Justin Sullivan

To say that defensive names have come into the fore in 2022 would be an understatement. Nearly constant selling tends to drive capital to defensive sectors, and in particular, great dividend stocks in defensive sectors. One company that certainly fits that description is bubbly beverage legend Coca-Cola (NYSE:KO), and its stock is flat on the year. That may not sound amazing, but against the S&P 500’s ~20% decline, it definitely is.

The last time I covered this stock, which was a year ago, the stock was in a position of strength, readying a breakout to a new high. Concerns at the time were long-term debt, forex conversion, and a not-that-cheap valuation. Today the concerns are somewhat different, as we’ll see below. Chiefly, input cost inflation, in my view, is a much bigger deal than a year ago.

Coca-Cola is a company with over a century of non-alcoholic beverage dominance under its belt, and it’s a Dividend King, the most coveted of titles among stocks that pay their shareholders. The company’s dividend increase streak is 59 years old, and surely that’s a big reason why investors like to own it. There are some good reasons to own Coca-Cola, and if you want a stock that will pay you rising dividends for a long time, you can just buy it and forget about it. But, if you’re looking to maximize your capital, I’m not so sure. Let’s dig in.

Nearing support

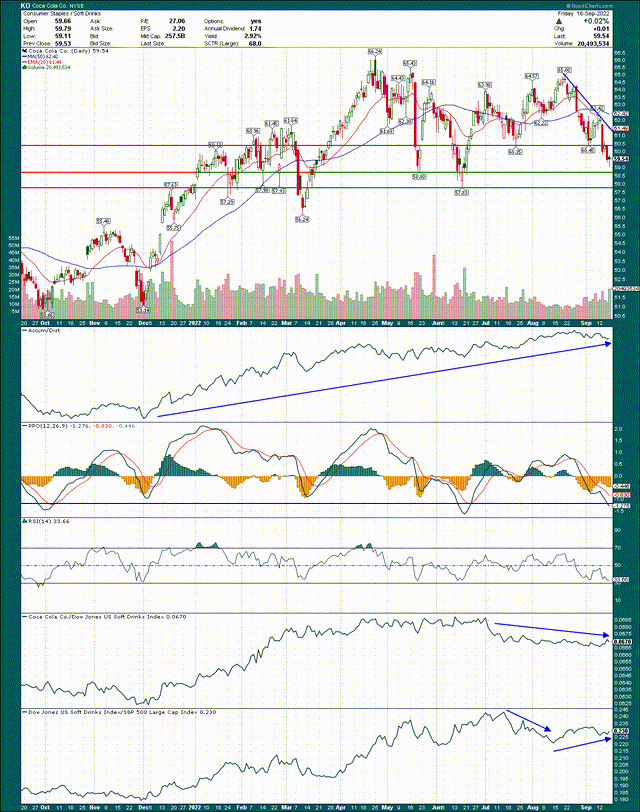

Let’s begin with the chart, as we always do, to get a sense of the technical landscape.

The stock had substantial support around $60 that dates back to very early in 2022, but that was broken last week, and decisively so. We saw this with the broader market, as well as countless individual stocks last week, so Coca-Cola is not alone. However, it’s no less bearish for it. Next up are what I’d deem somewhat weaker support levels at $59 and $58, give or take a few pennies. If Coca-Cola breaks those levels, we could see a lot more selling. However, it looks like this selling episode is losing some steam, so that’s not my base case.

Why do I think those levels are likely to hold? The accumulation/distribution line remains truly outstanding despite weak price action. That means investors are buying dips rather than selling rips, thus the “accumulation” nomenclature. In addition, the PPO and 14-day RSI are both very near points where selling episodes have ended in the past. Does that guarantee the stock cannot blast through those levels? Absolutely note. But it does greatly increase the chances of a bounce at price support.

Relative strength has been very good this year, as I mentioned in the open, because of Coca-Cola’s steady and predictable nature. However, some of that has been worked off in recent weeks as the stock has somewhat underperformed its peers, and its peers have been treading water against the S&P 500.

In total, I think Coca-Cola is likely to bounce soon given the selling looks tired, but I’m not sure I see a lot of catalysts for the next rally.

