Ethan Miller

2022 has been an interesting year for World Wrestling Entertainment, Inc (NYSE:WWE) to put it mildly. The company has been through various life altering events while the stock has significantly outperformed the market, gaining more than 60% compared to the S&P’s 15% loss. Let’s recap some major events in 2022 and evaluate the stock’s outlook for 2023.

2022 Recap

Close-shave for The Game

Paul Levesque, known popularly as “Triple H” or “The Game” in the ring, disclosed his near death experience and the resulting retirement from in-ring competition. For those who may not know this, Paul is the real-life husband of current co-CEO Stephanie McMahon, daughter of the just-retired long time patriarch of the company, Vince McMahon.

While Triple H has always been a terrific in-ring performer and story-teller, this news was more debilitating from the business front. While fans have been accusing Vince of losing touch with reality for more than a decade now, Triple H offered the ray of hope from a creative and nurturing talent standpoint. As an example, Triple H was the brainchild behind what is now known as NXT. The fact that he came so close to losing his life was a sobering reminder that not many can kick out of the three-count in real life.

End of an era

However, the double whammy came later in the year with Vince McMahon stepping down in July 2022 after yet another scandal. Vince and WWE are no strangers to scandals but the latest allegations were too strong to overcome or brush under the rug, especially as he is nearing 80. Despite being a billion dollar global entertainment giant, WWE has always been controlled by Vince from a creative standpoint. This has been voiced many times over in the last few years from writers to wrestlers to sometimes his own family members.

WWE stock body slams the market

Despite the issues described above, WWE has strongly outperformed the market in 2022 with only one month to go, with a 60% gain YTD. The stock’s rise was based on strong revenue and profits in most of the quarters as well as the relief over the whole Vince saga, which ended with him retiring. But this outperformance is not without side-effects as we will see below.

2023 Outlook

Expect continuing weakness in live attendance

With the post-pandemic, reopening trade firmly behind us, WWE is having a harder time filling up arenas with attendance. In the recently reported quarter, although the Peacock partnership was showing strength, in person attendance was beginning to slow down. The report quoted:

“North American average attendance was nearly 6300, down from nearly 8300 last year in the same time period.”

That’s a 25% YoY decrease. It’d be ridiculous to assume WWE will continue losing attendance at the same rate but it is also safe to assume the post-pandemic tailwind is a thing of the past. Live attendance is key for WWE’s profit as it also leads to cross-selling in various merchandise categories including food, apparel, and collectibles.

Unproven leadership

Vince was practically the founder/CEO who led and controlled the company for four decades and hence, it is not an understatement to say the company is in unchartered territory now. As much as his daughter, and now co-CEO, Stephanie McMahon has been involved in the business since her childhood, it was always Vince’s show. Any company going through transitions is likely to face challenges and WWE is unlikely to be an exception, especially given the turbo-charged real life environment. Let’s not forget that Shane McMahon, Vince’s son, is no longer with the company once again as he was fired by his own father in one of Vince’s biggest moves before retirement.

In short, although fans have been clamoring for Vince to retire and especially for “Triple H” to be in creative control, history has shown us many times that when the founder-CEO leaves the scene, too many cooks end up spoiling the broth.

Valuation

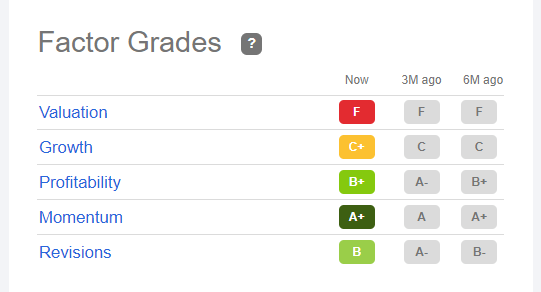

The stock’s outperformance in 2022 has pushed its valuation. With a forward multiple of 32, the stock is priced to perfection and any hint of missing projections is likely to cause a sell-off. No wonder, Seeking Alpha’s quant ratings gives a “F” to valuation as shown below. One factor heavily in favor of the stock right now is its momentum as can be seen in the chart below as well as the stock’s RSI which stands at a healthy 70, which leaves little room before the stock becomes overbought technically as well.

Taking analyst price targets with a pinch of salt, at $80, WWE is less than 7% away from its median price target of $86. Once again, unless earnings improve significantly, the stock is priced to perfection here.

WWE Ratings (Seekingalpha.com)

Conclusion

In our last two analysis of WWE, here and here, we were more favorable to the stock due to its valuation and the stock has since returned an impressive 67% and 30% respectively. However, things have changed now. For a company with unproven leadership facing stiff competition in the entertainment industry, WWE is too richly valued here for our taste after the 60% return Year-to-date. The stock does not pay a large enough dividend to cushion the blow during sell offs. We consider the stock a sell here.

Be the first to comment