Image Source: Drug Target Review

After a follow-up review of Northwest Biotherapeutics’ (OTCQB:NWBO) clinical data, I’ve uncovered more details about its flagship drug, DCVax, and its statistical validity. The findings are far from positive.

In two separate, blinded interim analysis conducted in 2017 and 2018, the overall cohort in DCVax-L Phase 3 clinical trial appears to show a 20-25% median overall survival benefit compared to the radiotherapy + Temozolomide + surgery treatment protocol for Glioblastoma. Despite nearly 90% of 331 patients have been administered with DCVax as per a cross-over protocol, however, it is impossible to determine whether patients living longer are due to the initial SOC treatment or DCVax because the vaccine never had an comparator arm in Phase 2 .

This isn’t any new information NWBO shareholders aren’t aware of already. 2 years later, however, the lack of any institutional investor interest in the company, combined with a crippling balancing sheet, should prompt an investigation to the validity of the clinical data.

Glioblastoma is one of the most invasive types of cancer with only 25% of patients surviving beyond year one and 5% patients surviving more than 5 years, for an average survival time of 12-18 months. Therefore, whenever new therapies are being investigated for the condition, interim analysis are frequently conducted and will be stopped early if the primary endpoint in such studies are met with robust clinical and statistical efficacy. This is done to ensure the expedited approval of the therapy as to save the lives of patients with this devastating type of brain tumor. One recent example of this phenomena is the approval of Tumor Treatment Fields.

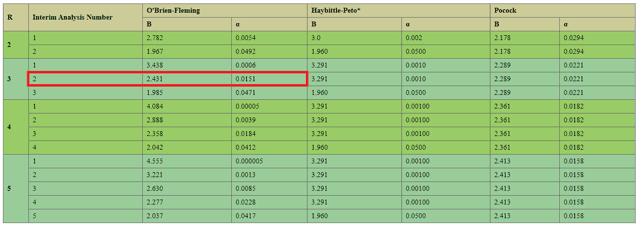

The commonly used criterion for stopping a trial early is the O’Brien Fleming Boundary, which is a function of the total number of analysis conducted during a clinical trial. While NWBO’s interim analysis itself is released as blinded to the principal investigator and the public, the company’s Data Monitoring Committee will have access to the unblinded results in regards to the survival difference between the DCVax and SOC arms and will make recommendations based on its findings (such as terminating the study early for efficacy). As per NWBO’s treatment protocol, there will be 2 interim analysis conducted along with a final analysis, for a total of R=3. Plugging in this number into an OBF table yields the following:

Source: Penn State University

As one can see, by the time the second interim report (November 2018) was released, the p value recommended to stop the study for efficacy was 0.0151. Since the trial is still ongoing, it can be concluded DCVax did not achieve this p value when compared with the standard of care arm when reviewed by the DMC. Moreover, the company designed its clinical trial to stop at p = 0.02, and the fact this endpoint was not met 14 years after the inception of the trial while standard of care drugs saw p values of 0.0001 after just 2-4 years into their study raise significant questions regarding the ability of DCVax to achieve statistical significance. Considering SOCs such as Temozolomide and TTFields all have similar hazard ratios as DCVax (0.63 vs. 0.62 vs. 0.74), it is unclear why the alleged survival benefit has not seen massive statistical significance and trial terminated for the vaccine to be rushed to approval. For example, the clinical trial for TTFields ended early based on interim results of only 315 of the 695 enrolled patients, and was fast-tracked to approval so patients could enjoy the benefits of this amazing therapy. Considering the company cares deeply about the humanitarian use of its unapproved vaccine, NWBO should rejoice if its £250,000 DCVax treatment was approved several years earlier than anticipated and significantly improved patients’ survival. (sarcasm)

Instead, ample evidence exists that are detrimental to DCVax. Statistical questions aside, the drug’s mOS benefit should be adjusted by -3.1 months as current standards of care measures mOS after progression while DCVax’s protocol requires patients to be progression free for enrollment. When adjusted for this difference, DCVax was not able to beat TTFields+Temozolomide in terms of mOS benefit (20.0 months vs. 20.5 months). Since DCVax has not been evaluated in non-superiority studies against TTfields+Temo, it is highly NWBO may choose to conduct another clinical trial as to justify the use of DCVax. Additionally, the company’s claims the trial continuing to capture “the long tail effects of immunotherapy” is also unfounded. This is because 20% of patients in immunotherapy trials will always live for 20% longer than expected with no explanation, and is consistent with the findings of NWBO’s interim report. Therefore, once adjusted for an abnormal placebo effect, DCVax is unlikely to demonstrate any superiority compared with its standard of care arm.

In addition, there has been little or no communication from NWBO’s management as to when the DCVax trial will end. Meanwhile, the company has filed for a mixed shelf offering last October totaling more than its entire market cap of $130 M. This is highly concerning as the company is only operating at a $6.5 M loss per quarter, or $26 M per annum to fund clinical trial expenses. Hence, it is unclear what the company plans to do by diluting shareholders by 50% to raise $150 M in capital, unless it implies the DCVax trial will continue for another 4 years or so.

To add insult to injury, investors should beware due to the crossover design, complex statistical modeling would be required after the data becomes unblinded. This is because the crossover arm would feature patients who first received the SOC and then were administered DCVax. To separate their benefits require, sophisticated Kaplan-Meier survival modeling utilizing differential equations are required. Hence, it is very possible NWBO will announce a PR regarding the appropriate number of events that have been reached, then announce the top-line results 6-12 months afterwards as the statistical analysis is completed. In meantime, shareholders would further endure pain and suffering as the company is burning cash to analyze results which are more than likely to be statistically futile.

In all, investors should seriously consider the risk factors, management woes, dilution, uncertainty, and the complexity of DCVax’s study before viewing it as an opportunity. There are countless other stocks in the biotech sector which can offer lucrative alpha, with a fraction of the stress of holding NWBO in anticipation of its likely futile clinical results.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment