TanyaSid/iStock via Getty Images

Oatly (NASDAQ:OTLY) is positioned to become the number one plant-based milk company globally, but the company is currently facing high costs and a limited cash runway. Oatly must insource production and realize economies of scale in coming quarters or may need to raise capital under extremely unfavorable circumstances. Assuming the company can transition to cashflow breakeven without diluting existing shareholders, the long-term success of the company is largely dependent on their ability to remain a differentiated premium product in the eyes of consumers.

Market

The global dairy market food retain channel was estimated to be worth approximately 630 billion USD in 2021, and is expected to increase at a 5.9% CAGR through to 2025. Plant-based dairy has approximately a 3% share of this market which is increasing. Foodservice is another significant market opportunity for plant-based dairy products and could potentially significantly expand the total addressable market.

Global milk industry retail sales were estimated to be 179 billion USD in 2020 and are expected to increase at a 6.6% CAGR through to 2025. Plant-based milks have a 9% share of this category (excluding soy drinks in China). The penetration of plant-based alternatives in other categories is far lower though, with an estimated market share of less than 1%.

The shift towards plant-based dairy products is likely driven by a mix of concerns related to health, the environment and ethics. With Generation Z and Millennials becoming the dominant global generations in the coming years, the shift away from animal products is likely to continue.

In contrast to the plant-based meat category, plant-based dairy is also driven a large population of lactose intolerant people. It is estimated that two-thirds of the global population cannot process cow’s milk due to lactose intolerance. While there are alternatives like A2 milk, this population provides a captive consumer base for plant-based dairy products. Lactose intolerance is common in Asian countries, which is probably one of the reasons that Asia is the largest plant-based dairy market in the world, predominantly driven by high consumption of soy-based beverages.

Dairy milk consumption is declining in a number of developed markets, as the popularity of plant-based alternatives increases. Over the past 3 years, 32% of consumers in the US have reduced or stopped their dairy milk intake. An estimated 35-40% of the adult population in the US, UK, Germany, China and Sweden have purchased plant-based milk in the last three months.

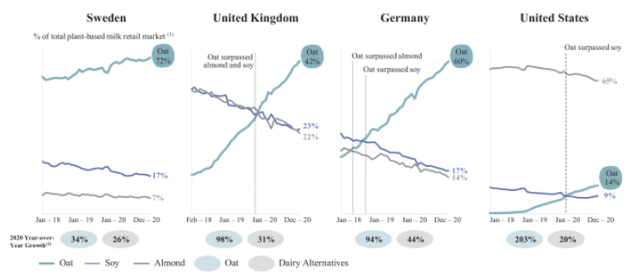

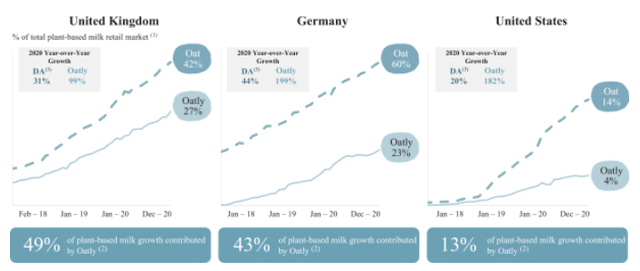

Figure 1: Plant-Based Milk Retail Market Share (source: Oatly)

The plant-based dairy market is somewhat fragmented though, with a large number of alternatives competing for market share. Oat based products appear to be establishing dominance in a number of markets, but this is not universal, with almond milk the preferred alternative in the US.

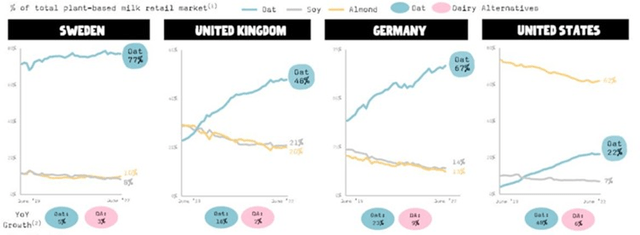

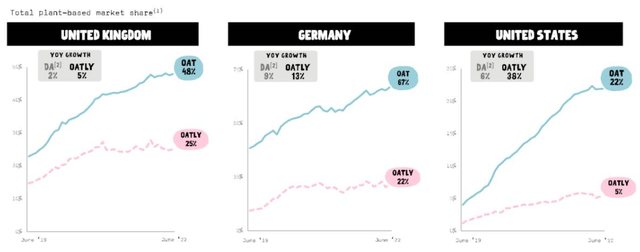

Figure 2: Plant-Based Milk Retail Market Share (source: Oatly)

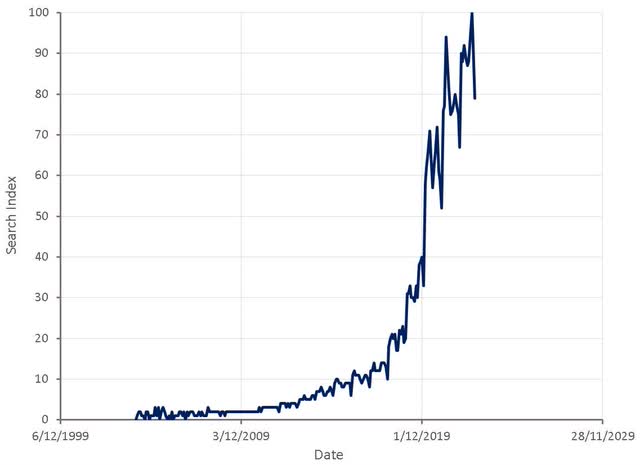

The popularity of oat milk has skyrocketed over the past few years, but it remains to be seen whether this growth will continue or even if the current popularity can be maintained. There is a risk that this type of product is a fad that will eventually be supplanted. Only time will tell whether oat based dairy alternatives can become a long-run consumer staple.

Figure 3: “Oat Milk” Search Interest (source: Created by author using data from Google Trends)

Oatly

Oatly was founded in the 1990s by a group of food scientists who developed a process that uses enzymes to break down oats into a dairy alternative, while retaining key fibers. The first oat milk was launched in 1995 and the first oat milk under the Oatly brand in 2001.

The company enacted a retail focused strategy and significantly stepped up their growth efforts in the 2010s. Oatly was relaunched in the Nordic countries in 2013 and 2014, the UK in 2016 and Germany in 2018. A focus on specialty cafes and coffee shops rapidly led the oat category from relative obscurity to the preferred plant-based milk. Expansion continued with a launch in the US in 2017 and China in 2018, focusing on specialty coffee and tea shops.

Oatly’s product portfolio has since expanded beyond milk, and now includes:

- Oat milk – includes Original, Low-fat, Full-fat, Flavored, Barista Edition (best-selling product)

- Oatgurt – yogurt alternatives that include a mix of consistencies and flavors

- Frozen desserts and novelties – dairy alternative ice creams

- Cooking – including Cooking Cream, Crème Fraiche, Whipping Cream, Vanilla Custard and Spreads in a variety of flavors

- Ready-to-go drinks – include Cold Brew Latte, Mocha Latte, Matcha Latte and Mini Oatmilk in original and chocolate flavors

There is still potential for Oatly to leverage this product portfolio, as most of their markets still only have a limited range of SKUs due to production capacity constraints.

Oatly is a premium product in the space and is trying to create a brand in a historically commoditized category. As part of this strategy the company is using the foodservice channel to build brand awareness. Oatly’s Barista Edition oat milk is their best-selling product globally, and has been formulated to improve creaminess and foamability. 80% of Oatly’s sales in Asia in Q1 2022 were derived from the Barista product compared to 85% in Q1 last year.

The company also heavily leans on the environmental benefits of their products. Oatly products consumed in place of cow’s milk result in around 80% less greenhouse gas emissions, 79% less land usage and 60% less energy consumption.

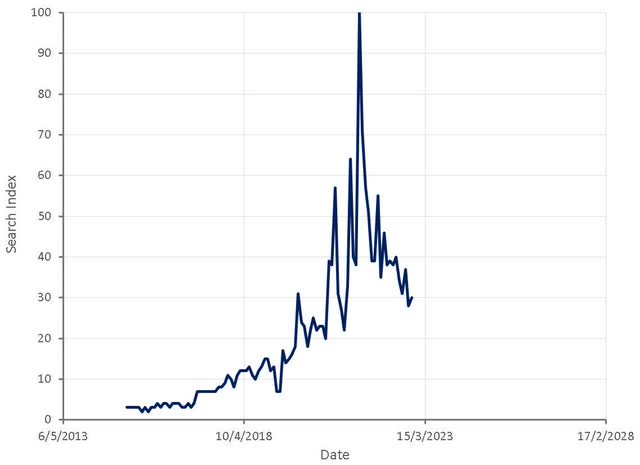

Figure 4: “Oatly” Search Interest (source: Created by author using data from Google Trends)

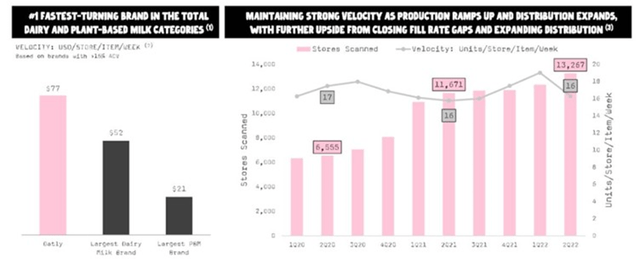

Scanner data continues to show that the oat category is gaining share and becoming the non-dairy default alternative across Oatly’s key markets. Oatly is the number one selling oat based brand by retail market share and the number one velocity brand in non-dairy in the UK, Germany, Sweden, Switzerland, Austria, and the Netherlands. Their velocity has remained stable so far, despite weakening macro conditions and continues.

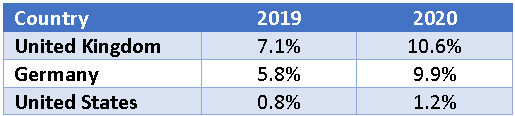

Figure 5: Oatly Share of Plant-Based Milk Retail Market (source: Oatly) Figure 6: Oatly Share of Plant-Based Milk Retail Market (source: Oatly) Figure 7: Oatly Sales Velocity (source: Oatly) Table 1: Distribution Share of Total Selling Points (source: Created by author using data from Oatly)

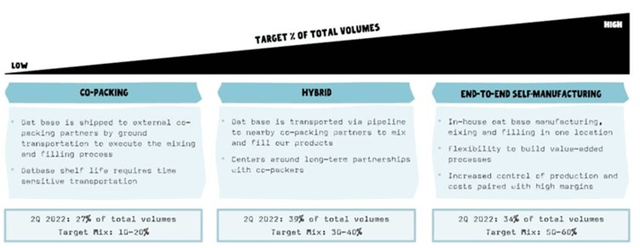

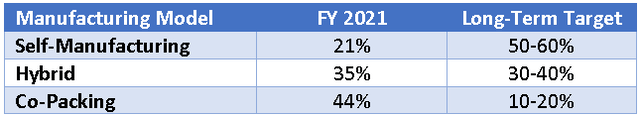

Oatly have stated that they are currently supply constrained and that increasing their manufacturing footprint will allow the company to increase sales and expand their product portfolio. Much of this increase in supply is coming from Oatly production facilities. In the second quarter self-manufacturing increased to 34% of Oatly’s total volume compared to co-packing of 27% and hybrid of 39%. Oatly expect to produce between 135 million to 145 million liters of finished milk in the third quarter, driven primarily by improved production output in Ogden and their two Asia facilities. Run rate capacity is expected to be approximately 900 million liters annually at the end of 2022.

