goncharovaia

MGM Resorts (NYSE:MGM) is a company that we recently revisited as we built our latest PRO Idea in IAC Corp (IAC) which was a substantial public holding of theirs. In today’s earnings, we see clear signs that COVID-19 concerns by governments are over at least in terms of local mobility with Vegas in full recovery. Moreover, BetMGM, which is MGM’s ticket into major growth, is progressing nicely. Finally, our assessment of regional resilience from a few months ago holds true. MGM is a buy.

Q3 Notes

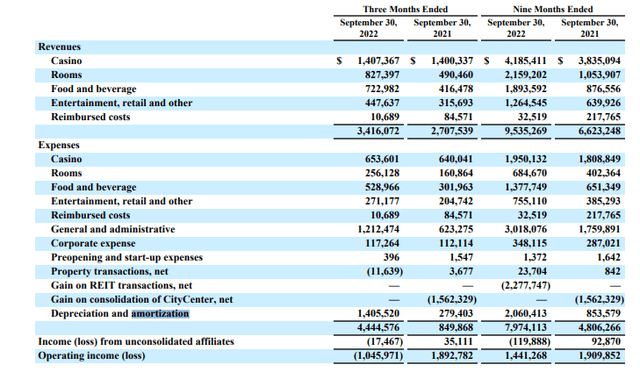

Let’s begin with the Strip. In the last several months there were various acquisition that had a major impact on growth figures. Now on a same store basis we can at least confirm that key drivers like foot traffic and travel activity are restoring this segment to a satisfactory degree. Same store revenues increase 18% in the Strip YoY which is excellent. The headline growth was 67% showing the big impact from consolidation accounting. EBITDAR grew on a same store basis by 8% thanks to recovery in scale for higher value easier pricing flex.

Regional properties which are generally more resilient due to less exposure to corporate activity and more to individual gamblers grew a couple of points YoY in terms of revenue but shrank 10% in EBITDAR. This is primarily due to labour inflation and having to rightsize workforces from a heavily furloughed industry.

MGM China is a mess due to very spotty Macau traffic due to COVID-19 zero policies and further deleterious changes with respect to concession lives that caused large amortisations for the MGM Grand Paradise. The impairment was $1.2 billion on a 3-month operating loss of $1 billion. These big amortisation costs as well as other gains from last year associated with the CityCenter acquisition are the reasons by EPS losses deepened substantially, and would turn losses essentially into profits for this quarter which is dealing with a resumption in activity causing inflation in the G&A line as well, which grew $600 million this quarter, accounting for half of the growth over the last 3 quarters. Further recovery should scale these costs down as a proportion of revenue.

China is a pressure but without the one-off in amortisation the operating losses would be operating profits. The situation is stable in other words, thanks primarily to a Vegas recovery and the situation in regional gaming. What’s on the horizon is what could drive MGM’s stock price.

BetMGM

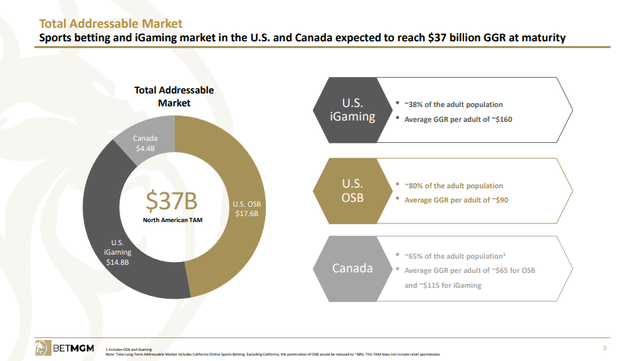

BetMGM remains the main story for us. The annualised revenues are at $1.4 billion, and this should be on a deconsolidated basis. Operating losses from the J.V have halved as the company scales, and in terms of runway they have taken almost 10% of the US iGaming market which has a TAM of $15 billion. There are still open seas but execution is clearly there as more states put in regulation around iGaming for BetMGM to land in. BetMGM is already about 10% of MGM’s overall revenues. With almost 100% YoY growth the representation in the mix should grow and the EBITDA margins could be substantial. Assuming 30% of the US iGaming TAM is claimed by the BetMGM brand, and the TAM doesn’t consider growth in the market, there is 50% more growth that can easily be achieved given precedent growth, and at 35% theoretical EBITDA margins EBITDA could grow 20% from here just on the basis of the BetMGM growth. With Canada being a potential market and much larger obtainable markets going beyond just current gamblers that could be onboarded thanks to the existence of an online platform, prospects become even better.

BetMGM TAM Report (BetMGM Investor Report)

With the total BetMGM JV with Entain (OTCPK:GMVHF) close to already 20% of the current US iGaming market, a 30% market share may be very conservative. Competitors like Betsson (OTC:BTSBF) have not yet moved in the US market still waiting for approvals, so BetMGM is reaping fully whatever first move advantages might be present in this push.

Remarks

MGM trades for 4.7x EV/EBITDAR, and in addition to an eventual even just partial recovery in China, they have BetMGM as well as the Osaka prefecture partnership to boast, which several companies including Las Vegas Sands (LVS) were hunting for some years. They’ve got the license and are pursuing the process to develop the resort, possibly ready by the late 2020s. Their situation is relatively stable and their operating losses hampered primarily by one-offs, indeed the 9-month results show operating profits without problems, despite inflation in cost lines related to the resumption in convention and corporate facing revenues in the Strip.

Leverage isn’t excessive and neither are interest expenses. Overall, the 20% growth being very achievable by BetMGM in the next couple of years, as soon as they roll back marketing and let true EBITDA margins emerge, is something that doesn’t seem to be considered by markets for the time being. MGM has that nice option, and on that basis we’d consider it a buy.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment