CreativaImages

Let’s start with the recent news:

This news flashed on Friday Nov 25: US bans sale of Huawei, ZTE tech amid security fears. The tech sector de-coupling between the US and China is continuing, and this is bad news for the tech companies (NASDAQ:QQQ). The process of “reshoring” and “onshoring” will continue to increase the costs, while the likely Chinese retaliation will significantly reduce the sales of the US tech products in China.

Apple (AAPL) is particularly vulnerable, given its leading market share in China, and given the recent issues with iPhone 14 production in China: “Apple hit a record 23% market share in China in the fourth quarter of 2021, with the iPhone maker reclaiming the number one player for the first time in six years, Counterpoint Research said.”

The upcoming recession

The Nasdaq 100 is still overvalued in my view with the ttm PE ratio at 24.37 and forward PE ratio at 22.54 – and the recession is coming.

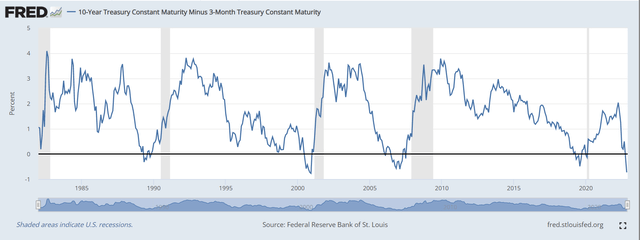

The Fed’s most reliable recession indicator is flashing an imminent recession warning sign – the yield curve spread between the 10Y Treasury Bond and the 3M Treasury Bill is now deeply inverted at -0.73. It has just inverted for the first time on Oct 25th, and the level of inversion is at the highest level, approaching the record inversion of -0.77% before the 2000 recession. Here is the chart:

That implies two things: 1) Tech earnings will be downgraded as the analysts factor in the upcoming recession, and 2) the valuation multiple will have to contract as the recession gets priced in. The combination of the lower earnings and the contracting valuation suggests a deep selloff in QQQ over the near term, even after the 29% selloff in QQQ YTD.

What about the Fed pivot and soft landing?

The upcoming recession will likely be induced by the Fed, which is fighting the highest inflation since the 1980s. The Fed intended to invert the yield curve to slow down the demand – and the yield curve is now inverted, as shown earlier. So, the damage has been done, and the Fed can likely stop with the interest rate hiking campaign soon.

In fact, the path to the yield curve inversion has been the Phase 1 of the full bear market. That phase is now ending. Now, we are entering the Phase 2 of the full bear market – the recessionary selloff.

The market has been hoping for a soft landing, which would imply that the Fed would stop hiking interest rates without causing a recession, inducing just a slowdown or even just a shallow and short technical recession. The hopes of such “soft landing” depended on the assumption that the Fed would stop hiking interest rates before inverting the yield curve. That hope is now essentially gone.

The Federal Funds futures are now pricing the Fed to hike to 5% by May 2013, and if the 10Y Treasury Yield stays below 4%, that would imply the record yield curve inversion – or an extremely tight monetary policy.

The Federal Funds futures are also suggesting that the Fed would hold rates at 5% until Dec 2023, which is the first expected cut. Further, the Fed is expected to keep cutting the interest rates in 2024 to 3.6%. Based on these expectations, the balance between the growth and inflation would start to shift in 2024 more towards the growth concerns – which signals a recession.

However, given the unfolding trend on de-globalization and the tech de-coupling (with reshoring and onshoring), the price pressures are unlikely to sharply ease even in a recession.

Yes, the CPI inflation will fall, but will it fall back to the Fed’s target of 2%? Unlikely. Deglobalization is inflationary. The Fed will ultimately have to accept a higher inflation target. That’s the Fed pivot the market is waiting for, and the Fed is nowhere near formally accepting the higher level of inflation. Thus, any hopes for a soft landing based on an elusive Fed pivot are unfounded in my view.

Tactical considerations

Fundamentally, given the upcoming recession and expensive valuations, I rate tech stocks as a sell.

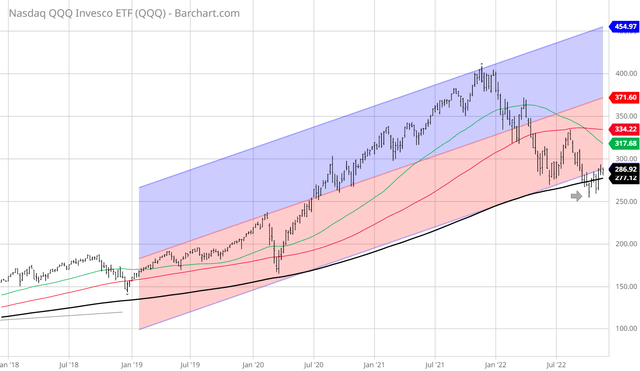

Tactically, the long-term uptrend in QQQ is under threat. Just recently, QQQ broke down below the key long-term support of the 200-week moving average, but it temporarily bounced back above the key support. Here is the chart:

QQQ is currently in a weak bear market rally based on the hopes of the Fed’s pivot, falling CPI inflation, and soft-landing expectations. As I previously explained, the damage has been done, and the recession is coming, thus the Phase 2 of the bear market is upon us – the recessionary selloff. The QQQ is still overvalued and the recession is not priced in.

However, the bear market rally can also be vicious. I recently rated QQQ a sell, expecting a major breakdown, but recommended a cautious approach given the bear market rally risks:

Short QQQ at around 263 (current level), with the stop loss above the 200wma above 273 seems like a good risk-reward trade.

Obviously, the Fed is the key risk variable. Any slightly dovish (or even less hawkish comment) could cause a major short covering. Thus, with this trade it is important to have the stop loss in place and re-evaluate the tactical long if necessary.

Currently, QQQ is trading at 286, above the 200wma. Given the bear market rally, I evaluated the long tactical position as QQQ rose above the 200wma, but given the deteriorating fundamentals, I viewed the trade as purely speculative. Rather, I am looking to enter the short position. Tactically, it makes sense to re-short below the 200wma, which is currently at 277. For NASDAQ 100 futures that’s currently the 11372 level. Under this level, the bear market rally should fade out, and the selling will likely intensify.

Specific QQQ considerations

Apple is nearly 15% of QQQ by weight. Given the China news from the beginning of the article, Apple is particularly vulnerable to deglobalization. Apple is also a cyclical consumer discretionary company and it’s not priced in for a recession with the PE ratio at 24, as I previously noted. Note, Apple is down by only 5% over the last 12 months. Microsoft (MSFT) is weighted at nearly 10% of QQQ, and similarly, it has a very heavy global exposure, particularly in China, and a still high valuation multiple at 26. These heavily weighted overvalued mega cap companies will likely lead QQQ lower in the next Phase of the bear market – the recessionary selloff.

Be the first to comment