Justin Sullivan

What happened?

Lumen (NYSE:LUMN) recently completely eliminated the $1 dividend which was yielding approximately 13% at the time. Unfortunately, many were caught off guard by the move as the company’s management had seemingly been very committed to the dividend payout. Nonetheless, after missing on the top and bottom lines in the latest earnings release, the company announced it was eliminating the dividend and changing the capital allocation plan. According to a Seeking Alpha News report on Nov. 2:

“Lumen Technologies has slipped 9.5% post market following a third-quarter earnings report where it missed on top and bottom lines and eliminated its dividend while authorizing a $1.5M share buyback.

The company also entered an exclusive arrangement to sell its EMEA business to Colt Technology Services for $1.8B.

Revenues fell by double digits to $4.39B, with broad declines in business accounts and mass markets.

There won’t be a dividend paid for the fourth quarter, the company confirmed. After its last dividend of $0.25 per share, paid on Sept. 9, forward yield for the company had become an implied 13.46%.

“Today’s announced capital allocation change follows a very thoughtful process by our Board of Directors that we believe will provide a clear path to invest in growth, repurchase shares at attractive valuations, and maintain a strong balance sheet,” says CEO Jeff Storey, set for retirement next week.”

No one saw it coming, except me…

Seeking Alpha

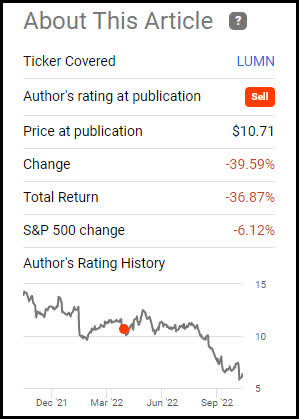

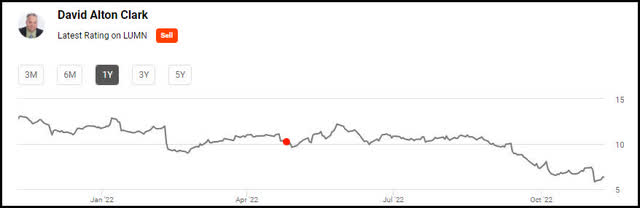

Don’t feel bad if you were left holding the bag. You were not alone. In fact, I was the only Seeking Alpha author to write a Sell article on the stock back in April when the stock was trading significantly higher. No other author had a sell rating on the stock but me and there was a plethora of authors writing bullish articles on the stock right up until the dividend cut.

Beware of Confirmation Bias

The funny thing is I took quite a beating in the comments section at the time as well. A lot of investors, myself included, like to read articles the confirm their bias. I have learned to seek out and perform due diligence on the regarding the opposite viewpoint over the years. Nonetheless, the fact of the matter is I saw the writing on the wall when it came to Lumen cutting the dividend.

Seeking Alpha

The transition was tough ask for management

It’s a tough ask for management to try and transition from being a company with legacy low profit assets to a company with higher margin technologies. Add to this the fact that the company has a heavy debt burden and attempting to make the treacherous transition in the midst of a macro market meltdown, and you have the recipe for disaster, which is exactly what happened. Furthermore, I don’t see things changing for the better just because they eliminated the dividend. Let me explain.

The ship is still sinking

Now, there have been a plethora of articles stating Lumen is a “generational buying opportunity” and many other, what I consider, hyperbolic titles. These articles are the impetus of this writing. Here’s the deal. The bottom line is the dividend wasn’t the problem. The problem is the company is losing money. Cutting the dividend masks the symptoms, it doesn’t cure the disease, so to speak. My takeaway is to sell out of Lumen and take advantage of tax loss harvesting and reinvesting into AT&T (NYSE:T) for dividend income and opportunity for capital appreciation.

Tax Loss harvesting

Tax loss harvesting is a strategy employed by savvy investors looking to salvage what they can from losing positions. Fidelity published an article “How to cut investment taxes” that I think explains it the best. Below is a short excerpt from the piece:

Investment losses can help you reduce taxes by offsetting gains or income.

Even if you don’t currently have any gains, there are benefits to harvesting losses now, since they can be used to offset income or future gains.

If you have more capital losses than gains, you may be able to use up to $3,000 a year to offset ordinary income on federal income taxes, and carry over the rest to future years.

Sometimes an investment that has lost value can still do some good—or at least, not be quite so bad. The strategy that changes an investment that has lost money into a tax winner is called tax-loss harvesting.

Tax-loss harvesting may be able to help you reduce taxes now and in the future.

Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains with those losses. The end result is that less of your money goes to taxes and more may stay invested and working for you.”

So, you sell out of your Lumen position and can use the capital loss to offset taxes on future gains and dividend payments. This way you get a risk-free return on the disposition of the position. Also, you can take the proceeds and invest it into a new dividend paying stock that meets the needs of your income portfolio. For me, it is AT&T (T).

AT&T is my top pick in communications sector

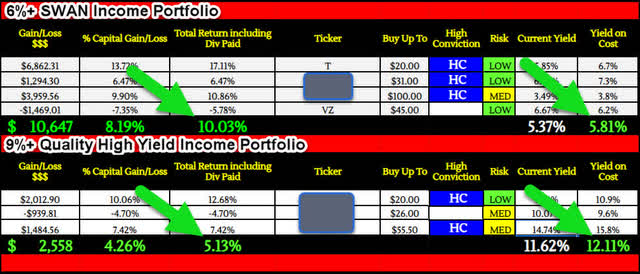

Prior to Lumen cutting the dividend you basically had three choices for high yield income payers in the communications sector. Lumen, AT&T, and Verizon (VZ). I own both AT&T and Verizon in my SWAN income portfolio for my Winter Warrior Investor Retirement Income Marketplace Service, yet favor AT&T over Verizon at present due to AT&T’s strong growth results. Both the 9%+ Quality high yield and 6%+ SWAN portfolios are substantially outperforming the market benchmark at present.

WWI Portfolio

Furthermore, AT&T has previously right-sized the dividend and it’s well covered at present.

The case for AT&T as a dividend replacement

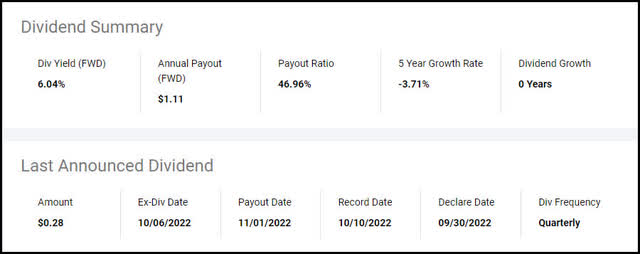

AT&T’s dividend payout of $1.11 per year meets my three primary requirements to be included in my SWAN income portfolio. The dividend must be paid by an undervalued company with a strong growth story, be supported by adequate free cash flow, and have a reasonable payout ratio or distribution coverage percentage. AT&T meets all three of these primary requirements.

AT&T undervalued with strong growth story

Finviz

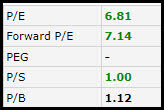

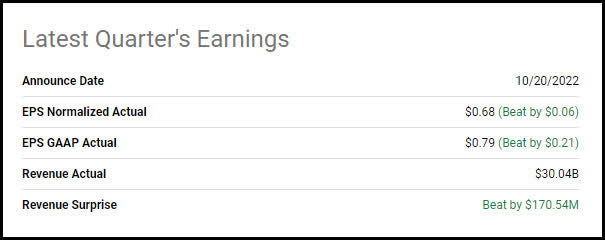

AT&T’s stock has been in the doghouse for most the past year and is still selling for a rock bottom valuation on both a historic and relative basis with a forward P/E ratio of 7.14 and trading at one times sales and book value. Nevertheless, the stock has only just begun to make a run back to the previous highs after beating on the top and bottom lines on the last earnings and reporting strong growth in Fiber subscriptions.

Seeking Alpha

Even after the recent run, the stock still has a long way to go to getting back to where it was previously trading.

Finviz

My 12-month price target is $22 which provides another 15% upside making it a 20% total return opportunity within the next year. Now let’s address the coverage.

Free cash flow adequate

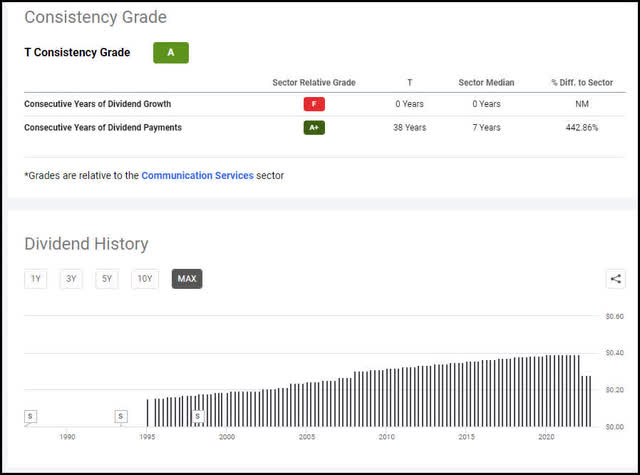

AT&T scores an A on Seeking Alpha’s dividend consistency score card.

Seeking Alpha

The company has paid a dividend for the past 38 years. They did just cut the dividend in half and sell off the Time Warner assets. I like the moves management has made recently. They have right sized the dividend and refocused the company on the business segments that are related to their primary areas of expertise and core competences. This has led to an increase in confidence regarding free cash flow. CEO John Stankey stated on the conference call:

“Our free cash flow for the quarter was in line with our expectations despite higher third quarter capital investment spend, and we’re on track to deliver on our previously stated $24 billion capital investment plan for the year. At the same time, we hope this healthy free cash flow for the quarter gives you confidence in our ability to achieve our target for free cash flow in the $14 billion range for the year, a level that is more than ample to support our $8 billion dividend commitment.”

What’s more, the payout ratio is more than adequate at 46% per Seeking Alpha’s dividend summary statistics.

Seeking Alpha

So now let’s wrap this up with the bottom line.

The Bottom Line

Just because Lumen cut the dividend does not mean it has solved its issues with the business. I see it as akin to addressing the symptoms rather than the disease itself. It has nothing to do with increasing profits or improving the business plan. To me, employing a tax loss harvesting strategy and selling out is the much more sensible move. My choice for a dividend income replacement is AT&T due to the company’s solid dividend yield of 6%, strong free cash flows, and opportunity for an additional 15% upside. You may have a different choice. Those are my thoughts on the matter. I look forward to reading yours.

Be the first to comment