dosecreative/iStock via Getty Images

Earnings of Peoples Bancorp Inc. (NASDAQ:PEBO) will most probably surge this year on the back of mid-single-digit loan growth. Further, the net interest margin will expand significantly, thereby lifting earnings. Moreover, the first half’s large provision reversal will support earnings for this year. Overall, I’m expecting Peoples Bancorp to report earnings of $3.47 per share for 2022, up 60% year-over-year. Compared to my last report on the company, I’ve revised upwards my earnings estimate as I’ve increased my margin estimate and changed my net provision expense estimate. For 2023, I’m expecting earnings to grow by 2% to $3.54 per share. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Peoples Bancorp.

Strong Job Markets to Keep Loan Growth at a Decent Level

After growing by a strong 1.8% in the first quarter, the loan portfolio grew by a disappointing 0.7% in the second quarter of 2022. As mentioned in the earnings presentation, the management expects loans to grow by 4% to 6% this year. This target seems reasonable given the first half’s performance. It is also much below the historical trend.

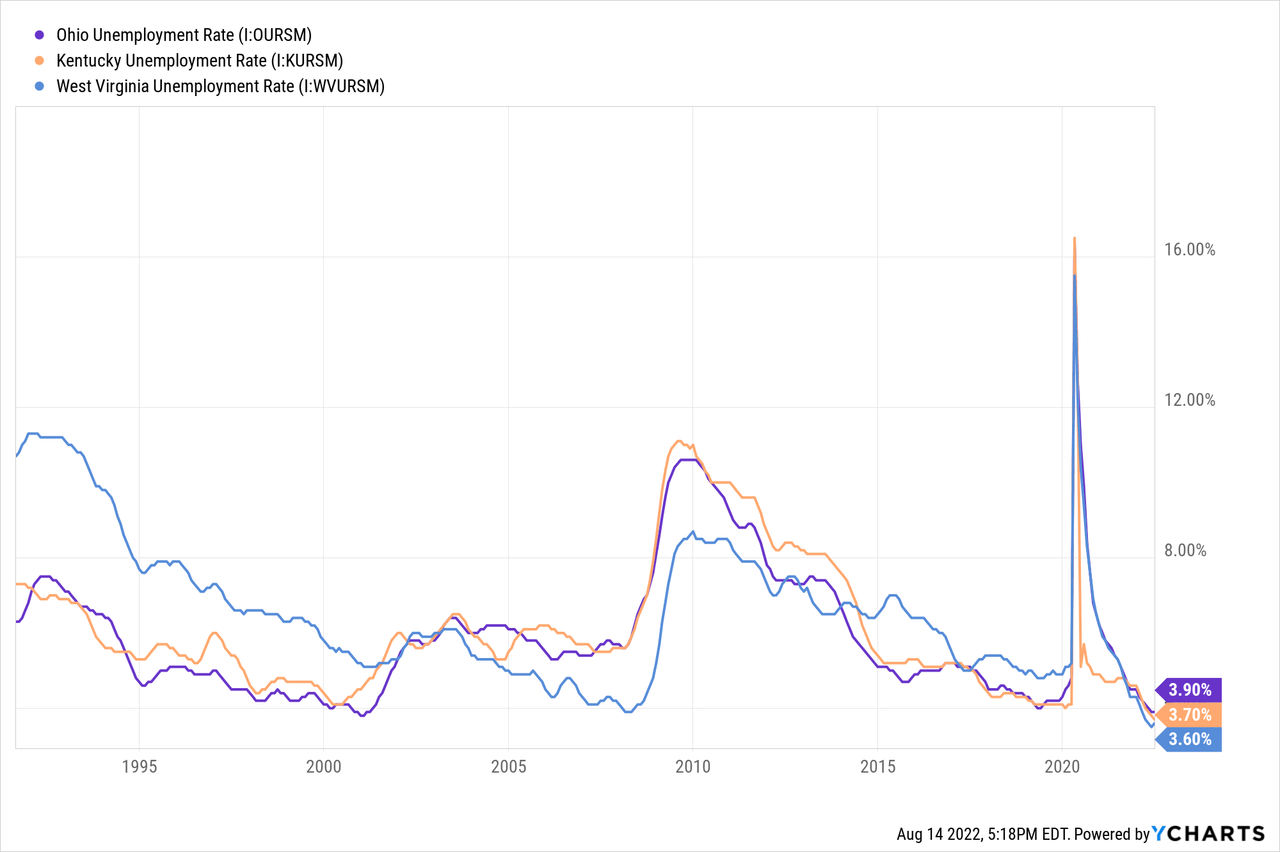

Strong job markets in Peoples Bancorp’s operating regions will likely support loan growth in the quarters ahead. Peoples mostly operates in Ohio, Kentucky, and West Virginia. All three states have unemployment rates that are at record lows.

Overall, I’m expecting the loan portfolio to grow by 5.6% in 2022. In my last report on Peoples Bancorp, I estimated loan growth of 8.1% for 2022. I’ve revised downwards my loan growth estimate because of the second quarter’s performance as well as a deterioration in the outlook. For 2023, I’m expecting loan growth to continue mostly at the same level as the second half of 2022.

Peoples Bancorp has historically relied on acquisitions for growth. As the company doesn’t currently have any ongoing M&A transactions, I have only considered organic loan growth for my investment thesis. If the management announces any M&A plans, then total loan growth will beat my expectations.

Mark-to-market of Securities to Further Erode Equity Book Value

Due to a large investment securities portfolio, Peoples has racked up significant unrealized losses amid the rising-rate environment. Increasing rates have lowered the book value of fixed-rate, available-for-sale securities. This loss on mark-to-market has flowed directly into equity after bypassing the income statement, as per relevant accounting standards. The tangible book value per share declined to $16.21 per share at the end of June 2022 from $19.61 at the end of December 2021, as mentioned in the earnings presentation.

During the second half of 2022, the unrealized losses will increase even further as the Federal Reserve raised the fed funds rate by 75 basis points in July. I’m also expecting a further 75 basis points hike in the remainder of the year. The following table summarizes my balance sheet estimates, including the tangible book value per share.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 2,709 | 2,852 | 3,353 | 4,411 | 4,660 | 4,898 | ||||

| Growth of Net Loans | 15.8% | 5.3% | 17.6% | 31.6% | 5.6% | 5.1% | ||||

| Other Earning Assets | 893 | 1,079 | 953 | 2,027 | 2,059 | 2,142 | ||||

| Deposits | 2,955 | 3,291 | 3,910 | 5,863 | 6,108 | 6,420 | ||||

| Borrowings and Sub-Debt | 466 | 400 | 184 | 266 | 450 | 450 | ||||

| Common equity | 520 | 594 | 576 | 845 | 754 | 811 | ||||

| Book Value per Share ($) | 27.20 | 28.86 | 29.61 | 30.06 | 26.88 | 28.91 | ||||

| Tangible BVPS ($) | 18.72 | 20.22 | 20.11 | 19.61 | 15.19 | 17.21 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Topline’s Rate Sensitivity Marred by Flexible Deposit Costs and a Large Securities Balance

Although the average earning-asset yield is quite rate-sensitive, the net interest margin is only moderately rate-sensitive due to the following factors.

- Deposit mix. As interest-bearing deposits with variable rates made up a hefty 62% of total deposits at the end of June 2022, the average deposit cost will rise quickly after every rate hike.

- A large securities balance. Investment securities made up 23% of earning assets at the end of June 2022. Most of these securities have fixed rates; therefore, they will weigh down the average earning-asset yield as rates rise.

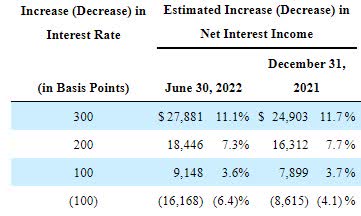

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing show that a 200-basis points hike in interest rates could boost the net interest income by 7.3% over twelve months.

2Q 2022 10-Q Filing

Considering these factors, I’m expecting the margin to grow by 20 basis points in the second half of 2022 before stabilizing in 2023. Compared to my last report on the company, I’ve increased my margin estimate because of the larger-than-expected expansion in the second quarter of 2022.

Normalized Provisioning Likely for the Quarters Ahead

Peoples Bancorp reported a net provision reversal of $780 million in the second quarter of 2022, which beat my expectations. As a result, I’ve decided to reduce my provision expense estimate for this year. Moreover, I’ve reduced my loan growth estimate as mentioned above. Due to lower anticipated loan additions, the provisioning for expected loan losses will also be lower.

The provision expense averaged 0.15% of total loans from 2017 to 2019. I’m expecting the provision expense to return to the same average in the second half of 2022 and the full year of 2023. Despite the normalized provisioning for the second half of 2022, the full-year provisioning will be a net reversal due to the large reserve release in the first half of the year.

Expecting Earnings to Grow by 60%

The mid-single digit loan growth and significant margin expansion will likely be the chief drivers of earnings growth this year. Further, the large loan-loss reserve release in the first half of 2022 will drive earnings. Overall, I am expecting Peoples Bancorp to report earnings of $3.47 per share for 2022, up 60% year-over-year. For 2023, I’m expecting the company to report earnings of $3.54 per share, up 2% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 130 | 141 | 139 | 172 | 247 | 273 | ||||

| Provision for loan losses | 5 | 3 | 26 | (0) | (4) | 7 | ||||

| Non-interest income | 57 | 64 | 64 | 70 | 79 | 81 | ||||

| Non-interest expense | 126 | 137 | 134 | 184 | 207 | 220 | ||||

| Net income – Common Sh. | 46 | 54 | 35 | 48 | 97 | 99 | ||||

| EPS – Diluted ($) | 2.42 | 2.65 | 1.73 | 2.16 | 3.47 | 3.54 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on Peoples Bancorp, I estimated earnings of $3.05 per share for 2022. I’ve increased my earnings estimate because I’ve tweaked upwards my net interest margin estimates and changed my net provision estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Attractive Dividend Yield and Price Upside

Peoples Bancorp is offering a dividend yield of 4.8% at the current quarterly dividend rate of $0.38 per share. The earnings and dividend estimates suggest a payout ratio of 43% for 2022, which is below the five-year average of 56%. Although there is room for a dividend hike, I’m assuming no change in the dividend for my investment thesis to remain on the safe side.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Peoples Bancorp. The stock has traded at an average P/TB ratio of 1.58 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 18.7 | 20.2 | 20.1 | 19.5 | ||

| Average Market Price ($) | 35.5 | 32.1 | 24.1 | 31.7 | ||

| Historical P/TB | 1.90x | 1.59x | 1.20x | 1.63x | 1.58x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $15.2 gives a target price of $24.0 for the end of 2022. This price target implies a 24% downside from the August 12 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.38x | 1.48x | 1.58x | 1.68x | 1.78x |

| TBVPS – Dec 2022 ($) | 15.2 | 15.2 | 15.2 | 15.2 | 15.2 |

| Target Price | 20.9 | 22.4 | 24.0 | 25.5 | 27.0 |

| Market Price | 31.5 | 31.5 | 31.5 | 31.5 | 31.5 |

| Upside/(Downside) | (33.6)% | (28.8)% | (24.0)% | (19.2)% | (14.3)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 13.9x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 2.42 | 2.65 | 1.73 | 2.16 | ||

| Average Market Price ($) | 35.5 | 32.1 | 24.1 | 31.7 | ||

| Historical P/E | 14.7x | 12.1x | 13.9x | 14.7x | 13.9x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.47 gives a target price of $48.0 for the end of 2022. This price target implies a 52.3% upside from the August 12 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.9x | 12.9x | 13.9x | 14.9x | 15.9x |

| EPS 2022 ($) | 3.47 | 3.47 | 3.47 | 3.47 | 3.47 |

| Target Price ($) | 41.1 | 44.6 | 48.0 | 51.5 | 54.9 |

| Market Price ($) | 31.5 | 31.5 | 31.5 | 31.5 | 31.5 |

| Upside/(Downside) | 30.4% | 41.4% | 52.3% | 63.3% | 74.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $36.0, which implies a 14.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 19.0%. Hence, I’m maintaining a buy rating on Peoples Bancorp.

Be the first to comment