Lisa Maree Williams/Getty Images News

Having just raised its full-year profit guidance last month, leading Australian carrier Qantas Airways (OTCPK:QABSY) again revised its guidance upward by a massive ~A$150m. Impressively, the latest upgrade comes despite cost headwinds and reductions in capacity, as improved yields emerged as the primary driver. Importantly, the P&L gains will translate into stronger cash generation as well, with Qantas guiding to net debt levels even lower than the lower end of its target range.

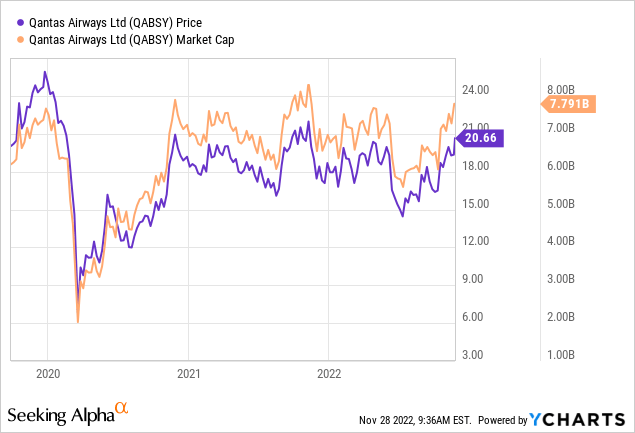

From here, the entry of a new competitor and the implications for the competitive intensity in the domestic market will bear watching, but given the strong post-COVID demand and industry supply constraints, the near-term setup remains compelling. With the market cap still below pre-COVID levels, the stock does not adequately reflect Qantas’ improved post-COVID earnings trajectory, in my view.

The Strong Recovery is Getting Stronger

Having already revised guidance higher last month, Qantas again moved its pre-tax profit guide upward to A$1.35-1.45bn (up from A$1.2-1.3bn previously). While management provided limited disclosure on the raise other than continued travel spending by consumers, a glance at passenger numbers in August suggests traffic was weaker for the month, with international still projected to run >30% below the pre-COVID peak for H1 2023. While some of this weakness is down to seasonality, the extent of the upgrade implies yield-driven strength – in other words, passengers’ willingness to pay is allowing Qantas to lean on its pricing power.

Management commentary from the trading update suggests domestic travel demand could soon outstrip pre-COVID numbers. Domestic demand is already running at twice pre-COVID levels despite the macro headwinds (i.e., inflation and interest rate hikes), which bodes well for yields. This should more than offset weakness in international, where capacity restrictions will continue to weigh on volumes. With domestic margins almost double the international business as well, this mix shift should drive incremental accretion to the overall margin profile.

Defying the Margin Headwinds

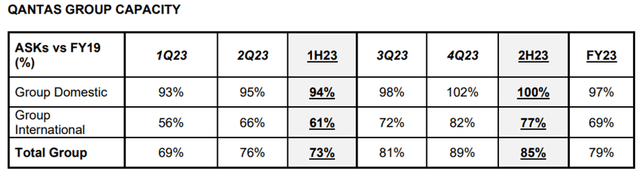

Looking out to the rest of the year, current robust demand trends and higher ticket prices bode well for Qantas’ ability to navigate any macro concerns down the line. Thus far, the airline has successfully navigated a range of variables, including domestic and international capacity cuts throughout the industry (now guided at 60% of pre-COVID levels in FY23 and 80% in FY24). Of note, the profit upgrade also came through despite rising costs – Qantas has allocated an incremental ~A$200m to increasing on-time performance and another ~A$40m in additional wages. Finally, the airline has dealt with opex headwinds from spot fuel, which was significantly higher MoM in September due to the AUD decline.

While no full-year earnings guidance has been issued, key assumptions such as fuel costs of ~A$5bn and capex of A$2.2bn-2.3bn were reiterated. Based on the yield-driven H1 2023 earnings guidance upgrade and unchanged capacity expectations, though, FY24 profitability targets look set to outperform expectations as well. Beyond the core airline, the performance of subsidiary Jetstar Domestic will be worth watching – thus far, the EBIT margin target disappointed at 15% due to a lack of pricing power to offset the high fuel prices, but continued domestic travel demand could drive upside here. Also worth monitoring will be any revisions to the profitability target for Qantas International, which is set to be announced at the H1 2023 results meeting next February.

Accelerated Deleveraging Supports Capital Allocation Optionality

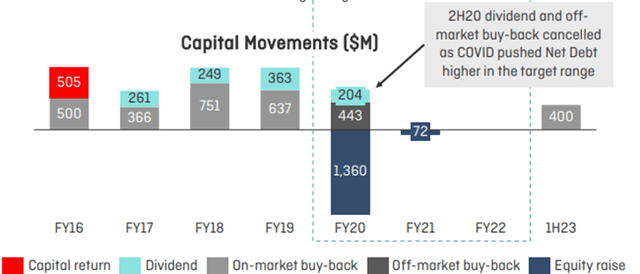

On the back of the strong operational trends, Qantas’ balance sheet deleveraging has been accelerated – net debt is now guided to hit A$2.3-2.5bn, $900m ahead of the prior guidance. While ~$200m of the delta is down to the benefit of capex deferred into the second half (due to a delay in aircraft deliveries), the balance reflects a stronger-than-expected contribution from bookings (including for partner airlines).

The adj net debt range is also well below the A$4.2-5.2bn target range, implying ample balance sheet capacity available for deployment. Buybacks will likely be prioritized – the active A$400m buyback (announced in August) is almost completed, and Qantas’ release noted it is in a “position to consider future shareholder returns.” Even with capex set to ramp up in the coming years as Project Winton (domestic fleet modernization) and Project Sunrise (ultra-long-haul service expansion) kick in, the near to mid-term earnings growth should be more than enough to support an upsized buyback.

Latest Guidance Upgrade Signals Improved Outlook

Qantas’ decision to upgrade its H1 2023 pre-tax profit guidance for the second time in as many months highlights the strong underlying domestic demand trends across the industry. The extent of the yield-driven revision was impressive, particularly given the prevailing macro concerns spanning interest rates, inflation, and cost of living pressures. The strong operating performance also allows for an accelerated balance sheet deleveraging, paving the way for more capital return opportunities ahead. With a similarly accelerated pace of bookings across its partner airlines and a more rational Australian domestic aviation market emerging as well, this trend looks set to continue into the coming years. Yet, the market cap remains below pre-COVID levels, signaling the stock is not adequately accounting for Qantas’ improved earnings growth potential at current levels.

Be the first to comment