for IMAX sheltered it from the devastation of the Pandemic. As you can see in the charts below, other movie theater companies lost hundreds of millions & billions of dollars.

5 Year Operating Income (SeekingAlpha)

5 Year Net Income (SeekingAlpha)

IMAX’s cash on hand also causes concern. Even though the company is “growing” over the last 5 quarters, cash is also steadily depleting. The amount of cash on hand is not severely alarming for a typical business, nor is the decline. But for a business that is not profitable & yet to recover, I would not ignore the decline in cash. IMAX went into serious debt to get through the Pandemic. In 2020 total liabilities more than doubled from 2019 as well.

Another cause for concern was the lack of growth & profitability before the pandemic. Sales haven’t grown significantly since 2015. Although sales have not grown by much, the company did have some operating income growth during the same period. This demonstrates efficiency, but I would prefer to see efficiency with growing sales as well.

Looking Forward

IMAX does not have significant growth due to the nature of the business. Although the company is selling its products to new theaters, the company has limited diversification ability. For example, CEO Rich Gelfond states that IMAX partnered with iHeartRadio for December’s Jingle Ball concert, which is an annual tradition in NYC. Branching into other businesses shows initiative, but this concert is a one-time annual event. Other events such as Pink Floyd performances are irregular & I do not see them generating significant recurring revenue. This development could have significant upside should IMAX get itself involved in every concert, but so far this concept seems to be in testing phase.

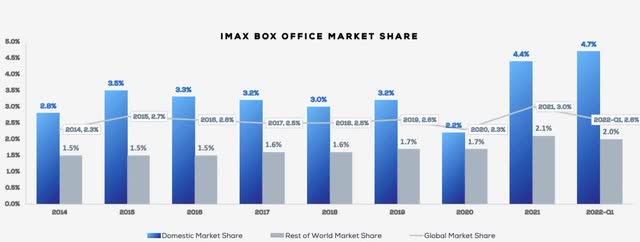

IMAX’s growth in market share is also miniscule. Although market share varies with each movie, total market share of Box Office in the US grew to 4.7% from 4.4% YOY. This is only a 7% increase. As the chart below shows, that market share fluctuates & is inconsistent.

IMAX Market Share (IMAX)

The movie business is also not as prominent as it once was in the US, so I would not rely on tailwinds pushing IMAX’s business higher. One might wonder how the movie business isn’t prominent with record setting Box Office movies coming out over the last few years. But those figures are very misleading. Because these figures are measured in Box Office dollars instead of number of tickets sold, they paint a more optimistic picture than actually exists.

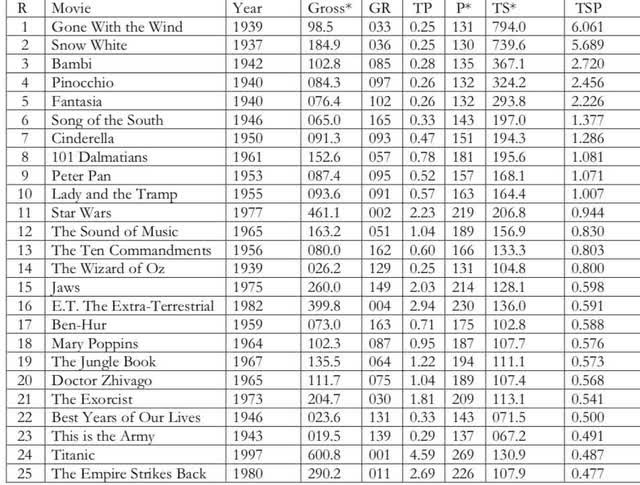

Personally I think the CPI is highly inaccurate & the figures do not display an accurate picture of movie ticket sales. There is a great deal of debate about the accuracy of the CPI to reflect inflation, which is a whole other topic for another article. So, I will include a study that shows movie tickets sold measured against population growth of the country & cost per ticket. Although this study is from 2004, it shows the severity of this situation.

For example, Titanic was ranked #1 for gross ticket sales at the time. But when measurements include price per ticket & total population, Titanic then sinks to #24… pun intended. Titanic sold 130M tickets. Gone with the Wind which debuted almost 60 years earlier sold 794M tickets. This is 500% more tickets sold with 54% less potential viewers.