While insourcing production is an important component of Oatly’s growth and transition to profitability, the company recently cut their 2022 CapEx plans from 400-500 million USD to 220-240 million USD. They have stated that this will not compromise growth, but it would appear the company’s financial position is restricting their plans.

Figure 8: Oatly Production Models (source: Oatly) Table 2: Oatly Target Production Mix (source: Created by author using data from Oatly)

Oatly competes with a large number of companies across both dairy and non-dairy. Competitors include traditional consumer packaged goods companies such as PepsiCo (PEP), Coca-Cola (KO), and Chobani, traditional dairy companies, such as Nestlé (OTCPK:NSRGY), Danone (OTCQX:DANOY), Lactalis, Fonterra (OTC:FTRRF), HP Hood, Arla Foods and Valio, plant-based dairy companies, such as Blue Diamond Growers, Califia Farms, Ripple Foods, and Ecotone, new market entrants building lab-based products and private-label brands.

The biggest risk that competition presents is probably commoditization. If Oatly cannot retain their position as a premium product they will have to compete on price and will struggle to achieve decent profit margins.

Financial Analysis

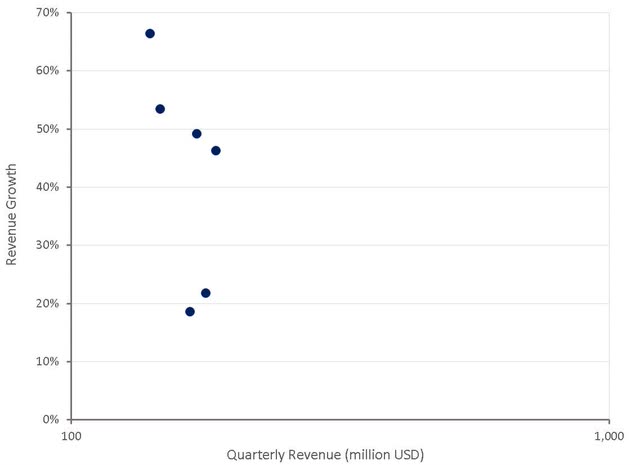

Oatly’s revenue growth has fluctuated in recent quarters, driven by a combination of production issues and currency headwinds. Oatly updated their full year revenue guidance in the most recent quarter to 800-830 million USD, citing an uncertain operating environment and network factors in EMEA and Asia.

Figure 9: Oatly Revenue Growth (source: Created by author using data from Oatly)

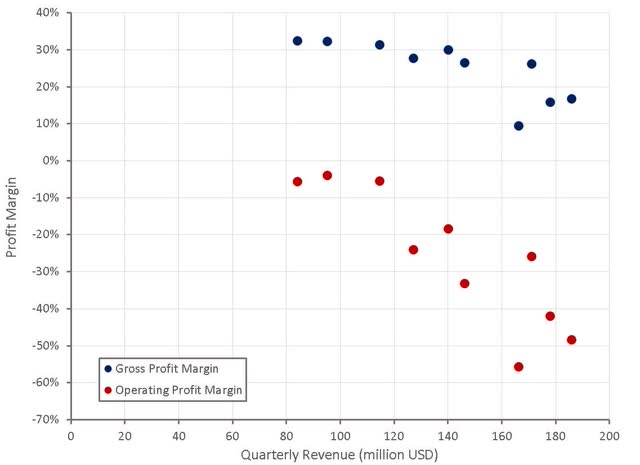

The primary concern for investors should be Oatly’s ability to progress towards cash flow breakeven without needing to raise capital. Like many companies, Oatly has been prioritizing growth over profits, choosing to invest aggressively in production capacity and sales and marketing. Inflationary pressures and capacity utilization have pressured the company’s margins in recent quarters and now potentially place Oatly in a vulnerable position.

In response, Oatly has implemented double-digit price increases which are only expected to yield a full benefit in the fourth quarter of 2022. Oatly is also evaluating additional price increases in Europe, but ongoing price increases are potentially risky given the financial strain that many consumers now find themselves under.

The higher share of self-manufacturing will eventually improve margins but is also potentially a near term headwind. Oatly have indicated in the past that it generally takes 3-4 quarters before a new facility reaches steady state utilization, resulting in elevated costs during the ramp-up phase.

Figure 10: Oatly Profit Margins (source: Created by author using data from Oatly)

Oatly is also experiencing higher prices for raw materials, logistics, energy and labor globally. Inflation is expected to increase Oatly’s total costs another 5-6% in the coming quarters, potentially offsetting much of the benefit of higher product prices.

This is at least in part due to the war in Ukraine, as Russia and Ukraine are both large exporters of grains such as wheat, as well as vegetable oils. In addition, Russia is a significant exporter of fertilizer and fertilizer production in Europe is being pressured by high energy prices.

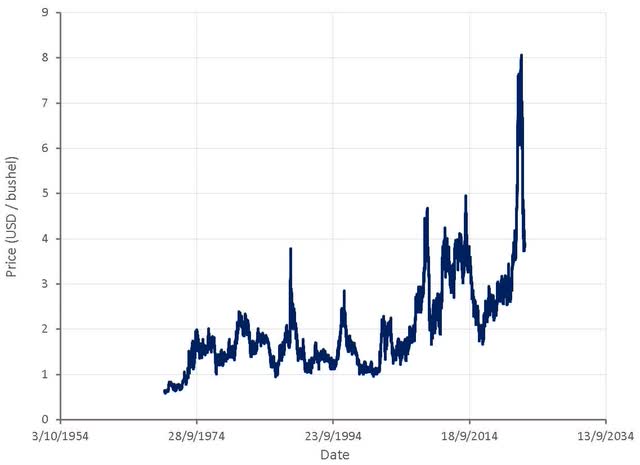

While the price of oats is down significantly from their peak, which could be beneficial to Oatly, it is not clear how sustainable this move is or what the path of oat prices will be going forward.

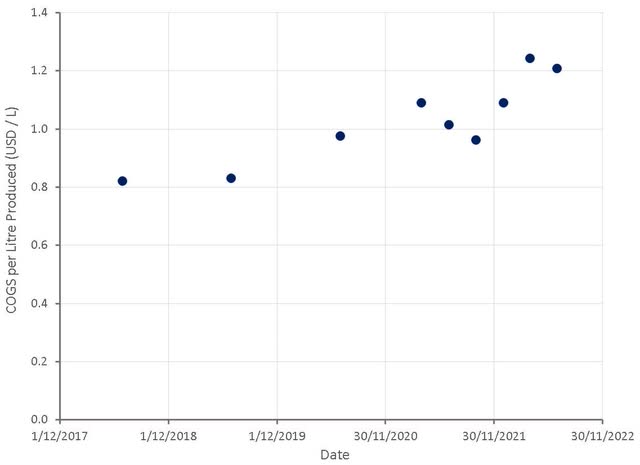

Figure 11: Historical Oat Prices (source: Created by author using data from macrotrends.net) Figure 12: Oatly COGS per Litre Produced (source: Created by author using data from Oatly)

