doug4537/iStock Unreleased via Getty Images

Original thesis

In my January 2022 article on Dollar Tree, Inc. (NASDAQ:DLTR), I put forth the following investment thesis, which I have updated as events unfolded:

|

Thesis |

Update |

|

|

1 |

Dollar Tree serves customers caught on the wrong side of the widening wealth polarization gap (e.g., lower income workers, under-saved retirees), the mass affluent who enjoy a good deal, and small businesses / non-profits that need to make their dollar go further |

The disparity in wealth has continued to widen as the economy emerges from the COVID-19 pandemic Inflation has increased pressure on lower-income earners to cut back on their spending and forced some of the mass affluent to trade down. Walmart, Dollar General, and Dollar Tree all noted that their fastest growing segments are customers with annual household incomes above $80,000 – $100,000 |

|

2 |

Revenue growth driven by: – Comp store sales – New store openings |

Revenues of Dollar Tree bannered stores rose in the last quarter due to the increase of its price point from $1 to $1.25 Revenues of Family Dollar bannered stores remain weak due to “pricing actions” to improve customer value proposition Per-store revenues have not grown on a real, inflation-adjusted basis |

|

3 |

Dollar Tree margins have stabilized |

Looking beneath the surface: Dollar Tree margins have improved with the new $1.25 price points Family Dollar margins continue to be under pressure as inflation hits its core lower income base disproportionately Margin pressure should abate as ocean freight and domestic logistics costs recede from the post-COVID spike |

|

4 |

Activist investor Mantle Ridge, which has an economic stake representing almost 10% of the company, will institute changes to create value for itself and other shareholders |

Mantle Ridge has instituted Rick Dreiling as Executive Chairman and repopulated the board. It has also refreshed the company’s senior management team with proven executives who have highly relevant industry experiences in supply chain, IT, and merchandising The refreshed management team has committed to creating a culture of greater accountability, empowerment, bold leadership, transparency, and two way communication |

|

5 |

Valuation attractive |

Dollar Tree’s P/E ratio is currently in the middle of its 7-year historical band, but its free cash flow yield is temporarily depressed by the increase in inventory |

Missed revenues and EPS for fiscal Q2 2022

Dollar Tree’s fiscal Q2 2022 revenues and EPS announced on August 25 narrowly missed estimates, causing the stock to drop sharply (figure 1). It currently trades at 20% below the 52-week high but is up 62% over the last year as investors bid up the stock following the announcement that activist hedge fund investor Mantle Ridge will take an active role in the operations of the company. Mantle Ridge currently has economic exposure to just under 10% of the company. (I encourage you to peruse my previous article about Mantle Ridge and its historical track record).

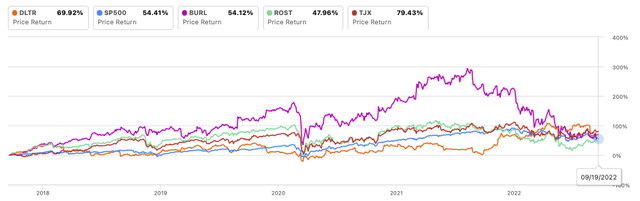

Figure 1: Dollar Tree 1-year stock price

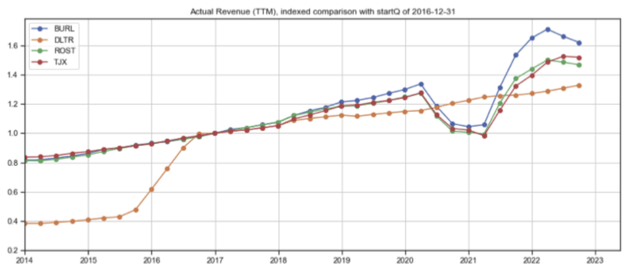

Over the last 5-years, Dollar Tree’s stock price has outperformed the S&P500 (figure 2, orange vs blue line) and its discount retailer peers Burlington (BURL) and Ross Stores (ROST) even though its revenue growth has underperformed its peers (figure 3, orange line). However, nearly all of Dollar Tree’s stock price gains have taken place over the last 12 months following the news of Mantle Ridge’s involvement in the company, reflecting investors’ high expectations of results from Mantle Ridge’s involvement.

