Trygve Finkelsen/iStock Editorial via Getty Images

With more than 55,000 cars around the world, Polestar (NASDAQ:PSNY) has established its reputation as a reliable car manufacturer. Although PSNY stock has fallen 58% since its SPAC listing in June, I believe this is a reflection of the overall market more than a reflection of PSNY’s performance so far.

Unlike many new EV manufacturers, Polestar has years of experience and its cars have been tried and tested. As its Q3 earnings call demonstrated, PSNY is well on its way to becoming a major player in this arena. I believe PSNY is a buy due to PSNY’s likelihood of outperforming other speculative EV stocks in the long-term. Right now is an opportunity to long PSNY ahead of what I expect to be a reversal over the next two years with the easing of automotive supply chain issues and Covid restrictions.

EV Market Downturn

With its background as an established car manufacturer, PSNY had a rather successful IPO which valued the company at $18.6 billion in June 2022. However, PSNY has lost 29% of its value since then, putting its current market cap at $13.1billion.

It’s important to note that Polestar chose to list during a period of uncertainty for many EV companies – particularly those which listed through a SPAC deal. Lordstown, Canoo, and Nikola have not impressed investors since their listing and as companies which went public at the height of the SPAC boom continue to lose their initial valuation, skepticism regarding EV SPACs has begun to seep in.

This is in part due to the poor performance of EV stocks like Tesla which are seen as bellwethers for the larger industry. Even Tesla has dropped 54% since December of last year. Although TSLA’s drop is partly related to CEO Elon Musk’s decision to buyout Twitter, it’s fair to say the EV sector has been particularly impacted by market conditions and supply chain issues.

Although PSNY has fallen 58% since its IPO on June 24th, over the same time period Lucid Group, Inc. (LCID) has dropped 54%, Fisker Inc. (FSR) 24%, Lordstown Motors Corp. (RIDE) 16%, and Tesla Inc 27%. While it’s not uncommon for a recent IPO to lose part of its initial valuation in the months following – NIO Inc. (NIO) for example dropped 90% over the course of 12 months following its IPO – I believe PSNY’s decline is largely the result of quantitative tightening and supply chain issues. The effects of which are more exaggerated in Polestar since it has had much less time to prove its value to investors. This provides room for significant upside moving into 2023 as the company demonstrates continued strength amidst improving supply chains, the release of the Polestar 4 SUV coupe, and deliveries of its other models.

Semiconductor Shortage

After a drop in demand across the automotive sector in 2020, demand for other types of chips increased. However, demand for new vehicles recovered more quickly than expected and a shift across the semiconductor industry to meet demand in other sectors has now put the automotive sector in a supply shortage.

If my thesis is correct, then PSNY will likely see a rebound with the larger EV sector as supply chains ease. It appears that there are already some signs of easing demand due to the Fed’s efforts to get inflation under control. While this will impact sales down the line, it will also result in less demand for household products containing semiconductor chips.

Semiconductor companies are already reflecting weakening demand as TSMC warned in its Q2 forecast of a likely decline throughout the entire semiconductor industry in 2023. AMD has also lowered its revenue forecast for Q3 thanks to shrinking demand for PCs. Across the board, Intel, Nvidia, and Micron Technology are warning of lessening demand.

Semiconductor companies typically have not prioritized the automotive industry since demand for chips used in smartphones and computers amounts to more than half of global foundry capacity. As more chips developed during 2020 enter the market, there is the risk of oversupply. This could lead producers to prioritize demand across the automotive industry, offering some relief in 2023 and 2024.

Automakers don’t need the most advanced chips, rather they require older models compared to those used in computers and smartphones. This can represent a problem for the industry, but I am encouraged by reports that the microchip industry is improving its supply. A report from the industry association for electronics manufacturers shared that the capacity for building the type of chips required “increased 6% in 2021, is expected to increase by 5% in 2022, and will increase again by another 3% in 2023.” Therefore, the combination of shifting demand, increased capacity, and improving contractual arrangements between automakers and chip manufacturers could present significant upside for EV manufacturers in 2023.

PSNY credits its relationship with Volvo and Geely for helping it navigate supply chain tightness since the company so far has not been impacted by rising semiconductor costs due to contractual arrangements. However, these price changes are expected to affect its Q4 earnings.

While PSNY may not have been financially affected, the company was forced to adjust to the semiconductor shortage by changing some of the features in its Pilot Pack. These changes affected Polestar 2 cars produced after March 21st, 2022 for all markets except the US and Canada. The hands-free tailgate sensor was another feature affected by the shortage and according to PSNY they are working hard to mitigate the shortage’s impact and prioritize semiconductors where possible. But according to the website, Polestar still lacks the materials necessary to even retrofit the cars which are missing this feature.

There is certainly no exact timeline for when the semiconductor shortage will begin showing signs of relief in the automotive sector, however PSNY is confident that its experience dealing with the issue over the past two years has put it in an excellent position moving forward. Its ability to largely remain on schedule and ramp up production despite Shanghai lockdowns attests to this. Therefore, even if the issue drags on longer than expected, PSNY will be able to rely upon the logistical network of its two major shareholders to meet its targets.

For comparison, Polestar has maintained its ambitious goal of 50 thousand deliveries by EOY whereas Rivian halved its goal by March and Lucid is aiming for a mere 6,000-7,000 cars having produced just over 2,000 in Q3.

Lithium-Ion Batteries

Like many other EV companies, Polestar is concerned with its battery supply. Currently, PSNY’s suppliers of lithium ion battery modules are CATL of China and LG Chem of South Korea thanks to a deal secured by Volvo Car Group. As is, it is uncertain whether PSNY will fully benefit from recent US legislation providing $7,500 tax credit for the purchases of certain EVs.

As is, LG Chem has production plants in the United States, China, and Europe. The company has also signed an MOU with Snow Lake Lithium (LITM) to establish a domestic supply chain of lithium in North America. While its production will only commence in 2025, may help qualify PSNY for US federal tax credits in the future.

So far, PSNY has not been impacted by price increases for batteries and other components due to its contract terms with Volvo. However, Polestar has recognized the need to maintain and grow its access to battery cells by developing and manufacturing its own. Despite the challenge this presents over the long-term, the company appears to be faring well since it has recently agreed to deliver batteries and charging systems for Candela’s electric boats. This suggests PSNY is in a good position to continue meeting its own needs and if the situation unexpectedly worsens Polestar will likely turn to Volvo and Geely for additional investment rather than pass the costs onto its customers.

Supply Chain

Overall, Bloomberg Economics has acknowledged that the supply chain crisis appears to be easing, with some even predicting an end sometime in 2023 or early 2024. However, the Federal Reserve Bank of New York’s Global Supply Chain Pressure Index (GSCPI) recorded a moderate increase in global supply chain pressures after five consecutive months of easing. But overall the GSCPI’s trend suggests that supply chain pressures are falling back in line with historical levels.

Still, other factors such as the Russia-Ukraine war could continue to impact estimates. The outlook for 2022 remains bearish and the energy crisis in Europe could add additional logistical pressure. According to S&P Global Mobility, the global auto industry will face “significant risk exposure from the looming European energy crunch”. This is because the energy required in key parts of the supply chain related to pressing and welding metal is quite significant and will result in higher MSRP costs down the line. However, this could be an advantage for Polestar whose manufacturing occurs in China where the energy crunch is less severe.

So far, its decision to manufacture the Polestar 2 in China has been Polestar’s biggest obstacle since shutdowns in China led the company to cut its expected deliveries for the year by 23%. Polestar recently shared that had it not been for these lockdowns, the company would have easily exceeded its vehicle sales target. The company is already mitigating the impact of any future lockdowns in China since the Polestar 3 and 4 will take place at Volvo’s facility in South Carolina.

Volvo & Geely

It seems unlikely that China will be able to draw out its policy of zero-Covid as lockdown restrictions have slowed its GDP growth significantly leading the country to rethink its strategy. Since PSNY’s parent company is Geely – China’s seventh largest automobile manufacturer – the company could stand to benefit from Geely’s amicable relationship with the Chinese government. Indeed, Polestar’s relationship with Geely and Volvo gives the company a significant advantage over other emerging EV players such as Fisker, Mullen (MULN), and Canoo (GOEV) since it has access to Geely and Volvo’s considerable resources.

Volvo has committed to becoming an all-electric car manufacturer by 2030, a feat which puts particular emphasis on Polestar as well as its other EV brands. Geely itself has stated its goals of making 50% of all its car sales electric by 2023. This emphasis on manufacturing EVs will benefit Polestar due to improved access to Geely and Volvo’s supply networks, facilities, and connections.

In order to meet the additional logistical demand brought on by manufacturing these EVs, PSNY’s parent companies will need to adapt their own networks. Compared to traditional ICE vehicles, these cars will require two to three times as many semiconductors and roughly four times as much copper. As they adapt to build a stronger supply network, PSNY will be a beneficiary of their improvements.