Movie Ticket Study (USI.edu)

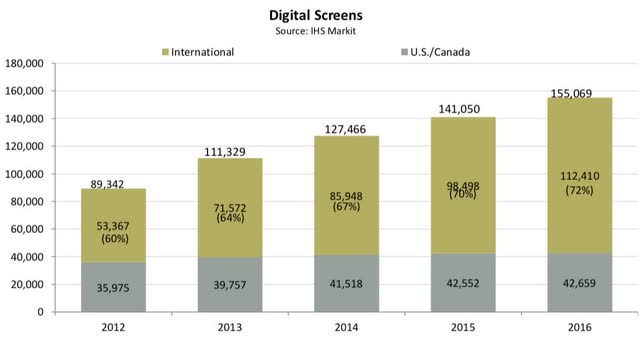

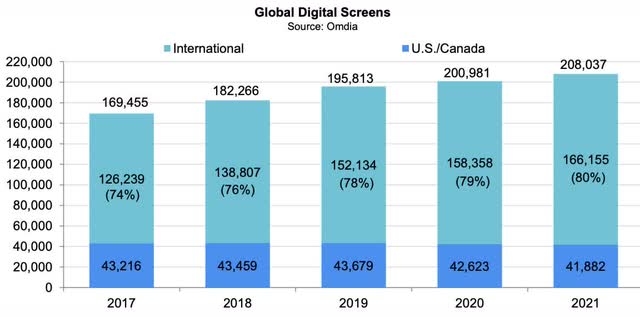

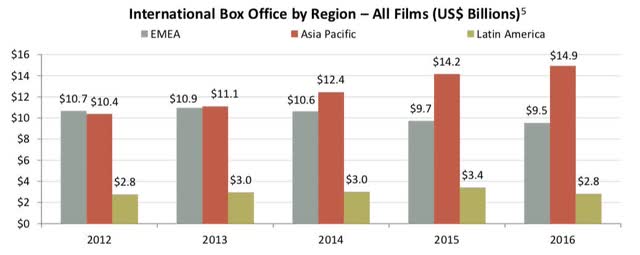

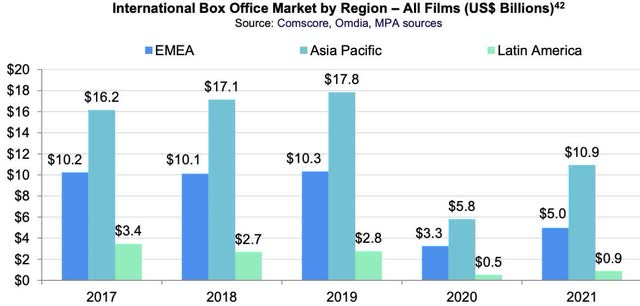

Even though movie theaters are not as prominent in the US as they once were, that is not necessarily true worldwide. Digital Screens are being installed worldwide at a much faster rate than in the US. Digital Screens internationally now compose 80% of all digital screens. Growth is especially prominent in the Asian market & EMEA. This most recent motion pictures Theme Report shows the domestic & international box office sales market. the study also shows at home entertainment is far outpacing physical (in theater) market. This is a headwind for IMAX. But the international sales growth of both Box Office & digital screens is still growing despite the at home entertainment growth.

Digital Screens 2012 – 2016 (MotionPictures.org)

Digital Screens 2017 – 2021 (MotionPictures.org)

International Box Office Sales 2012 – 2016 (MotionPictures.org)

InternationalBox Office Sales 2017 – 2021 (MotionPictures.org)

So Is IMAX A Buy Or Sell?

This question does not have such a simple answer. The business model limits IMAX’s risk. This should ease defensive investor concerns to possible losses. This limit to the downturns of the industry proved itself throughout the Pandemic & minimized the company’s downside & losses.

I would consider a long investment in IMAX, but not at this price. IMAX currently sits at a FWD P/E of 35 which is a good valuation for a company in growth. But the company is not growing, it is recovering. The company’s TTM sales of $276M is still 30% lower than the pre-Pandemic TTM figure of $396M in September of 2019. The TTM operating income of $8.6M is 89% lower than December 2019 TTM. AMC CEO Adam Aron was quoted saying the movie business would not recover until 2025. So I do not expect a major increase in stock price because of the company’s actions. However, a bull market could lift the company’s stock in inflation eases & any possible recessions are mild.

IMAX is also a risky short. The movie business is no longer as dominant as it used to be, but it is not dying in the US. Although international at-home entertainment is growing at a faster rate than Box Office entertainment, the latter’s growth is still worth noting. IMAX is the preferred way to experience a new film worldwide. This emerging market growth makes me hesitant to place a short on IMAX. But should international growth slow, it may be a catalyst for the stock price to fall.

Be the first to comment