Figure 2: Dollar Tree 5-year stock price

(Two quick notes: (1) the sharp growth in Dollar Tree’s revenues (figure 3, orange line) in 2016 was driven by the acquisition of Family Dollar Stores; and (2) Dollar Tree did not suffer through the 2020 COVID-19 outbreak as it was deemed an essential service and remained open while its peers Burlington, Ross Stores, and TJ Maxx (TJX) (blue, green, and red lines) were ordered to close through the lockdowns).

Figure 3: Revenue growth comparison

Created by author using publicly available financial data

A tale of two cities

Revenue drivers

Dollar Tree’s revenues are primarily driven by same-store sales growth and store count. Dollar Tree’s enterprise same-store sales has performed reasonably well (figure 4, solid blue line), but I note that apart from the three quarters in 2020 following the COVID-19 outbreak, Dollar Tree bannered stores (DT) have consistently out-performed Family Dollar bannered stores (FD) (dashed orange vs dotted green line).

Figure 4: Same store sales

Created by author using publicly available financial data

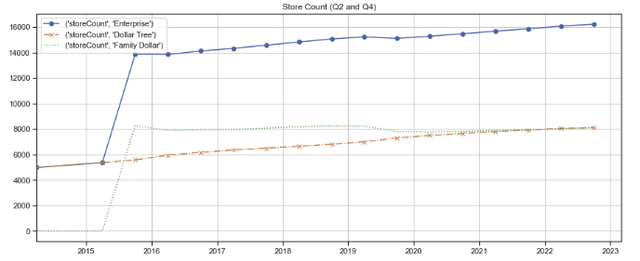

The company has continued to open new stores, and the mix of stores has shifted towards Dollar Tree-bannered stores since the acquisition of Family Dollar in 2015, largely due to the re-bannering of Family Dollar stores into Dollar Tree stores and the closure of some under-performing Family Dollar stores (figure 5).

Figure 5: Store count

Created by author using publicly available financial data

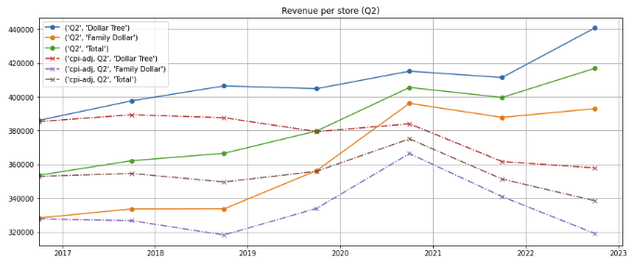

The company’s revenue per store has grown due to inflation and was boosted by the recent increase in selling price from $1 to $1.25 at Dollar Tree-bannered stores. However, the real revenue per store (i.e., the consumer price index-adjusted revenue) at both banners have decreased over time, indicating that revenue growth at the store level has not kept up with inflation.

Figure 6: Revenue per store: nominal and real (base=Q2 2016)

Created by author using publicly available financial data

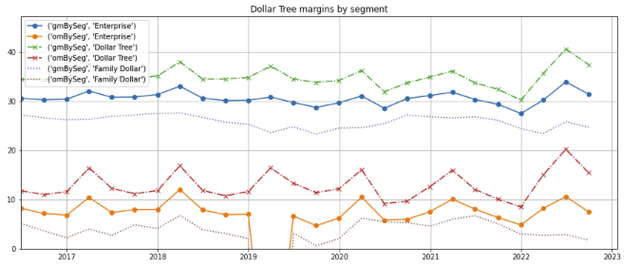

Margins

Both gross and operating margins have been flat over the last 5 years (figure 7, blue and orange solid lines) but ticked up over the last two quarters as the Dollar Tree-bannered store price point increase from $1 to $1.25 (dashed lines) helped offset continued weakness at Family Dollar-bannered stores, where both gross and operating margins have continued to compress (dotted lines).

