tupungato

Bank of America Corporation (NYSE:BAC) rose after the bank reported 3Q-2022 earnings, with BAC likely benefiting from a strong market rally that sent the Dow Jones Industrial Average up 1.86% yesterday.

However, I do not believe the enthusiasm is warranted because macroeconomic risks such as inflation, slowing economic growth, and higher interest rates pose a threat to consumer banks. Overly hopeful and optimistic bank investors appear to be ignoring recession warnings.

While the earnings release may provide some temporary relief to bank investors, I believe Bank of America will begin trading at a discount to book value within the next 3-6 months.

Bank of America Beat Earnings, So What?

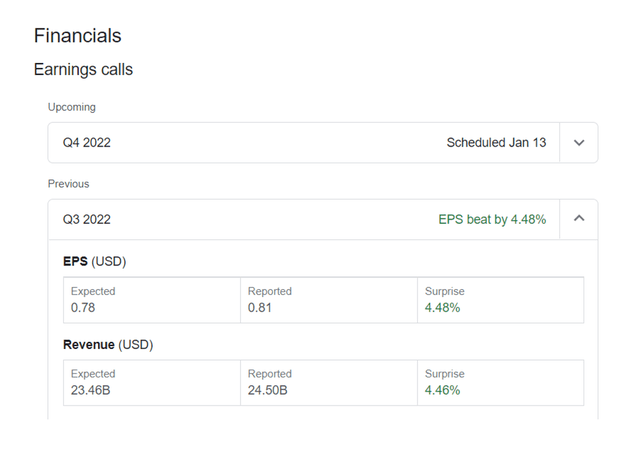

Bank of America’s 3Q-22 earnings report showed a 4% increase in earnings and revenue. The bank reported diluted earnings per share of $0.81, which were $0.03 higher than the market consensus, and revenue of $24.5 billion, which was $1.04 billion higher than expected for the third quarter.

Earnings Calls (Bank of America)

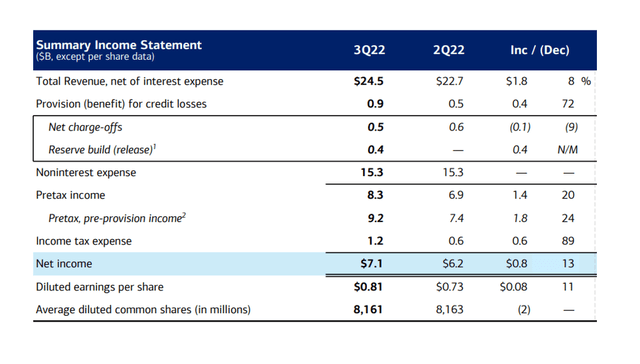

Bank of America’s third quarter profit was robust, with net income increasing $0.8 billion QoQ, owing to a strong but unexpected performance by the consumer bank and higher net interest income, an unavoidable result of the central bank’s recently converted action plan to combat inflation.

Bank of America earned $7.1 billion in profits, compared to $7.7 billion in the previous quarter. While profits fell YoY, they increased relative to the second quarter, owing primarily to the central bank.

Summary Income Statement (Bank of America)

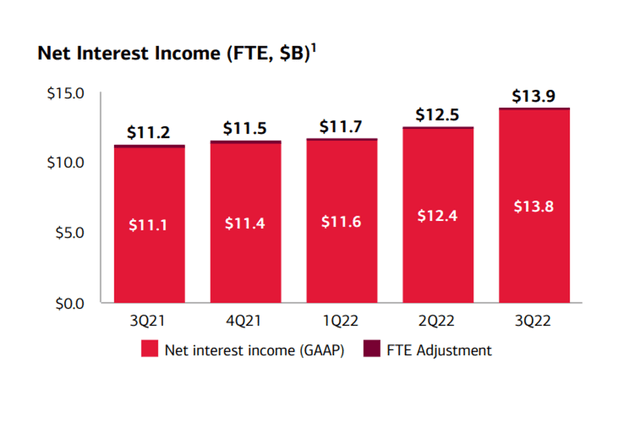

The chart below shows how much the central bank aided Bank of America’s earnings growth. Bank of America earned $13.8 billion in net interest income in the third quarter, allowing the bank to charge higher rates to its customers.

Bank of America’s net interest income increased $2.7 billion over the same period last year as a result of the central bank’s gift. Additional interest rate hikes by the Fed will almost certainly be a catalyst for Bank of America’s net interest growth in 4Q-22 and 2023.

