Dzmitry Skazau

As comments from heads of central banks go, yesterday’s press conference was relatively lucid. For anyone who remains confused about the likely path ahead for monetary policy, well, they probably weren’t listening.

“My colleagues and I are strongly committed to bringing inflation back down to our 2 percent goal,” Powell said in the wake of recent news that headline consumer inflation ran at roughly 8% year-on-year through August. He went on to reaffirm the commitment several times, outlining multiple advisories that interest rates are likely to rise further and that taming inflation isn’t likely to be painless and so recession risk is rising.

“No one knows whether this process will lead to a recession or if so, how significant that recession would be,” he explained, after the Fed announced a third-straight 75 basis points increase in its target rate to a 3.0%-to-3.25% range. “The chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive, or restrictive for longer. Nonetheless, we’re committed to getting inflation back down to 2%.”

In case anyone missed the point, he asserted: “We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t.”

Not surprisingly, Fed funds futures continue to price in another 75 basis points rate hike at the next FOMC meeting on Nov. 2 – this morning’s implied probability is roughly 70%, according to CME data.

The confluence of rising rates, the risk of slower growth that may lead to recession, and the potential/likelihood that inflation softens substantially at some point in the future opens the door to thinking about when the bond market’s outlook turns convincingly bullish.

The challenge is deciding how the interactions of three key variables play out: the path of future rate hikes, the degree of slowdown in economic growth, and the pace and timing of inflation deceleration. The calculus is tricky because each of these factors influences the other, and so there’s a dynamic, evolving feedback loop in play.

In the case of deciding when the bond market writ large bottoms and begins an extended rise, a fourth factor comes into play: investor sentiment, which is influenced by the three factors above and simultaneously influences those factors in some degree. Suffice to say, there’s a high degree of uncertainty in running the analytics and looking for a high-confidence nowcast/forecast.

That doesn’t stop anyone from trying. “This is a very good time to buy bonds, and one of the ways I know that, is nobody wants to do it,” says Jeffrey Gundlach, Chief Executive of DoubleLine Capital.

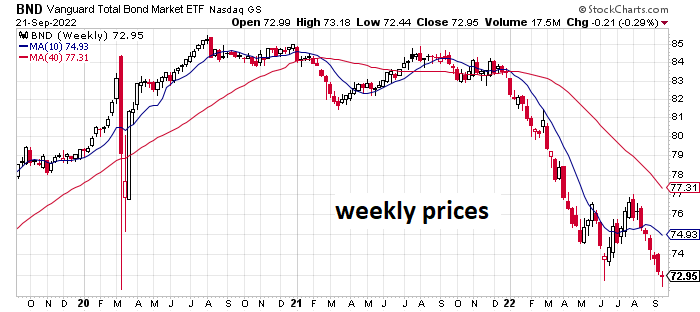

Meanwhile, the trend in the bond market, proxied by Vanguard Total Bond Market ETF (BND), still looks bearish.

Estimating when the core danger has passed and a new rally in fixed-income has started is a mix of art and science, but at some unknown point in time, that transition will arrive. As yields rise and inflation eases, the relative allure of bond payouts becomes attractive, in absolute and relative terms vs. other assets.

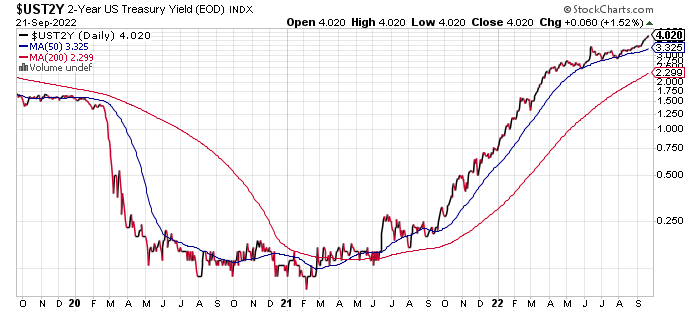

Among the key indicators to monitor is the policy-sensitive 2-year Treasury yield. As explained yesterday, this key rate tends to anticipate the near-term path of Fed funds. On that basis, the latest increase above 4% suggests there’s more upside ahead. In turn, the case for arguing that the path of least resistance for bond prices is now up still looks premature.

But this is now a fast-moving market with an aggressively hawkish Fed. The four-factor interaction noted above, in turn, is constantly swirling, and so the risk outlook is rapidly evolving. That doesn’t make market analytics easy, but it does remind that whatever passes for relevant estimates du jour will age quickly, for good or ill, in the days and weeks to come.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment