litnib

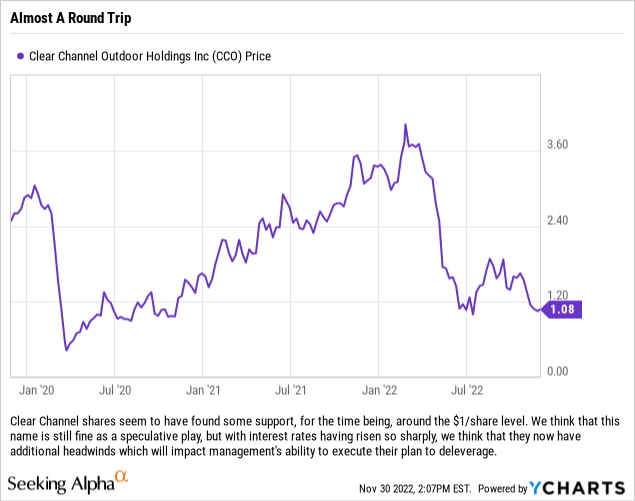

In our high-risk, high-reward portfolio, Clear Channel Outdoor (NYSE:CCO) has been a clear laggard this year as they have been hit with quite a few headwinds over the last few quarters. In the midst of trying to divest assets in Europe, which was already going to be a tough task due to the war in Ukraine and other macro-economic issues, they have been hit with rising interest rates (which impacts potential buyers who need to finance a deal, and Clear Channel itself due to its debt stack having some variable rate debt) and an overall cooling of the M&A market. While operations have performed well, the debt load is a drag and management has also discussed the European assets enough that we all know that they are not divesting from the entire European marketplace. Instead, it appears that they will be selling some assets and keeping exposure to Europe.

The market has been waiting on a deal in the hopes that Clear Channel can address its leverage with the proceeds, and while we would prefer to see a full exit from Europe in order to simplify the company’s structure and focus on the Americas (specifically the United States), we do recognize that selling assets piecemeal can, and should, generate richer multiples for the seller. So while some might end up disappointed in the overall size of the divestiture, whatever the company eventually sells might actually be better for them in the long-run by improving their leverage (selling at a higher multiple lets you retire, potentially, proportionally more debt, thus allowing for greater deleveraging). The company might also be able to benefit from a turnaround in Europe with the assets retained, and with stronger results for that segment, it would help deleverage the balance sheet.

Recent Quarterly Results

One thing we really like about Clear Channel’s management team is that they are doing everything in their power to improve the company’s assets and operating results, even with a balance sheet that significantly constrains what they can do. In the United States Clear Channel deployed 34 large-format digital billboards in Q3, which gives them 1,600+ digital billboards in the market. This is key because this is where all of the growth in the industry is, and conversions of static displays to digital result in higher revenues and profits as the properties are more productive due to their ability to handle more ad inventory. This quote from Scott Wells, Clear Channel’s CEO, on the company’s Q3 conference call really highlights the power of digital within Clear Channel’s portfolio:

“As we noted during our Investor Day, we believe digital is not just a growth driver, it’s a revenue multiplier. At the close of the third quarter, digital represented less than 5% of total inventory, yet digital revenue accounted for 40% of our consolidated revenue and rose 20% during the period, compared to the third quarter of last year, excluding movements in foreign exchange rates.”

We were also pleased to see, much like Outfront Media (OUT) reported this quarter, that Clear Channel’s transit business grew solidly – which should have further to run as ad rates are higher now and there is a tailwind of travelers and commuters still trickling back. So while rates have gone up, overall eyeballs are still not at historic levels and that is something that could still show up in the numbers moving forward.

While acquisitions are not at the forefront of management’s to-do list, we would point out that the company did make a few acquisitions in Q3 which totaled $28 million (all of which was in the Americas segment according to management). That is a healthy amount of transactions for the company when you consider they did about $24 million for the entire first half of the year. So through nine months Clear Channel has purchased $52 million in permits, land, permanent easements and digital billboard structures.

The Road Ahead

Clear Channel still has $5.6 billion in debt (as of September 30th), and due to some of the debt being tied to LIBOR rates (floating rate debt) the company is going to have increasing debt costs year-over-year for the next few quarters. In Q3 the interest expense was $56 million, which was up $4 million YoY. The interest expense is going to be a major headwind for the company as 2022’s interest expense of $341 million will increase to an expected $404 million in 2023. That $63 million increase in expenses will blunt improvements in the operating business and put further pressure on FCF.

The good news is that the company currently has plenty of breathing room on its one debt covenant (maintaining leverage that does not exceed the covenant threshold of 7.1x) with the first lien leverage ratio at 4.98x as of September 30th.

While the out-of-home (or OOH) industry looks strong right now, we suspect that certain markets will begin to see economic headwinds and at that point everyone will be able to see which assets will be poised to outperform (large markets, medium-sized markets or smaller markets).

Things To Keep In Mind

We have looked at this as a lottery ticket. We have some positions that have been owned for a while and have a cost basis well below $1/share. Our belief is that if one analyzes this as a credit, and looks at the individual pieces of Clear Channel’s portfolio, that there is reason to believe that the company has multiple avenues in which to address their debt issues. Worst case scenario, we believe that the company could move to monetize certain US billboard assets in smaller markets; a move which we believe could deliver far more cash than anyone expects and enable Clear Channel to pay down a portion of their debt while also proving to investors and creditors that there is hidden value on their balance sheet. Back in 2016 Lamar Advertising (LAMR) purchased five markets for $458.5 million, so this would not be a crazy move.

The debt is currently only an issue as it pertains to the floating rate on the loan. Clear Channel only has $20 million in debt payments (on their loan) due in 2023, with another $20 million due in 2024 (on the loan as well). In 2025 the company will have to address $20 million in loan payments again, but will also have to address the maturity on 8/1/2025 of their 6.625% 1st Lien bonds which have $375 million outstanding. All of that seems doable today, and we suspect that the company will announce new loan terms on their maturity in 2026 (probably in 2025). After that, the company faces a rough stretch where they have three years (2027, 2028 and 2029) of $1 billion+ in maturities.

Our Final Thoughts

The good news for Clear Channel is that the billboard segment in North America remains very strong with clear paths for growth (via digital and conversions). The company also has a window to address the debt/leverage issues, and they appear to be addressing this task via multiple fronts (asset divestitures in Europe and CapEx spending to digitize the portfolio and boost EBITDA). We still think that this is a buy, for speculation purposes, due to the quality of the assets on the balance sheet and the various options available to management to dig their way out from under the $5 billion+ debt load.

This is a debt play, with a focus on deleveraging, so if the company can navigate this tricky rate environment and refinance their debt longer-term while also maintaining positive FCF in the years ahead, then this is a stock which could most certainly run higher because then this management team could execute on other plans we believe that they have; such as acquisitions in the US and a potential conversion to a REIT.

Be the first to comment