Daniel Balakov

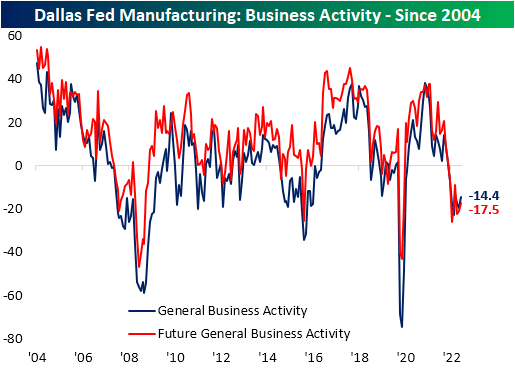

At face value, today’s release of the Dallas Fed’s manufacturing report put up a decent number with the General Business Activity index coming in at -14.4. That was up 5 points month over month and was handily better than expectations which were pointing to a further decline down to -21.

Regardless of the better-than-expected reading, the negative number indicates the region’s manufacturing activity continues to decline at a steady pace (the index is still in the bottom quintile of readings in spite of this month’s rebound), and the other components only tainted the picture.

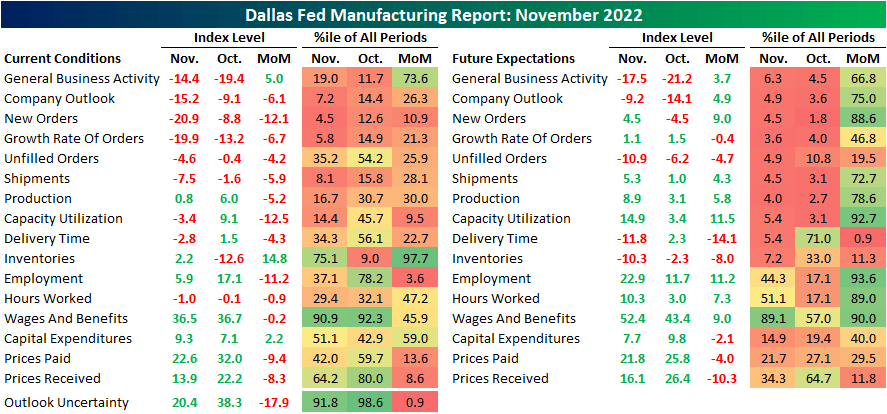

Outside of the headline number, there were only two other components with higher month-over-month readings: Inventories and Capital Expenditures. A slightly higher number of indices are in contraction than expansion with some of the more important readings like New Orders appearing to have cratered the most.

Although there were more positive month-over-month moves, expectations indices are broadly sitting at far weaker levels relative to their histories than the current conditions indices. Of the 16 indices, 10 are in the bottom decile of all periods.

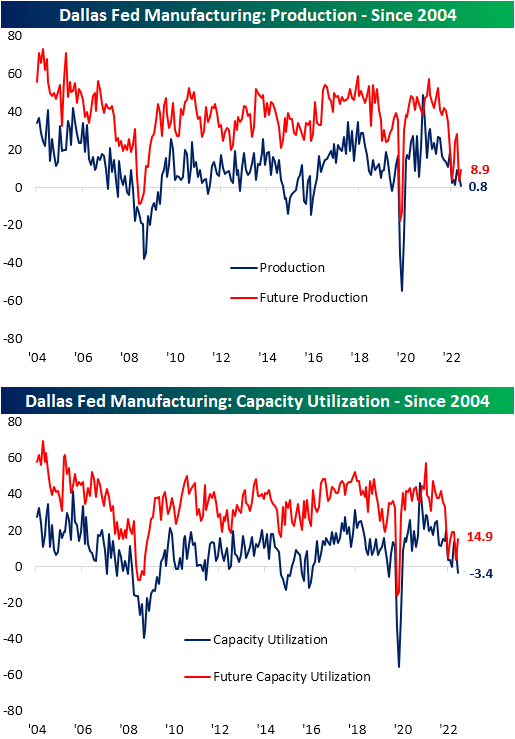

Of the current conditions indices, one of the largest declines has been for capacity utilization. That index fell from expansion into contraction in November plummeting 12.5 points (a bottom decile monthly move). Paired with a barely expansionary reading of 0.8 for production, these readings point to the region’s manufacturers cutting down on their output.