Legislation

PSNY and the larger EV industry will also experience significant tailwinds in the coming years thanks to US legislation such as Biden’s Inflation Reduction Act which provides a tax credit for certain EVs. While PSNY’s customers may not meet the required combined household income of under $300,000, Polestar’s cars could still qualify for the tax incentive. It’s also worth noting that some analysts have raised their price targets for TSLA based on the tax credit’s expected benefits despite the average household income of a Tesla Model S owner clocking in at $151,096 per year.

While the Inflation Reduction Act may not have a significant impact on Polestar, the company will benefit from legislation like the Build Back Better Act which seeks to promote the EV industry by outlining a target of 50% EV sales in 2030. California – which has a projected population of 44 million by 2030 – has also passed laws that would ban the sale of gasoline-powered vehicles by 2035.

This legislation comes after the global EV market has grown at a rapid rate and is projected to grow even more – reaching $823.75 billion by 2030. In the US, the EV market is forecast to reach a whopping $137.43 billion valuation by 2028. Clearly demand is not an issue and PSNY should be judged on the demand it’s experiencing in these early stages to determine whether its growth can be sustained.

Polestar will also benefit from another piece of legislation as it leaps frogs the necessity of building out its own EV charging network – an expensive undertaking which Tesla has pursued. Biden’s administration has announced plans to build an additional 500,000 charging stations by 2030 and $5 billion has already been allocated for states to work on this plan over the next five years.

Polestar is no stranger to connecting with public charging networks since it provides a Plugsurfing card – allowing access to over 375,000 public charging points in the UK and across Europe. In the USA, PSNY has partnered with Electrify America to provide 2 years of free charging sessions to new and existing 2021 and 2022 Polestar 2 customers. If successful, the partnership could continue in the future – giving PSNY customers free access to these fast-charging stations all over the country. With the cost of gasoline elevated due to global events, PSNY’s partnership and the accessibility of public charging stations thanks to this legislation could offer a powerful incentive to drivers.

Polestar Reputation

Another strength which I believe has been overlooked when evaluating Polestar’s potential is the company’s established reputation. After decades spent developing high performance vehicles for racing, Volvo stumbled upon Polestar leading to its acquisition of the company in 1996.

Polestar’s first take on a Volvo car was the special edition C30 which claimed the title of “Fastest Road-Legal Volvo Car” for a few years. Judging by the reviews, it sounded like a car that Jeremy Clarkson would give a good rating. Their second collaboration was another special edition Volvo – the S60. Like the C30, only a few hundred of the S60 model were made. However, the last Volvo Polestar joint production – the V60 – underwent mass production and received favorable reviews which even described it as the “automotive equivalent of an understated luxury wristwatch”.

Building on its early success, PSNY has been making a name for itself since branding its cars separately from Volvo in 2017. This resulted in the impressive Polestar 1 in late 2019 and the Polestar 2 in mid-2020. These models have cemented Polestar’s place as an EV player in over 25 markets thanks in part to its relationship with Volvo and Geely.

For example, the Polestar 2 is manufactured in a Geely owned and Volvo operated Luqiao factory in China while the Polestar 3 is being produced at Volvo’s South Carolina factory. With this “parental” support, Polestar launched in the U.S, China, Canada, Belgium, Germany, UK, Sweden, Netherlands, Norway, and Switzerland in 2020. But the company appears to be on track for aggressive expansion as it began marketing its cars in Austria, Denmark, Finland, Australia, New Zealand, Hong Kong, South Korea, and Singapore only a year later. By the end of 2023, PSNY plans to sell its cars in a total of 30 markets including Kuwait and Israel.

Based on the cities and countries chosen for service centers and retail stores, it appears that PSNY is targeting areas yielding high value customers interested in performance electric vehicles. This of course puts it in competition with many well-known EV manufacturers.

