ImageegamI/iStock via Getty Images

Today, I will take another look into Apple Hospitality REIT (NYSE:APLE), which, as its name implies, owns and operates 219 hotel properties across 36 States. About a year ago, I had written another article about the company, named “Apple Hospitality REIT: Growth Will Bear Fruit”, in which I outlined the reasons to buy it. While an investor that would’ve purchased Apple’s shares back then, would have a 3.93% negative total return today, this figure is substantially better than the broader market, which showed a decline of 23%. The reasons that justified an investment in the company back then were namely the better – than – peer performance, the share discount relative to peers and the constraints in competitor hotels. Let’s see if the long case still exists for the company.

Peer group performance

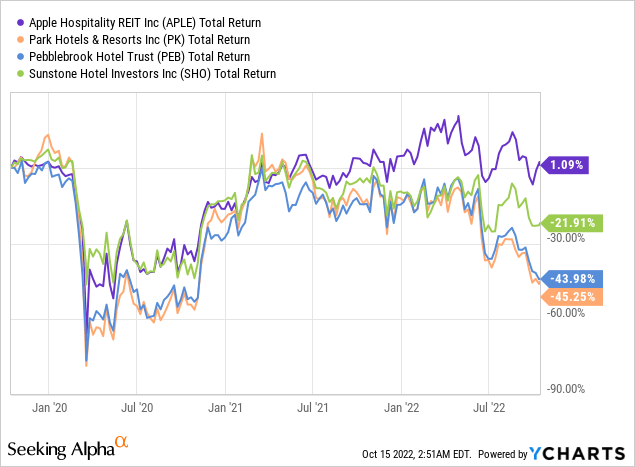

For the sake of comparison, I will create a peer group comprised of Park Hotels & Resorts (PK), Pebblebrook Hotel Trust (PEB) and Sunstone Hotel Investors (SHO). As we can see in the graph presented below, Apple Hospitality REIT has outperformed its peers by far, when it comes to total return levels, over a three-year period. Despite the numbers not being spectacular on their own, if we allow for the devastating effects of the pandemic in the hospitality sector, it is actually a small industry miracle that Apple managed to provide just positive total returns.

Let me remind you that the company had sliced their dividend to 1 cent per share, during the pandemic, which had given rise to some strong criticism. After all, the dividend is something that definitely affects the decision of a REIT investor. I had written that it was the right decision to make, given the turmoil at the time. And it appears that I was right, as the company recently increased their monthly dividend to 7 cents per common share, which at the current share price, stands for a forward dividend yield of 5.5%. Not bad at all. But is it healthy and sustainable?

At the end of Q2 2022, the company reported an FFO figure of $0.48 per common share. Based on a $0.21 dividend for the quarter, we have a 43.8% dividend payout, which is quite conservative. This, in combination with the fact that in the era before the pandemic the company offered a dividend yield in the ballpark of 6.5%, shows that there’s a good chance of a further dividend increase in the future.

At the same time, Park Hotels and Resorts and Pebblebrook Hotel Trust are currently paying just one cent in quarterly dividends, while Sunstone Hotel Investors is paying 5 cents in quarterly dividends, which stands for just 2% dividend yield. So, Apple Hospitality Trust outperforms all of its peer from a dividend yield perspective, and also that dividend is secured by a very wide FFO margin.

Lastly, from an FFO multiple perspective, Apple Hospitality Trust is currently trading at a forward P/AFFO multiple of 11.45x, while Sunstone is at 16.55x, Pebblebrook at 10.60x and Park Hotels and Resorts at 10.96x. In other words, Apple Hospitality Trust is trading at a negligible premium to two of its peers and at a significant discount to Sunstone.

Leisure Vs. Business Diversification

As with all seasonal businesses, seeing your business operating at full capacity during a period while it is virtually empty during the next, is disappointing. That’s why hotel owners are diversifying their portfolio to allow for smoother fluctuations in occupancy between weekends and weekdays. With regards to Apple Hospitality Trust, one of the most encouraging statistics of their latest earnings call was the increase of overall weekday occupancy at 75% for the second quarter of this year, with weekend occupancy hitting 85%. While the latter isn’t a record number compared to 2019, the former represents a very low occupancy differential between weekdays and weekends. In terms of ADR, there was also a small differential between weekdays and weekends, with respective figures of $148 and $165. According to the management, these strong figures resulted in the offsetting of the increased labor cost and lower margins due to inflation. We don’t know what will happen to those numbers, given the ongoing monetary tightening and the subsequent economic slowdown. But business vs leisure portfolio diversification is there, and it’s good.

Risks involved

As with every investment case, there are some risks involved in this one too. The monetary tightening of the FED will, at some point, manifest itself in the real economy and, inevitably, economic slowdown will occur. This means less disposable income for leisure travelers and a more conservative approach to business trip spending. For the time being, the higher inflation benefits the higher ADR, but margins are under attack.

Another issue that arises from the FED’s policy, is the Apple’s debt serviceability. Almost two thirds of the company’s debt is in variable interest rate, which is something that should be noted, although Apple’s overall leverage is lower than that of its peers.

In addition, there are global geopolitical tensions, such as the Russia – Ukraine war, with an unpredictable turn of events, which are able to affect the world’s economy. In this context, hospitality is one of the first sectors that will suffer.

Conclusions

There’s no doubt that Apple Hospitality REIT is by far the best among its peer group. The company has withstood very much of the ongoing bear market, and it is currently paying a monthly 5.5% in dividends. Of course, I expect the dividend yield to increase, due to the wide FFO margins and because, historically, the company has offered a better dividend yield. The company has outperformed its peers by far, although it was hit by the pandemic as hard as every other hospitality company. They also have a very well diversified hotel portfolio with regard to leisure and business travelers, and that became clear in their Q2 2022 results. Of course, the current environment has some real risks involved with the hospitality industry, but the aggregate assessment of the company is positive.

Be the first to comment