Patrik Stollarz/Getty Images News

Introduction

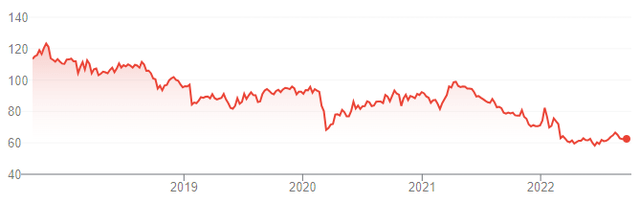

We review our Holding rating on Henkel AG & Co. KGaA (OTCPK:HENKY) three months after our original downgrade, and ahead of Henkel’s capital markets day on September 20.

Henkel’s Preferred Shares have risen 2.6% since our downgrade, but remain down by 45% in the past 5 years:

|

Henkel Preferred Share Price (Last 5 Years)  Source: Google Finance (18-Sep-22). |

(In this article we refer exclusively to Henkel’s Preferred Shares, the class most commonly held by institutional investors. They carry no voting rights but are entitled to €0.02 more in dividends than the Ordinary shares.)

We remain cautious on Henkel. While commodity prices have softened somewhat recently, Henkel will likely continue to see strong inflationary headwinds. Management reiterated most of Henkel’s 2022 outlook on August 15, including a 15-35% ex-currency decline in Adjusted EPS. Adjusted EBIT was down 18.5% year-on-year in H1, showing the impact of higher input costs on Henkel earnings. We would like management to address Henkel’s low overall business quality, restructuring risks and unclear targets at the capital markets day. Shares are at 17x 2022 guided EPS (at mid-point) and a 3.0% Dividend Yield, not cheap enough in our opinion. Avoid.

Henkel Hold Case Recap

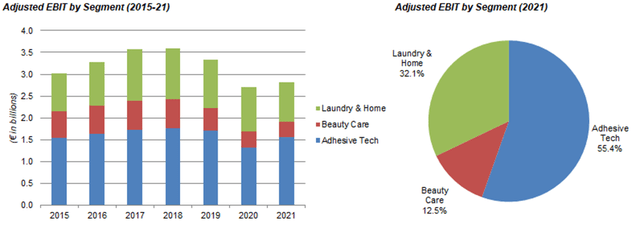

Henkel is a German-listed industrial/consumer conglomerate with global sales, historically reporting in three segments: Adhesive Technologies, Beauty Care and Laundry & Home Care. EBIT had been falling in 2018-20, and Henkel has been undergoing a series of restructurings under current CEO Carsten Knobel since early 2020.

|

Henkel Adjusted EBIT by Segment (2015-21)  Source: Henkel company filings. |

We downgraded our rating to Hold in June, meaning investors should avoid the stock, because we believe that macro headwinds since 2021 have exposed how Henkel’s Consumer businesses were structurally much weaker than we thought, and that this means the latest round of restructuring carries large execution risks and may not succeed.

Things have not improved much since our downgrade.

Commodity Prices Softening, But Not Enough

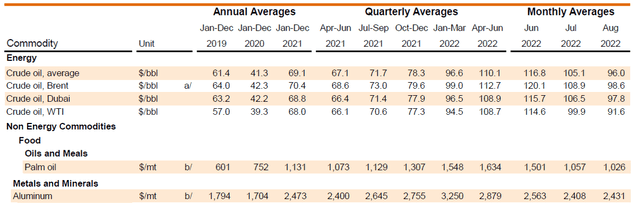

While commodity prices have softened recently, Henkel will likely continue to see strong cost headwinds.

Prices of key commodities have fallen since Q2 2022, with a particular sharp fall in palm oil prices:

|

Henkel Adjusted EBIT by Segment (2015-21)  Source: World Bank Commodities Price Data (02-Sep-22). |

However, comments made by senior Consumer Staples executives in early September indicate that the size of cost headwinds has not changed materially from existing guidance and that inflation will continue into H1 2023:

For example, Unilever (UL) CEO Alan Jope highlighted on September 6 at the Barclays Global Consumer Staples Conference that simple mathematics mean that prices will still be higher year-on-year in H1 2023:

There have been some softenings in commodity prices. But … if you do the math on second half run rate costs on first half next year, there will be continued inflation into next year … mathematically, it’s almost impossible that there won’t be significant inflation in the first half of next year.”

Similarly, Procter & Gamble (PG) CFO Andre Schulten stated that their cost headwind guidance remain the same, because suppliers are still passing through higher prices and P&G needs to pay to secure steady supplies:

We see some good news on commodity input cost sequentially. So that’s a little bit of help versus the numbers that were underlying our guidance … The two forces that work against that is pass-through from suppliers in terms of raw pack material costs as they are working through their cost challenges, and as we kind of work the best plan with them to ensure a steady supply, but at the same time limit the cost exposure … The net is the total exposure that was underlying our guidance is still about the same.”

