sutlafk/iStock via Getty Images

Small-cap biotech tickers remain under substantial selling pressure as the overall market fails to sustain a rally and the economic environment worsens forcing the Fed to raise interest rates. VBI Vaccines (NASDAQ:VBIV) has not been immune to sell-off with their share price falling around 75% over the past year despite making significant headway both clinically and commercially. I believe VBI’s efforts in 2022 have bolstered my bullish outlook and have helped solidify VBIV’s position in my Compounding Healthcare “Bio Boom” speculative portfolio.

I intend to review some of VBI’s updates thus far in 2022 and will provide my views on how they impact my long-term outlook for the company. In addition, I will point out some downside risks that could offset the company’s headway. Finally, I update my investors on my strategy for my VBIV position as we head for Q4.

PreHevbrio

The company’s hepatitis B vaccine, PreHevbrio, has had several notable updates thus far in 2022. Most importantly, the company launched their vaccine in the U.S. at the end of the first quarter. Then, PreHevbrio was approved by the EC and the UK’s MHRA in Q2. Moreover, the CDC’s ACIP recommended PreHevbrio in the updated universal HBV vaccination guidelines for adults aged 19-59 in April.

Recently, VBI announced that Valneva SE (VALN) will be the company’s commercial partner for PreHevbrio in Europe. Valneva will market in the United Kingdom, Sweden, Norway, Denmark, Finland, Belgium, and the Netherlands in early 2023.

In terms of commercial updates for PreHevbrio, VBI announced that they have already “detailed more than 80% of 3,200 target accounts.” In addition, the company claimed that “60% of Medicare-insured lives, 55% of commercially insured lives, and 50% of lives under state Medicaid plans are estimated to have coverage in place for the PreHevbrio specific CPT code.”

VBI-1901

The company’s cancer vaccine immunotherapeutic candidate for glioblastoma “GBM”, VBI-1901, is moving forward in development. In fact, VBI expects to expand their ongoing Phase I/IIa study by supplementing the study with a control arm. The company believes there is a possibility for “accelerated approval based on tumor response rates and improvement in overall survival.” As for the primary GBM setting, the company anticipates that they will initiate a Phase II adaptive platform trial in Q4, which may also lead to accelerated approval. Moreover, in June, the FDA granted VBI-1901 their Orphan Drug Designation for GBM.

COVID-19 Vaccine

The company has a trivalent “Pan-Coronavirus Vaccine” candidate that they have designated VBI-2901. The vaccine’s development has been sluggish despite the company’s partnership with the Canadian government, which allows the company to have up to CAD $56M in funding. However, VBI has not scraped the program yet and expects to initiate a Phase II clinical trial of VBI-2901 in the near term.

Financials

In terms of financials, VBI finished Q2 with $82.4M in cash, down from $121.7M at the end of 2021. However, VBI recently publicized that they refinanced with K2 HealthVentures and upsized their debt facility for up to $100M. As a result, VBI will have immediate access to $50M upon closing. Furthermore, the company will also have future tranches for up to $25M once the company hits certain “clinical and financial milestones.” In addition, VBI has a tranche of $25M that is available at the discretion of K2 HealthVentures.

My Takeaway

There is no doubt that VBI has made significant progress thus far in 2022. Clearly, the U.S. launch of PreHevbrio is the primary highlight, however, one must recognize their clinical and regulatory achievements for Hepatitis B, GBM, and COVID-19. In addition, VBI has secured Valneva as a European partner, who has a great track record with vaccine commercialization and working in their target European countries. The K2 HealthVentures refinancing will provide additional capital to help with their commercial launch of PreHevbrio and maintain their pipeline activities.

Overall, VBI’s developments have transformed the company into a commercial-stage company in the U.S. with Ex-U.S. partners. Moreover, the company still has a promising pipeline of assets that are moving forward in several indications. Into the bargain, VBI has the financial capital to fund their initiatives and potentially unlock shareholder value down the line. I believe these points support a long-term bullish outlook.

Downside Risks

First and foremost, the company only has roughly $82.4M in cash in the bank and potentially another $100M in financing to fund the company and its commercial efforts. If PreHevbrio has a lackluster launch in the U.S. and Europe, we could see VBI begin to scale back their pipeline initiatives in order to conserve finances for PreHevbrio’s commercialization efforts. VBI cannot slow their pipeline development if they are looking to be the first-to-market, or take advantage of the current market opportunities.

Considering these risks, I still see VBIV as a speculative investment and will remain in the Compounding Healthcare Bio Boom Portfolio.

A Conservative Strategy

After a nice run in August, the market has recommenced punishing VBIV. Indeed, VBIV is most likely getting caught up in the market-wide sell-off that is crushing small-cap biotech. However, this selling pressure does indicate the market is going to disregard the company’s progress, and I don’t expect the company’s fundamentals to force the ticker to buck the trend in the near future.

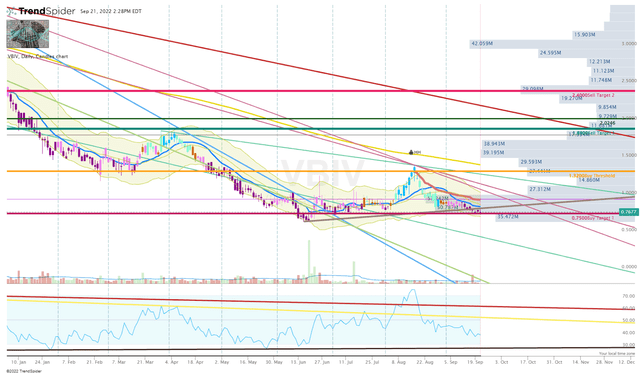

VBIV Daily Chart (Trendspider)

As a result, I am going to remain conservative and will stick to a cost-average method with miniature-sized investments over the course of the next few years. However, I will increase share sizing if the share price drops below my Buy Targets to take advantage of the discounted price.

I will book profits at my Sell Targets in order to transfer my VBIV position back into a “house money” state. The ultimate objective is to attain a “house money” position after Sell 2 and reserve profits at Sell 3, while still holding a small core position for a longer-term investment.

Be the first to comment