kmatija

The selloff in REITs and evaporation of enthusiasm for cannabis equities (MSOS) have led to a rough ride for New Lake Capital Partners (OTCQX:NLCP) shares since its IPO last summer, with shares down 46%. Despite a spotless balance sheet and strong tenant roster, NLCP screens as one of the cheapest REITs and yields nearly 10%. While shares are likely to remain volatile, I believe NLCP shares represent a compelling value at today’s price.

NewLake listed on the OTC exchange in August 2021 at a price of $26, raising $93 million (after fees). While REIT peer, Innovative Industrial Properties (IIPR) listed on NYSE in 2016, prior to the closing of the loophole for federally illegal cannabis related businesses, NLCP was forced to list on the OTC exchange which has led to reduced liquidity and investor interest.

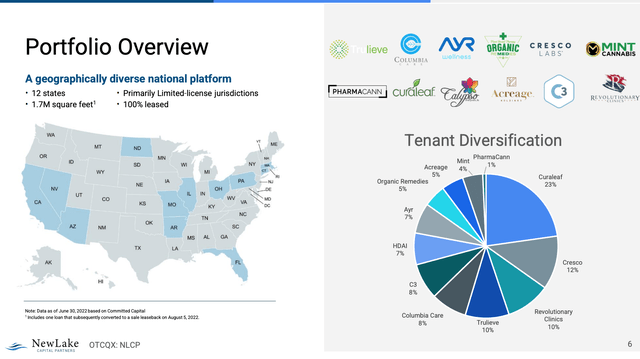

While NLCP may be less known than IIPR, NLCP boasts an impressive tenant roster consisting mainly of publicly traded multi-state operators, as shown below:

NewLake Overview (Company Investor Presentation)

As you can see above, nearly 2/3 of NewLake’s tenants are publicly traded cannabis operators. Nearly all of these companies are generating positive EBITDA and have greater access to both debt and equity capital which increases their ability to make lease payments to NLCP even as conditions in the cannabis market weaken. While IIPR trades at a significantly higher valuation than NLCP, only 52% of IIPR tenants are publicly traded. Further, NLCP is geographically diversified by state. Geographic diversification is particularly important in the cannabis business because differing state regulations have a significant impact on tenant profitability.

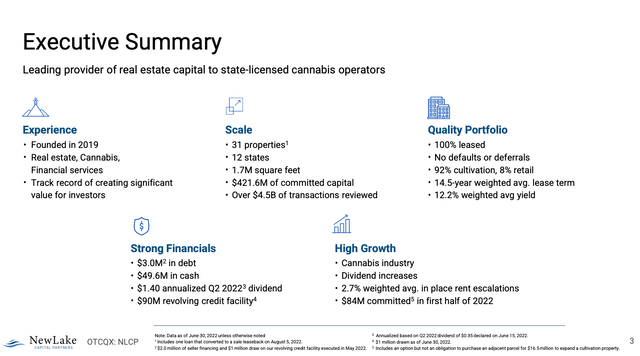

Executive Summary (Investor Presentation)

While increased competition and a weakening economy have curtailed the profitability of some cannabis operators, as shown above, all tenants are currently paying rent. Importantly, lease terms are long (14.5-year weighted average lease term) and contain annual 3% escalators.

NLCP is in a very strong financial position – cash exceeds debt by $47 million. Further, NLCP has a $90 million credit facility, which will allow the company to continue to invest in new properties and grow NOI and dividends going forward.

Valuation – takeover target?

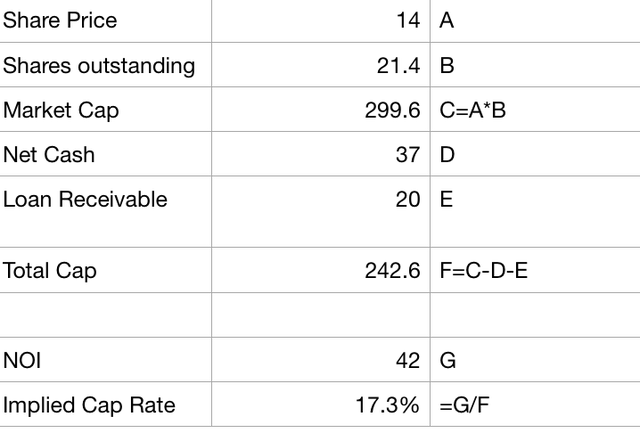

While its better known peer IIPR trades at an implied cap rate of roughly 10%, despite a superior tenant roster, NLCP trades at a whopping 17% implied cap rate:

NLCP Valuation (Author Estimates)

While NLCP went public to have access to capital markets and facilitate accretive growth, today’s valuation is so low that it does not make sense for NLCP to issue shares and fund new property purchases. Said differently, it does not necessarily make sense for NLCP to be a standalone public company. Given that IIPR trades at a significant premium to NLCP, I believe it would make sense for IIPR to do an all-stock transaction to acquire NLCP. This would help IIPR to not only grow its portfolio, but to upgrade its tenant roster and have a higher mix of publicly traded tenants.

I estimate that IIPR could pay $20+ per share for NLCP and the transaction would be financially accretive (increase NAV per share) for IIPR. It is also possible that a private equity buyer could make an all-cash bid for NLCP. A $20 price tag would still represent an 11% cap rate to the buyer and a 43% premium to NLCP shareholders, which could be seen as a win-win.

Conclusion

With a strong balance sheet, high quality tenant roster, and extremely low valuation, a 10% dividend yield and a realistic possibility of a takeout, I see NLCP shares as an asymmetric investment opportunity.

Risks

1. As with all things cannabis, the federally illegal status of cannabis creates a unique set of risks for all companies operating in the sector.

2. REITs continue to remain out of favor

3. OTC listed stocks are more volatile than average

Be the first to comment