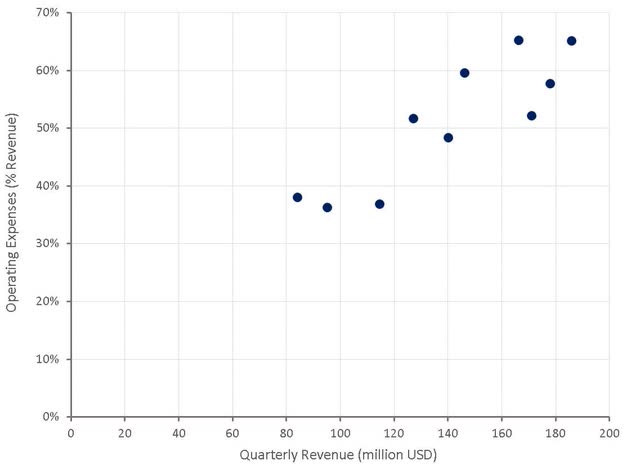

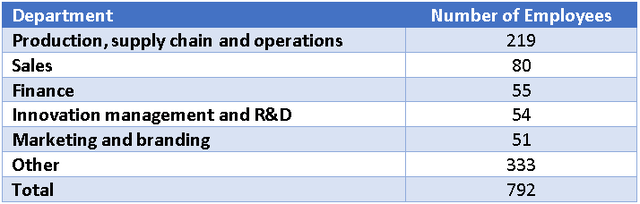

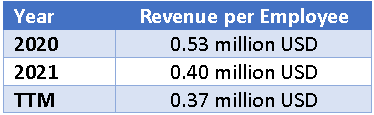

In addition to elevated production costs, Oatly also has bloated operating expenses. This appears to largely be the result of headcount growth exceeding revenue growth, and maybe a reflection of disappointing production volume in recent quarters.

Figure 13: Oatly Operating Expenses (source: Created by author using data from Oatly) Table 3: Oatly Employees by Department at the end of 2020 (source: Created by author using data from Oatly) Table 4: Oatly Revenue per Employee (source: Created by author using data from Oatly)

In the long run, Oatly is targeting gross profit margins of greater than 40% and adjusted EBITDA margins near 20%. These targets are not unreasonable given the nature of the company, but are largely dependent on Oatly’s ability to remain a differentiated premium product in the eyes of consumers. Oatly will face ongoing competition and pricing pressure, which could make achieving these targets difficult.

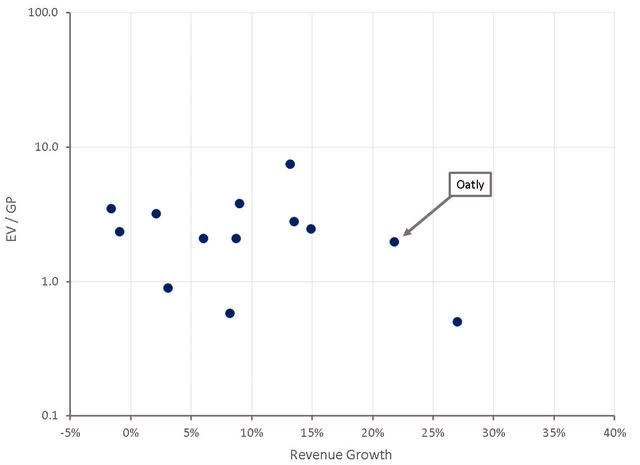

Valuation

Oatly’s stock is down over 90% from its peak and now trades on a relatively low sales multiple. At this point Oatly’s stock price is less a reflection of the company’s long-run prospects than its ability to reach profitability without diluting existing shareholders. Until Oatly begins to make serious progress towards cash flow breakeven, the stock price is likely to remain under pressure in the current environment. Given the company’s growth and strong brand, an improvement in margins, coupled with increased investor appetite for growth stocks, could see the stock rapidly move higher. If Oatly had a stronger balance sheet and was closer to profitability, the stock could easily trade 2-3x higher than it currently is.

Figure 14: Oatly EV/S Multiple (source: Seeking Alpha) Figure 15: Oatly Relative Valuation (source: Created by author using data from Seeking Alpha)

Conclusion

Oatly’s attempts to insource and scale production with limited cash, and at a time when access to capital markets is restricted, leave the company in a vulnerable position. Oatly is also dependent on commodity prices in an inflationary environment, creating another vulnerability. If oat prices stabilize or move lower, and customers accept Oatly’s price increases, the company’s margins could improve significantly going forward. It remains to be seen whether this will be sufficient for the company to avoid raising capital though.

Be the first to comment