Dragoljub Bankovic/iStock via Getty Images

The Health Care sector has been a strong play lately. The generally defensive area has been a place of solace amid a year of volatility. Just in the last five weeks the broad market has seen selling resume.

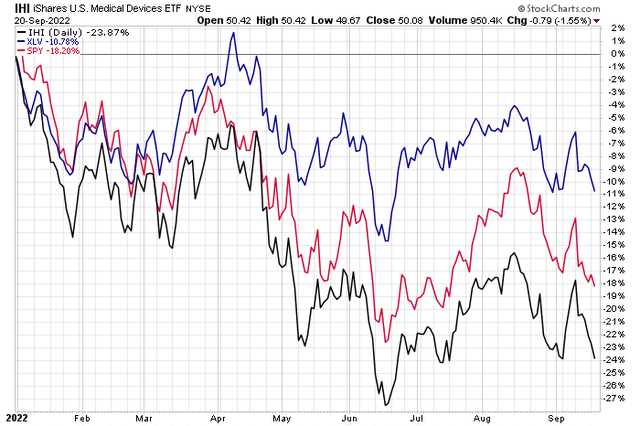

While the Health Care Select Sector SPDR ETF (XLV) is down just 11% in 2022, the S&P 500 ETF is off more than 18%. An industry that has not worked in the sector, though, is Medical Devices.

The iShares U.S. Medical Devices ETF (IHI) is down a whopping 24% so far this year. One stock that had been a massive winner is mired in a downtrend and still sports a pricey valuation.

Medical Devices ETF Underperforming SPY & XLV YTD

According to Bank of America Global Research, DexCom, Inc. (NASDAQ:DXCM) operates as a medical device company focused on the design and development of continuous glucose monitoring (CGM) systems for people with diabetes. The Company has developed a small implantable device that continuously measures glucose levels in subcutaneous tissue just under the skin. Real-time data is processed and displayed, and patients are also alerted when levels are too high or too low. DexCom’s products are marketed to physicians, endocrinologists, and diabetes educators.

The California-based $34.5 billion market cap Health Care Equipment & Services industry company within the Health Care sector trades at a very high 180 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

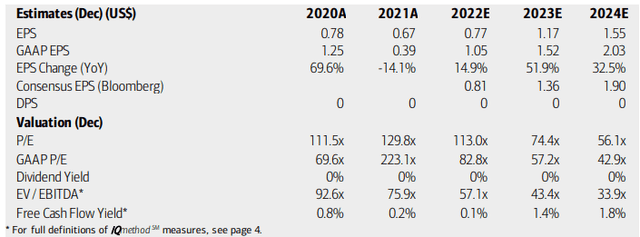

On valuation, BofA analysts expect both operating and GAAP EPS to rise at a solid clip looking out through 2024. The Bloomberg consensus forecast for per-share profit growth is even higher, but DexCom is not expected to initiate a dividend anytime soon. Its free cash flow yield is exceptionally low, so the company is focused on reinvesting earnings. A high P/E is coupled with a very elevated EV/EBITDA multiple.

Whenever a company has nosebleed valuation multiples like this, it’s important to review growth prospects. Seeking Alpha has an A rating on DXCM’s growth outlook. As a result, its PEG ratio is 4.2 using a 26.8% 3-5-year EPS growth rate. That’s still a high price to pay in my opinion.

DXCM Earnings, Valuation, And Free Cash Flow Forecasts

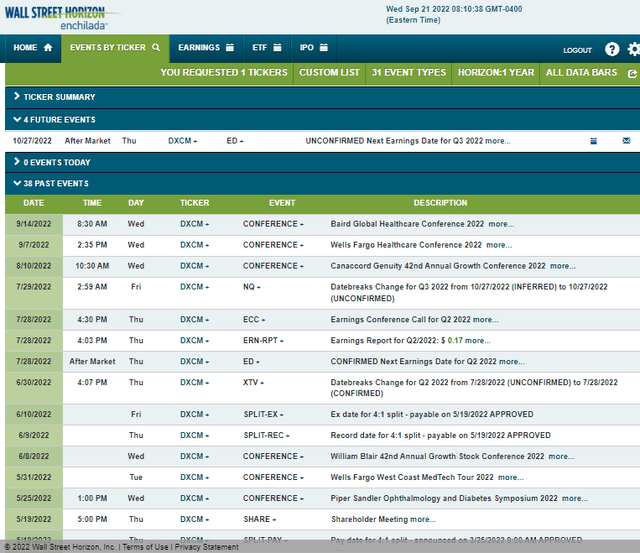

Looking ahead, Wall Street Horizon shows an unconfirmed Q3 earnings date of Thursday, Oct. 27 AMC. After presenting at a trio of recent industry conferences, the corporate event calendar is light until the next quarterly report.

Corporate Event Calendar

The Technical Take

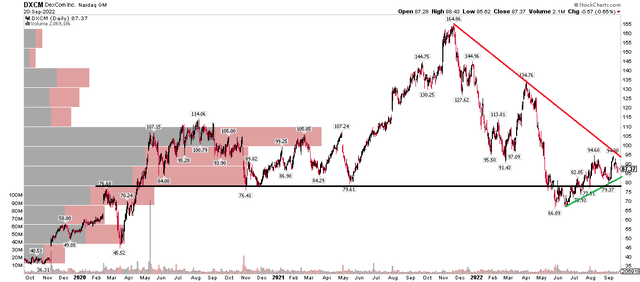

DXCM is nearing a critical juncture on the chart. Notice in the 3-year zoom below that shares have been consolidating for a few months now. After a massive rally in 2020 and 2021, the stock peaked late last year around $165. A plunge of almost $100 actually brought the stock under its key range in the mid-to-upper $70s. That looks like a bullish false breakdown to me. Since then, DexCom has trended higher toward the $90 mark.

But notice the ‘volume by price’ indicator on the left – there is a hefty amount of shares traded in the $77 to $110 range. That could be tough resistance to get through. Moreover, the bulls have to muster a rally above DXCM’s downtrending resistance line off the all-time high.

This is really a ‘wait and see’ pattern. I want to see what happens with this consolidation pattern – will it feature a bullish breakout toward $110 or will the current uptrend breakdown?

Given the big volume just above the current price and what looks like a corrective pattern off the 2021 peak, I lean bearish technically.

DXCM Shares Consolidating At Resistance

The Bottom Line

DexCom has a sky-high valuation and a questionable chart. That yields a sell recommendation and long-term investors should at least wait for the downtrend to show better signs of ending and hopefully improving valuations in the years ahead.

Be the first to comment