Competition

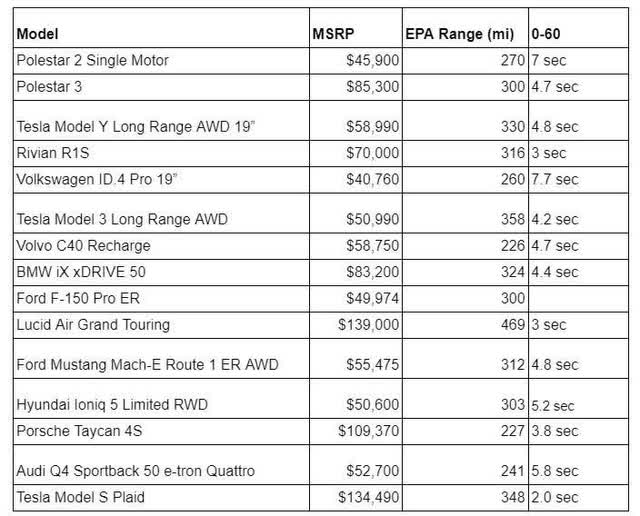

The company recently launched its latest model – the Polestar 3 – in October 2022 which when compared to other EVs in the premium SUV category appears to be a competitive candidate.

Polestar is marketing itself as a high-end car manufacturer, targeting the same audience as Porsche Taycan, Tesla Model S Plaid, and Lucid Air. In comparison to these models, the Polestar 3 has a significantly lower MSRP with better mileage in some cases. While PSNY is clearly targeting the luxury EV market, its ability to keep its latest model’s price only 29% higher than the average price of EV cars in the US is an indication of how competitive its vehicles are. If Polestar is able to price its vehicles competitively as it ambitiously moves to release one new vehicle each year leading up to 2025, then it can target a larger portion of the EV market.

Another advantage PSNY offers over its competitors is its industry experience. Mass recalls from EV manufacturers like Lucid and Rivian have continued to plague the industry and are a particularly discouraging sign for these companies’ investors.

I believe PSNY has an edge over many other emerging EV companies thanks to the many years it spent producing cars with Volvo. Of all the Polestar cars produced, the company has only issued 2 recalls affecting roughly 8,000 cars. While it’s not unusual for a car manufacturer to issue recalls – especially for its early models – it is a significant hurdle which can shake the confidence of many investors.

Polestar’s experience will help it avoid this while also ensuring that its vehicles remain competitive with new technology. The new model 3 uses the NVIDIA DRIVE platform for software-defined architecture – making it competitive with Tesla which defined this innovative functionality. It appears Polestar is also targeting autonomous driving in its later models since the NVIDIA DRIVE chip is intended for this purpose. As Polestar includes this feature in its future updates, the company will maintain its place on the cutting edge of automotive technology.

Financials

Although PSNY slightly beat Q3 EPS estimates by 1.34%, the company missed revenue expectations of $675.8 million by 35%. Wall Street had expected a 20% increase in revenue from Q2 when the company reported $467.4 million. Despite this miss in revenue, PSNY saw a roughly 42% increase following its earnings thanks to a surprise $4 million in gross profits.

But I believe its Q3 earnings do more to solidify the company’s place as a long-term contender in the luxury EV market. The company has successfully met its goals for the past two years and is in a comfortable position to meet its targets for 2023 and beyond thanks to funding from its major shareholders.

With $1.6 billion in shareholder financing and $988 million cash balance the company projects that it has enough capital to fund operations through 2023. This funding comes at a pivotal time for PSNY which would have been strapped for cash without it.

Sales and marketing spend is also expected to ramp up in Q4 and into 2023 with the launch of Polestar 4. Increasing production will also contribute to its cash burn, especially as PSNY begins to reflect price increases in some critical components such as semiconductors and lithium-ion batteries. But even with this funding secured, investors should focus on the company’s cash burn, production numbers, and consumer demand.

Orders:

Currently, PSNY is at an advantage thanks to strong demand. The company is working double time to meet orders and PSNY’s management expects Q4 to be its strongest on record in terms of production. In the first half of 2022, orders increased by 50,000 and PSNY has already secured deals with Hertz and Uber to deliver 65 thousand vehicles over five years.

Considering that the company is set to release the Polestar 2 all-electric fastback in 2023 as well as the Polestar 4, I believe it will continue to see strong demand moving forward. Polestar’s CEO Thomas Ingenlath shares this confidence saying that he does not doubt customer demand, rather his focus is being able to deliver on that demand moving forward.

Production:

Polestar has successfully expanded its production, delivering 30,400 vehicles globally over nine months for an almost 100% increase YoY. As it begins production at Volvo’s South Carolina manufacturing facility, the company will also be able to tap into Geely and Volvo’s production capacities across Asia, Europe, and the US, cutting back on the costs of expansion moving forward. While Polestar’s goal of 290 thousand EV sales by 2025 is ambitious, I believe it is achievable given the company’s performance in the face of this supply chain crunch.

