Diego Thomazini

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on November 19th, 2022.

Tesla (TSLA) gets all the attention in the EV space, but Proterra (NASDAQ:PTRA) is another player in the EV category. Albeit, the two companies operate wholly differently.

TSLA focuses mostly on personal vehicles, while PTRA focuses on commercial products in the space. This is through “Powered, Transit, and Energy.”

PTRA Business Segments (Proterra Presentation)

I’d say it’s pretty safe to say that between TSLA and PTRA, PTRA is much more of a gamble or speculative play. It has no profits and is burning cash – exactly what you don’t want in this environment.

Oh, and it came about as a combination with a SPAC. A dirty word in 2022.

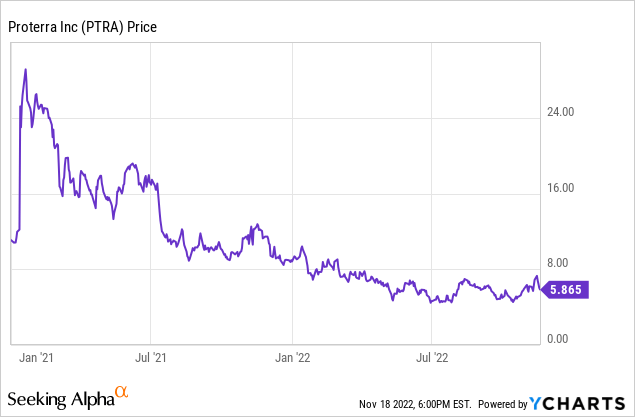

At this point, the gamble I’ve taken here leaves a lot to be desired. The series of trades began by selling puts at a $15 strike in August 2021, rolling that trade, and then taking the assignment of shares in November of last year. With rolling that position, we ended up collecting a higher amount of premium, which helped reduce the breakeven.

Heading into the expiration in November 2021, shares were actually rising quite materially higher. That’s originally what made me believe that going long the shares to turn around and write calls was an attractive proposition. However, I didn’t anticipate how aggressive the Fed would get – pushing down speculative growth investments along with it.

Initially, we collected $1.20 when shares were trading richer right after taking assignment. After November 19th, 2022, shares have only moved down substantially.

The latest two covered call trades collected $0.54 and $0.21 as shares declined. Along with collecting the premium for the puts, our breakeven has been reduced down to $10.99. A level where shares are still significantly shy of, to be sure. PTRA remains one of my worst investments in terms of percentage losses. I completely underestimated how aggressive the Fed would be and how negatively it would impact the name.

YCharts

Cash burn in the latest quarter was significant at around $115 million. However, they said this was purposeful and related to the build-out of Powered 1. Powered 1 is their battery manufacturing facility in South Carolina, which they continue to expect to start production before the end of this year. Excluding the items related to that, they put cash usage at $40 million.

At the end of the quarter, they had cash and cash equivalents of around $408 million. That provides them a position where they can sustain at least through 2023 at the current trajectory. If they slow down the cash burn, as hinted at after these large investments, it will leave them in a better position to remain solvent for longer.

Finally, on cash. We continue to be supported by strong balance sheet, ending the quarter with $408 million in cash, cash equivalents and short-term investments. As we’ve been mentioning since the beginning of the year, we are expecting a higher than normal cash burn in 2022 as a result of our investment in our Powered One factory. Consistent with Q2 of 2022, there were a number of discrete investments and timing factors that led to higher than normal cash usage in the quarter.

Total cash usage in the quarter was $115 million. This included $14 million in CapEx, almost all of which was related to the construction of Powered One, $25 million related to a strategic equity investment in a privately held entity that we expect to diversify our domestic cell supply into other chemistries, which Gareth will discuss in greater detail in a few minutes, a $20 million increase in accounts receivable due to a significant portion of our bus deliveries landing late in the quarter, as well as a $16 million increase in inventory.

It isn’t all bad news; the company has continued to provide significant revenue growth. This is at a time when most other growth plays are continued to be pressured. They last reported a 55% jump in revenue year-over-year in Q3.

The third quarter of 2022 was a breakthrough quarter for Proterra. We reported record quarterly revenue surpassing $96 million, representing growth of 55% compared to Q3 2021 and 29% compared to our prior record in Q2 2022. Proterra Transit deliveries rose to a new record of 60 new electric buses. Proterra Powered grew deliveries by 274% compared to Q3 2021 to 292 battery systems and has delivered battery systems for more than 1,000 vehicles over the last four quarters. And Proterra Energy had its highest delivery quarter yet with 22.5 megawatts (MW) of charging solutions, growing 765% compared to Q3 2021, with customers in both the transit bus and non-transit bus commercial vehicle segments.

They’ve also continued to point to the improving situation with more support coming from the infrastructure bill.

There has also been significant progress over the last few months with funding and incentive programs designed to accelerate adoption of electric commercial and industrial vehicles in the United States. First, under the Bipartisan Infrastructure Law’s first year of funding for the Low or No Emissions Vehicle Program, more than $800 million was Q3 22 QUARTERLY LETTER awarded in August to transit agencies across the country specifically for the purchase of zero emission transit buses and related charging/refueling infrastructure. Second, in October the U.S. Environmental Protection Agency awarded approximately $900 million to 377 school districts spanning all 50 states specifically for the purchase of electric school buses, which must be ordered by April 2023.

With this funding, they expect to ramp up their production in 2023 to take advantage of the new demand for electric transit and school buses.

They are also pointing to the Inflation Reduction Act, which should help support their growth.

Last but not least, the Inflation Reduction Act, which was signed into law in August 2022, not only establishes the “Commercial Clean Vehicle Credit” which provides a 10-year tax credit beginning in 2023 of up to 30% (up to $40k per vehicle) of the price of new Class 4 – 8 electric commercial vehicles but also provides a production tax credit for domestic battery manufacturing facilities, as well as numerous other provisions, which altogether provide unprecedented funding for commercial and industrial vehicle electrification in the United States

Whether one supports the transition to electric vehicles or not isn’t up for debate here, it is happening and is coming in one way or another. So I’m not here to say what is right or wrong, but to try to find a way to profit from such a transition. I know this topic can often spark some “passionate” debates.

Perhaps most importantly, they’ve maintained their guidance for 2022. They are anticipating revenue in the range of $300 to $325 million. Of course, it highlights how small of a company this is, but this has been another negative of growth names as of late, reducing guidance.

The company has continually mentioned supply chain disruptions as having held them back. They noted that these have eased in the latest quarter.

Moving on, Proterra Energy reported a very strong quarter in Q3. Supply chain limitations that had held back project execution in recent quarters eased and we completed our largest single customer project to date at 9 megawatts of charging infrastructure installed for Miami-Dade transit.

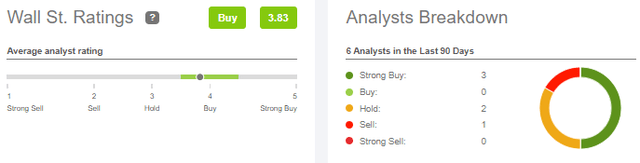

For what it’s worth, analysts have an average price target of $7.42. It is currently rated a “Buy,” with 3 analysts showing a “Strong Buy,” 2 at a “Hold,” and one analyst at a “Sell.”

Wall St Ratings (Seeking Alpha)

What’s Next For PTRA?

All this brings us to the next point, what to do next with the shares being held. Shares had been jumping along with the rest of the market, but they had quickly turned the other way. I was holding out hope that strength could continue for a while to get some covered calls sold again. Shares trading at $7+ would make a material difference in the strikes selected, and premium pocketed.

Since that isn’t the case, at this point, I’m considering getting more aggressive with selling calls that are closer to the money. If shares spike higher, then rolling the calls out could always be an option. For the most part, being a speculative play, I kept the weighting to a very minimal allocation in my portfolio.

Another option is always to let the shares get called away, bag the loss, and move on. A couple of ideas that are present at the time of writing could be worth considering.

- December 16th, 2022, expiration at a $6 strike could collect $0.40 (last bid.) The breakeven there would be reduced to $10.59.

- Going out to February 17th, 2023, expiration at a $6 strike would collect $0.70 (last bid.) That brings the breakeven down to $10.29.

Given the trajectory of the share price, it would suggest a good probability that shares will finish below $6. The Fidelity probability calculator puts the chances for either expiration date at a ~41% chance shares would be higher.

Either trade above would mean realizing a loss, but again, that’s where rolling could come into play.

Be the first to comment