While Dollar Tree-bannered stores are holding up well, management warned that Family Dollar is expected to break even at the operating margin level in the second half of 2022 due to “price action” to “improve value proposition” (author’s note: frankly, I don’t quite understand exactly what this means), down from 2% in the first half of the year which saw merchandise markdowns and higher than expected inventory shrinkage.

Figure 7: Gross and operating margins

Created by author using publicly available financial data

Impact of inflation on revenues

Same store sales were driven by increased ticket sizes (+14.2% at DT and +3.3% at FD), offset by a decrease in traffic (-5.8% at DT vs -1.2% at FD) because, according to management, shoppers have consolidated trips due to high gas prices.

Management also cited a shift towards away from discretionary items towards lower-margin needs-based consumables as consumers cut back on spending. Management noted:

We see [customers] moving from liquid to powder detergent. We’re seeing them even go without softener — liquid softener and detergents, they’re just choosing not to have softener.

This same phenomenon has also negatively impacted Ross Stores, which I wrote about earlier this month, as clothing is (at least in the short term) considered a semi-discretionary purchase.

Inflation has increased pressure on lower-income customers and forced some mass affluent earners to trade down. Walmart (WMT), Dollar General (DG), and Dollar Tree all noted that their fastest growing segments are customers with annual household incomes of $80,000 – $100,000 and above.

The strong initial negative reactions to the price point increase from $1 to $1.25 at Dollar Tree-bannered stores appear to have tapered down. During the Q2 2022 earnings call, management said:

We did some in-depth customer research and customer intercepts about Dollar Tree at the beginning of the quarter. And we really wanted to dig into our brand and the assortment and in-store experience. And I was shocked. Not one of them brought up price, not one of them brought up the $1.25.

Inventory and markdown risk

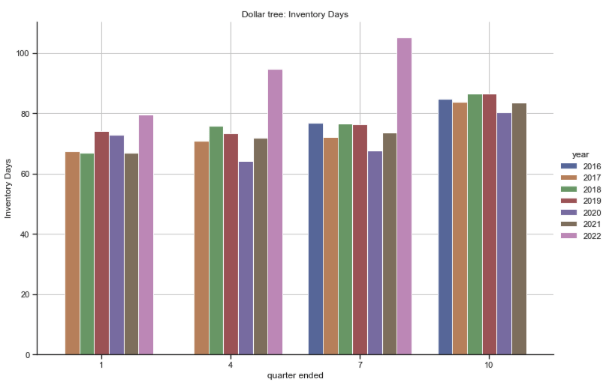

Large and small retailers, which amassed extra inventory because they expected sustained demand and supply-chain problems, now have too much inventory and are forced to mark down prices as well as offer additional promotions to work through unwanted inventory. In an analysis of Dollar Tree’s inventory, the number of inventory days outstanding for the last 2 quarters is more than 25% above levels of the previous 5 years (figure 8, pink bars).

Dollar Tree management noted on the Q2 2022 earnings call that “compared to last year, inventory levels at Dollar Tree are up 59.7% in dollars due to increased capitalized freight and distribution costs, additional multi-price plus inventory and a significant increase in import inventory in transit compared to the prior year” but that “the inventory is fresh and basic in nature and does not represent a significant markdown risk.”

The situation at Family Dollar is more worrisome–on the same call, management noted that inventories are up 35.7% compared to Q2 last year, margins have decreased in Q2 2022 due to higher promotional costs and price markdowns, and provided lowered guidance of breakeven operating margins for the second half of 2022, compared to 2% in the first half of the year.