Revenue:

Meanwhile, PSNY is targeting $2.4 billion in revenue for the full year having generated $1.48 billion so far. If achieved, this would represent a 77% increase YOY in revenue. PSNY appears to be handling its cash-burn well, having increased its gross profit from $1 million in the nine-month period of 2021 to $57 million in 2022. However, the total cash used for operating activities over this nine-month period totaled $1.02 billion – a marked increase from the $155 million used over the same period last year. This increase is largely due to a $372 million share-based listing charge.

Regarding PSNY’s revenue, Ingenlath shared that with “the three product launches we have over the next three years, we are really focused on delivering on those milestones for those products to then start generating the revenues and the margins.”

This strategy puts a lot of emphasis on consumer demand which could expose the company to more risk if consumers cut back on discretionary spending over the next few years. While PSNY’s target audience is less likely to be affected by an economic downturn, I will be watching order numbers over the coming quarters for signs of weakness which could spell danger for Polestar down the line.

As is, the breakeven target for PSNY appears to be near 290 thousand vehicles per year – PSNY’s goal for 2025. Analysts tend to agree that PSNY will become profitable over the next 3 years, but the company’s operating expenditure is a key metric to watch. Surprisingly, PSNY’s R&D expenses over the nine months of 2021 dropped 21% from $157 million to only $123 million. But with new models scheduled for release and the company ramping up production, these costs could increase adding to its cash burn.

The expectation is for PSNY’s gross profit to be close to the $4 million generated in Q3 but considering that some of the company’s material costs will only begin reflecting supply chain issues in Q4 and beyond, I believe the company’s ability to generate a gross profit could be affected.

Risks

Despite Polestar’s backing from Geely and Volvo, it is far from the largest player in the EV market. As the dominant pure-play EV manufacturer, TSLA has a significant advantage over many newcomers. However, traditional OEMs like Ford Motor (F) and General Motors (GM) are targeting the EV market with their more than considerable spending power. Merrill Lynch’s “Car Wars” study shared its prediction that Ford Motor and General Motors will squash Tesla’s market share by 2025. As is, Polestar is unlikely to outcompete these giants if they successfully break into the luxury EV market where Polestar is working to capture market share.

Additionally, inflationary pressures are likely to affect consumers’ decision to buy EVs which could dampen demand for Polestar’s vehicles. Over the long term this could even affect its chances of reaching the 290 thousand vehicle sales target for breakeven by 2025. Alternatively, if consumer demand remains too strong and supply chain issues do not improve, Polestar runs the risk of not meeting demand. This would lead consumers to order from other brands which may offer more availability.

Polestar will also face obstacles as it attempts to break into new markets. If Polestar is not received well, it will require additional marketing to improve brand awareness adding to its expenses. In the US Polestar is competing with well-established names with extensive legacies, as a relative newcomer PSNY could face significant marketing costs as it attempts to establish itself globally.

Polestar has also been affected by the Euro’s depreciation since most of its manufacturing costs are in the Chinese Yuan Renminbi. This has affected its cost of sales in Q3 and could continue to affect its margins in Q4. Although the Renminbi is expected to weaken compared to the US dollar, if this trend continues it could pose a risk for Polestar financially.

As the company’s semiconductor and battery agreements come to an end, Polestar will also be exposed to potentially higher component costs. If supply chain issues drag on, this will also affect its financial growth and ability to retrofit cars with pilot pack features.

One of Polestar’s greatest risks is the possibility that its major shareholders will withdraw funding. Financing from Volvo and PSD Investment helped extend Polestar’s operational runway, without which PSNY may have diluted shareholders. On this note, the share lockup period will end in December which may create a larger free float for Polestar as insiders sell shares. Depending on the amount of insider selling, PSNY stock could drop notably in December.

Take Away

I believe that PSNY will see a turnaround in 2023 thanks to strong demand, improving supply chains, and the start of production at Volvo’s facility in South Carolina. Unlike many others in the EV space, PSNY is already in production with cars on the road. Additionally, PSNY has a cash runway expected to last until the end of 2023. Thanks to the support of its major shareholders and Polestar’s added experience as an established car manufacturer, I believe PSNY is one of the few competitive pure-play EV manufacturers in the EV market.

Given that the share lockup period is set to end in December, investors should wait for possible insider selling to push the stock’s price down for a better entry price. As PSNY gives back much of the gains it made following its revenue beat, I see a play for far out calls or an opportunity for investors to play PSNY’s next earnings where it will be reporting its full year, 2023 guidance. I would wait for the gap from 5.09 to 4.56 to fill before taking a position.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment