Lan Zhang/iStock via Getty Images

With this title, I am choosing my words carefully. My goal is not to generate “clickbait”…far from it. While I consider it unlikely that China will invade Taiwan, the ramifications of a war between the two nations are profound. If you think I’m an alarmist, consider this:

The Rand Corporation estimates a war between the US and China would lower US GDP by 5%. That is nearly double the drop in GDP witnessed in 2009 during the height of the Great Recession. Investors witnessed a 55% decline in the S&P 500 during that economic downturn.

I maintain that Rand’s forecast is probably very conservative. Taiwan’s and China’s economies are so intertwined with that of the US and the developed world that I believe stringent sanctions alone could result in a global depression.

I am not alone in this assessment.

…the economic fallout would be disastrous. A global depression would be all but guaranteed.”

From Hal Brands and Michael Beckley authors of Danger Zone: The Coming Conflict with China

Does China have the military muscle to take Taiwan? If so, can Taiwan fend off an invasion long enough for the US and its allies to come to the country’s aid?

If sanctions are applied by the US and its allies, how would they affect the global economy?

Comparing Ukraine/Russia To Taiwan/China

I posit that it would not take an armed conflict between the US and China to generate an economic tsunami. A wave of sanctions akin to those Russia faces for the invasion of Ukraine would likely result in a multi-domino effect. There is virtually no industry and no facet of life that would not be affected.

