Onfokus

Intro

In 2014, GoPro, Inc. (NASDAQ:GPRO) hit the market with a bang, seeing record-high success just months after going public. In recent times, however, GoPro has not seen the same initial prosperity, having fallen 52% YTD. Investor sentiment quickly turned negative as the company began to battle supply chain issues and inflation. However, recently there has been a rebound in sentiment as some believe that GoPro is poised for a turnaround. While I don’t completely disagree with this thesis, I believe right now is not the time to act on it.

GoPro’s Main Business

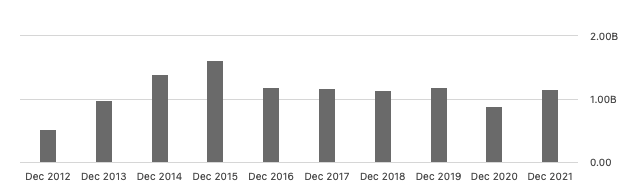

GoPro’s main hardware business has been in decline and even more so during this economic downturn. Its topline has yet to reach its 2015 levels, while management reports in Q2 that total camera units shipped and overall retail sales have dropped by 12% and 4% respectively. However, that’s not entirely the company’s fault, as its target customer base revolves around only a small group of sports enthusiasts. Their SAM is only around $3Bn and is expected to grow at a CAGR of 5.2% through 2030. Fundamentally, GoPro’s inability to grow is the reason its stock has fallen from its peak of $82 in 2014.

Now, GoPro is facing a host of new problems, from decreasing consumer spending to supply chain issues. On a macro level, the next 6-9 months are still quite grim as the Federal Reserve sticks to its goal to keep inflation at 2%–which means continued Fed hikes. When the U.S. increases interest rates, the amount of interest that the government pays to its debtors increases as well. This means that Congress will have to find ways to cut spending or increase taxes, both of which will further hurt consumer spending in addition to the inflation that’s present.

Seeking Alpha

GoPro’s Crutch

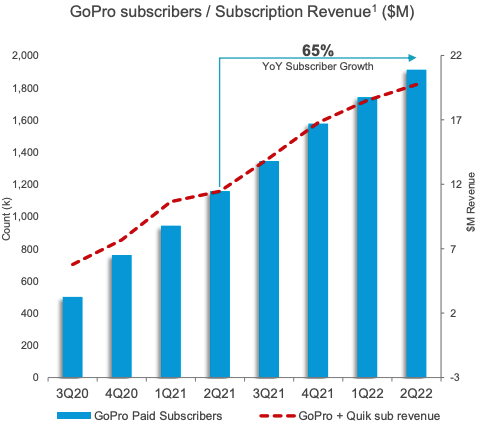

However, GoPro’s subscription business remains its crutch. It’s a very lucrative business model that has seen record growth. As stated by CFO Brian McGee:

“Two million GoPro subscribers translates into $100 million in annual recurring revenue with a gross margin of 70-80%, positively impacting our bottom line, and we expect subscription growth to continue as we add significant new features and benefits on an ongoing basis.”