Figure 8: Dollar Tree enterprise inventory days

Created by author using publicly available financial data

Ocean and domestic freight costs

As Dollar Tree items tend to be lower cost, transportation and shipping constitutes a higher percentage of its cost structure. As a result, its margins are more impacted by changes in the cost of shipping than items with higher intellectual content (e.g., Louis Vuitton handbags or Ferragamo shoes). Fortunately, there is evidence that ocean shipping and domestic freights costs are declining, which should provide some relief to margin pressure.

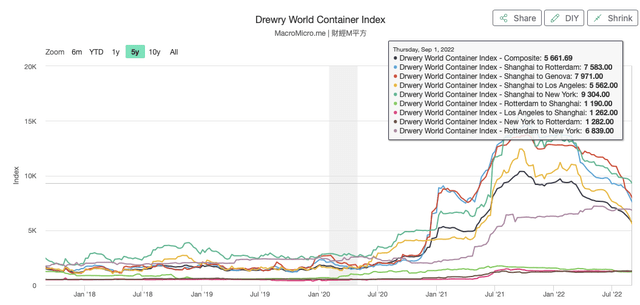

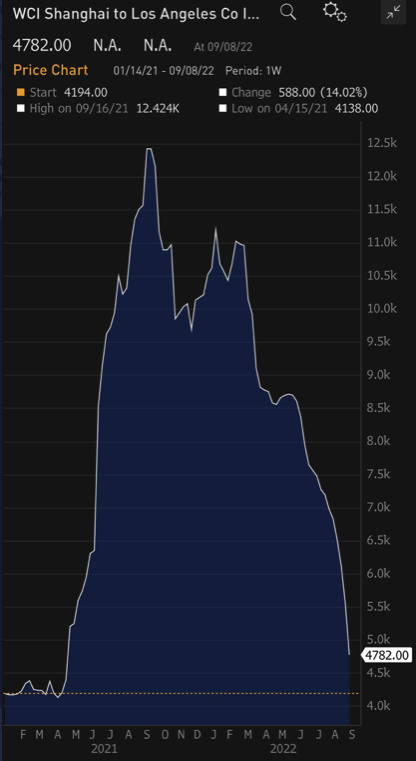

Ocean freight cost has pulled back significantly from the post-COVID peak. The Drewry World Container Index (WCI) – Shanghai to Los Angeles container rate has declined by over 60% (figure 9) and is now below $4,800 (figure 10). While it remains nearly 3x pre-pandemic levels of $1,600, the pace of the decline is encouraging.

Figure 9: WCI – Shanghai to Los Angeles container index

Drewy World Container Index

Figure 10: WCI Shanghai to Los Angeles container price

Twitter

Source: Conor Sen on Twitter: “Biggest weekly drop yet in ocean freight rates, -14%. This chart is really something now: pic.twitter.com/LAs2AuvqoS / Twitter.”

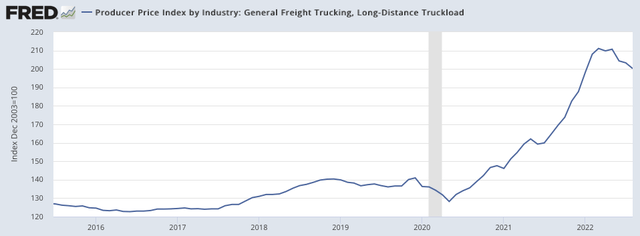

Similarly, the price index of U.S. domestic long-distance trucking of general freight appears to be receding from the post-COVID peak (figure 11).

Figure 11: Producer price index of general freight trucking, long distance truckload

St. Louis Federal Reserve FRED

Management changes put in place by Mantle Ridge

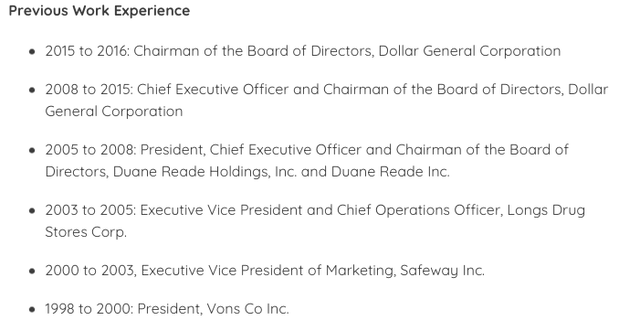

Mantle Ridge has instituted Rick Dreiling, former Chairman and CEO of Dollar General, as Executive Chairman, and has repopulated the board. It has also refreshed the company’s senior management team with proven executives who have highly relevant industry experiences in supply chain, IT, merchandising, and finance.

Rick Dreiling as Executive Chairman

I see Mr. Dreiling as the most significant addition to the team. Mr. Dreiling brings a long and successful career of directly relevant experiences to Dollar General (figure 12).

Figure 12: Rick Dreiling’s biography

Recruitment of Dollar General alumni into key senior management roles

(1) Head of Enterprise Supply Chain, John Flanigan

Flanigan most recently served as Dollar General’s EVP of global supply chain and has held other leadership positions at Longs Drug Stores, Safeway and Vons.

According to Rick Dreiling: “We have a lot of distributions centers that need to be updated and modernized.” Flanigan’s main focus will be to lead productivity improvements across the logistics function through the use of data, analytics, process improvements and automation, and to bring best in class supply chain practices to the company.

(2) Enterprise IT head, Bobby Aflatooni

Aflatooni most recently served as Executive Vice President, Chief Information Officer for The Howard Hughes Corporation (HHC), where he was responsible for leading all information technology strategies and operations across the company’s portfolio. Prior to joining Howard Hughes in 2018, Mr. Aflatooni held leadership positions for 9 years at Dollar General as Vice President of IT Operations, Architecture, Merchandising and as Senior Director IT Infrastructure and Architecture.

Dreiling noted that Dollar Tree’s IT system has fallen behind. In the Q2 2022 call, he remarked:

“IT side, information technology, I might classify as a little bit bigger surprise, in that there’s a lot of basic things that the operators and the merchants need and the supply chain needs.”

Bobby Aflatooni’s team is tasked to provide better support for Dollar Tree stores, which includes improving DC and store in-stock service levels through refinement of our demand forecasting, allocation and replenishment systems for both banners; improving customer satisfaction and driving through enhanced ability to support more complex promotional offers; supporting field leadership and store efficiencies with improved labor systems; and enhancing enterprise-wide data integration platforms.

(3) Family Dollar Chief Merchant Larry Gatta

Gatta, who joined Dollar General in 2009, most recently held the position of SVP and general merchandise manager for consumables at the company. According to Dreiling, Mr. Gatta will “improve the merchandising and to provide a better assortment and more linear footage where the customers shop”–a crucial role to turn around the consistent underperformance at the company’s Family Dollar bannered stores.

New Chief Financial Officer Jeff Davis

Davis most recently served as Chief Financial Officer of Qurate Retail Group, Inc. From 2006 to 2018, Mr. Davis served in a number of financial leadership roles, including as Treasurer at Walmart, Senior Vice President of Finance & Strategy, and Chief Financial Officer for Walmart’s U.S. Segment, Chief Financial Officer of J. C. Penney Company, Inc. and Chief Financial Officer of Darden Restaurants, Inc.

New board members

Paul Hilal, managing partner of Mantle Ridge, will join the company’s board. In addition, the company will benefit from the experience and backgrounds of five new independent directors (Ned Kelly, Cheryl Grisé, Daniel Heinrich, Mary Laschinger and Bertram Scott), each of whom bring a broad range of experiences in a variety of industries to the board.

Transformation of firm culture

Culture eats strategy for breakfast.

– Peter Drucker, management guru.

The culture of a company ultimately determines its success regardless of how effective the company’s strategy may be, and the company’s efficacy will be held back by members of the team if they don’t embrace the proper culture. In the company’s Q2 2022 earnings call, Dreiling clearly stated:

We will develop a culture of accountability, empowerment, courageous leadership, transparency, fostering two-way communication.

