JHVEPhoto

In our previous coverage of Rio Tinto (NYSE:RIO), we reluctantly handed it a “hold/neutral” rating as the exceptional downside risks from commodity pricing were offset by a very strong balance sheet. Today, we examine the recently released Q3-2022 operational review and update our ratings and price target on this company.

Rio Tinto Q3 2022 Operational Review

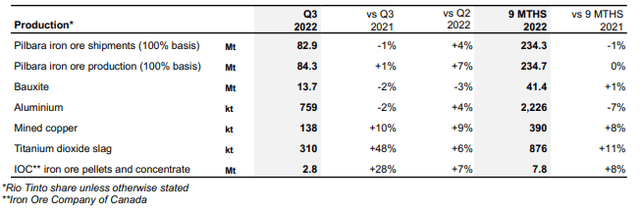

Production numbers were about in line with expectations and numbers ramped up versus the previous quarter.

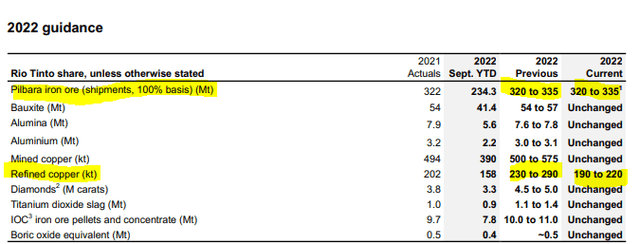

RIO updated its guidance slightly from H1 results and this included two small downgrades to their outlook. Iron ore production numbers, while still in the original range, were guided to the low end.

RIO is trying to ramp up iron ore production at Gudai-Darri and Robe Valley while combating skilled labor shortages in both locations. Despite the higher costs associated with recruiting skilled labor, RIO did not increase its cash cost guidance for iron ore production.

Pilbara iron ore 2022 unit cost guidance of $19.5-$21.0 per tonne remains unchanged. Operating cost guidance is based on A$:US$ exchange rate of 0.71 and excludes COVID-19 response costs.

Source: Q3-2022 Operational Review

This has likely come about as the local price pressures have been offset by a very weak Australian dollar. Note that RIO’s guidance for costs is captured in US dollars.

On the refined copper side, Kennecott smelter and refinery materially underperformed, and this caused a modest drop in the outlook. Unit cash costs were revised up by 20 cents a pound due to lower volumes. Overall, there was just a slight shift versus expectations as the bulk of RIO’s performance is driven simply by Pilbara iron ore shipments, and those numbers did not move.

Outlook

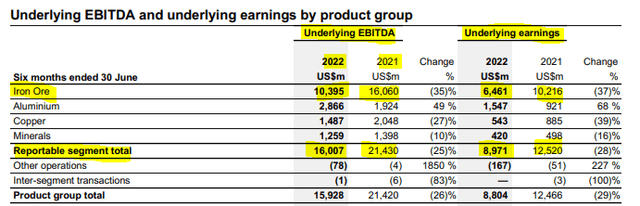

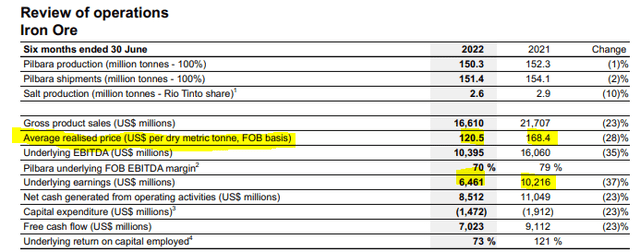

RIO’s fortunes are deeply tied to its Pilbara Iron Ore Mining resources. Those mines collectively produce close to 330 million Tonnes of iron ore and that number is likely to move up to 360 million Tonnes in the next 3-4 years according to company guidance. Iron Ore is already driving 60-80% of the company’s EBITDA and earnings, and that number would move up even further if commodity prices don’t move much.

Within that segment, earnings are tied to movements in the price of the commodity.

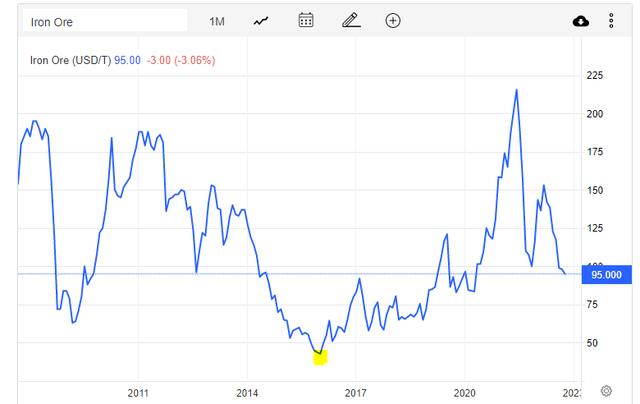

While this delta is high, it is actually lower than most other commodity producers as RIO’s cash costs and total costs are very low. Nonetheless, if we move the price of iron ore lower, we can reach the point where free cash flow from this segment reaches close to zero near $50 Tonne. The exact number is not that relevant as a lot will depend on depreciation rules that we don’t have an exact insight into, as well as RIO’s decision to power ahead with its capital expenditures. While ruminating over where free cash flow will hit the zero may seem like an irrelevant exercise, that number is important in our outlook. In fact, we expect $50 to be breached on the downside in this cycle at its trough. Of course, investors are using price anchoring here and the recent highs near $225 might make them believe that triple digits are likely to be the long-term average. We would remind them that we hit $45 in 2016 with just a generalized slowdown in world GDP.