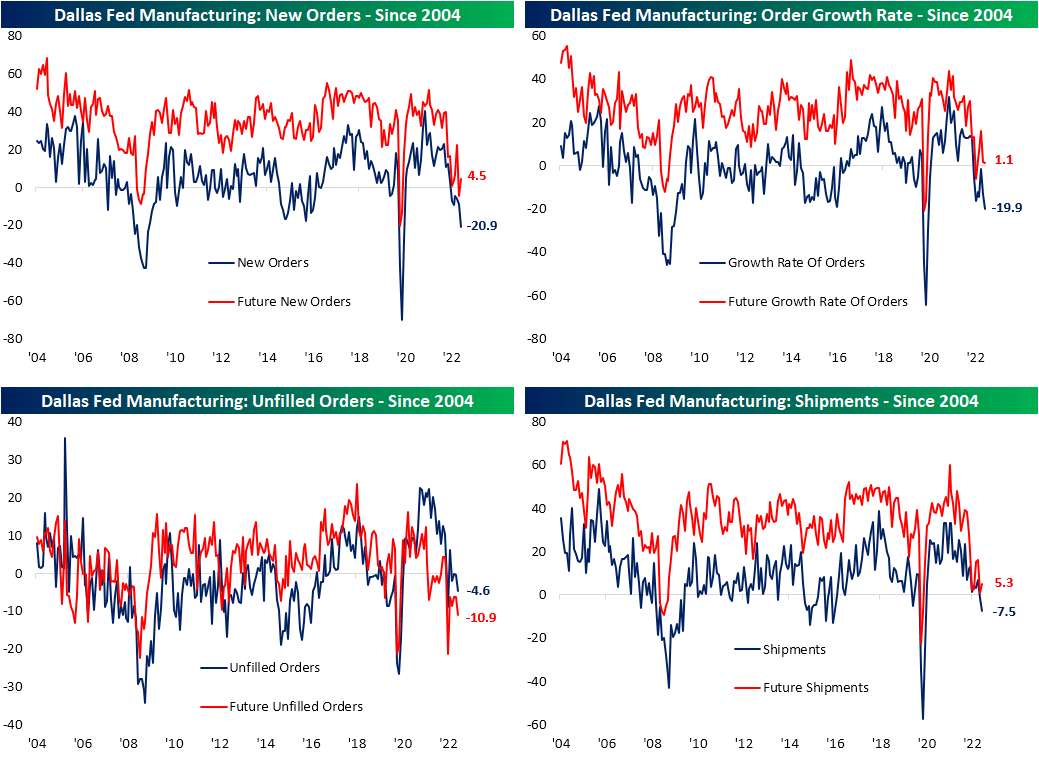

The reason for the decline is that demand has been crushed. New Orders fell another 12.1 points month over month to hit a fresh low of -20.9. That is the weakest reading since May 2020 and the only other sub-20 readings came in the first half of 2009.

Unfilled Orders and Shipments are contracting in turn. While those two indices are likewise at post-pandemic lows, they are not quite as historically depressed as New Orders.

