Scott Olson

Consumer staples stocks were the place to be for the early part of this year. After growth stocks began to unravel in early 2022, more defensive names reigned. That is just about always the case during periods of market turmoil, and 2022 proved to be no different. However, it is my view that we are nearing the end of this bear market, and until I see evidence to the contrary, I’m continuing to position that way. That means I don’t see a lot of value in owning defensive names this late in the cycle, as I believe the best way to take advantage of the next bull run is with growth stocks.

That leaves perennial dividend favorites like Procter & Gamble (NYSE:PG) in a place where I don’t think they should feature heavily in most investors’ portfolios. In this article, we’ll look at some of the struggles and successes of P&G, but ultimately, I think the stock is unattractively priced and faces too many headwinds to want to own right now.

That was virtually the same the last time I covered P&G, and the stock is roughly flat in the past year and a half. That’s better than the S&P over that time, to be fair, but given the outlook for margins and the current valuation, I think P&G has a downward bias for the foreseeable future, especially relative to the broader market.

Has Wall Street abandoned P&G?

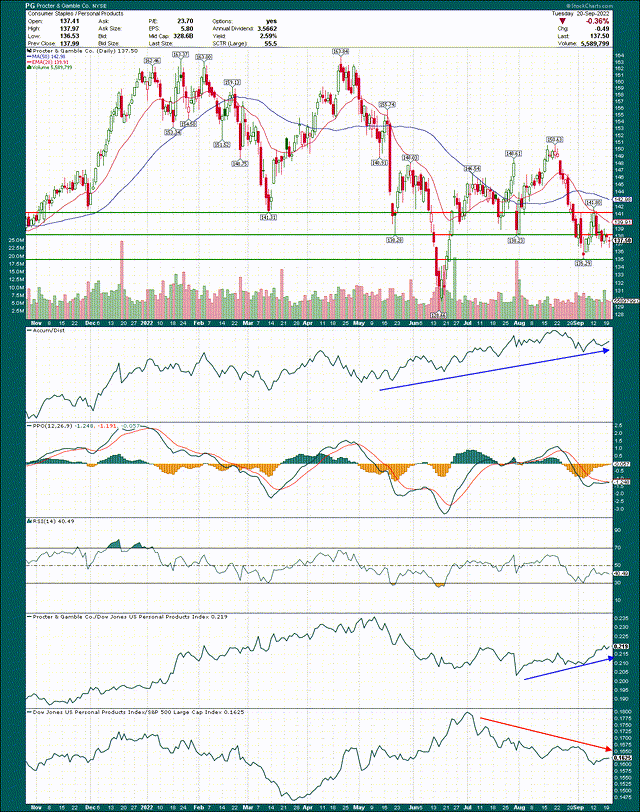

While Wall Street may not have fully abandoned P&G, the below does not have a good look. You’d think a prolonged period of market weakness – like what we’ve had for 2022 – would produce strong outperformance in consumer staples companies. That simply hasn’t been the case, and it’s largely because of input cost inflation. More on that below, but the chart looks like a stock that nobody wants to own.

There are two levels of fairly stout resistance overhead, one at $138 and the next at $141, and given the way this stock has been trading, I think taking those out anytime soon is a tall order. The momentum indicators are bouncing, but quite feebly, and the stock is seeing lower peaks on bounce attempts. This simply does not have a good look, and this is not a chart I would attempt to trade on the long side.

One positive note is that P&G is outperforming its peers, as seen in the bottom two panels, but its peer group is weak against the S&P 500. So while P&G is slightly outperforming, it’s doing so in a weak group.

I won’t belabor the point on the chart here, but the bottom line is that the bias for this stock – in my view – is lower until further notice.

What about the fundamentals?

We’re all fully aware of the inflation situation because you cannot get away from commentary and data on it. The situation is unique, given we previously had years and years of persistently low inflation, followed by a sudden skyrocketing of higher prices. That has impacted different companies in different ways, but for companies that make and ship things, it’s been doubly tough. P&G certainly fits that bill, but as we’ll see, it’s seemingly weathering the storm fairly well.

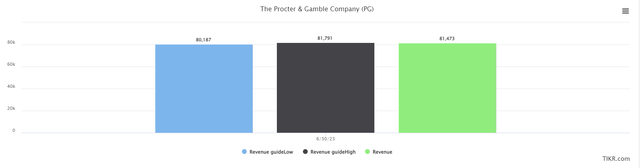

Below we have guidance for this fiscal year from management, with the lower bound in blue, the upper bound in black, and the analyst consensus in green.

We can see analysts simply went right in the middle of the range provided by management, but to be fair, P&G’s revenue is usually quite easy to forecast given its steady demand. That gives us a good baseline for this year to then look at the out years from a demand perspective.

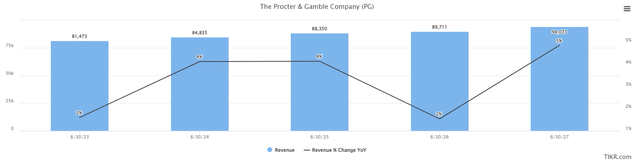

Consensus estimates for the next few years are for ~4% average annual growth, which again is pretty typical for P&G. One of the things income investors like about P&G is its predictability, and that’s one of the things that has afforded it the ability to raise its dividend for more than six decades consecutively.

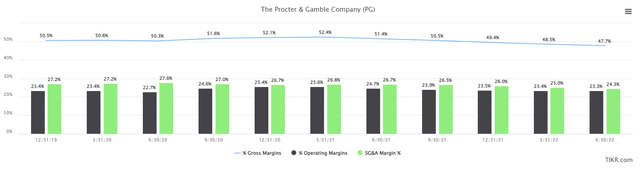

Where things get interesting is when we look at margins, which we have below on a trailing twelve months basis for the past few years. We have gross margins in blue, SG&A costs in green, and operating margins in black. These are the primary components of a company’s profitability and give us good insight into whether management is able to effectively price their goods and manage expenses.

Gross margins have been in decline for several quarters, and it would appear that, despite pricing actions being taken, it may be some time before that gets better. Indeed, with freight and input costs – two huge line items for a manufacturer of consumer staples – still very elevated, P&G looks set to struggle with gross margins despite sizable pricing increases. The good news is that P&G owns some of the most recognized and purchased brands in the world, so it’s able to push pricing increases through. However, there’s a point that will stop working.

On the plus side, the company has done a nice job of controlling expenses. We can see SG&A costs have declined from almost 27% of revenue in 2021 to just over 24% on a TTM basis last quarter. That’s quite significant, and it has kept operating profits from massive declines due to gross margin contraction. The management team is doing what is necessary to preserve profits, but just like pricing increases, these things have endpoints where more cuts simply aren’t an option. Still, I’m impressed by expense management in a difficult environment.

If we add these things together – demand via revenue projections, and profitability via margins – we get the below, which is the EPS revision schedule for P&G from its extensive analyst community.

Unfortunately, this isn’t pretty. There have been numerous downward revisions to earnings estimates not only for this year but out years as well. This is the impact of lower margins, because as we saw, revenue is pretty steady with mid-single digit gains each year. This chart is a function of margin headwinds, primarily, and it’s not a good story. If you wonder why the stock is being sold and the price chart looks the way it does, I’d point you here. It’s very difficult for any stock with persistently downward revisions in earnings to rally and P&G is no exception.

Let’s value this thing

We’ll start with the forward P/E ratio for P&G for the past five years to give us some historical context on today’s valuation. We can see during this period the stock has ranged between 16X and 27X earnings, but the former was for a brief period almost five years ago. More recently, the stock has been in a tight range of 21X to 25X, for the most part.

We find the stock exactly in the middle of that range today, so while I wouldn’t say it’s expensive, it is definitely not cheap. If you also consider that the pandemic period saw the now-defunct pantry-stocking behavior from consumers where consumables were essentially hoarded, benefitting P&G and others in the process, today’s multiple looks to have some downward bias. In other words, if the boom times of the early pandemic stages saw the stock trade for ~23X forward earnings, how in the world can we justify the same multiple when earnings estimates are in freefall? To my eye, we cannot do so, and that’s why I think it’s much more likely we see a lower multiple than a higher one.

Finally, since P&G is a legendary dividend stock, we can use its yield to value it.

Today the yield is 2.6%, and that’s about 100bps better than the S&P 500, which is great. P&G has always been a strong income stock, and 100bps better than the market keeps it firmly in that camp. However, as a valuation tool, I think this also leaves a bit to be desired. For the stock to be “cheap” in my view, we’d need to see the yield approach 3%, or possibly slightly over that, given the struggles it is having right now with earnings estimates. We’re in a downward cycle for P&G right now, but it appears to me on both the forward P/E and dividend yield, those struggles aren’t fully priced in just yet.

Final thoughts

If you’re an income investor and just want a stock that will reliably pay you dividends each year, you can’t do much better than P&G. However, if capital appreciation plays any part at all in your decision-making process, P&G is a sell in my view. It is facing numerous margin headwinds and EPS estimates are freefalling as a result. The stock isn’t priced for this, and I, therefore, see downside risk to the price today.

Be the first to comment