Net Interest Income (Bank of America)

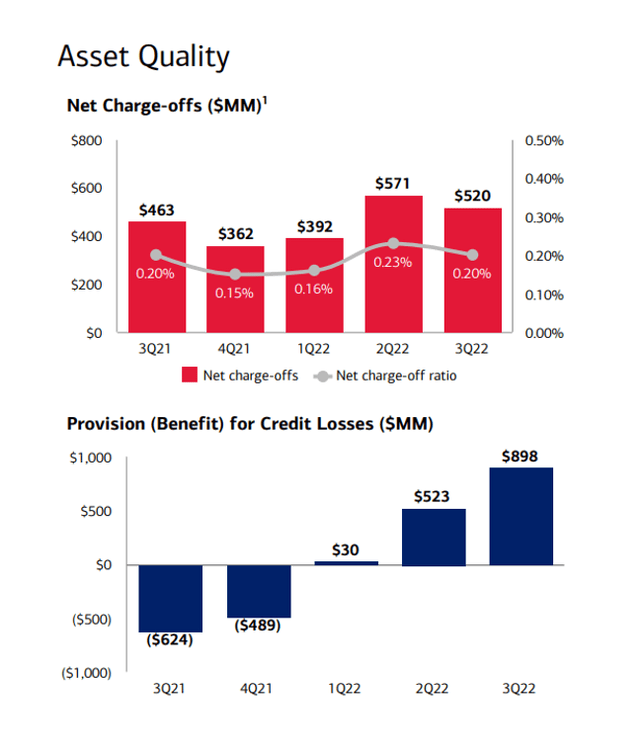

Bank of America’s asset quality has remained generally stable QoQ, despite an increase in credit provisions as a result of new reserves being built in response to growth in the bank’s credit card business.

The total provision for credit losses in 3Q-22 was $898 million, a $375 million increase from the previous quarter. Credit provisions and net charge off ratios show how troubled Bank of America’s loans are. An increase in net charge-offs and credit provisions indicates a deterioration in overall loan health and is a strong recession indicator.

Asset Quality (Bank of America)

A Recession Is Coming, But Hope Always Dies Last

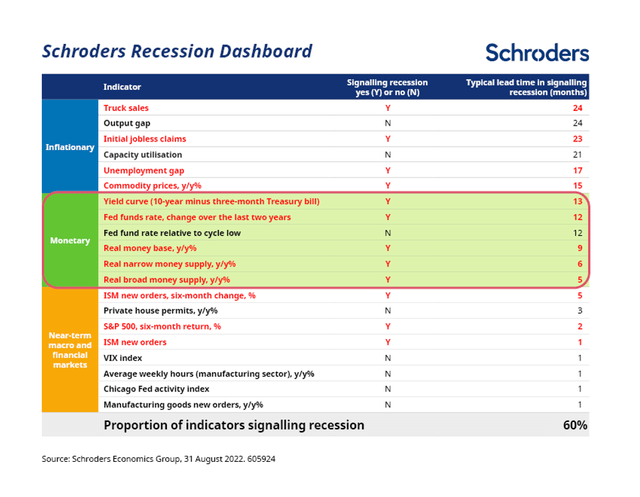

As I previously stated, I believe Bank of America does not deserve to trade at a premium to book value given that the U.S. economy is widely expected to enter a recession. JPMorgan Chase Chairman and CEO Jamie Dimon predicts a recession within the next 6-9 months, and Schroders predicts a 60% chance of a recession occurring.

Recession Dashboard (Schroders Economics Group)

The International Monetary Fund stated a week ago that the “balance of risks is firmly tilted to the downside,” predicting a global economic slowdown next year.

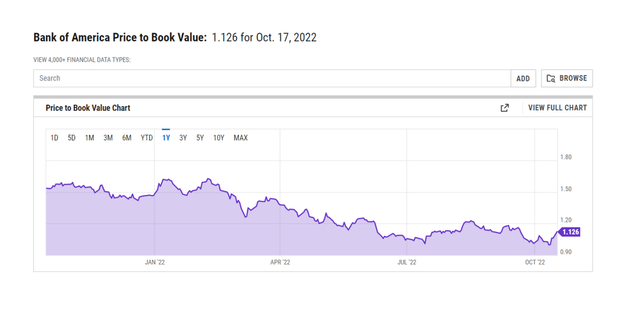

I believe investors are overly optimistic about Bank of America’s prospects in a recession, which is why I believe the stock will trade at a discount to book value within the next 3-6 months.

Discount vs Premium Valuation

At the end of 3Q-22, Bank of America’s book value was $29.96. Bank of America’s stock closed at $33.62 yesterday, representing an unjustified 12% premium to book value.

Why Bank of America Might See A Higher Valuation

So far, Bank of America has done reasonably well given the economic backdrop. Asset quality remained strong in 3Q-22, earnings remained above $7.0 billion, and the consumer bank is experiencing moderately healthy business trends.

A U.S. recession, which would likely have a significant impact on the cyclical banking sector, is a significant risk factor for Bank of America that investors must consider.

My Conclusion

Even though Bank of America’s 3Q-22 earnings release was better than expected, and the bank beat on revenue and earnings, the risks, in my opinion, outweigh any potential for upside.

While asset quality has remained stable, rising credit provisions are a clear red flag for investors.

I still believe that major U.S. commercial banks will begin to trade at discount valuations in the next 3-6 months, and thus Bank of America is not a buy.

In terms of earnings expectations for Bank of America in a recession, the market is overly optimistic, and, as always, hope dies last.

Be the first to comment