Herbert Pictures

Airbus recently shared its order and delivery numbers for November. The company also shared that it no longer expects to meet its delivery target for the year. This actually was according to my expectations so not a big surprise there. In this report, I will be analyzing the November order and delivery numbers as well as other order book mutations and I will discuss the full year delivery target miss.

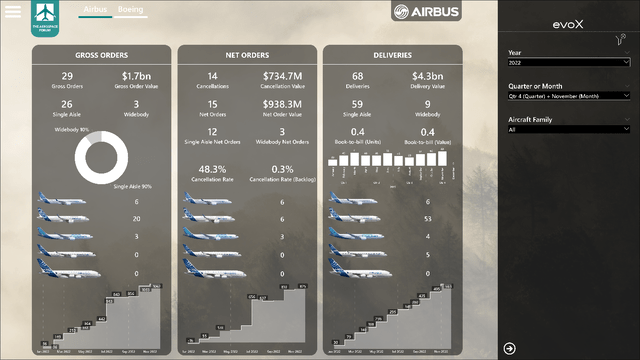

For this report, I will be using the evoX order and delivery monitor developed by The Aerospace Forum leveraging the hundreds of thousands of datapoints we got. This ultimately allows us to analyze orders and deliveries and see where manufacturers are falling short, meeting or exceeding expectations.

Airbus Numbers Are Underwhelming

In November, Airbus booked 29 gross orders, marking a month-over-month decrease of 148 orders, consisting of 26 single-aisle aircraft and three wide body aircraft with an estimated value of $1.7 billion:

- Condor ordered four Airbus A320neos and six Airbus A321neos.

- Croatia Airlines ordered six Airbus A220-300s.

- Aer Lingus ordered two Airbus A320neos.

- British Airways ordered four Airbus A320neos and two Airbus A321neos.

- Azul (AZUL) ordered three Airbus A330-900s.

During the month, the following changes were made to the order book:

- Aviation Capital Group converted an order for one Airbus A320neo to an order for one Airbus A321neo.

- Two Airbus A320neos were transferred from BOC Aviation to Flynas.

- BOCOMM Leasing was identified as the customer for one Airbus A320neo.

- Chengdu Airlines was identified as the customer for one Airbus A320neo.

- Croatia Airlines cancelled orders for four Airbus A320neos.

- International Consolidated Airlines Group (OTCPK:ICAGY) cancelled orders for six Airbus A320neos and two Airbus A321neos.

- Malta MedAir was identified as the customer for two Airbus A320neos.

- Viva Air cancelled orders for two Airbus A320neos.

- Asiana Airlines converted orders for nine Airbus A350-1000s to orders for nine Airbus A350-900s.

November most definitely was not an exciting month for Airbus. There were some changes to the order book that also had an equivalent cancellation attached to it. For instance, International Airlines Group cancelled orders for eight aircraft, which were offset by the same number of orders from Aer Lingus and British Airways both of which are part of the International Consolidated Airlines Group. Furthermore, the announcement of the order for six Airbus A220-300 aircraft was part of a cancellation for four Airbus A320neo aircraft that Croatia Airlines was seeking. So, with 14 out of 29 orders being part of order conversions or re-alignment, it most definitely was a bit of a meager month for the European jet maker.

Airbus logged 29 gross orders with a value of $1.7 billion while it scrapped 14 orders valued $735 million from the books, bringing the net orders to 15 orders with a value of $939 million. A year ago, Airbus booked 318 orders and 75 cancellations, bringing its net orders to 243 units with a net order value of $15.2 billion. So, we see that order inflow decreased sharply year-over-year, but it should be noted this was driven by the timing of airshow orders. Last year Indigo Partners firmed 255 orders valued $15.2 billion at the Dubai Airshow as shown in the evoX Airshow Order tracker.

Year-to-date, the European jet maker booked 1,062 gross orders and 237 cancellations, bringing the net orders to 825 units with a net order value of $39.4 billion. In the first eleven months of 2021, Airbus booked 610 gross orders and 242 net orders with a net value of $23 billion. So, Airbus is having a far better year this year driven by revival of demand and really, we are comparing a risk-off low year (2021) to a year where customers are quickly finding out that the recovery in air travel demand is much faster than they anticipated.

In November, Airbus delivered 68 jets compared to 60 in the previous month. The European jet maker delivered 59 single-aisle jets and nine wide-body aircraft with a combined value of $4.3 billion:

- Airbus delivered six Airbus A220s.

- A total of 53 Airbus A320neo family aircraft were delivered, consisting of 28 Airbus A320neos and 25 Airbus A321neos.

- Airbus delivered three Airbus A330 family aircraft including one -200, one Airbus A330-800 and two A330-900s.

- Five Airbus A350s were delivered, all for the smallest -900 variant.

In November, we saw deliveries increase slightly but not enough to achieve the delivery target that Airbus had previously set. The good news is that Airbus A320 deliveries were better aligned with the production rate this month while wide body deliveries also looked strong and this is actually the kind of delivery mix one would like to see from Airbus.

Compared to last year, deliveries increased by 10 units while the delivery value increased by $2.6 billion. Year-to-date, Airbus delivered 563 aircraft valued at $37 billion compared to 518 aircraft valued at $33 billion last year. We saw that since July deliveries are higher year-over-year, and that also holds for the value of the deliveries which is a positive element but as we have pointed out before the increase has been lower than what should be expected based on the delivery targets that were communicated.

The book-to-bill ratio for the month was 0.4 in terms of orders and 0.4 in terms of value. For the first eleven months of the year, the gross book-to-bill is 1.9 in terms of units and 1.7 in terms of value while the cancellation rate is 22.3% and 4.8% when measured against the backlog. The book-to-bill ratio for the year is looking extremely strong. This is primarily driven by a combination of the big order from Chinese airlines, but also by the underwhelming delivery numbers due to supply chain issues. So, book-to-bill ratios higher than one do show balance or oversold positions in general, but in this case, they also reflect the big challenges when it comes to hiking production.

Airbus Misses Delivery Target

Airbus

Those that have been following the monthly order and delivery reports might recall that I have been pointing out that it was unlikely that Airbus would meet its delivery target. Despite the fact that these statements are driven by analytical insights, I did receive some commentary from readers and even contributors that forced me to retract my statements in case I was wrong on Airbus missing the target.

Airbus has now confirmed that the company will not reach the delivery target which was already lowered by Airbus earlier this year:

Amsterdam, 06 December 2022 – Based on its November deliveries of 68 commercial aircraft and the complex operating environment, Airbus SE considers its target to achieve “around 700” commercial aircraft deliveries in 2022 to now be out of reach. The final figure is not expected to fall materially short of the “around 700” delivery target.

It shows that data is King. We are always fact driven putting the words of OEMs to the test where possible and that has allowed us to warn for a delivery target miss in the first half of the year with no sign of improvement shown in the second half of the year. For November, our model suggested deliveries in the 60-65 range so with 68 deliveries Airbus did not do too badly but simply not good enough to get anywhere near the target.

Ten days into the month, Airbus has delivered 23 aircraft. Linearizing this would suggest 71 deliveries during the month, bringing the total deliveries to 634 deliveries. However, the delivery flow does not have a linear tendency. From the 1A and 1B models that we generated previously, we would get to a delivery number in the 660-680 range and in the 645-655 range. However, these numbers are in part based on November delivery numbers to estimate December deliveries.

Remodelling with November numbers in mind gives a range of 655-685 aircraft for the 1A method and still around 650 deliveries for the 1B method. If we keep in mind the number of aircraft that Airbus usually deliveries during the first 10 days of the December month (which is the number of days that has passed at the time of writing), we would get to a range of 655 to 675 aircraft and we also apply a correction for the model being off by roughly 5% for the November deliveries we would get to 650-675 deliveries. So, I would say that we should see deliveries in the 650-670 range in the worst case, and around 685+ deliveries would be my best case estimate at this time. Anything between 670-685 would be satisfactory.

Conclusion: Airbus Stock A Buy Despite Delivery Target Miss

There is not much to conclude as the main news from this month was that Airbus would not be hitting its delivery target, which we already anticipated since mid-2022. We did see that November deliveries were slightly stronger than expected, but the conclusion from my previous report that anything above 685 deliveries would be good doesn’t change because we already anticipated the delivery target miss. For now, I would expect 675 deliveries as supported by data, but Airbus could still get to those to 685 or above but we only one scenario in which that is the case.

On the order side, I would say there is nothing exciting. Maybe Airbus is collecting some announcements to end the year with a bang, but even if they don’t it has been a good year with strong demand for commercial aircraft put on display.

The European jet maker is remapping its production rate ramp up which also does not come as a big surprise, but overall what we are seeing is year-over-year improvement in the delivery stream and I would expect that at this point the worst part of the supply chain issues are behind us. More interesting would be to see what Airbus will guide for next year. I would be hoping to see at least 725 deliveries for 2023. Despite the near-term delivery target miss, the remap of the ramp up in production I do believe that shares of Airbus continue to provide opportunities for investors.

Be the first to comment