niphon/iStock via Getty Images

2022 Losses: I Want My Money Back

For a relatively new asset class, Bitcoin has been providing amazing returns since 2015. Instant wealth creation occurred pre and post-pandemic. Many individuals made millions riding the crypto wave. Unfortunately, this incredible performance was followed by a 2021 reversal and a complete meltdown in 2022. Along with crypto, meme stocks peaked in 2021 and suffered a nasty fall. The bull run was not just associated with crypto and meme stocks. During the last decade, five Mega-Tech stocks were on fire, dominating the S&P 500 and Tech indexes, and the amount of wealth created during the period was astronomical. Retail investors wanted in on the action and dove head first into get-rich-quick meme stocks, cryptocurrencies, and leveraged ETFs, which offered risky opportunities for upside. As reported by CNBC,

“America’s stock wealth nearly doubled, from $22 trillion to $42 trillion. The bulk of that wealth went to those at the top, since the wealthiest 10% of Americans own 89% of individually held stocks, according to the Federal Reserve.”

But the tides have turned. Investors that were once flying high have now fallen fast. This past year, market volatility, meme-stock mania, and fear of missing out have cost investors trillions. Between market declines, unprofitable spec techs, crypto scams, and the fallout from FTX, headwinds to consumer spending and economic growth could result in a loss to real GDP growth by nearly 0.2%, as highlighted by Mark Zandi, chief economist of Moody’s Analytics.

The swiftness of the FTX failure is breathtaking, and the 64% decline in Bitcoin this year has many investors weak at their knees. Even the popular Technology Select Sector SPDR ETF (XLK) is down 24% YTD. With this in mind, investing does not have to be a crapshoot, and it does not have to be ruled by emotion or a charismatic influencer that was a great athlete or incredible singer; an individual’s superior performance on the football field or a musical stage does not mean they are a world-class investor. The best investors are well-informed, and being informed does not require much time or resources. Investors can perform their own investment research, and with the right tools, they can do it fairly quickly. One tool to help minimize portfolio losses and make well-informed investment decisions is gaining steam: quant investing.

What is Quant Investing?

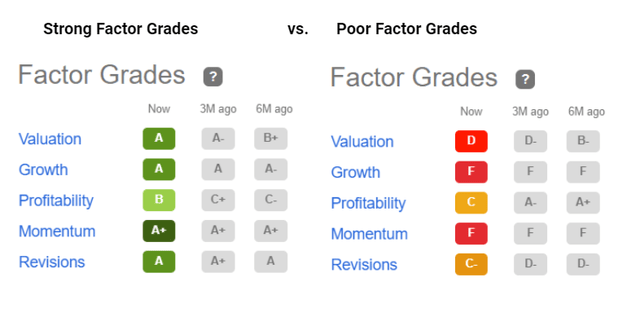

Quantitative investing, also known as factor Investing, picks stocks purely based on comparing their financial metrics to the same metric average or median for the sector, removing fear and emotion. The removal of emotion allows investors to make decisions based on a data-driven assessment. Not only does quant investing highlight the best stocks based on powerful computer processing, quant strategy also uses an algorithm to pick stocks using five popular investment characteristics – Valuation, Growth, Profitability, Momentum, and EPS Revisions. Investors can instantly identify the strength or weakness of each metric compared to the sector based on our A+ to F grades. Measuring a stock’s metrics and comparing it to other stocks in the same sector is incredibly powerful for making smart investment decisions.

What are Seeking Alpha’s Factor Grades?

Seeking Alpha’s Factor Grades rate investment characteristics on a sector-relative basis. Strong factor grades are highlighted below in green and indicate excellent potential and fundamentally sound characteristics compared to the sector. Conversely, average (‘C’ rated) to poor factor grades are also showcased to compare and gain insight into less-than-optimal metrics in orange or the downright dismal grades in red.

Strong vs Poor Factor Grades (Seeking Alpha Premium)

While quant investing, which uses historical data, is not a foolproof predictor of the future and does not account for macroeconomics and geopolitical factors, quant risk management through systematic styles is a proven advantageous technique.

Advantages of Quant Investing

Artificial intelligence is slicing and dicing data, taking the emotion out of investing in showcasing that quant investing can make you money. 2022 has been one of the worst years for stocks. When you factor in post-pandemic macro and geopolitical concerns like inflation, surging costs, interest rates, supply chain constraints, and more, negative sentiment can be a detriment to investor portfolios. Despite all the issues facing 2022, good quant strategies steered investors towards energy, materials, commodities, and financials. Whether you’re a bullish or bearish investor preferring to make money no matter what happens, quant investing can steer you in the right direction to measure a company based on its investment metrics. There are many benefits to quant investing, some of which include:

-

Consistency and reliability

As mentioned above, one of the biggest benefits of quant investing is that it takes the fear – emotion – out of investing. Fear and greed move the markets, and psychological factors can lead to poor investment decisions. Using artificial intelligence, AI compiles historical data and factor-based rankings for better risk management, removing human error and emotion to locate Top Rated Stocks.

-

Machine Learning and Ai are Cost-effective

In the era of robo-advisors, automated portfolios not only incorporate algorithmic investing with minimal human supervision, but they’re also cost-effective. With quant investing, there is zero human input other than the proprietary development of the model. The building blocks have been established, and computers analyze all data available, allowing investors to pick and choose the Best Stocks by quant rating or by creating their own screener.

-

Bigger pool of securities

Because quant analysis is fast, focused, and conducted by computers versus a team of analysts, thousands of securities can be analyzed simultaneously to provide directional buy, hold, or sell recommendations. Moreover, each stock is re-analyzed and given a fresh assessment with a new directional recommendation daily.

Don’t Fall for Greed, Fear, or the Influencer

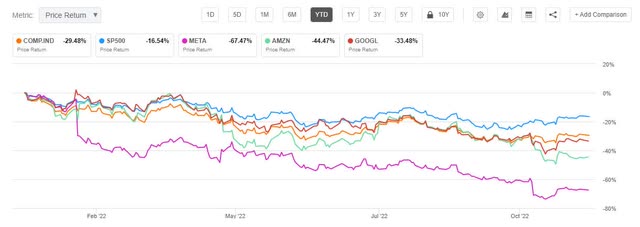

With the dethroning of mega-cap stocks like (META), Alphabet Inc. (GOOGL), and Amazon (AMZN), quant investing continues to grow in popularity as a means for investors to choose stocks with the best investment fundamentals. Hence, as an investment tool, quant gives investors the power to make informed decisions quickly and intelligently.

Mega-Caps Fall More Than Indexes in 2022

Mega-Caps Fall More Than Indexes in 2022 (Seeking Alpha Premium)

As the worst year for equities since the global financial crisis, bad bets on popular stocks like those mega-techs above, to smaller meme-craze and COVID-darlings like

GameStop (GME), Coinbase (COIN), and Peloton Interactive (PTON), investors are going through the wringer, where quant ratings saw their demise coming far in advance. Avoid rollercoaster rides and stocks with negative data points. Just because there is hype surrounding an investment does not make it a good buy, as we all see from the latest FTX and crypto scandals. “Investor confidence in crypto has taken a severe knock, and the aftershocks from this event will continue to be felt for some time…there is little doubt that the FTX collapse will delay the crypto spring,” said Bradley Duke, Founder and CEO at ETC Group. Doing research via the internet or using chat boards like Reddit and FinTwits, or perhaps listening to celebrities whose names rhyme with Tim Framer or McGrathy Hood may prove entertaining, but the reality is that investors are losing billions of dollars by pouring their time and hopes into the hype, forged by promises. Don’t believe all of the hype. Quant investing equips you with the tools every investor needs.

Take the fear out of investing – Use quant to measure the strength of a stock’s spine.

To invest successfully, it’s crucial to identify stocks that look good on collective investment characteristics like the outlined factor grades. Our quant model identifies stocks that look good and those that look poor on these core investment factors. If an investor does not have the ability to measure the characteristics of a security, then they stand a greater degree of risk and a far greater risk of seeing their assets underperform. When it comes to volatile markets or companies with poor investment fundamentals, our goal at Seeking Alpha is to help you instantly characterize stocks with solid fundamentals and strong investment metrics and avoid stocks with poor fundamentals that create portfolio losses. Through quant investing, Seeking Alpha incorporates an algorithm that chooses securities based on collective attributes associated with higher returns.

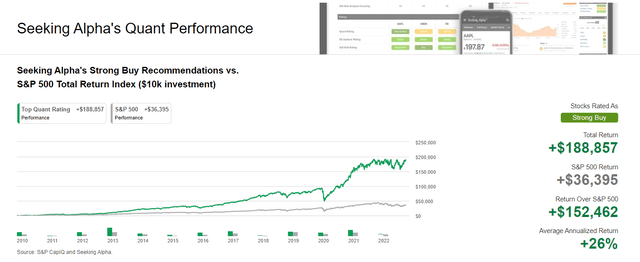

Seeking Alpha’s ‘Quantamental’ analysis has allowed our Strong Buy Recommendation to outperform the S&P 500 Total Return Index 12 years in a row.

Seeking Alpha’s Quant Performance (Seeking Alpha Premium)

We have dozens of Top Stocks for you to choose from with great fundamentals. Test out tools to evaluate your stocks or portfolio, check out their Health Score, and start putting our Quant system to work for you.

Be the first to comment