Innovation secures the future

Whatever someone thinks of the chart, Coca-Cola is a tremendously well-run company. I did not think this when Muhtar Kent was CEO, because Coca-Cola was SG&A-heavy and lacked any sort of innovation. It was like the company was happy just to sell Coca-Cola, Diet Coke, and Sprite forever. However, the current regime has done nothing but innovate and Coca-Cola is so much better for it. This includes the bottling operation divestitures that took place starting a few years ago, strategic acquisitions such as BodyArmor, fairlife, and Costa, but also using its world-class distribution system to its distinct advantage.

The company has known for many years that soda was not the way forward. Consumers still drink enormous amounts of soda but enthusiasm for sugary drinks continues to wane from consumers. What they want is beverages from the categories where Coca-Cola is acquiring and innovating, such as coffee, tea, dairy, healthy drinks, etc.

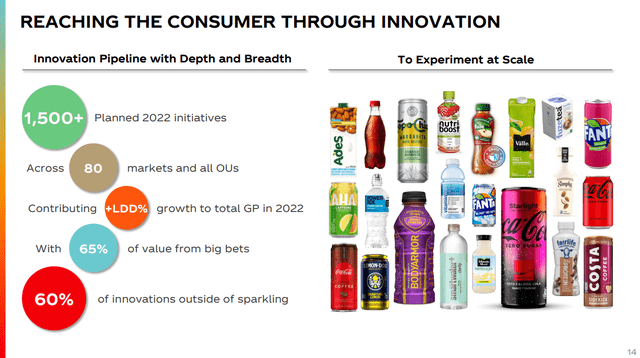

This slide shows the enormous amount of time and money the company spends on innovation, with 1,500 planned initiatives for this year alone. The company has a laser focus on each of its hundreds of markets’ individual tastes and preferences, and executes against those. It’s the reason Coca-Cola tastes different in different parts of the world, and why certain brands only make it to certain regions.

The point is that the company is able to do this in part because of its immense distribution system that can reach anywhere in the world. That’s a competitive advantage that no one can match, and no one can take away.

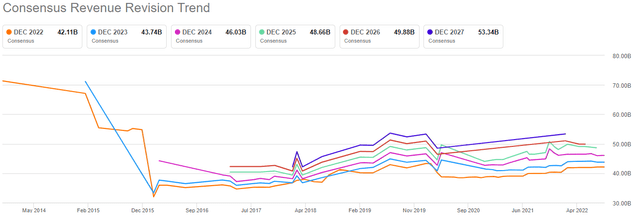

That all sounds nice, but is it working? The below would suggest it is.

Revenue estimates plummeted several years ago on the bottling divestitures, so ignore that. Since the worst of the pandemic, we’ve seen steady increases in the estimates of the company’s revenue, including rather sharp upgrades this year. The lines are moving up and to the right, and analysts are expecting mid-single digit sales growth for the foreseeable future. For a company that’s been around for 130+ years and serves over two billion beverage portions per day, I think that’s fine.

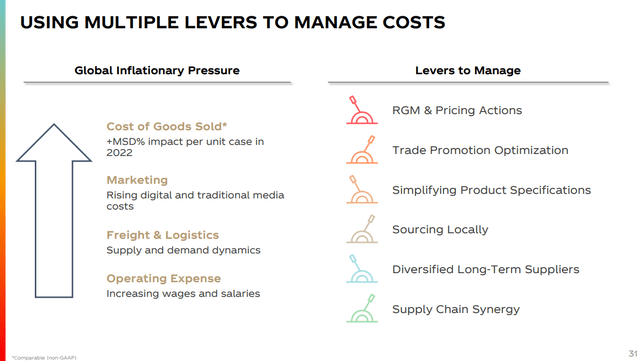

Now, one thing that isn’t helped by any of that is margins. The company’s margin profile was greatly improved following the bottling divestitures, but there are things that are outside of its control as well.

We’ve seen inflationary pressures hit countless companies this year, whether it’s wages, freight, commodities, you name it. Coca-Cola is not immune to this, but it’s combating these headwinds with its own measures. Pricing is one way to do that, but efforts are well underway to help margins with sourcing and supply chain initiatives, among other things. To my eye, revenue growth should be pretty straightforward; margins are a bit of a wildcard because of this.

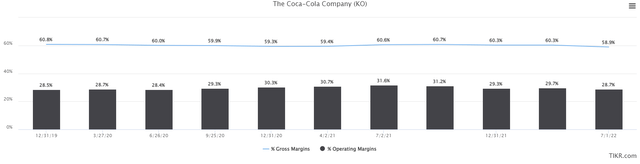

Below we have trailing-twelve-month gross margins and operating margins as a percentage of revenue for the past few years.

There’s not a huge amount of movement here, except that the past few quarters have been lower from the prior peak. That’s the impact of inflation on the company’s profits, and with few signs of that inflation slowing down, one has to expect it may be a while before the company sees 31%+ operating margins again.

That may not sound like a big difference from ~29%, but keep in mind if the company’s operating margin gains just 1% as a percentage of revenue, that’s a ~3% gain on a relative basis, and the company is expected to grow earnings in the mid-single digits each year. An additional 3% (or losing 3%) makes a huge difference to the company’s rate of growth. Operating margins matter, and the fact that the company is facing a lot of inflationary pressures is a big deal for the medium-term health of the stock price.

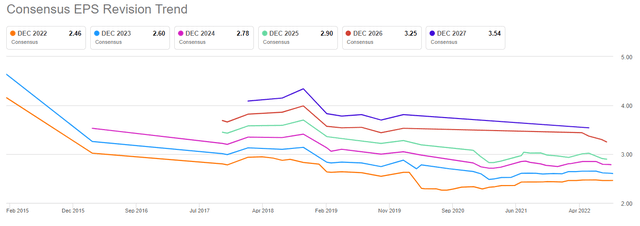

EPS revisions have much the same look as revenue, and we can see there are a bunch of upgrades for this year’s estimates.

However, the longer-term picture is a bit murkier, as the out years are still seeing revisions lower. That’s margin expectations at work, and it’s another reason why I’m not so sure Coca-Cola has a huge rally in front of it. We should see mid-single digit growth in the years to come, but is that enough at the current valuation? Let’s take a look.

Not cheap enough

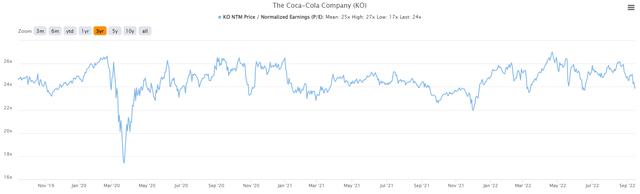

We’ll look at Coca-Cola’s valuation two ways, but we’ll begin with the traditional forward P/E ratio.

The valuation doesn’t really move that much, and apart from the COVID panic selling, the stock has spent almost all of the past three years between 23X and 26X forward earnings. It’s at 24X now, so it’s right in the range you’d probably expect. That’s fine because it’s not expensive, but there’s no way for me to argue it’s cheap, either.

Now, since Coca-Cola is a legendary dividend stock, another way we can value it is through the yield. Hers’s a five-year look at yield to give us an idea of where we stand there.

Unfortunately, it doesn’t look much better here. The yield of 2.9% is great, and about double that of the S&P 500. Coca-Cola, therefore, is still an epic dividend stock from its combination of longevity, yield, and dividend growth prospects. But is it cheap on this basis? Absolutely not.

Final thoughts

As I mentioned, I think this company is in great hands. There’s a focus on constant innovation and margin expansion, while thoughtfully growing the top line. This is no longer a soda company given its diversification, and it performs well in recessions or booming economies. The dividend is great as well, and if you’re looking for a buy-and-hold dividend stock, you will find it difficult to do better than Coca-Cola.

But is it a buy today? I don’t think it is. The company is facing constant inflationary pressures and thus far, its ability to combat these has proven inadequate. The stock isn’t cheap by any means, and I don’t particularly like the look of the chart. Given all of that, while I like it as a dividend stock, I think the best thing to do if you’re of a trading mindset is to simply pass on Coca-Cola until we see signs of a bottom and/or the valuation improves.

Be the first to comment