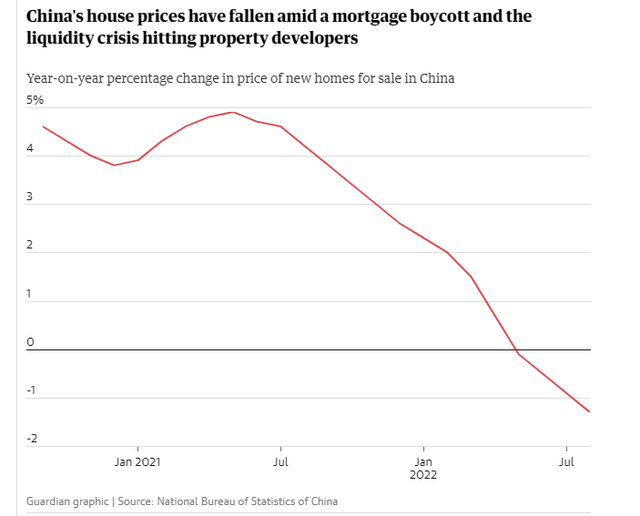

Our current forecast is for a recession, and this recession is likely to be coupled with China’s housing market going into a complete tailspin. As a reminder for investors who are not aware, China consumes about 70-75% of the world’s iron ore, and the vast majority of that gets incorporated into its housing bubble. That bubble is unwinding as we have documented several times over the past year.

Bubble Watch

The official state numbers show a decline in the price index, and the real numbers are likely far worse.

National Bureau Of Statistics Of China

Estimates for how much state intervention is needed to stabilize this vary between high to “out of this world high”.

The rating agency S&P said at least 800bn yuan would be needed – or even 10 times that much in the worst-case scenario – to rescue a property market in which prices have fallen, sales have slid, developers have gone bust and buyers have staged an unprecedented and widening mortgage boycott in protest at having paid largely upfront for homes that have not been finished.

The market is experiencing a total collapse in confidence, analysts say, and only government intervention can save the day.

Source: A Ponzi scheme by any other name. The bursting of China’s property bubble

About a third of all property loans are now classified as bad debt, and Citigroup (C) believes even state-sponsored actors are at a risk for a default. None of this should come as a surprise to anyone following this over the years. While the media has been reluctant to give their official “Ponzi” stamp on it, we have been calling it that for quite some time.

In short, it resembles a Ponzi scheme where money taken from new investors is used to pay off existing clients in an ever-decreasing spiral to collapse. It is even how the sober pages of the Economist sees it.

George Magnus, an associate at the China Centre at the University of Oxford, said the Chinese market was not quite a classic Ponzi scheme in the style of Bernie Madoff’s notorious scam that was exposed after the global financial crisis, but it was very similar.

“Developers raise huge amounts money from customers to basically fund the purchase of the next construction projects. This continues on and on before it has got to the size it has,” Magnus said. “It’s not strictly a Ponzi in the asset management sense, the Madoff style, but they’re essentially using clients’ money to fund the next project, so yes, it’s the standard definition of what that means.”

Source: A Ponzi scheme by any other name. The bursting of China’s property bubble

Verdict

For better or for worse, RIO’s fortunes are tied to a commodity which we believe will be one of the worst, if not the worst, in the space. China’s housing implosion is just in its second innings and whether bail-outs occur or not, you can rest assured that there is zero appetite to add huge amounts of inventory to the problem. Here is the proof.

In July, new construction starts by floor area fell at the fastest pace since January-February 2013 – down 45.4% – after a 45% slump in June.

In January-July, new construction starts tumbled 36%, extending from a 34.4% drop in the first half.

Source: China New Construction Starts Sink to Almost 10-Year Low

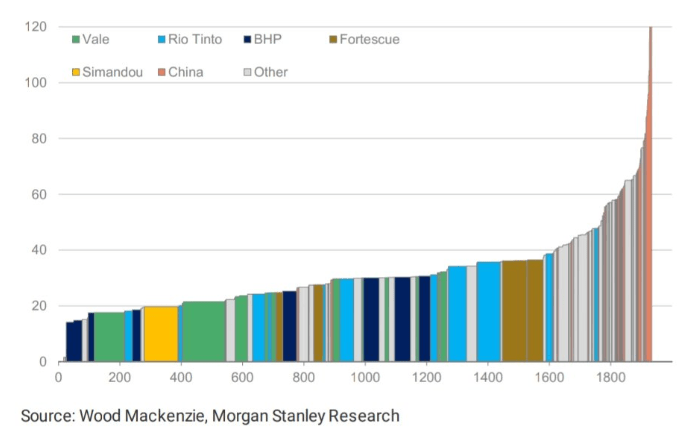

Even outside China, across the world, the very sharp move in interest rates is slowing housing development. In such a synchronized slowdown, we would expect iron ore to drop until a good deal of mines is uneconomical. That is where the problem lies as well. BHP Group Limited (BHP), Vale S.A. (VALE) and RIO, the three largest producers, all have mines that run with very low cash costs. We estimate that at a price of $40 per Tonne, production would drop only 20%.

Wood Mackenzie

Realistically, we would calculate that demand for iron ore will drop by at least 30%, just from China’s property bubble fallout. So the price repercussions will surprise, on the downside. We love Rio’s balance sheet, and we think it is one of the better capital allocators in the business, but it is fighting a war it really cannot win. The dividends are currently attractive, but we expect them to eventually (please don’t read that as next quarter) fall below the run-rate of 2016 ($1.52 per share). That would amount to a sub 3% yield at current prices. We rate the shares a sell and would look for $40 in the next 12 months.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment