emyu/iStock Editorial via Getty Images

Introduction

We’re living in a low-yield environment. In this case, I’m not referring to bond yields, which are rapidly rising, but the S&P 500’s dividend yield, which has fallen off a cliff after the pandemic. One way to seek refuge when seeking yield is the financial sector, especially (regional) banks. U.S. Bancorp (NYSE:USB) is America’s largest regional bank with a 3.2% dividend yield. In the current market, that’s considered “high yield.” In this article, I will discuss this opportunity and give you my opinion based on its yield, growth, and the stock’s valuation – among other things.

So, if you’re looking for yield, bear with me!

Banking Yield

I own Huntington Bancshares (HBAN), which I bought for $9.30 in 2020. I bought it because it was cheap and a good source of income. Moreover, the bank has a solid balance sheet and a dominant position in the area where it operates (the Midwest). All of this applies to US Bancorp as well, except that this bank is larger – much larger.

USB has $570 billion in assets and a market cap of roughly $84 billion, which makes it the fourth-largest bank in the US – including money center banks. The only regional bank with more deposits is PNC Financial Services Group (PNC).

The company is also well-diversified. It has 39% consumer and business banking exposure, 28% payment services, 18% corporate and commercial banking, and 15% wealth management services.

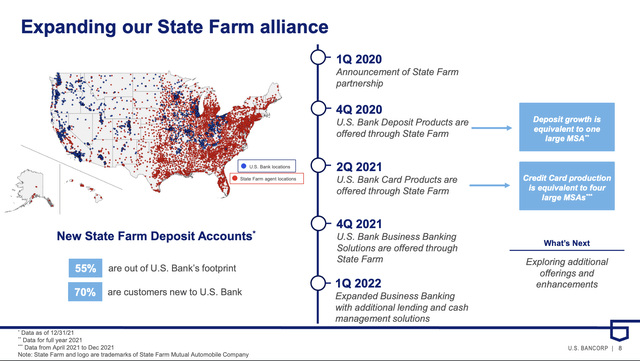

Since 2020, the company has had a partnership with State Farm, which means that U.S. Bancorp deposit products and card products are offered through State Farm.

And while I will get to the numbers in this article, regional banks are very straightforward. Most of the big regional banks have very similar stock price movements, similar yields, and similar reactions to certain economic developments.

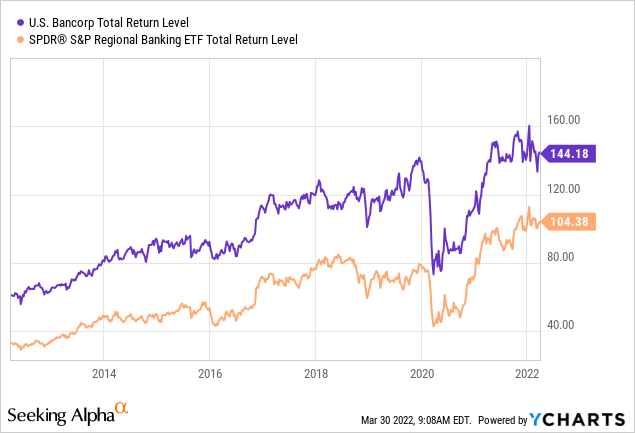

Including dividends (total return), USB and the well-diversified regional bank ETF (KRE) have had very similar movements. The general trend is up because of compounding dividends and because stronger economic times result in new all-time highs for most large banks. The same goes for downturns and sideways trends.

