Zolak

November 2022 Passive Income

Seinfeld – Helllllooo!

The market is starting to rip again…. and I’m not a fan. Being in the accumulation stage I want prices to be as low as they can be. I don’t think the market should be getting all excited as inflation is still north of 7% and interest rates will still be increasing. Powell mentioned rates may not go as high as he originally thought and here we are.

Rates are still way higher than they were at the start of 2022 and will probably go up once or twice more before they freeze or start lowering them in my opinion. I read a great article on mortgage rates the other day, but here’s one line that stood out to me.

From another historical perspective, when rates increased in the 1980s from a base point of 10% to 20%, this represented a 2x rate increase. However, a rate increase in 2022 from a base point 0.25% to 4.25% represents a 16x rate increase, which will have a much greater shock to the economy.

I think we will see even better prices in 2023, but we continue to dollar cost average into our portfolio. I’m not cashing out our portfolio, although I am really tempted by this rally to be honest. I have been wrong in the past though, so I’ll just stick with the plan.

Raises

We had 4 Raises this month.

- Suncor (SU) raised their dividend for the 2nd time this year. This raise was another 11% adding $82.20 to our forward income.

- Couche-Tard (OTCPK:ANCUF) came through once again with a monster raise. This one was 27.3% and adds $20.40 to those future dividends.

- Enbridge busted out a 3.2% dividend raise. Since it’s one of our largest holdings this added $33.22 to our income.

- National Bank raised 5.4% but since we only hold the 1 drip currently this added only 20 cents.

A great month for dividend raises and in total we will bring in $136.02 more income next year without doing anything different. We sold off a bunch of companies this year to pay off our HELOC. While some have worked out good, some haven’t. But the nice thing is our entire dividend portfolio has announced raises in 2022. We got rid of all non-dividend raisers, and it feels good! (Other than Disney.)

Total Added Income from Dividend Raises in 2022 – $537.09

Since our portfolio currently brings in $8,182 yearly these raises alone added just over 7% to our income during 2022. This is the power of dividend growth investing.

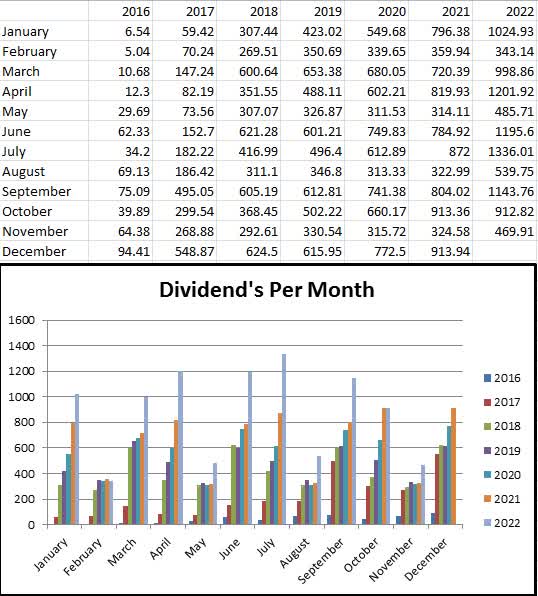

November 2022 Dividend Income

6 Companies paid us this month.

| Stocks | November 2021 Income | Nov 2022 Income |

|---|---|---|

| SmartCentres (OTCPK:CWYUF) | 33.15 (1 Drip) | sold |

| RIT ETF (RIT:CA) | 65.95 | sold |

| National Bank of Canada (OTCPK:NTIOF) | 41.18 | 154.56 (1 Drip) |

| Texas Instruments – USD (TXN) | 0 | 32.24 |

| Air Products – USD (APD) | 0 | 74.52 |

| Procter & Gamble – USD (PG) | 20.88 | 31.05 |

| AbbVie – USD (ABBV) | 91.00 | 98.70 |

| General Mills – USD (GIS) | 72.42 (1 Drip) | 78.84 |

| Totals | 324.58 | 469.91 |

1 stock Dripped in November.

Unfortunately, only 1 dividend dripped this month and even worse I sold the position after the ex-dividend date. (I thought banks would be in for some hard times the next 6-12 months and so far they have done well. Although we can see the income down on some as they set more money aside for bad loans)

General Mills has been on a tear this year and now we no longer bring in enough to drip them. But I don’t mind too much as I want as much USD in the account as we can get. This month is mostly US stocks, and that money will be fuel for the next US stock purchase. 310 bucks USD is nice, since I hate converting our CDN dollars at the moment!

Our Drips (Dividend Reinvestment Program) added a monster $3.88 in future dividends.

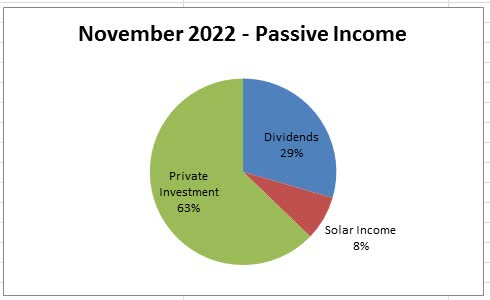

Other Income

Private Investment Payment – $1000.00.

1k a month, straight to the HELOC.

Solar Panel Income

In October (we always get paid a month later) our solar panel system generated 444 kWh. Since we bring in a fixed rate of 28.8 cents per kilowatt hour, Hydro One (OTCPK:HRNNF) deposited $122.73 into our checking account this month.

Last October the system generated $99.42 so we are quite a bit higher this month. The weather has been all over the place this fall.

| Total Income for 2022 | $2,225.11 |

| System Installed January 2018 | |

| Total System Cost | $32,396.46 |

| Total Income Received | $12,110.33 |

| Amount to Break even | -$20,286.13 |

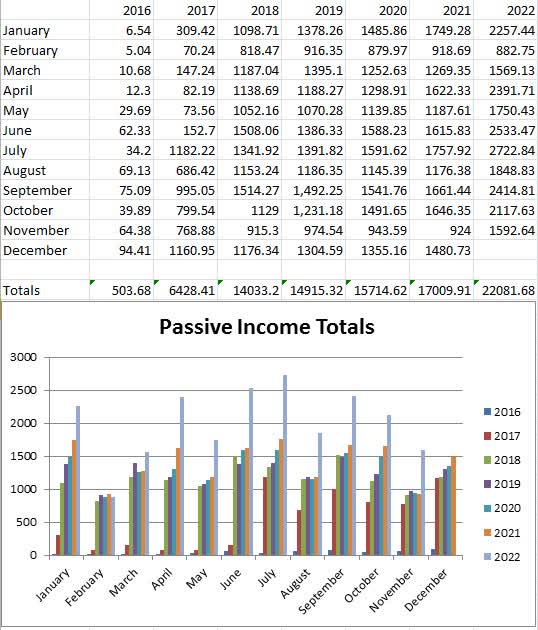

Total November 2022 Passive Income – $1,592.64

November 2021 Passive Income – $924

This has got to be our highest growth rate ever, and let’s be honest probably won’t see this for a long time. This month our growth rate in total passive income is a monster 72.36% growth rate year over year. Absolutely massive and nice to see in these lower paying months.

Totals For 2022

Dividends Year To Date Total – $9,652.41

Other Passive Income Year to date – $12,429.27

Total Passive Income for 2022 – $22,081.68

Year End Goal – $25,000

Getting close to the goal, but likely will be a little short. All good when you set the bar so high.

November Stock Purchases

We made just 1 purchase this month as the market in my opinion shot up for no reason at all. Inflation is still over 7% and rates are still rising.

We bought 8 more shares of Microsoft (MSFT) before the run up. I have always wanted to get this position into our top 10 and this month it broke into the list in the number 8 spot.

8 shares purchased at $224.02 per share. This adds $21.76 to our forward income. I plan on continuing to grow this position in the future under 240.

Bitcoin

Well as some of you may well know, I have been anti crypto for years now. My mind has changed a bit. I attend a monthly mastermind meetup with 6 guys. 2 crypto bulls, 2 stock guys and 2 real estate guys. The crypto guys have convinced me to dip into the space. I won’t touch any crap coins. I’ll just stick with bitcoin and possibly Ethereum. This is purely a speculative investment and basically a hedge against our dollar. In my opinion governments are absolutely destroying our dollars and we live in a world with no repercussions. They keep their jobs and continue printing money.

For the first time ever the bank of Canada is now losing money. They lost 522 million in 3 months. Will interest rates keep going up to fight inflation or will they dial back since they can’t afford it? I’m guessing we will continue printing the difference.

But, hey, got to give credit where it’s due. The liberals literally said monetary policy wasn’t a concern this election and people still voted for them…

My plan for bitcoin is 100 to start and 20 bucks added every week. I’ll update how things are going every month.

Total invested – $110

Financial Goals Update

Charities

- We continue our monthly donation to The Nature Conservancy of Canada of $85.

Increase Dividends by $4285.81 this year (bringing our forward income from dividends to $13,000 a year).

Unfortunately, I’m going to disregard this now. While we could have been really close to hitting this, things changed. I’m not as bullish on the market and with interest rates doubling in 6 months (and still growing) I decided to pay off all our HELOC which we used for investing. As long as the forward passive income is higher at year end vs. last year, it’s all good!

ETF Monthly Minimum Purchase of $250

- This month we added 7 more units of XAW ETF.

- Questrade is great because it offers free ETF trades and cheaper stock trading options than most Canadian brokers. $250.00 a month would kill us if we needed to pay high trading fees.

November 2022 Passive Income Conclusion

A decent month overall. Clearly an emotional one, but her time was due. Now we get ready to go away on vacation and then enjoy time with friends and family for Christmas. Always one of my favourite times of the year although not financially…

Wish you all nothing but the best. Cheers!

In the end it’s not the years of your life that count. It’s the life in your years – Abraham Lincoln

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment