Petmal

Thesis

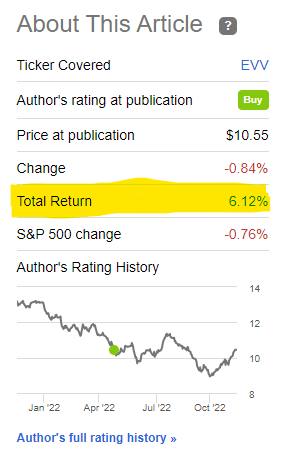

We assigned the Eaton Vance Limited Duration Income Fund (NYSE:EVV) a Buy rating earlier this year in May (you can find the article here). Since our rating, the CEF has outperformed the market, posting a positive net total return:

Buy Rating Details (Seeking Alpha)

It is hard to find fixed income CEFs that have generated positive total returns in an environment of ever rising rates:

Total Return since May (Seeking Alpha)

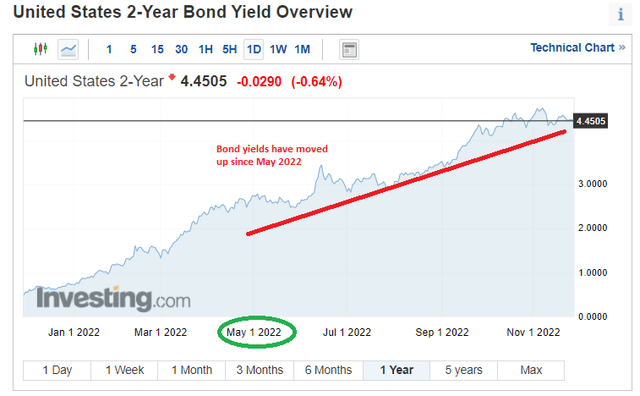

In the above chart, we are benchmarking several funds’ performance since the beginning of May 2022. We can notice how even leveraged loan funds such as AIF had a hard time posting positive total returns in that time span. The reason behind the performance is an environment of ever increasing rates across the yield curve:

We can see how short dated 2-year yields have moved up more than 150 bps in that time span. So how did EVV managed to outperform and generate a positive result?

Factors Behind EVV’s Outperformance

We are going to take a look at some of the factors that have driven the fund’s outperformance, representing some of the pillars that drove us to give this CEF a Buy rating earlier in the year.

Factor Nr. 1 – Duration Hedging

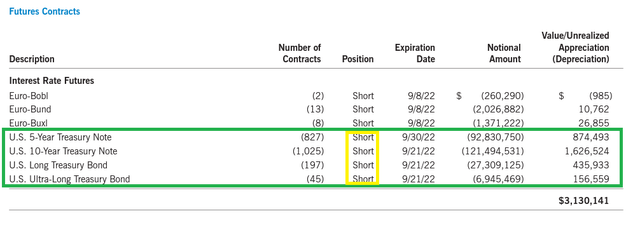

Unlike other funds, EVV hedges duration. Duration is the sensitivity of the underlying collateral to rising rates. Theoretically, in a long only fund, you can only decrease duration by decreasing the maturity of your asset pool. Unfortunately, this usually results in the collateral pool providing for a lower dividend yield. In a CEF, there are alternative ways to decrease duration, namely via swaps or futures:

Futures Positioning (Q2 Holdings Report)

From the above table extracted from the fund’s Q2 Holdings Report, we can see how the CEF shorted the yield curve via futures contracts. Basically, as rates rose, EVV made money via its positioning. The notional amounts were fairly large, with an aggregate position of over $250 mm. This is the flexibility of the CEF structure versus an ETF – it allows an agile fund manager to adjust duration positioning via derivatives, thus simultaneously running a robust long portfolio, while accounting for shorter term factors such as interest rates rising. Many times in our own portfolios we have struggled with the decision of selling certain assets, because we fundamentally liked them, versus the specter of lower shorter term valuations due to rates. Hedging, while complex, is a solution to this problem.

One needs to give credit however to the management team. Without an active and savvy management, the CEF would have been in the red. It is useless to have a CEF structure if not taken advantage of. Recently we reviewed an equity buy-write fund, namely DIAX, where we were extremely disappointed by the lack of active management, which led to the fund underperforming this year and thus our downgrade. What is the use of owning a bicycle if you don’t ride it? The same concept applies to CEFs in terms of savvy active management.

Factor Nr. 2 – Discount to NAV

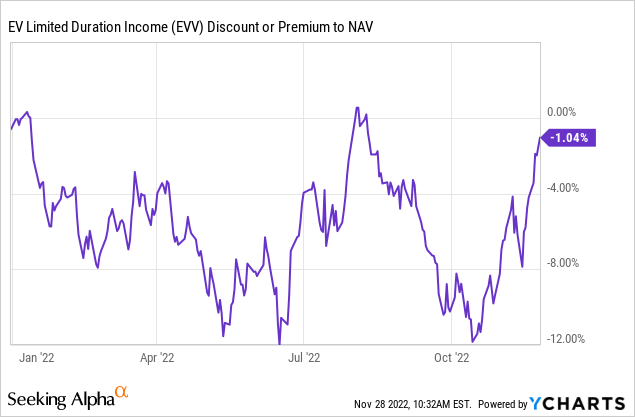

In our original article, we pointed out how the discount to NAV had reached a very low level versus the fund’s performance. As expected, we saw a claw-back:

This fund is a high beta discount to NAV one, with the propensity for aggressive mean-reversions. This is not a fund that moves to a large discount to net asset value and stays there – do expect EVV to trade flat against net asset value in a normalized trading environment. Very large discounts here mean only one thing – time to buy!

Factor Nr. 3 – Collateral Pool

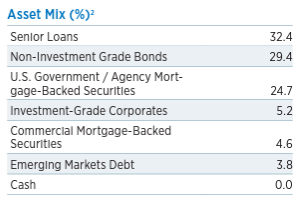

EVV has a collateral pool that includes a large percentage of floating rate loans:

Collateral Pool (Fund Website)

Leveraged loans have been one of the few fixed income asset classes, which have done well in 2022. Ultimately, floating rate loans are now paying cash interest levels almost double of what was disbursed at the beginning of the year. EVV has a 32% allocation to this asset class.

An interesting aspect to notice is the fact that the CEF has a very large allocation to MBS bonds (labeled as “US Government / Agency Mortgage-Backed Securities” in the above table). This year has seen a massacre in this space, with mortgage rates significantly higher and a duration increase in the asset class on the back of lower prepayment speeds. While the fund does not parse out the maturity profile of each bond in its collateral pool, we surmise a high percentage of the MBS book of business is shorter duration. Shorter duration MBS bonds mean the CEF received principal payments (MBS bonds do not have bullet maturities) as the year progressed, and thus were able to monetize at par the paydowns.

Conclusion

The fixed income CEF space has been a tough environment this year. Most funds are significantly down in this bracket, and rightfully so given the substantial increase in risk-free rates. The notable outperformers in the space have been leveraged loan funds, which we have covered extensively. Floating rate loan CEFs is a cohort which has benefited from an actual increase in the cash flows coming into the structure. Multi-asset bond funds with an active management like EVV have been the other winners. The beauty of the CEF structure is that it allows fund managers to layer in derivative positions to hedge certain market risks, in this instance duration risk. EVV has outperformed from this angle.

Be the first to comment