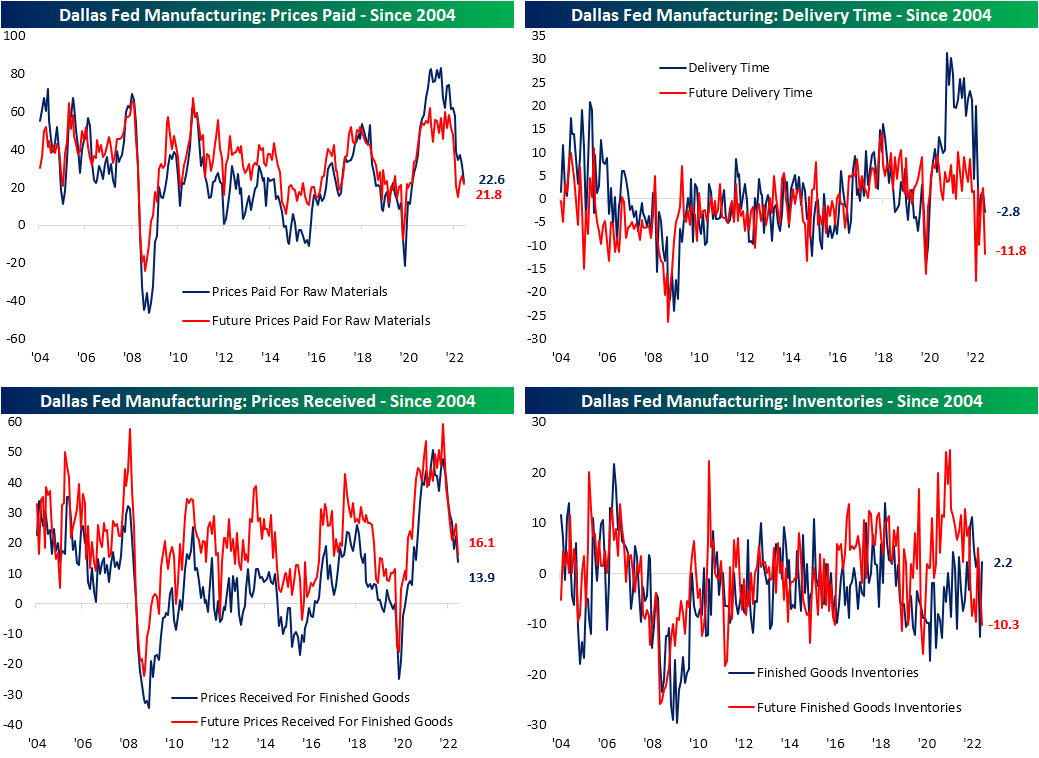

While it might not exactly net out the negatives of demand and production weakening dramatically, if there is a silver lining in this month’s report, it is the relief in price pressures. Both indices for Prices Paid and Received have plummeted reversing large portions of the post-pandemic increase.

That is not to say prices themselves are turning lower, but they are increasing at a much less dramatic clip. Delivery times, on the other hand, are contracting with expectations predicting far larger declines down the road. Additionally, on the supply chain front, Inventories have begun to rise likely as a result of crimped demand.

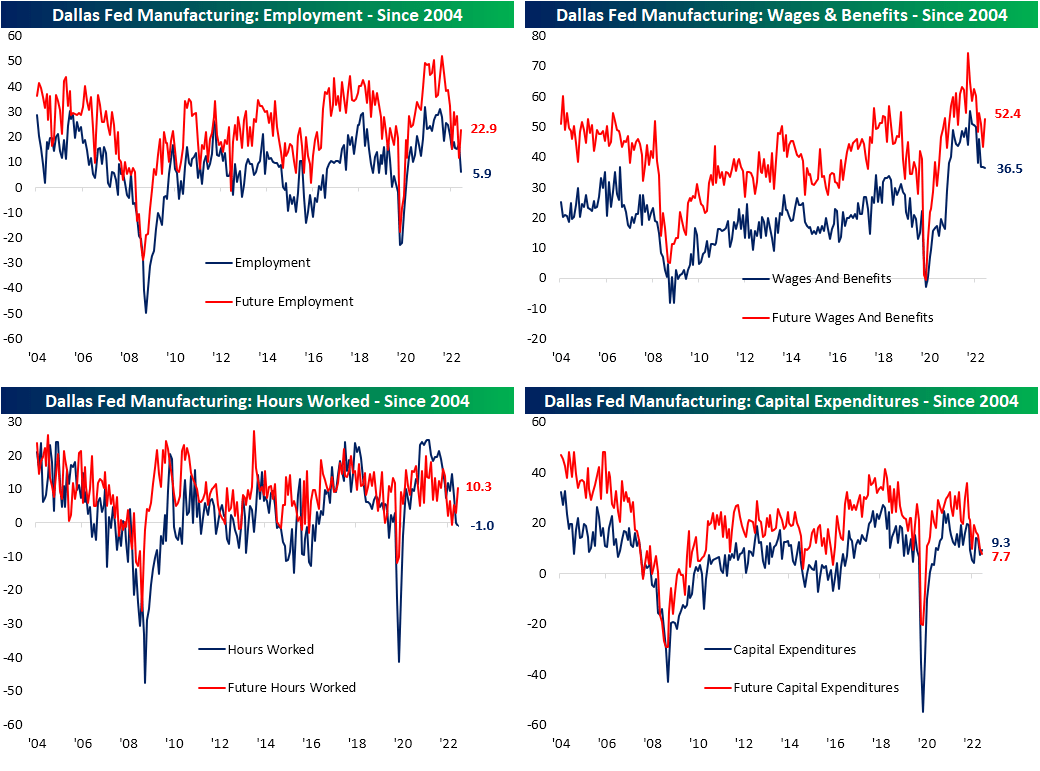

Employment metrics were another notable area of deterioration this month. While Wages and Benefits went little changed and are at the low end of the past year and a half’s range, Hours Worked are falling and hiring has slowed as the Employment index fell back into single digits to the lowest level since July 2020.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment