Eoneren

You’d be right to consider SuRo Capital (NASDAQ:SSSS) as undervalued against its current 47% discount to its last announced $7.83 net asset value per share. But the NAV is down sequentially from $9.24 in the second quarter and from $14.79 in the year-ago comp. This tale of a constantly declining NAV portends a NAV-based investment strategy in SuRo. The protracted discount to NAV exists because the broader macro conditions have not supported a stabilization of what remains an investment portfolio that’s been fully vulnerable to the risk-off sentiment of the equity capital market.

To be clear, the market thinks NAV will continue to decline. Indeed, the current dire macroeconomic conditions are likely to persist into 2023 with interest rates set to rise further on the back of elevated inflationary pressures set to tip the US economy into a recession. This will drive a continued repricing of private securities to the downside and will shrink the current gap between common shares and NAV as it would reduce the fair value of SuRo’s investment portfolio. However, the company held cash and equivalents of $140 million as of the end of its last reported fiscal 2022 third quarter. This places the 67% year-to-date pullback of the commons in context. SuRo’s market cap is now 84% of its liquidity position and should allow management to take advantage of down rounds to add new late-stage and fast-growing companies to its investment portfolio.

However, whilst SuRo should be commended for trying to return capital to shareholders in the form of share buybacks, the 3 million shares bought back this year are all trading below cost. The company most recently completed a Dutch auction tender offer to repurchase 2 million shares at $6.60 per share against common shares that are currently trading hands at $4.16 per share. The buyback was completed using available cash on hand and represented 6.6% of shares outstanding. It creates a conundrum because it makes sense for the company to acquire its own shares when they’re trading at a discount to NAV. This has become jarring as the Dutch offer was announced after the end of the second quarter against NAV which was 18% higher than its current level.

An Attractive Investment Portfolio But Ugly Capital Market Backdrop

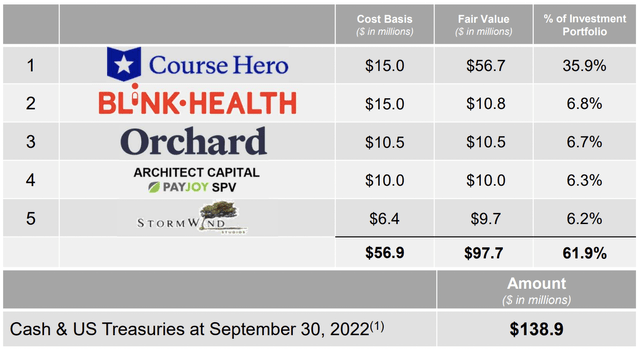

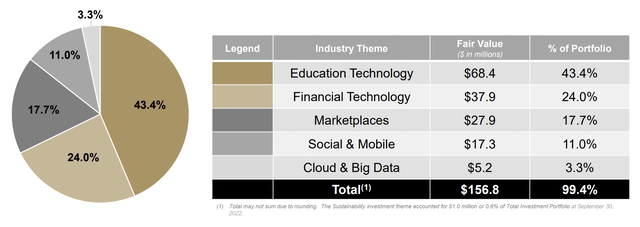

As of the end of its last reported quarter, SuRo held positions in 39 portfolio companies of which 32 were private and 7 were publicly traded. The total fair value of the portfolio stood at $157.7 million with the top five positions in the portfolio accounting for approximately 62% of the total portfolio at fair value.

Course Hero is a peer-to-peer marketplace for educational resources and expert tutors and formed its largest holding at 36% of the portfolio. Current unrealized gains on the digital education resource provider stand at $41.7 million.

Blink Health which formed the second largest position is a digital health company that enables patients to access lower prices for their prescriptions. The startup formed 6.8% of the investment portfolio and is currently sitting on unrealized losses of $4.2 million.

Net realized loss on investments stood at $5.1 million during the quarter with a $5.3 million loss from an investment in Enjoy Technology driving the bulk of these losses. The retail startup only went public via SPAC in October last year but filed for chapter 11 bankruptcy less than a year after this. This loss was partially offset by a realized gain of $300,000 on dog walking app Rover (ROVR).

Rockets Don’t Yet Go To Mars

The returns of VC investments have historically hinged on a small number of rockets. This describes a situation where a small number of positions within a larger portfolio drives the majority of positive returns, similar to the Pareto principle. SuRo’s investment themes look attractive and its largest position continues to see healthy growth.

SuRo needs its top positions to become rockets if it’s to escape its current malaise. But this will be difficult against a rising interest rate environment and declining investor appetite for the type of high-growth but loss-making companies that make up the bulk of the investment portfolio. The outlook for next year also does not look great with some economists pencilling in a recession in the second half of the year. This will come on the back of inflation that remains sticky and Fed hawkishness. The prospect of a prolonged global recession would of course further close off points of exit for its investments with the SPAC and IPO market remaining anaemic.

Prudent and conservative management of the current cash position is important and SuRo might want to consider pausing then backloading what remains $16.4 million in authorized funds on its share repurchase program. Critically, whether the company is undervalued depends on how attractive investors consider its investment portfolio. A quick bounce-back in fair value could happen once current extreme economic conditions normalize. The company is not a buy until this happens.

Be the first to comment