batuhan toker/iStock via Getty Images

Investment Thesis

Southwestern Energy (NYSE:SWN) has seen its share go nowhere since the start of April. This makes no sense.

Back in April, we had some pieces to this puzzle but we struggled to get the whole picture. Today, the picture is very nearly fully visible.

This is the bull case for SWN. It’s going to benefit from a substantial demand for US natural gas in the coming several years. There are a few more nuances than this, which we’ll discuss.

Yet ultimately, there’s no need to over-intellectualize this investment opportunity. A cheaply valued stock, making a lot of free cash flow, makes for a rewarding investment.

Now, let’s get to it.

What’s Happening Right Now?

Yesterday, the CPI figure come in lower than expected. And investors quickly saw an opportunity to buy into tech stocks. That’s the dream, to buy at the bottom of a bear market.

However, I ask you, what’s changed? Nothing has changed! Fundamentally, the demand for US natural gas will continue to increase. But everything becomes further complicated with this unseasonably warm weather.

Hence, many investors now appear to believe that we’ll go from autumn straight to spring and miss 2022 winter altogether. And while that’s certainly a possibility, I deem it highly improbable.

Nevertheless, the thesis at stake here is not about the weather being hot or cold this winter. The thesis is about the long-term demand for US-based natural gas.

There’s a significant price discrepancy between US natural gas and that of Europe and Asia. Depending on the month, the discrepancy ranges from 7x to 9x. That’s the underlying opportunity, and until that’s resolved a few years from now, there’s going to remain a secular growth story for US natural gas.

What’s more, European gas prices will be above-average for many years to come. This is a simple and unavoidable fact. So, not only are prices in the US lower than in Europe, but European prices are going to climb higher in 2022.

Even though, the market, for now, appears not to have come to this conclusion.

Southwestern Energy’s Hedged Book

The one consideration that weighs on Southwestern Energy’s bull case is its hedged portfolio:

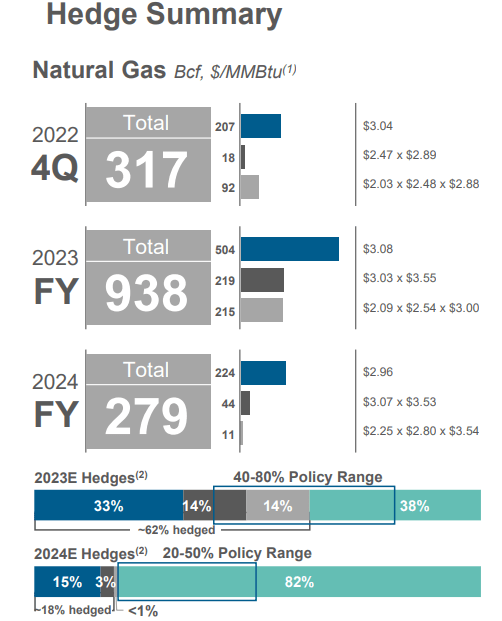

SWN Q3 2022

What you see above is that going into 2023, SWN is 60% hedged. This is a step down from the 80% that Southwestern Energy is going to exit this year.

But when asked extensively on the call about its hedging portfolio into 2024, SWN make their stance clear. They view hedging as a financial responsibility to protect against natural gas’s downward pricing volatility.

And as the graphic above infers is that 2024 will be hedged by approximately 20% to 50%.

Simply put, this would take SWN from an 80% hedged book with hedges at very approximately $3 per mmbtu. Perhaps by 2024, SWN will only be 50% hedged at the max.

That still leaves 50% of its production exposed to upside natural gas prices. And to be clear, when SWN hedges out its 2024 book, it’s highly likely to be much higher than approximately $3 per mmbtu that we see for 2023 — thus, the investment case will improve in the coming months.

Next, we’ll discuss another element that is weighing down SWN.

Balance Sheet Still Leveraged

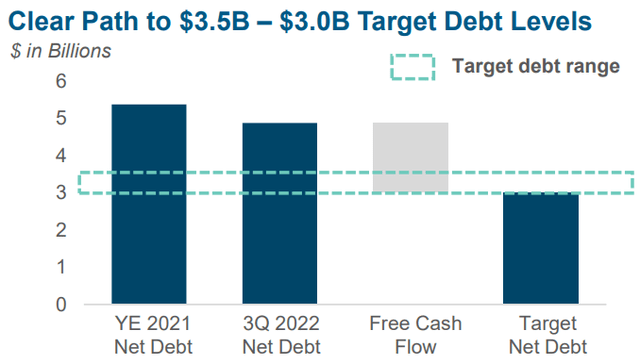

SWN’s balance sheet at the end of Q3 2022, still carries close to $5 billion of net debt. Until that figure gets down to $3 billion, SWN is not able to ramp up its capital return program.

So, for now, SWN is in a position where it must divert free cash flows to pay down debt.

And until its debt comes to $3.5 billion, at some point in 2023, SWN’s shareholders will not be in a place to benefit from this investment in a serious manner.

Consequently, investors are paying approximately 6x 2022 free cash flows, and having to wait around and be patient. Something investors always struggle with. Particularly when many of SWN’s peers are already ramping up their share repurchase programs.

The Bottom Line

I believe that in the very short term, the market fails to recognize opportunities for what they are. If you want evidence of this, consider the following two examples.

One, when the pandemic hit and everyone was sent home, companies like Amazon (AMZN) actually moved lower, even though they were perhaps the only “sure” beneficiaries.

Secondly, when the pandemic hit, oil prices on the spot market went negative. The market was essentially saying that we no longer need oil.

These two demonstrate how in a short period of time when the system gets an unexpected jolt, the market doesn’t know how to react. And what is obvious in hindsight isn’t quite obvious at the time.

Along these lines, I contend that companies that are priced cheaply priced on a free cash flow basis and will benefit from strong demand over the coming few years make for good investments.

But investors will have to be patient and wait around to be rewarded here. Something that investors are not very good at doing, particularly in the current environment.

Be the first to comment