courtneyk

Verisk (NASDAQ:VRSK) is becoming a more focused, pure-play insurance analytics company, but it is paying a price for it in the form of lower earnings, at least in the short-term. As part of this transformation, Verisk sold Wood Mackenzie to Veritas Capital for $3.1 billion in cash, with an additional $200 million in future consideration. The sale is expected to close in the first quarter of 2023. Verisk plans to use the proceeds from the sale for share repurchases and debt pay down, and expects the deal to be dilutive to its earnings in the range of 4% to 6%. The company is selling the deal as bringing increased focus, but we are not convinced there was much value, if any, generated for the company from the transaction. We are also not convinced share repurchases add much value at current prices, and reducing debt might actually make more sense in our opinion, even though it would probably mean even lower earnings per share. Still, by prioritizing reducing debt the company would prepare itself should an attractive acquisition opportunity present itself.

Operationally the company appears to be performing relatively well. In the most recent quarter the company experienced strong growth in subscription revenues across both underwriting and claims, resulting in overall organic constant currency growth of 6.1%. Strong results were achieved in core underwriting, extreme event solutions, international businesses, and newer acquired businesses, including life insurance and specialty business software solutions. Transactional revenues grew only 1.8% due to a lower level of storm activity and headwinds in the personal auto underwriting and marketing businesses. These headwinds are likely to persist for some time. Verisk’s total revenue was $745 million, a decline from the prior year due to dispositions and foreign currency exchange rate headwinds. Net income for the company decreased 6% to $189 million, and diluted GAAP earnings per share also decreased 3% to $1.20.

Verisk is taking actions to improve its operating efficiency, with a target to deliver 300 to 500 basis points of margin expansion by 2024. This expected margin expansion with mid to high single digit revenue growth should result in very decent EPS growth going forward. Still, we don’t think that is enough to justify the current valuation.

Going back to the sale of Wood Mackenzie and how they plan to split the proceeds between debt pay down and share repurchases, it sounded like management is planning to spend most of it on share repurchases. They didn’t share a number on the debt pay down target, other than stating that there’s no change to their target leverage range of 2x to 3x, and that it is likely that the significant majority will be spend on share repurchases.

Financials

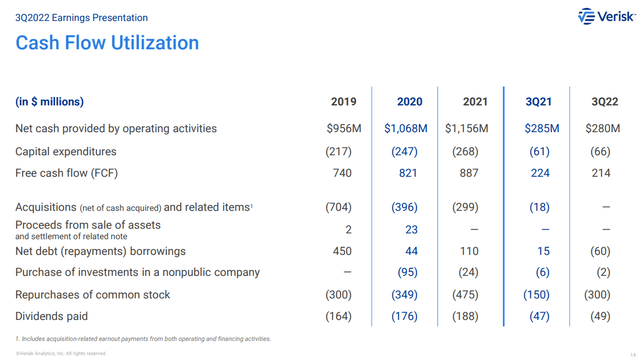

It is interesting to look at the company’s recent cash flow utilization. One thing to note is that in the most recent quarter it spent more on share repurchases than it generated in free cash flow. What this means for investors is that the current share repurchase pace is not sustainable in the long-term. The company could also consider increasing its dividend, which remains quite modes, if it does not see any attractive acquisitions or internal investments.

Verisk Analytics Investor Presentation

Growth

During the company’s most recent earnings call there was an interesting question regarding revenue growth, and whether the company remained confident on its ~7% target. We also wonder whether that is an attainable goal, so we were very curious on the response. In any case, this is what CEO Lee Shavel had to say about it:

What I will first say and reiterate that our confidence in that long-term target remains in place given what we see as the opportunities in front of us. I think when you look at what we’ve even achieved in 2021 at a more challenging environment, where we had two quarters of organic revenue growth above 7% clearly demonstrates the ability of the insurance – of our insurance business to achieve that.

We’ve had some weakness related to pandemic effects, such as lower driving activity, impact on workers’ comp. And I think, to Mark’s comments, we are seeing some weakness as a result of the economic environment, but we’re also seeing recovery in some of the pandemic-related effects. And I think that biases us towards stronger performance ahead from a growth perspective as we come out of some of these stronger elements.

Some of the macroeconomics may persist, but I think we’re seeing kind of more momentum towards that target ahead. That would be the way, I think, about it, both from a longer-term perspective, which we are still confident that we can deliver on that. We have to work our way through, I think, the conflicting impacts of some recovery from pandemic impacts and then some of the more sustained macroeconomic, which, I think, are of a lower magnitude than what we experienced through the pandemic.

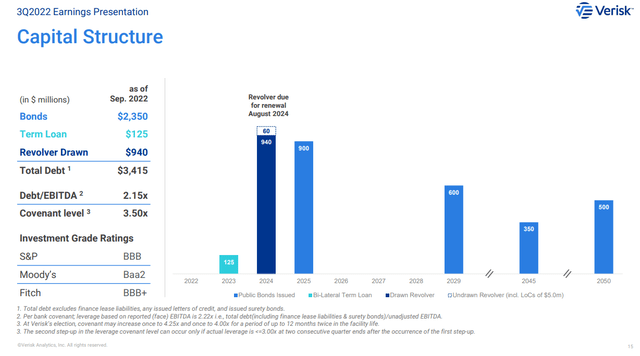

Balance Sheet

Verisk has a solid balance sheet and an investment grade credit rating, with debt/EBITDA of ~2.1x. The company’s total long term debt is ~$3.4 billion, and its cash and short-term investments amount to ~$276 million.

It does have a significant amount of debt that will have to be refinanced relatively soon, probably at much higher rates. This is one of the reasons we believe the company should prioritize debt repayment over share repurchases at this time. The other reason being that the company’s valuation is not very attractive at the moment.

Verisk Analytics Investor Presentation

Valuation

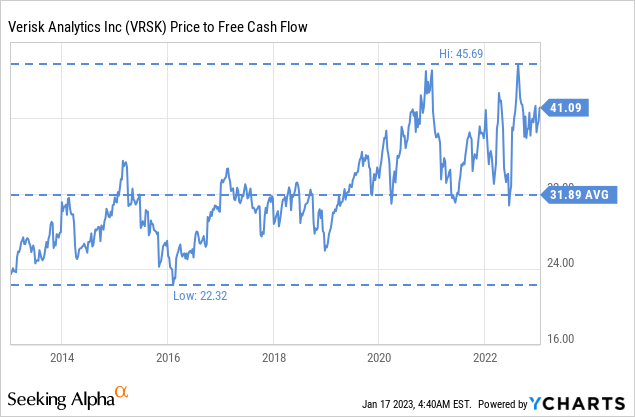

Most valuation indicators point to a stretched valuation, such as an EV/Revenues multiple of ~10x, or a very small dividend yield of only ~0.67%. One of the attractive things of Verisk’s business model is that it generates significant free cash flow, but unfortunately the price to free cash flow is also quite high at ~41x, significantly above the ten year average of ~31x.

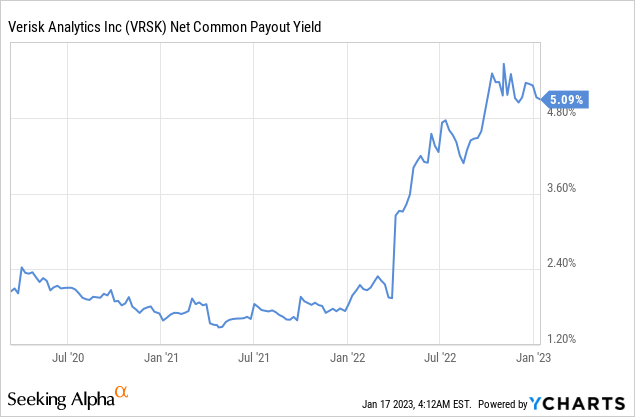

The net common payout yield, which combines the dividend yield and the buyback yield, is high at the moment, but as we previously discussed, the company is buying back more shares than it is generating in free cash flow.

Even with relatively optimistic future earnings estimates we only get a net present value for the future earnings stream of ~$138. We therefore believe shares to be somewhat overvalued, and priced to deliver only high single digit returns for long-term investors buying at current prices.

| EPS | Discounted @ 10% | |

| FY 23E | 5.56 | 5.05 |

| FY 24E | 6.54 | 4.60 |

| FY 25E | 7.45 | 4.18 |

| FY 26E | 8.34 | 4.47 |

| FY 27E | 9.35 | 4.63 |

| FY 28E | 10.47 | 4.71 |

| FY 29E | 11.72 | 4.80 |

| FY 30E | 13.13 | 4.88 |

| FY 31E | 14.70 | 4.97 |

| FY 32E | 16.47 | 5.06 |

| FY 33E | 18.45 | 5.15 |

| Terminal Value @ 3% terminal growth | 270.40 | 86.16 |

| NPV | $138.65 |

Risks

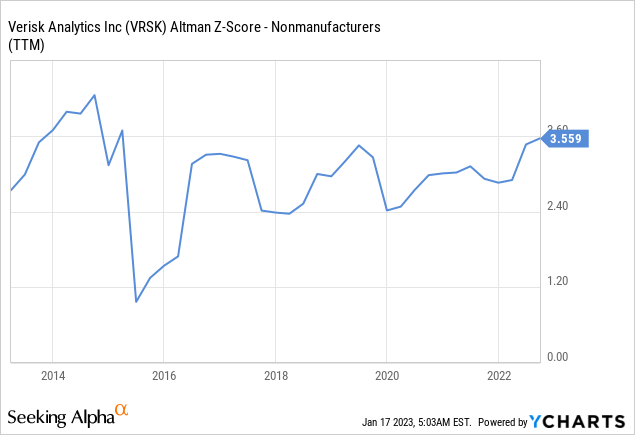

The company has the typical risks associated with most companies, including regulatory risks, foreign currency exposure, etc. Still, these risks are mitigated by a strong balance sheet, reflected in an Altman Z-score of ~3.5x, and the company’s strong competitive moat. The main risk we believe investors should focus on is that of the high valuation, as we believe shares are currently overvalued.

Conclusion

Verisk’s decision to sell Wood Mackenzie for $3.1 billion in order to become a more focused insurance analytics company is expected to be dilutive to its earnings per share. It remains to be seen if the expected benefits from the increased focus materialize. The company’s operational performance has been decent, but we question whether the decision to spend a significant majority of the sales proceeds on share repurchases is the right one. We believe shares are currently overvalued and priced to deliver high single digit returns to long-term investors, as such we are maintaining our ‘Hold’ rating.

Be the first to comment