GoPro

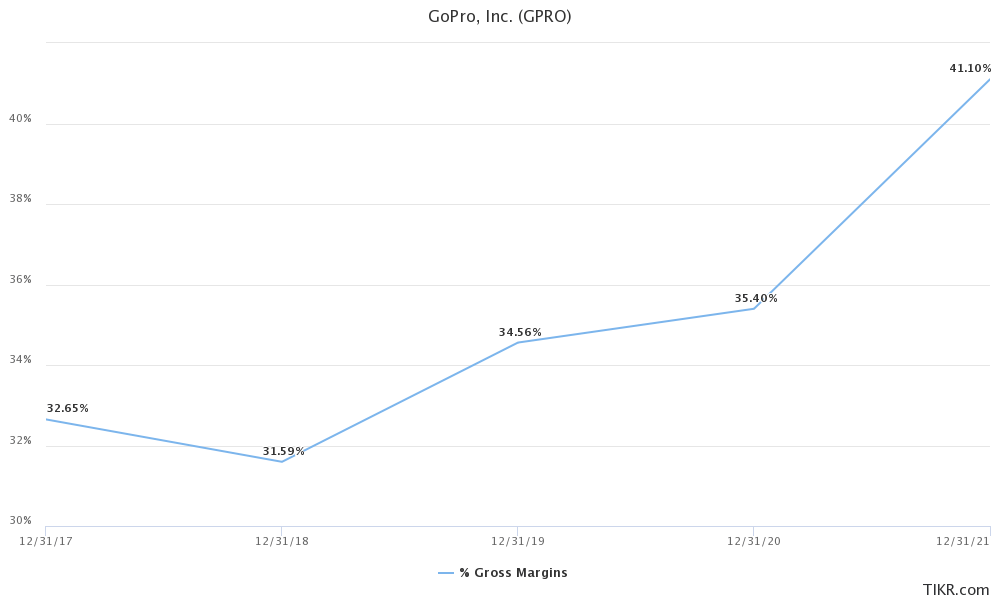

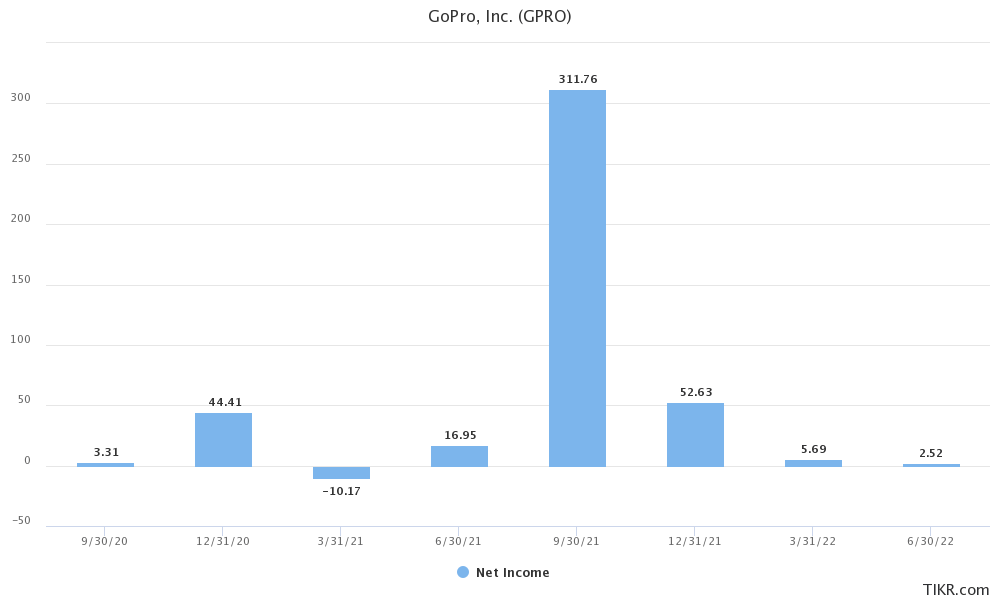

Along with GoPro’s initiative to increase direct sales from its website, the company has seen significant improvements in margins and earnings. It has grown its gross margins to over 40% in FY 2021, while earnings have for the most part stayed positive.

TIKR Terminal

TIKR Terminal

Both of these are great trends to have as the company battles the recession. However, I am skeptical about the sustainability of their subscription model. There is no question that the big discounts GoPro ran for these subscriptions were a big reason for the sudden uptick. The subscription is included in the purchase of a new GoPro, and customers can get a $100 discount just to opt-in for the subscription that’s free. Essentially, GoPro is paying $100 for every subscription. It’s great that the subscription provides storage solutions and editing software, and it’s great that sign-ups so far have been fantastic. However, until we can get a proper estimate of the churn rate, investors shouldn’t get too giddied up for a turnaround story.

Conclusion

If GoPro’s subscription model works out, it could potentially propel GoPro’s stock to rise much higher. However, we must get a better idea of the churn rate, and understand how much customers really value the subscription before I recommend acting on that thesis. It also doesn’t help that all of the macro trends are against the company. In this environment, investors are better off holding cash and searching for turnaround candidates that have a higher probability for success.

Be the first to comment