Pranita Thorat/iStock via Getty Images

The Mosaic Company (NYSE:MOS) is strategically positioned to experience revenue growth in 2022 due to the increased price of fertilizers. The recent price explosion comes after the company announced a $400 million share buyback program in February 2022. Analysts have revised earnings expectations higher to the tune of 67 higher revisions to 1 lower revision in the last 30 days.

The momentum of this stock could find it reaching $75, but at this level, the company could become a selling opportunity as soaring costs meet a fertilizer price ceiling caused by the weakness in the farming industry. We believe revenue estimates might be errantly high and when 2013 margins are applied to these optimistic revenue estimates, EPS forecast an implied price of around $30 per share.

Mosaic Stock Price 2010-2022 (TD Ameritrade)

The Mosaic Company

The Mosaic Company produces and markets phosphate and potash fertilizers primarily in North America, but also operates internationally, with a focus in Brazil. They operate 15 mines in North and South America, 19 production facilities with the capacity to produce 11.72 million metric tons of potash and 21.7 million metric tons of phosphate a year.

As major foreign competitors in these markets are banned from supplying markets with needed fertilizers, Mosaic has a strategic opportunity to profit from that supply vacuum. They profited heavily from the aggressive demand in fertilizers in 2021 and ended the year with EPS of $4.27, their highest since Q1 2013. Analysts are very optimistic about Mosaic’s 2022 performance with the average estimate for 2022 revenue at $17.29 billion with a $9.7 EPS. EPS revisions over the last 30 days have had 1 revision lower compared to 67 revisions higher, with a notable upgrade by Goldman on 3/15/22 from neutral to buy with a target of $83. The price of Mosaic stock just recently jumped from $44 to $64 on news of a $400 million stock buyback. There is no denying market sentiment for this stock and industry is very positive given the current climate.

Market and Industry Trends

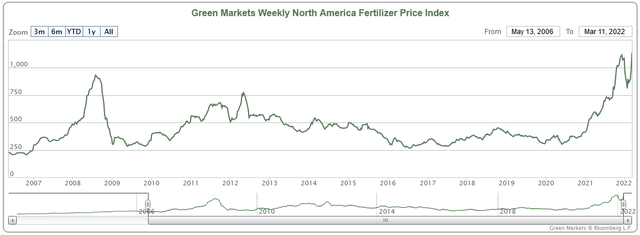

The current state of the global economy is severely disrupted due to supply chain constraints caused by continuing COVID-19 related worker shortages and lockdowns, aggressive sanctions on Belarus and Russia, export bans in China, war-torn Ukraine, and uncontrollable inflation. One industry that has gotten more attention than normal is the agricultural products industry. Fertilizer prices have continued to rise throughout 2021 and into 2022 at an incredible pace.

We are currently experiencing the highest prices for fertilizer in the last 20 years. The cause of this meteoric rise is the loss of required production inputs due to sanctions on two of the world’s largest exporters, higher than normal demand in 2021 exhausting supply, and higher energy costs derived from the increase in oil. This doesn’t seem likely to happen prior to beginning of Q3 given the persistence of sanctions, oil supply not meeting demand, the high cost of natural gas, and the locked-in costs of fertilizers on food since planting seasons require fertilizer before the crops are produced.

Historically, during times when fertilizer prices increased quickly, revenue for the entire industry increased, but earnings decreased due to the inelasticity of end-use product price. The food industry has many substitutable products if consumers find that prices are high for a preferred product. This dynamic of this industry leads to tighter margins as costs rise. This has never been truer than in the current state of the agribusiness industry as the crop production sector has been showing increasing signs of weakness in the form of food manufacturers and processors continuing to innovate to decrease the costs of inputs.

While innovation is typically a good sign of competition, in this case it has come about as a means for survival. The strain currently exhibited on the supply of fertilizer resulting in the price increases is not as clearly a revenue windfall as many market analysts are signaling in their estimates. High fertilizer prices have a monumental impact on the expenses required to grow food and feed animals and these expenses are not a part of government programs to protect the income of U.S. farms.

Valuation

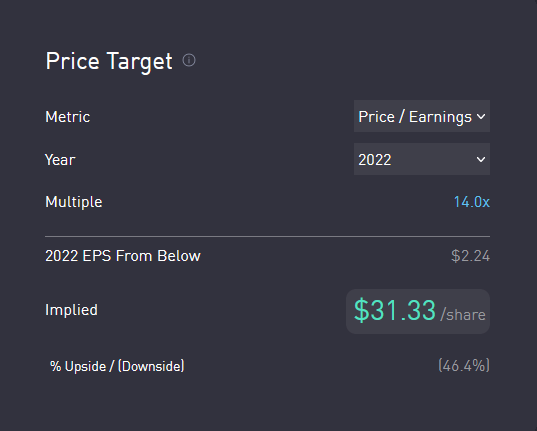

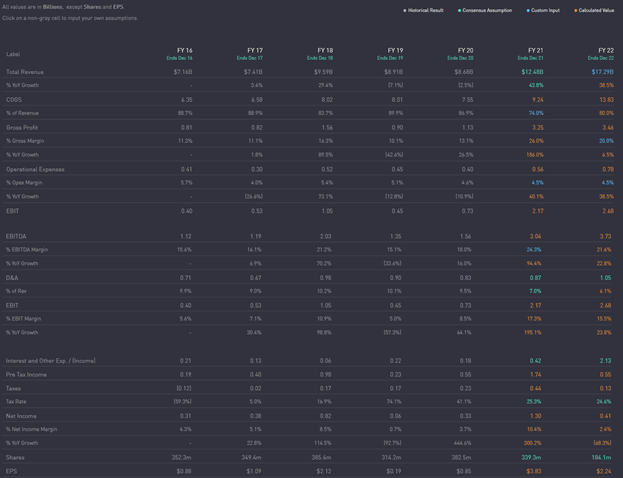

At the end of 2021, Mosaic had a market price of $39.29 trading at a P/E ratio of 9.2x their $4.27 EPS. Since then the price has risen to $58, and is trading at 14x their TTM EPS. With current analyst estimates for revenue and EPS for 2022 with current P/E ratios, the implied price for Mosaic is $143, a price near the all-time highs for Mosaic in 2008. However, the glaring problem with average analyst estimates for 2022 revenue of $17.29 billion is it represents 91% of total yearly production sold at current fertilizer prices.

The only way these revenue targets can be achieved is by factoring in continued increases in fertilizer prices, but this will likely strain profit margins unlike what the company experienced in 2021. The fundamental difference is that, in 2021, the market supported higher prices after the stagnant markets of 2020, while in 2022 the industry won’t be able to support ever-rising prices.

The necessary requirement for Mosaic to reach these revenue estimates is the farming industry having the price elasticity to support continued fertilizer price increases. This is dependent on the elasticity of prices at the end-use food industry, which is historically inelastic as can be seen in the weakness in the farming industry where farm bankruptcies have growth year-over-year since 2018 due to tightening profit margins experienced from higher costs and highly competitive low product prices.

The farming industry saw prices decline significantly in 2020 as consumers switched to the least expensive food alternatives, and restaurants closed down. The inflationary environment of 2022 is generally expected to bring relief to this sector, however the current price of oil and fertilizer have grown faster than food prices. The capacity of the farming industry to absorb persistent rising prices is far more limited than current valuations suggest.

The current environment is similar to 2012-2013, when we saw rapid price growth and volatility in fertilizer prices, WTI Crude between $90 and $110, and Natural Gas between $3.50 and $6.40, followed by a normalizing decrease in all prices through the end of 2013 and beyond. The major differences to consider now are the continued supply chain issues from the pandemic, that the Federal Reserve is tightening monetary policy rather than easing, and that the market is further disrupted by geopolitical events. Using actual margins the company experienced at the end of 2013 we find that our average estimated EPS of $9.7 drops to $2.24, lower than 2021 even with the additional $4.81 billion in revenue, causing an implied share price of $31.33 with the same 14x P/E ratio.

S. Spain using Atom Finance

Own work using Atom Finance

Catalysts and Risks

As we see attractive revenue from Q1 fueling the current momentum, a big red flag is expected in earnings come Q2 results this summer. As analysts see the high input costs eating away the earnings, they may begin to revise their estimates. Missed earnings and revisions lower will be the beginning catalyst to stunt the upward momentum. Further margin compression in Q3 will cause immense downward pressure on the stock as valuation models begin to factor in revenue growth with margin compression.

This model assumes sustained natural gas and oil prices with stagnant or decreasing fertilizer prices. Should the price of fertilizer inputs decrease while prices stay elevated, Mosaic could reach 2008 highs again as revenue growth couples with earnings growth. Lifting of sanctions on Russia and Belarus, and/or China exporting fertilizer before their announced timeframe will change the dynamics of the industry. This may accelerate the price collapse if fertilizer prices drop from sudden increased supply, and expenses have already been realized, or it could return the industry, and Mosaic, to its typical price ranges and fluctuations.

Bottom Line

Mosaic’s stock could rise from current price levels, but such bullish price action is unlikely to continue in the mid-term. Margin compression in Q3 will likely dampen earnings expectations and put an end to the stock’s meteoric rise. While we are not necessarily advocating for a pure short, we do not believe the stock can rise significantly above $75, or sustain such price levels for long.

We would like to thank S. Spain for his contribution to this piece.

Be the first to comment