anthonysp/E+ via Getty Images

Chasing down future crude oil (CL1:COM) pricing is becoming a lot like the massive man hunts needed to catch hardened, escaping criminals: hard. The erratic price swings, driven often multiple times daily, leave traders and the rest of us dizzy. News that China is opening sends prices higher, while news that claims China is locking down once again drives prices lower. The same is true with recession on/off rumors. Some important matters remain the same, others have or will change.

What Hasn’t Changed

This important market condition hasn’t changed. Crude oil consumption continues to significantly outpace production. The following slide from Julianne Geiger of Oil Price perfectly illustrates the massive deficit between the two.

Oil Price

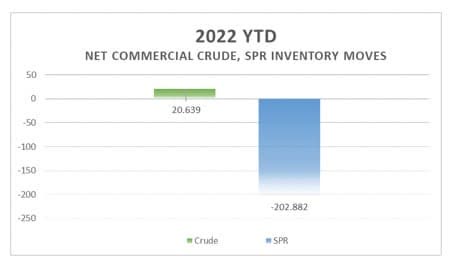

Since March, the Strategic Petroleum Reserve (SPR) has dropped more than 200 million barrels, with only slightly more than 400 million left. In just thirty-six weeks, almost a million barrels a day, the policy posed to drain the SPR has worked. A continued drain would leave Americans in dire straits and can’t continue. With crude oil production remaining stuck at 12 million barrels a day, demand destruction must occur and will so at some higher price.

A headline from the past week, Oil Prices Extend Losses After EIA Inventory Data Release, highlights the issue. The EIA reported another significant decrease in crude inventory at a -4.0 barrels for the week. This followed a 5 million barrel drop the prior week. The market isn’t yet factoring in the unsustainable straits that the market finds itself in.

Before we go on, a note from the November 18th EIA report found gasoline inventories significantly higher (3.1 million), a likely preparation for major Thanksgiving travel. Still, usage vs. production continues massively bullish.

The December Effect & Other Issues

So even with bullish ratios, oil traded down after the most recent EIA report. Why? One reason might be the December effect. One analyst noted that December might be the “mother of all buying opportunities.” Carley Garner, co-founder and analyst at DeCarley Trading, stated, “. . . there could be one last washout from this week, possibly early through December, and that washout could take crude down to the low $70s, or even the mid-$60s.”

Another focuses on the virus demand destruction in China. From Oil Market Metrics Signal Sufficient Supply And Weakening Demand, the markets moved into contango, delivery at later dates are higher priced, signaling enough near-term supply. But even more important is premium on Oman futures now at less than a $1 compared to $15+ a short time ago. This entity signals the demand status in Asia. Virus cases are driving deep shutdowns in China, by necessity, a temporary situation.

World Capacity

The EIA estimated in June that worldwide spare capacity was limited to approximately 3 million barrels per day, a historical extremely tight market. Oil traders can’t expect much help from outside of the United States. Changes in the shipments from one region to another becomes a zero-sum game.

A Certain Final Destiny

But, on the supply side, two factors are about to change. The European Union is preparing to implement an oil import embargo on Russia in early December, a move that is believed to represent a million barrels a day decreased worldwide supply. And in the U. S., SPR draws will cease, cutting off a large percentage of supply.

The market senses these coming supply changes. Brent crude for $200 per barrel in March 2023 were a few weeks ago the most traded option’s contract. The bullish vs. bearish trade ratio were at the widest ratio ever recorded, couple this action with crude inventories in developed countries now at their lowest level since 2004, the markets aren’t in any sense bearish. And all this with diesel markets “exceptionally tight.”

Add to this mix crude tanker pricing surging to astronomical levels, driven by increased transportation distance with Russia going off demand plus higher demands. All of this behind the backdrop of an OPEC production cut.

With inventories falling, production stalling and demand solid, only higher prices can be expected.

Cornering Crude Pricing

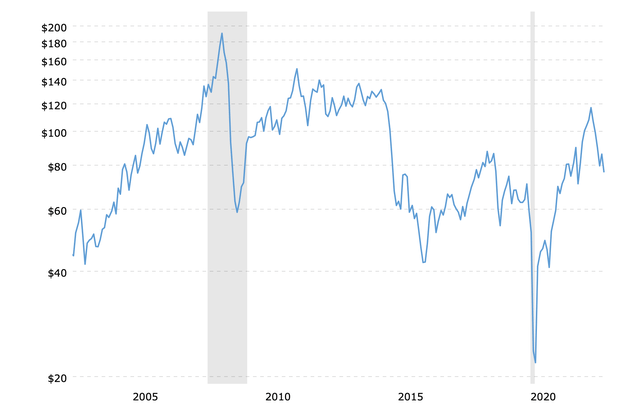

Crude oil charts, shown below, and actions from professional traders bracket future crude price range between $130-$200 within the next 12 to 18 months.

Reading from the chart, crude pricing created support near $60 and resistance ranged between $120 and $140. A breakout above $120-$140 is possible during stressed markets.

Several months ago, Goldman Sachs stated that significant demand destruction required oil prices to increase into the lower to mid $100s. Obviously, Goldman’s timing isn’t perfect, but the fundamentals which drive its thesis haven’t change. For us, we aren’t sure that exact pricing nor predicting timing for higher crude pricing is possible; the market place makes that decision. But, what seems enviable is higher prices significantly higher unless political changes foster increased crude oil production. Our expectation places at least one peak near June of 2023 bracketed between $130 and $200 per barrel.

Risks

Perceived or real health issues might dominate risk for oil. Renewable energy sources aren’t close to being replacements and aren’t likely to ever fill that role. It also seems clear that sooner rather than later, China and its demand for energy will resume with cases of the virus either dissipating or the government changing policy bringing huge demand back on-line. For us, investments including producers and mid-stream entities become lucrative, because higher prices likely result. Also, on the demand side, some weakening of diesel has appeared recently with inventories slightly increasing, this with refineries now operating in what once was a softer demand environment at summer peaks levels, 94%. Recession destruction seems limited outside of a total economic shutdown such as in 2020.

Weekly, the EIA posts a written summary for crude oil including pointed information about imports and exports. Watchful investors may find the 2nd paragraph insightful with its reference to crude imports. For example, the week of November 18th, crude imports jumped 1.7 million barrels per day. With production now flat in the United States, watching changes in import rates provide early signs for inventory changes signaling the price change direction.

Similar to the determined sheriff, within the natural investors horizon, the hardened and determined fundamentals will dominate, driving further north crude oil pricing.

Be the first to comment