We therefore do not see any material improvement in Henkel’s profitability from lower commodity prices.

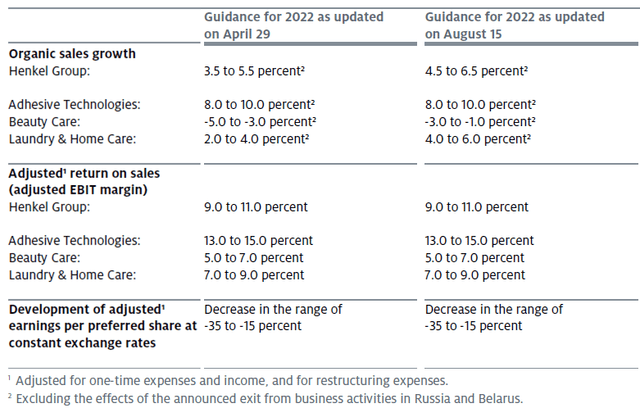

Henkel 2022 Outlook Mostly Reiterated

Henkel itself reiterated most of its full-year 2022 outlook when it released H1 results on August 15, when the declines in commodity prices described above were already well under way.

Management still expects an 15-35% ex-currency decline in Adjusted EPS and a group Adjusted EBIT margin of 9.0-11.0%. However, group organic sales growth outlook has been raised from 3.5-5.5% to 4.5-6.5%, as sales in the two Consumer segments are now expected to perform slightly better:

|

Henkel Adjusted EBIT by Segment (2015-21)  Source: Henkel interim report (H1 2022). |

The expected Adjusted EBIT margin of 9.0-11.0% represents a significant decline from the 13.4% reached in 2021 (which was in turn a significant decline from the peak of 17.6% in 2018).

Currency is expected to be a low-to-mid single-digit positive for sales in 2022. If we assume a 5% currency tailwind for Adjusted EPS, and take the mid-point of the guided range, then we arrive at a 20% decline in Adjusted EPS.

H1 Results Showed Impact of Cost Inflation

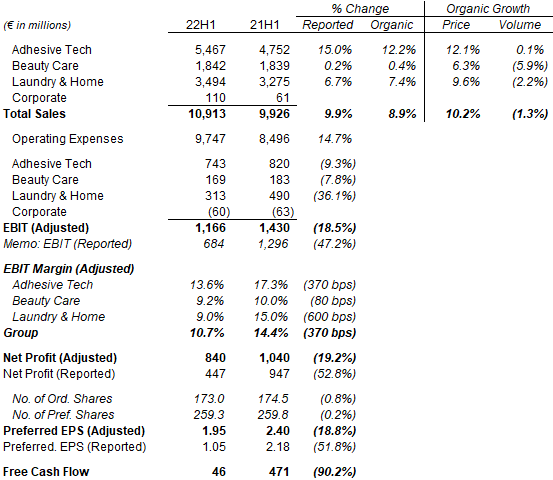

H1 2022 results showed the impact of input cost inflation on Henkel earnings and, by extension, the weakness in its business model, including when compared with peers.

Henkel’s Adjusted EBIT fell by 18.5% (€265m) year-on-year in H1; Reported EBIT fell even more, by 47.2% (€612m), primarily due to €258m of impairments (for both the Russia/Belarus businesses and a Beauty Care business) and €232m of restructuring expenses. Group Free Cash Flow was just €46m for H1, compared to €471m last year:

|

Henkel Key Financials (H1 2022 vs. Prior Year)  Source: Henkel interim report (H1 2022). |

Adjusted EPS fell 18.8% year-on-year in H1 2022, including currency.

Adjusted EBIT fell by a high-single-digit in Adhesive Technologies and Beauty Care, and by more than a third in Laundry & Home Care. Adjusted EBIT margin fell in each of the three segments as price increases were not yet sufficient to offset input cost increases. (For example, there is a time lag of 3-6 months in pricing in adhesives.)

Group sales grew 8.9% organically (excluding Russia and Belarus). Reported sales growth was 9.9%, benefiting from 2.4% of currency tailwinds but losing 1.4% to M&A (including the planned exit from Russia and Belarus).

Volume fell the most in Beauty Care, by 5.9% year-on-year, partly due to divestitures of non-core brands, which management expect to have a 5 ppt impact on segment sales for the full year. Volume was up 0.1% in Adhesive Technologies and down 2.2% in Laundry & Home Care.

Together, Henkel’s Consumer segments had a 4.9% organic growth, much worse than peers. For example, Unilever had underlying sales growth of 8.1% in H1, with 9.8% from price and a 1.6% volume decline; P&G had organic sales growth of 10% (with 3% from volume) for January-March and 7% (with a 1% volume decline) for April-June.

What We Want to Hear from Management

We hope the following concerns will be addressed at the capital markets day:

We continue to see Henkel as a low-quality business overall, with Adhesives Technologies being solid in terms of business quality, but Home & Laundry Care mediocre and Beauty Care weak. We are concerned about what appears to be a structural decline in the Consumer business, which we attribute to it being subscale compared to peers and having historically weaker brands.

We are also concerned about the execution risks in the ongoing restructuring, which includes merging the two Consumer businesses into a single Consumer Brands unit. Also, while management is targeting €250m of net savings by 2023 year-end, a further amount of savings by 2025 year-end remains undefined.

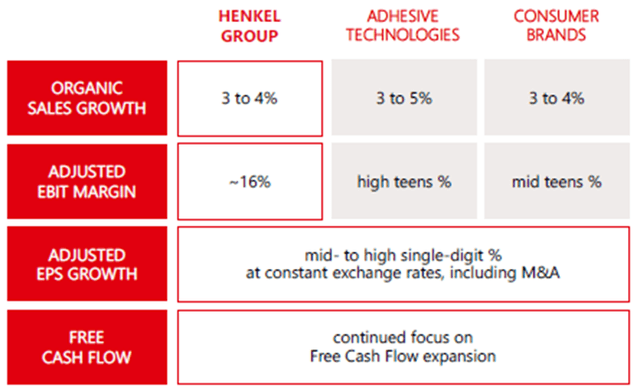

We also want more visibility on Henkel’s mid-to-long-term targets. Despite its recent struggles, Henkel has maintained its mid- to long-term target of growing Adjusted EPS at mid-to-high single digits at constant currency, and added a new target of reaching an Adjusted EBIT margin of 16%, but did not say when this would be achieved. We do not see an easy path for Henkel to achieve these targets.

|

Henkel Mid- to Long-Term Targets  Source: Henkel results presentation (Q2 2022). |

Our confidence in current Henkel management is low, and we are unlikely to change our rating to Buy until we see either more solid plans to improve Henkel’s business or a significant improvement in the macro environment.

Henkel Stock Dividend and Valuation

If we take the mid-point of the guided 15-35% Adjusted EPS decline and assume a 5% currency tailwind, then we arrive at a 2022 Adjusted EPS of €3.42. With Preferred Shares at €62.50, the implied P/E is 17.1x on 2022 EPS (and 13.7x on 2021 actual EPS).

Henkel Preferred Shares paid an annual dividend of €1.85 in April, implying a 3.0% Dividend Yield. The dividend has been flat since 2018, and represents a Payout Ratio of 41% relative to 2021 EPS.

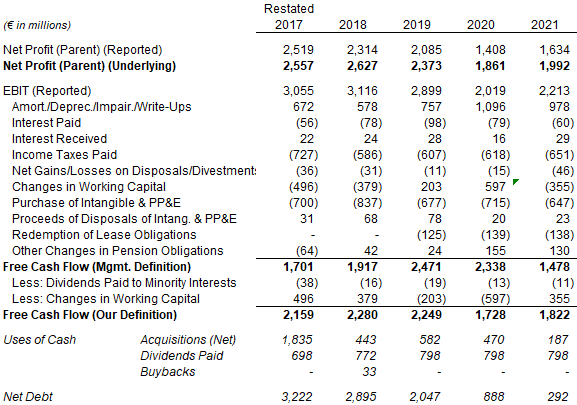

Henkel’s Free Cash Flow, per our definition, has fallen significantly after 2019:

|

Henkel Profit & Cashflows (2017-21)  Source: Henkel company filings. |

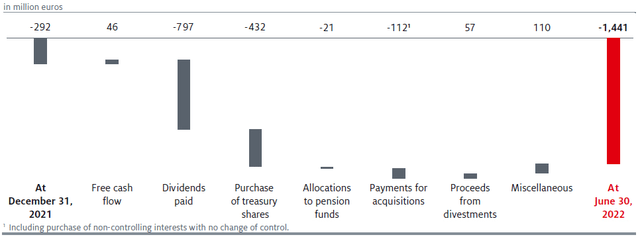

Net debt stood at €1,441m at the end of June 2022, €1.1bn worse than the start of year as Henkel paid out €797m in annual dividends and bought back €432m of shares, even though H1 Free Cash Flow was just €46m:

|

Henkel Net Cash / (Debt) (H1 2022 vs. Year Start)  Source: Henkel interim report (H1 2022). |

Henkel is in the process of executing the €1bn share buyback program that it announced in January, to be carried out 80/20 between the Preferred and Ordinary classes, and to be completed by the end of Q1 2023. The remaining €568m represents approximately 2% of Henkel’s current market capitalization.

Given its structural and execution risks, we do not believe Henkel shares are cheap enough at present.

Is Henkel A Buy? Conclusion

We reiterate our Hold rating on Henkel shares, meaning they should be avoided.

Be the first to comment