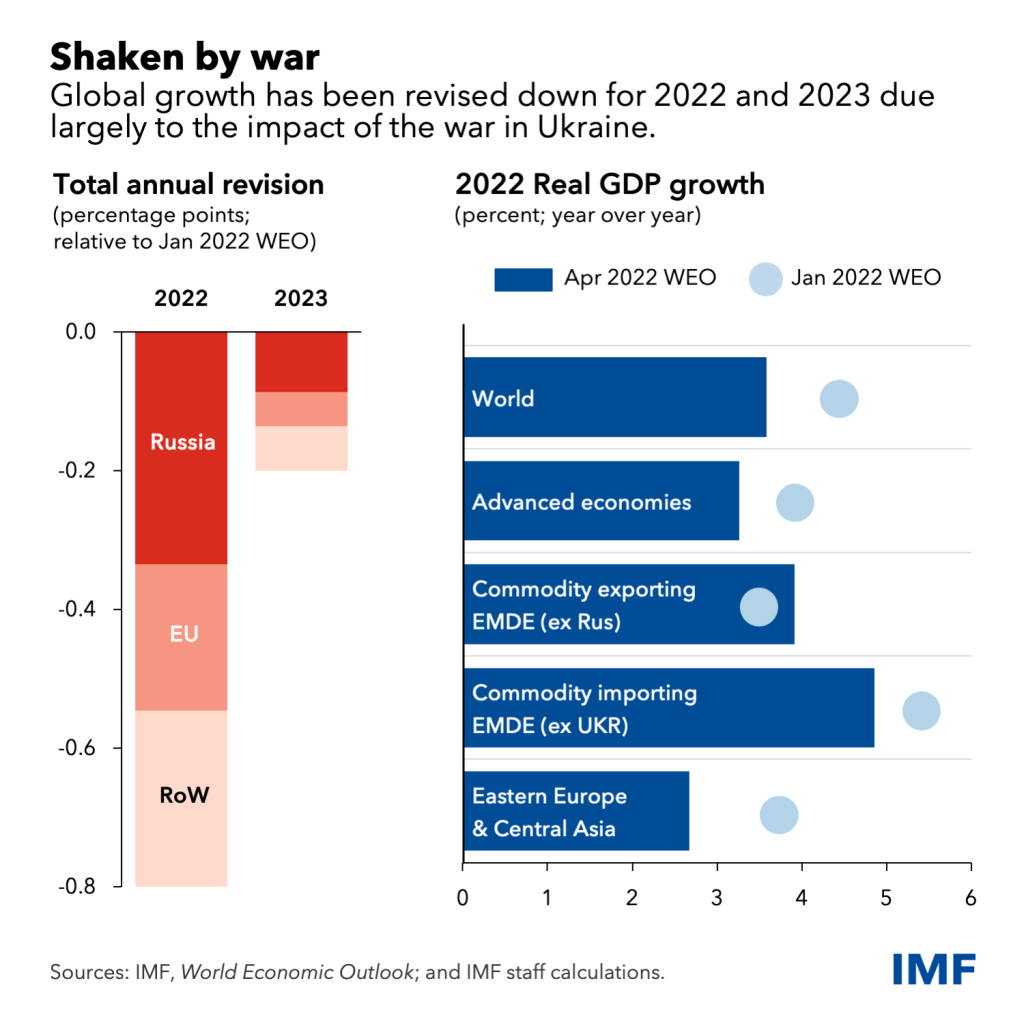

The following chart is an assessment by the International Monetary Fund of the negative impact the war in Ukraine has on the global economy.

IMF

Relative to the Great Recession, the impact is rather moderate. Rather than resulting in a drop in GDP, the conflict has simply slowed growth rates.

However, the economic impact goes beyond those numbers. For example, while the invasion of Ukraine had a direct effect on the US economy, the repercussions felt by the nations comprising the European Union is much greater. In turn, Europe’s economic woes drag on the US. It is an example of what I refer to as a multi-domino effect.

US trade with Russia was $36 billion per year, and with Ukraine $4 billion.

US trade with Taiwan was $114 billion, and with China $657 billion.

Russia’s economy, ranked eleventh in the world, with a GDP of just under $1.5 trillion, is smaller than that of Canada, a country with a population of less than 39 million.

Contrast that with the US and China, the first and second largest economies on the globe with GDPs of $20.95 trillion and $14.72 trillion, respectively.

I will add that Japan, with the world’s 3rd largest economy and South Korea, with the globe’s 10th largest economy, would likely be drawn to some extent into a conflict involving Taiwan.

Can An Invasion Of Taiwan Succeed?

China’s intentions and actions must be weighed by their chances of success. Therefore, a number of factors must be considered:

Can Taiwan defeat China without the direct military intervention of the US and its allies?

Can China overcome Taiwan before substantial military aid can be provided?

Can China make a military intervention so costly that the US would only opt for economic sanctions?

Of course, a comparison of the two militaries is in order. In conducting research for this article, I found differing estimates from reputable sources regarding the number of main battle tanks operated by Taiwan, officially referred to as the Republic of China (ROC).

For example, Forbes claims the ROC has 1,200 tanks. While they are not alone in publishing this figure, other sources report 800 tanks are in service. Therefore, I will opt for the more conservative figure.

China’s People’s Liberation Army (PLA) has 6,300 tanks. However, in the opening day of an invasion, it is estimated that at full capacity China’s amphibious force could transport a maximum of 379 tanks. Of course, that would mean that the armored forces would have to take precedence over other needed hardware, so that number is likely inflated.

Most of the ROC tanks are rather antiquated, but the same is true of at least 40% of the PLA’s tanks. Taiwan ordered 108 new M-1s from the United States, but the first M-1 will not be delivered until 2023. When the M-1s come into service, they will be absolutely superior to the PLA’s older tanks and will hold a significant advantage over China’s best.

China has 1,600 fighter jets to Taiwan’s 411. Unlike its armored forces, ROC’s Air Force operates modern aircraft. Roughly half of the fighters are F-16s and/or Mirage 2000 fighter jets. Those aircraft fly out of several underground airfields buried deep into Taiwan’s mountain ranges.

The PLA has nearly one million ground troops and a total of 30 infantry divisions. The ROC has 130,000 active-duty ground troops, but Taiwan can mobilize another 260,000 reservists in the event of an invasion.

If one adheres to the common doctrine that attackers need a minimum of a 3 to 1 advantage to defeat a defending force, that would require China to deploy roughly 1.2 million men to Taiwan.

Taiwan’s naval forces could offer little resistance to the Chinese navy. With 360 combat vessels, China has the largest navy in the world. Beijing also operates a large coast guard and possesses the globe’s most-advanced merchant fleet. Where China’s navy falls short is in its amphibious force.

The amphibious fleet consists of three Type 075 assault ships, eight Type 071 landing docks and 64 Type 073 and Type 074 tank landing ships. Observers note that these assets are not up to the task of ferrying the troops needed to conquer Taiwan.

With a potential defending force of 450,000 Taiwanese today … China would need over 1.2 million soldiers (out of a total active force of more than 2 million) that would have to be transported in many thousands of ships.

Howard Ullman, former USN officer and professor at the US Naval War College

A 2020 report authored by the U.S.-China Economic and Security Review Commission provided the following assessment:

The [Chinese military’s] most immediate limitation in executing a Taiwan campaign is a shortage of amphibious lift, or ships and aircraft capable of transporting the troops the [Chinese military] needs to successfully subjugate the island.

However, there are some that claim any assessment of China’s amphibious capabilities should include that country’s civilian shipping, particularly its ferry fleet.

Unlike the US, there is often little distinction between state owned and private assets in China. The Chinese engage in routine maneuvers in which civilian shipping is used in some form for amphibious assaults. The PLA has created auxiliary units that incorporate the country’s merchant fleets with the military. For example, the Bohai Ferry Group is organized into the Navy’s Eighth Transport Group. It operates large roll-on/roll-off ferries across the Yellow Sea and is but one instance of similar units in the Chinese navy.

Readers should be aware that China’s ferries are quite large in comparison to those operating within the US. The largest ferries on the east coast are approximately 4,500 gross tons, while the biggest on the west coast measure in at 13,000 tons. In contrast, China operates ferries that are more than two and a half times those on the west coast.

There are estimates that Chinese ferries could carry three times the tonnage of China’s amphibious fleet. Compare the ferries’ 1.1 million tons of combined displacement with that of the US Navy’s amphibious assault fleet at 840,000 tons.

There are, however, limits to the capability of most ferries in that they would generally need access to docks to offload troops and equipment, unlike vessels that are designed for amphibious operations. Additionally, Chinese vessels would have to navigate over one hundred miles or more of open ocean before reaching the invasion sites.

To deter an amphibious invasion, observers have noted the ROC has been stockpiling large quantities of surface-to-ship missiles. Relatively inexpensive to produce, and capable of being dispersed across a wide geographic range, there are some that believe these weapons are a key to Taiwan’s defense.

Taiwan is mass-producing these things. And they’re small, it’s not like (China) can take them all out. What’s cheap is a surface-to-ship missile, what’s expensive is a ship. The thought about China invading Taiwan, that’s a massacre for the Chinese navy.

Phillips O’Brien, professor of strategic studies, University of St. Andrews in Scotland

Even if the Chinese can succeed in transporting sufficient troops and supplies to conduct an assault, Taiwan’s terrain is the very definition of an invader’s nightmare.

Another factor to consider is that the area experiences two monsoon seasons that could make conditions difficult for attackers. A report by the US Naval War College states there are only two time frames in which an invasion would be practicable: May to July and October.

Assuming the invaders make it across the Taiwan Strait with sufficient force to launch an effective assault, the PLA is then presented with a limited range of suitable invasion sites. Two-thirds of Taiwan is a mountain range, and the number of beaches suitable for landing sites are limited and known by the defenders. The attackers would be met by missile salvos and pre-sighted artillery barrages.

The ROC have been preparing for an invasion for decades. Upon hitting the beaches, the PLA would be faced with a defense system consisting of strategically sited bunkers. Those defensive positions are also honeycombed with an extensive tunnel system that protects the defenders and provides interlocking interior lines of communication.

The Heng Shan Military Command Center is one example of the extensive defensive complexes the ROC have engineered. Heng Shen, is near the capital city of Taipei. Built under a mountain, it is designed to shelter thousands of personnel.

On the southern end of Taiwan, the Chihhang Air Base operates from a series of wide tunnels burrowed into the Stone Mountain complex. Jets can be refueled and rearmed in relative safety within its tunnel complex, a network that can shelter approximately one-fifth of the ROC’s fighter force.

This is not a comprehensive review of the ROC’s underground complexes, but rather an example provided to convey the nature of Taiwan’s defenses.

To advance from the landing sites, the PLA would be forced to fight across mud flats, through jungles and into mountains. The mountainous terrain would allow the ROC to pinpoint PLA positions and movements.

