David McNew

With the S&P 500’s significant bounce off its October low, led lower by the biggest of big companies, there are plenty of green spots on the year-to-date performance heat map. One household name, up 3% in 2022, reports earnings before the bell on Wednesday. After enduring a tumultuous two years of Covid hits, supply chain issues, worker shortages, and now soaring food prices, a lot has been going on with Hormel Foods.

Is the spam stock a buy ahead of earnings or is it too expensive like so many other Consumer Staples stocks? Let’s unpack the situation.

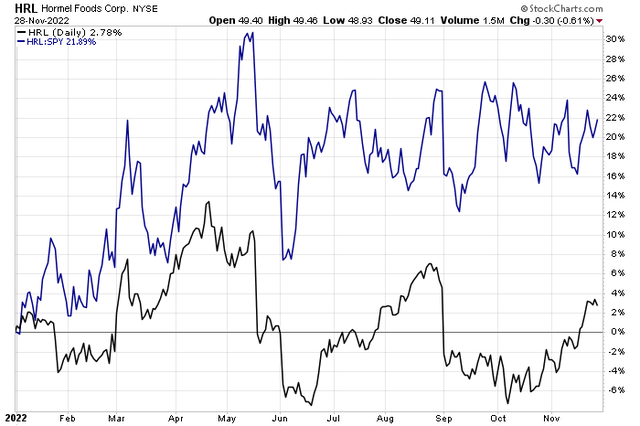

HRL up 3% YTD: Relative Strength Steady

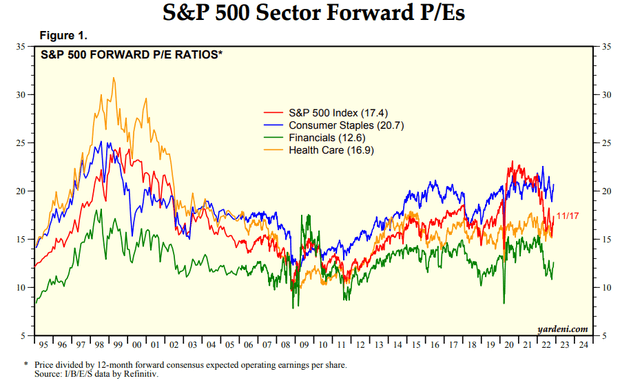

Consumer Staples Forward P/E: Stretched Above 20

According to Bank of America Global Research, Hormel (NYSE:HRL) is a leading producer of meat and other branded food products in the United States and internationally with a focus on pork and pork-related products, turkey, simple meals, nut butters, and Mexican foods via its MegaMex JV. HRL differentiates itself from the other protein processors as it is largely focused on the manufacturing and distribution of branded, value-added consumer products as opposed to a commodity fresh meats business.

The Minnesota-based $27.0 billion market cap Packaged Foods and Meats industry company within the Consumer Staples sector trades at a high 26.8 trailing 12-month GAAP price-to-earnings ratio and pays a 2.2% dividend yield, according to The Wall Street Journal.

Hormel faces significant input cost headwinds from the ongoing African Swine Flu that has helped send egg prices soaring. That same epidemic impacts pork, which Hormel’s sales mix is highly exposed to, around 50%. Moreover, exposure to uncertain international markets could prove to be bad for earnings as well as high domestic labor costs. On the upside, declining pork inflation would be a boon as well as unexpected earnings-accretive M&A.

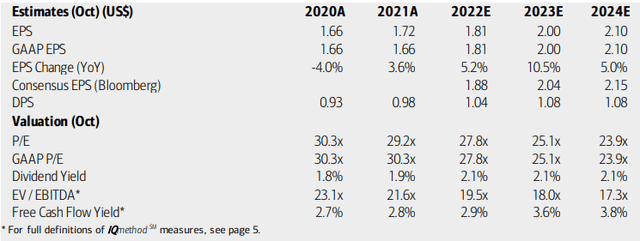

On valuation, analysts at BofA see earnings climbing more than 5% this year, less than the rate of inflation. EPS picks up next year as seen by a forecast 10.5% advance by BofA. The Bloomberg consensus forecast is about in-line with what BofA sees.

Dividends, meanwhile, are seen as growing commensurate with per-share profits. Still, both Hormel’s operating and GAAP P/Es remain very stretched, as does its EV/EBITDA ratio. On the plus side, HRL generates positive free cash flow, but at a below-market rate. Overall, the valuation looks expensive.