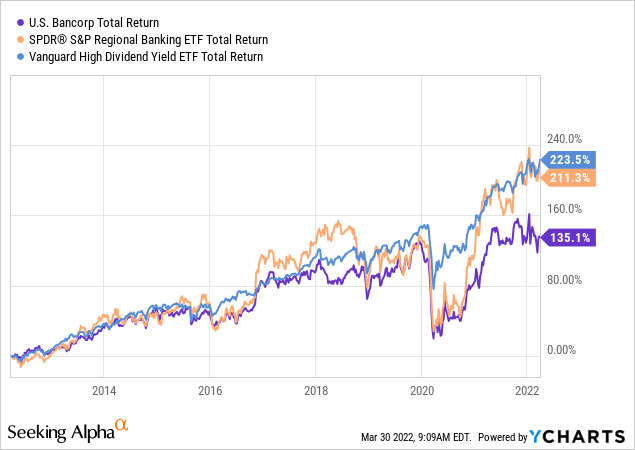

Moreover, regional banks are slow, but not bad investments. Over the past 10 years, the Vanguard High Dividend Yield ETF (VYM), which I like to use as a benchmark, has returned 224% including dividends. The regional banking ETF KRE I just mentioned returned 211%. U.S. Bancorp returned 135%, which is not that great, to put it mildly.

But no worries, as USB has an advantage: it has a higher yield. The KRE ETF has a 2.0% yield. USB is yielding 3.2%.

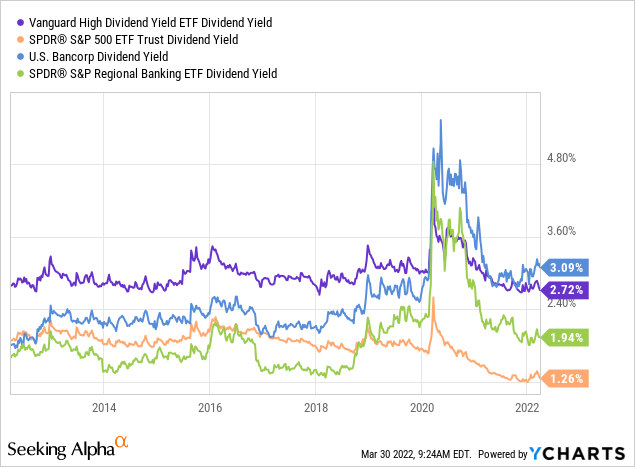

Since the pandemic, yields have fallen off a cliff. The S&P 500 used to yield close to 2% prior to the bad news out of Wuhan. Now, it yields close to 1.3%. USB’s yield is decent in this market.

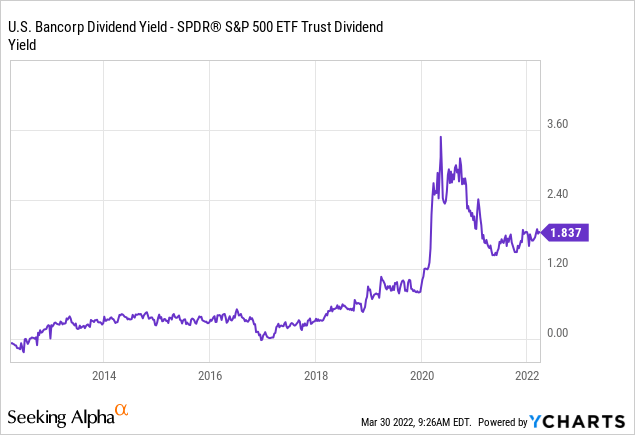

The yield “premium” is now roughly 190 basis points (I’m using a 3.2% yield, not the 3.09% yield YCharts uses), which is one of the highest spreads since the Great Financial Crisis.

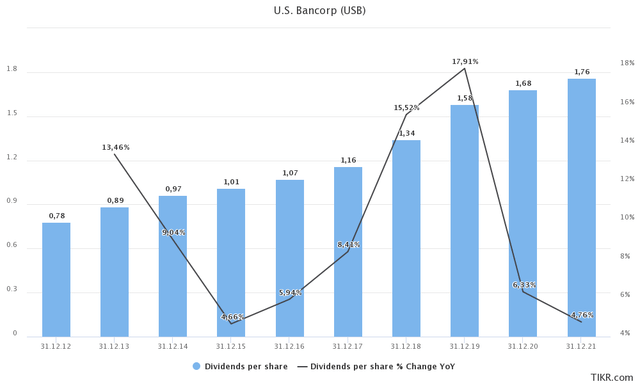

With that said, dividend growth isn’t bad either. Over the past 10 years, dividend growth was 12.2% per year, on average. Over the past five years, this number has declined to 10.5%. Over the past 3 years, it’s 8.5% and it includes two pandemic years (2020 and 2021). These numbers are more than decent, and I did not expect growth to be this high before starting this research.

With that said, the valuation isn’t too bad either.

Valuation

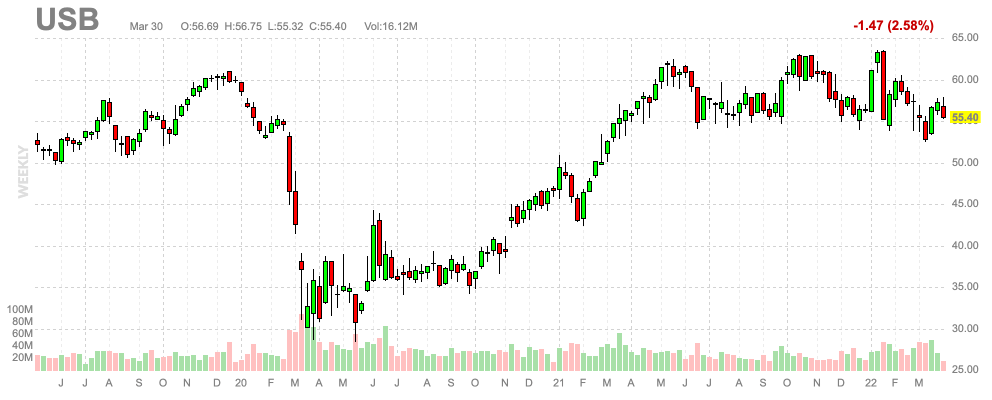

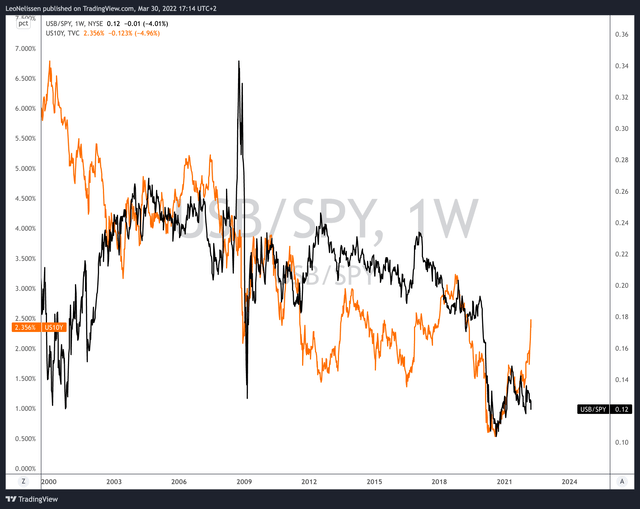

There’s good and bad news. The good news is that USB is expected to benefit from higher inflation. The graph below shows a black line (USB vs. S&P 500 ratio) and the 10-year yield (orange) Whenever the 10-year yield rises, USB (and its peers) tend to outperform. It happened after the 2008-09 recession, it happened in 2013, and it happened in 2016 as well. It also happened in 2020, but it ended going into this year.

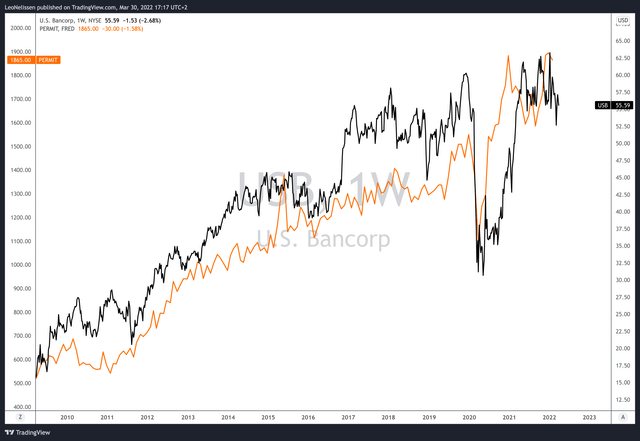

The problem is that the market expects that the Federal Reserve will “break” something. Because rates are expected to rise, the burden on consumers will rise. It will be harder to finance a new home or car and already high inflation is impacting people’s decisions to buy a house, in the first place. The graph below shows building permits, which is a good indicator of housing health, and the USB stock price (black). Building permits are a good indicator because housing is a key source of loan growth.

Unfortunately, both homebuilders and banks are weakening despite high housing demand. I explain this in greater detail in this Seeking Alpha article.

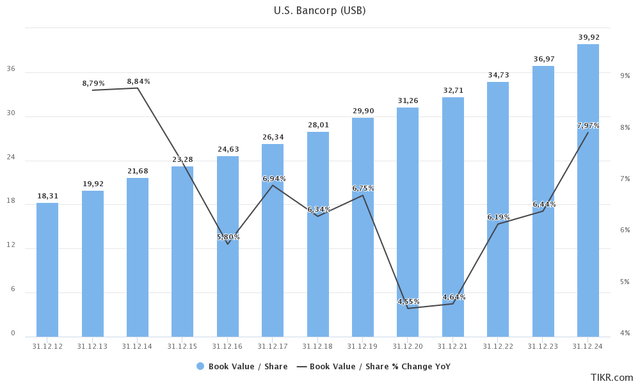

Because of its underperformance, we’re dealing with a favorable valuation. This is the point where we look at the (expected) book value per share. Since the Great Financial Crisis, the company has grown the book value per share very consistently without declines. It also helps that the company has fewer shares outstanding. In 2021, the company had 1.49 million common shares. In 2017, the company had 1.68 million common shares. That’s a decline of 11.3% or 2.4% per year. That’s indirect shareholder value as the value of each common share increases when a company buys back shares.

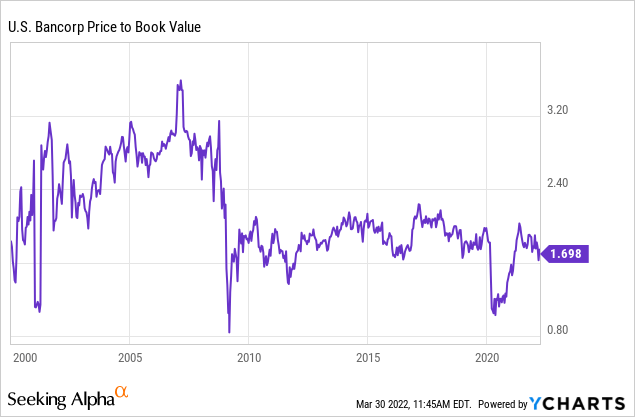

Using the company’s $55.60 stock price, we’re dealing with a 2022E price/book ratio of 1.60x. In 2023 and 2024, the valuation drops to 1.50 and 1.40x.

Since the Great Financial Crisis, USB has traded close to 1.7x book with lower values during weaker economic times and higher values prior to growth-slowing trends.

What these numbers imply – especially given the expected book value – is that the stock should add about 6-7% in capital gains per year going forward. That’s an average and it is prone to outlier years, but I’m positive that investors will get close to 7% in capital gains excluding dividends.

Takeaway

I’m not a huge fan of banks, as most are “boring” investments, it’s hard to find outperformance, and most are growing very slowly. U.S. Bancorp is no exception. America’s largest regional bank has underperformed its peers and the market on a long-term basis and growth is mainly coming from new partnerships and innovation is incremental like a better online platform and other cloud capabilities.

However, boring is good in some cases. The company offers a high yield and dividend growth isn’t bad at all. On top of that, the valuation is getting better, which I believe is key when buying banks.

TIKR.com

If you’re looking for yield in this environment, I think USB is a good pick. Like a (good) utility, it’s steadily growing, has a very decent yield, but a higher dividend growth rate.

However, it’s not as safe as a utility, so do not go overweight banks. I have 4.0% banking exposure, and I will likely keep it that way.

(Dis)agree? Let me know in the comments!

Be the first to comment