Using The Invasion Of Normandy As A Prototype

The Normandy coastline targeted by the Allies was 50 miles in length.

The island of Taiwan is 245 miles long and 89 miles at its widest point.

The Allies had naval and air superiority.

The distance naval vessels traveled for the Normandy invasion is largely comparable to that required to traverse the Taiwan Straits. The invasion Allied fleet numbered 6,939 vessels: 1,213 warships, 4,126 landing craft, 736 ancillary craft, and 864 merchant vessels.

In contrast, China has 360 warships and a large merchant fleet.

Approximately 156,000 troops landed on D-Day, 24,000 of those were paratroopers that landed behind enemy lines.

China’s amphibious fleet is capable of landing about 40,000 troops in the first day of an invasion.

As the battle developed, the Allies landed over a million troops in Normandy.

The Nazi’s had 850,000 men in France and ten panzer divisions with a combined force of 1,552 tanks; however, the Germans had just 80,000 infantry and one armored division in Normandy.

The ROC have at least 800 tanks (some sources state 1,200.) Once the reserve forces are put into action, the ROC would field 390,000 combatants, nearly 5X the number of German troops that defended Normandy.

The Allies had 7 million tons of supplies, including 450,000 tons of ammunition in staging areas to support the invasion.

I believe that many civilians underestimate the resources needed to support combatants, and this should be considered when assessing China’s chances of success. That is because a certain number of support troops must be shipped across the Taiwan Straits, thereby limiting the number of combatants that can be transported.

Referred to as the tooth-to-tail ratio, the number of support troops needed by the US during the Korean and Vietnam conflicts was more than 12 support troops for every one combatant.

The ROC also possesses interior lines of communication and will have foreknowledge of the time an attack is likely to ensue.

Using this information, we can state the ROC is probably better prepared to defend Taiwan than the Germans were to defend Normandy.

However, there is another example we can turn to evaluate an invasion of Taiwan.

In addition to Normandy, we can study Operation Causeway, the invasion planned by the US of Taiwan during WWII.

During WWII, the US estimated the Japanese had approximately 100,000 men in Taiwan (then known as Formosa). Allied planners intended to commit over 400,000 troops to the invasion. They estimated that it would take three months to subdue the island and result in 150,000 Allied casualties.

Can China Prevent A US Military Response?

Perhaps the most critical question is how the United States would respond to an invasion of Taiwan. There is a hidden facet to this question I pose. Aside from whether China could defeat the US in a war over Taiwan, we must also consider whether the US and its allies are willing to bear the cost of a conflict with China.

The complexities of this scenario mean a conclusion, i.e. whether the US will exert its military might to counter China, cannot be reached with a high degree of confidence.

One important variable is found in China’s ability to fend off a military response.

sing conventionally armed mainland-based missiles, China has the ability to project force well past Taiwan’s shores. The PLA has over 2,000 of these weapons, including DF-26 and DF-21D missiles, characterized by Beijing as “aircraft carrier killers.”

US ships would have to endure up to two days of travel through areas that could be reached by these lethal projectiles.

The US better be careful thinking about, in any kind of war environment, sending carrier battle groups close to China … If you’re fighting a state-to-state war, you’re going to stay far away from shore.

Phillips O’Brien, professor strategic studies, University of St. Andrews, Scotland

Of course, China could launch a preemptive strike of US bases in the region, but that would force the US and its allies into the conflict.

I am of the opinion that the US is unlikely to engage in a hot war with the Chinese over Taiwan.

The Silicon Shield

Last week, Bret Thomas and I collaborated on an article highlighting Taiwan Semiconductor (TSM). Our work regarding that stock was the impetus for my research on this article.

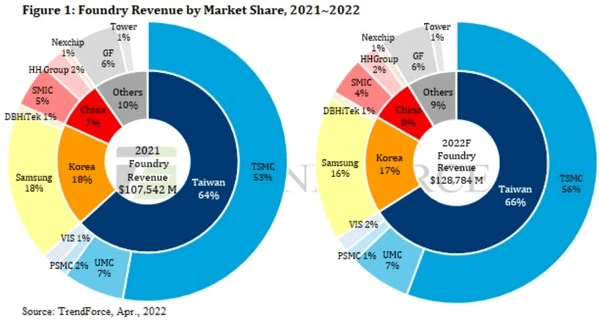

TSM is arguably an unmatched combination of the most dominant, wide moat, and absolutely critical company in the world. Combined with several smaller players, Taiwanese based firms account for nearly two-thirds of the world’s semiconductor foundry production.