Hormel: Earnings, Valuation, Free Cash Flow Forecasts

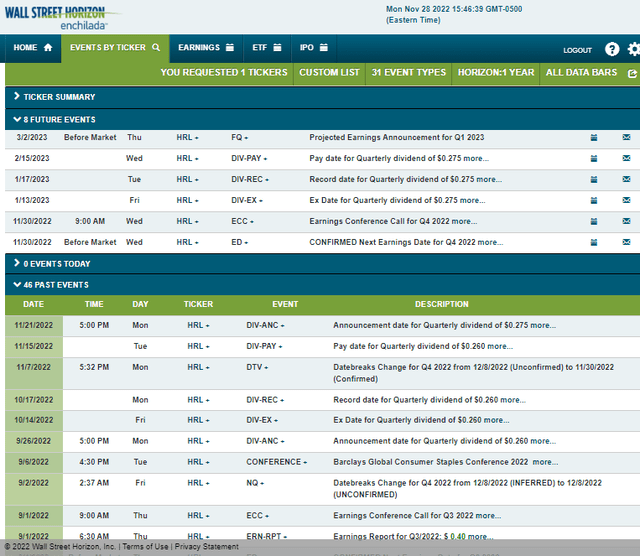

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2022 earnings date of Wednesday, November 30 BMO with a conference call immediately after results hit the tape. You can listen live here. HRL trades ex-div on January 13.

Corporate Event Calendar

The Options Angle

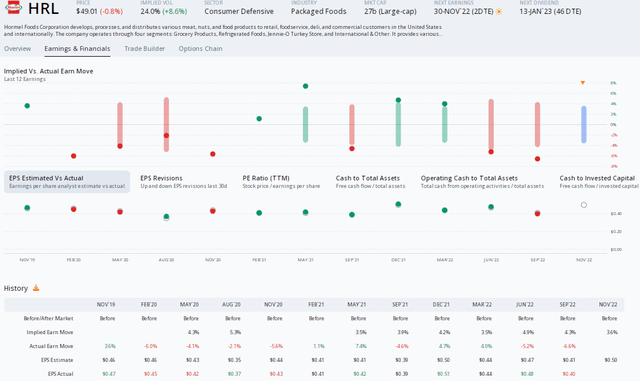

Digging into the earnings report expectations, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.50 which would be about unchanged from $0.51 of per-share profits reported in the same period a year ago. Since Hormel’s previous quarterly report, there have been a pair of upward EPS revisions.

The options market has priced in a 3.6% earnings-related stock price swing, using the nearest-dated at-the-money straddle, after Wednesday morning’s report. That is less than what has been seen following the previous six earnings releases. That leads me to be on the long side of the options trade – perhaps via a long straddle. In terms of direction, shares have traded down after the last two reports.

HRL: Cheap Options Compared to Previous Earnings Moves

The Technical Take

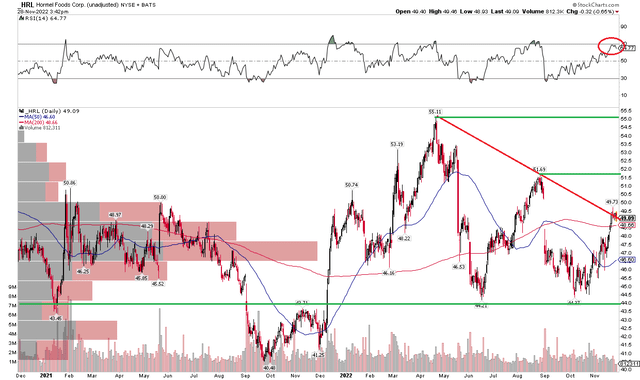

With an expensive stock and cheap options, what do the charts say? I see a pullback in the works. Notice in the chart below how the stock has run into a downtrend resistance line off the April high. While HRL climbed above its flat 200-day moving average recently, that line had not been an important spot on the chart over the past 12 months.

If shares break out from this small bull flag, though, a bullish measured move price objective to near $54 would trigger. For now, however, I’m in the bearish camp into earnings and would look to buy on a dip to support near $45.

HRL: Shares At Trendline Resistance Ahead of Earnings

The Bottom Line

HRL is an expensive staples stock with lackluster forward earnings growth. With options inexpensive, I would look to purchase near-dated puts and play the stock from the bearish side. Support is seen in the $44 to $45 range, but even there HRL is still pricey for long-term value investors.

Be the first to comment