We’re focusing the entire organization from a culture perspective on doing everything that we can do to make our store associates successful and enabling them to run better, cleaner, fuller stores.

As a Dollar Tree shareholder and customer, I have often been disappointed with the inconsistent quality of service across its stores. While I believe the culture of a firm is difficult to transform, I am encouraged by Dreiling and his senior management team’s stated objective to re-define Dollar Tree’s culture.

Valuation

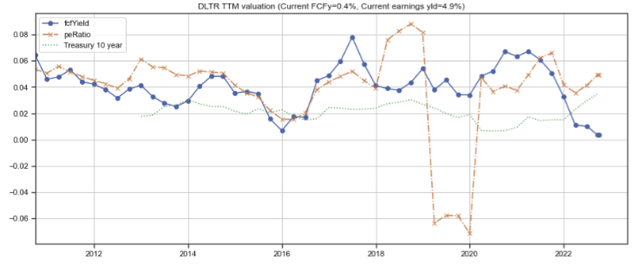

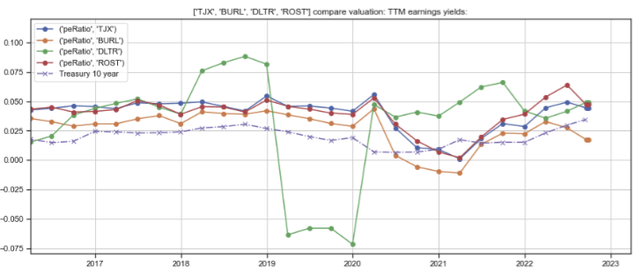

Dollar Tree’s earnings yield (i.e., 1 / price earnings ratio) is currently in the middle of its 10-year historical band (figure 13, orange dashed line) and roughly in-line with that of its peers (figure 14). Dollar Tree’s free cash flow yield (figure 13, blue line) is currently depressed because of the large amount of working capital used for inventory purchases and less relevant at this time.

Figure 13: Dollar Tree valuations

Created by author using publicly available financial and stock price data

Figure 14: Dollar tree earnings yields vs peers

Created by author using publicly available financial and stock price data

Concerns

(1) My main concern is that per-store revenue has not kept up with inflation:

The real, inflation-adjusted revenue per store has declined over the last 6 years (figure 6) and margins have not expanded (figure 7). Unless either changes, the earnings (and thus the value) of each store will have a difficult time keeping up with inflation and the company will have to depend on new store openings to stay ahead of inflation.

(2) E-commerce threat:

I do not view e-commerce as a major threat to Dollar Tree-bannered stores, as the items are priced too low and basket sizes are typically too small to justify the processing and shipping costs. On the other hand, Family Dollar-bannered stores are more vulnerable to e-commerce threat because of their higher price points. However, some lower-income customers whom Family Dollar serves have difficulty taking advantage of online deals as they may not have the bank accounts needed to make online purchases or be able to afford Amazon Prime or Walmart Plus memberships to qualify for free expedited shipping.

Summary

- Dollar Tree serves customers caught on the wrong side of the widening wealth polarization gap (e.g., lower income workers, under-saved retirees), the mass affluent who enjoy a good deal, and small businesses / non-profits that need to make their dollar go further.

- In this current difficult economic environment, the company’s Dollar Tree segment has held up well, but its Family Dollar segment needs much work.

- Activist investor Mantle Ridge has reconstituted the board and brought in proven executives to assume key senior leadership positions within the firm. If successful, Mantle Ridge will greatly improve Dollar Tree’s service to its customers and unlock significant value for shareholders.

- Margins may expand as the cost of ocean freight and domestic logistics recedes from post-COVID highs. However, the sharp rise in inventory and risk of markdowns remains a concern.

- The stock trades in the middle of its 7-year historical price-earnings ratio range, which I do not consider cheap given the prospect of further Federal Reserve interest rates hikes to combat inflation.

- I plan to continue holding onto my Dollar Tree position for the long haul.

Be the first to comment