TrendForce

However, when considering the more advanced semis, Taiwan accounts for 92% of the world’s production of nodes below 10 nanometers. The following are excerpts from our recent article:

TSM is the largest and most advanced contract chipmaker. TSM technology is behind approximately 85% of worldwide semiconductor start-up prototypes.

The firm’s lead in technology has made it the dominant producer of 7nm and 5nm nodes. Last quarter, TSM’s advanced technologies, defined as 7-nanometer and below, accounted for 51% of wafer revenue.

TSM will strengthen its competitive advantage when it begins production of 3nm chips in the latter half of 2022 and 2nm semiconductors in 2025.

The 3nm node will come in five tiers, each more powerful, more transistor-dense, and more efficient than the previous iteration.

The 2nm node is expected to increase performance by 10% to 15% with the same power requirements and an increased chip density.

There are estimates that even a one year disruption in the supply of chips originating in Taiwan would cost tech companies $600 billion. Furthermore, rebuilding capacity elsewhere, which would not necessarily include the leading-edge technology TSM possesses, would require a minimum of three years and cost $350 billion.

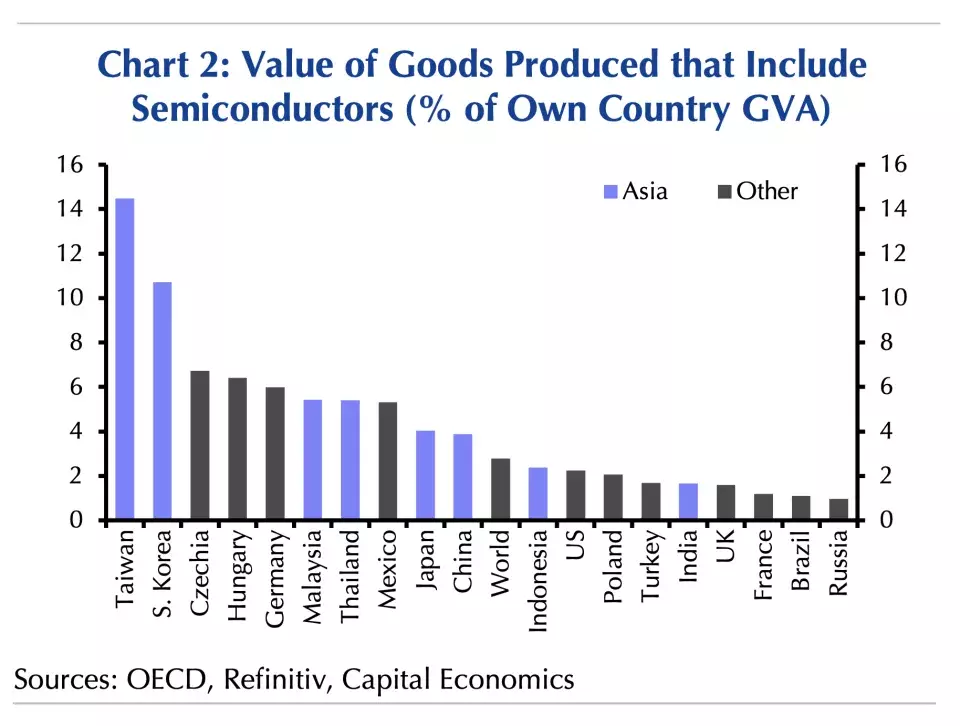

Semiconductors are an integral part of the world’s economy. A study by Goldman Sachs determined 169 industries are affected to some degree by chip shortages. One example of the weight semiconductors play in our economy is that a 10% shortage of auto chips resulted in $200 billion in lost revenue for manufacturers.

Yahoo Finance

Furthermore, in many respects the semiconductor industry is the definition of where a nation stands in terms of technological development. It can dictate the pace at which a nation can develop technology and plays an enormous role in a country’s defense capabilities.

The big concern in Washington is the possibility of Beijing gaining control of Taiwan’s semiconductor capacity.

Martijn Rasser, former senior intel officer and CIA analyst

Simply put, the semiconductor industry is absolutely essential.

Where Sanctions Could Lead

Earlier in this article, I touched on some of the sanctions imposed on Russia for its invasion of Ukraine as well as the resulting economic consequences. I also noted that the Russian and Ukrainian economies constitute a much smaller share of the globe’s commerce than that of the US and China.

The list below provides an overview of the nation’s that receive the largest share of China’s exports. Note that the allies of the US in the region, as well as close trading partners of the US, are in bold. (Numbers are rounded to the nearest $1 billion.)

United States: $521 billion (17% of exports)

Hong Kong: $313 billion (10%)

Japan: $151 billion (5%)

South Korea: $135 billion (5%)

Vietnam: $126 billion (4%)

Germany: $103 billion (3%)

Netherlands: $92 billion (3%)

India: $88 billion (3%)

United Kingdom: $79 billion (2%)

Taiwan: $70.8 billion (2%)

Malaysia: $69 billion (2%)

Thailand: $62 billion (2%)

Mexico: $61 billion (2%)

Australia: $60 billion (2%)

Russia: $60 billion (2%)

Roughly two-thirds of Chinese exports in 2021 went to China’s top trade partners. Those nations in bold constitute 36% of China’s exports.

The following nations export more to China than they import. Once again, US allies in the region are in bold.

Taiwan: $156 billion

Australia: $93 billion

South Korea: $59 billion

Brazil: $55 billion

Japan: $37 billion

Switzerland: $30 billion

Saudi Arabia: $24 billion

Oman: $22 billion

Malaysia: $18 billion

Angola: $16 billion

Additionally, China is particularly reliant on Taiwan for imports of integrated circuits. In 2021, Taiwan imported nearly $189 billion to China and Hong Kong. Electronic parts comprised 50% of that total followed by optical equipment. It is a given that China would lose access to Taiwanese products in the event of an invasion.

Furthermore, China relies on certain imports to feed its economy, and some close allies of the US would view an invasion of Taiwan as an acute security threat. Note that China runs trade deficits with three of those nations: Japan, Australia, and South Korea.

South Korea ranks as the number two global supplier of fabless chips, providing 18% of the world’s production. It is reasonable to assume that our Korean allies would be in lockstep with the US in regards to any sanctions.

While China produces half of the world’s steel, it is reliant on other nations for imported ore. In 2021, over 76% ($180 billion) of the ore needed to maintain the Chinese steel industry was imported. Much of the ore brought into China comes from Australia, a staunch ally of the US, and another nation that feels vulnerable to Chinese territorial expansion.

While China has extensive ore deposits in-country, Chinese ore costs $60 to $100 per ton to mine, compared to $30 for ore originating in Australia and Brazil.

China also relies heavily on other nations for energy imports. In 2021, Australia supplied China with over 39% of its natural gas. In addition to natural gas, China imported nearly 73% of the nation’s oil in 2021.

The Chinese also rely heavily on imports of electrical machinery. Since 2001, imports of electrical machinery into the country, including semiconductor chips, increased from $15 billion to $217 billion.

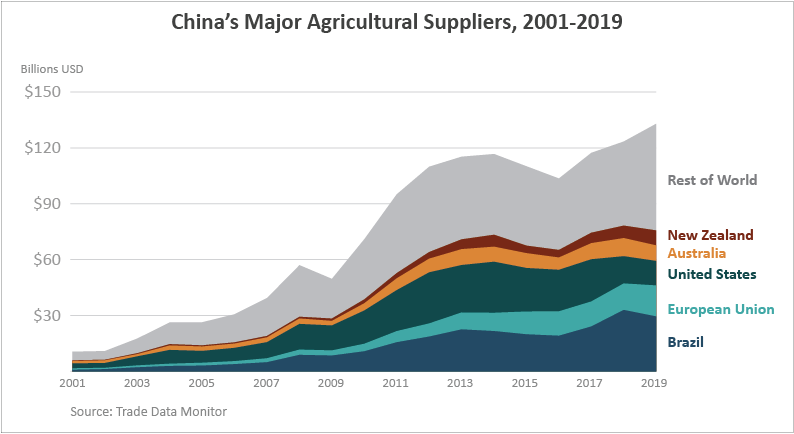

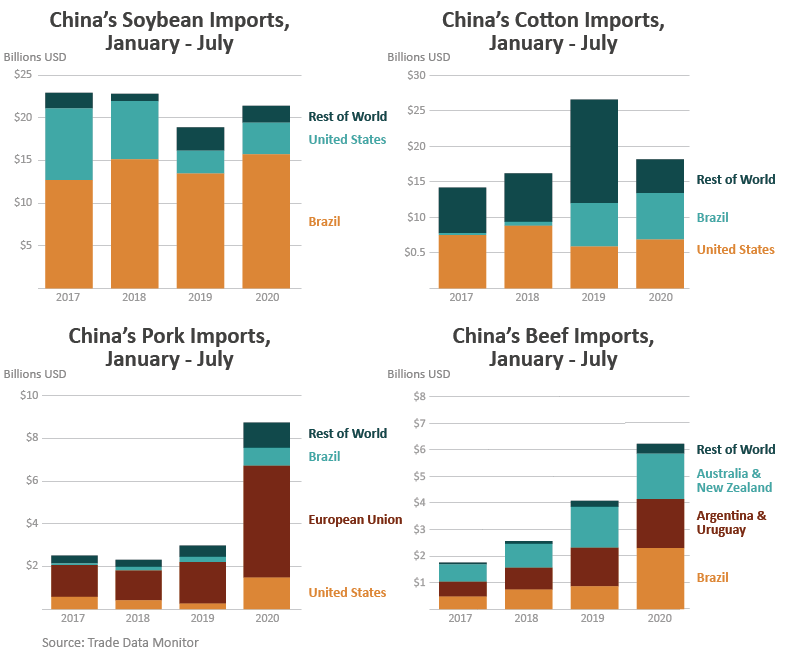

China is also the globe’s number one importer of agricultural products. China’s per capita arable land is less than one-fifth that of the United States. Along with the demands of a rising middle class, this resulted in the Chinese importing over $133 billion in ag products in 2019.

USDA

USDA

Of course, while China depends on others for the importation of essential products, the world also relies on China for certain of its basic and/or vital needs.

One example lies in the European Union’s dependency on metal imports. The German Mineral Resources Agency (DERA) estimates that 19 of the 30 raw materials the EU deems as critical are imported from China.

Ponder that China provides up to 98% of the magnesium, bismuth, and rare earths the EU imports.

What This Means For The Markets

My list of affected imports and exports is far from comprehensive. My goal is simply to paint a picture for investors so we can weigh how the imposition of stringent sanctions would reverberate throughout the global economy.

Although I only provided one example of imports into the EU, there is a veritable “laundry list” of exports from China that are essential to other nation’s economies.

I provided a list that included semiconductors, raw materials and other imports that are absolutely essential for China to maintain its economy.

An invasion of Taiwan and the imposition of stringent sanctions would result in the loss of over half the world’s steel production, two-thirds, of the globe’s semiconductor production, and a scarcity of a very large variety of the world’s finished products.

Without chips, natural gas and oil, China’s economy would fall off a cliff. The Rand Corporation estimates China’s GDP would decline by 25% should that nation invade Taiwan.

Once again, I will paint a picture of a multi-domino effect, wherein there is a loss of imports in one country, or an utter failure in the globally connected supply chain, and each lead to an inability to meet production demands.

In turn, this would contribute to a decline in individual nations’ economic outputs, and the net result would be a loss in demand in additional arenas. This would lead to decreased global trade that would trigger another domino effect in industries that have no direct connections.

I believe that a rational person would not contemplate an invasion of Taiwan once the costs are considered. I also believe that a blockade of Taiwan would lead to stringent sanctions that would outweigh any gains that might be achieved.

However, I never underestimate mankind’s propensity for savagery and stupidity.

The possibilities are startling and sobering.

Be the first to comment