chonticha wat

Introduction

In August, I wrote a bullish article on SA about gold mining company GoldMining (NYSE:GLDG) in which I said that it seemed significantly undervalued based on the quality of the projects it owns.

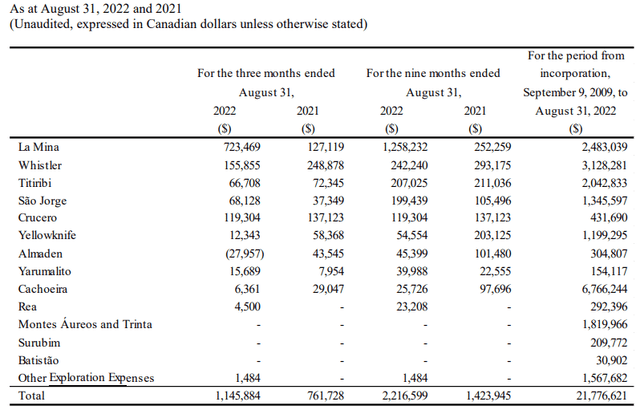

However, there have been no project sales or spin-outs since then. All is quiet on the exploration front too as GoldMining spent just C$1.15 million ($0.85 million)(see page 10 here) in this field during the quarter ended August, C$0.72 million ($0.54 million) of which was at La Mina.

The company is losing momentum, which is crucial for exploration-stage mining companies. Looking at the balance sheet, GoldMining had C$78.4 million ($58.2 million) in cash and marketable securities as of October 27.However, cash itself is running out and this means stock dilution could be high in the near future unless the share price increases. Let’s review.

Overview of the recent developments

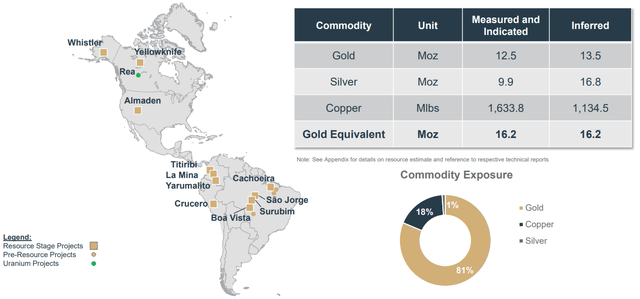

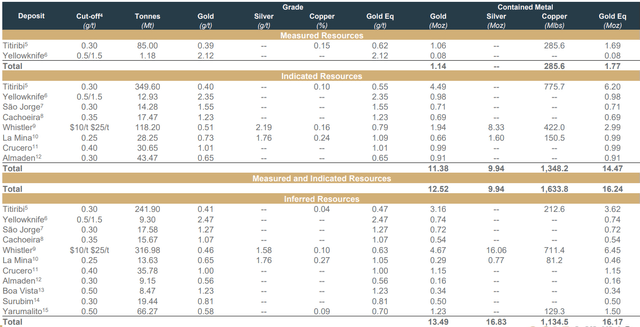

In case you haven’t read any of my previous articles about GoldMining, here’s a short description of the business. The company owns a portfolio of more than a dozen gold projects across the Americas, with a total of seven of them located in Brazil. Total measured indicated resources are over 16 million ounces of gold equivalent, but most of the projects are below 1 million ounces. At the moment, the Titiribi property accounts for 5.54 million ounces of gold and 1.06 billion pounds of copper of the measured and indicated resources of GoldMining.

GoldMining

GoldMining

In my view, Titiribi has little value as it’s pretty much mothballed at the moment. You see, GoldMining was planning to do some drilling in 2022 but in August 2021, the municipal council of Titiribi issued a Territorial Ordinance Scheme which prohibits mining and mineral exploitation activities in the municipality. The company is challenging the decision as it believes it’s unconstitutional, but it could take years before this project starts moving forward.

GoldMining has an interesting strategy of unlocking the value of its portfolio through spin-outs and disposals. The highlight here was an $90 million initial public offering of its royalty arm Gold Royalty (GROY) in March 2021. GoldMining still owns 20,773,200 shares of this company; the holding has a market valuation of $51.9 million as of the time of writing. However, there haven’t been any new asset disposals or spin-outs since the middle of June, when GoldMining optioned its Almaden project in the USA for up to C$16.5 million ($12.8 million) to NevGold (OTCQX:NAUFF). In my view, this is likely due to falling gold prices and I don’t expect the situation to improve anytime soon as major central banks around the world are raising interest rates at a rapid pace. Also, gold prices have a negative correlation to the US dollar, which has been strong over the past few months. With how things are going right now, I wouldn’t be surprised if gold dipped below $1,300 per ounce in 2023.

goldprice.org

In my view, another major issue for GoldMining investors is that the company is barely investing anything into exploration, which means that it rarely comes on the radar of new investors in the sector with drill results. This year, the company completed a five-hole 3,485 meter drilling program at the La Garrucha target at the La Mina project but that’s pretty much it. Most of the exploration expenses on the other projects are for things like camp maintenance, geological and technical consulting fees, and surface rights leases.

GoldMining

Turning our attention to the balance sheet, the situation doesn’t look good when you go into the details about those $58.2 million in cash and marketable securities. As I mentioned earlier, GoldMining has a stake in Gold Royalty worth $51.9 million. A total of 20.7 million of them are pledged as security for a margin loan. Speaking of which, the size of that facility was recently slashed to $10 million from $20 million. GoldMining also owns 5,925,925 shares of NevGold, which have a market value of $1.65 million as of the time of writing. This leaves little cash on the balance sheet and with $7 million drawn on the loan facility, GoldMining has to rely on its $50 million at-the-market (ATM) equity distribution program to fund its operations. With cash used in operating activities coming in at C$2.63 million ($1.95 million) for the quarter ended August 2022, it seems that stock dilution could be high in the near future unless the share price rises soon. During the nine months ended August 2022, GoldMining issued a total of 5,448,932 shares for C$9.2 million ($6.83 million) under the ATM program. A total of 2,579,620 of those shares were issued during the quarter ended August (see page 12 here).

Overall, I think that sentiment in the gold market is pretty bearish at the moment and that gold prices are likely to continue to slide over the coming months. In such a challenging investment environment, the share prices of exploration-stage companies with limited access to liquidity tend to fall the most. If you’re keen on the idea of investing in gold mining companies while the price of the metal is falling, the best place to go could be producers with limited capex needs and low all-in sustaining costs (AISC). Also, a long life of mine is always a nice thing to have.

Investor takeaway

I continue to think GoldMining looks undervalued but as the market changes, investors have to adjust accordingly. Low gold prices have made it more challenging to sell or spin-out exploration-stage projects and this is the company’s bread and butter. In addition, the share prices of Gold Royalty and NevGold haven’t been performing well over the past few months.

GoldMining isn’t spending much on exploration and while that might limit stock dilution, it also costs momentum as investors in the mining industry tend to avoid companies with mothballed projects. Overall, I’m concerned that GoldMining is becoming a value trap. That being said, I think that short-selling is dangerous as the prices of commodities are notoriously volatile. It could be best for risk-averse investors to avoid GoldMining.

Be the first to comment