MSPhotographic/iStock via Getty Images

Introduction

Chevron Corporation (NYSE:CVX), a U.S. based oil and gas company, turned in stellar results for Q-2, to no one’s great surprise. Record OCF of ~$13 bn spurred by high price realizations and increased oil and gas production, boosted the stock out of the upper $140’s.

We think the macro environment is improving for oil and gas, and these prices will recover to their June levels as we close out the year, and provide a backdrop for shares of CVX to push through previous levels.

We are bullish on CVX at current prices and will discuss the mechanics of how the stock could rise from here as we go through this article.

Be warned, I am going to get a little wonky here as I discuss the foundation of the company’s wealth and prospects for growth in the coming years.

The thesis for Chevron

Let’s agree that at $158ish per share, the company is in some pretty thin air. It should be noted as well that the air at the current level is a little thicker than just a few weeks ago when it hit $182ish. Chevron is one of the most widely discussed tickers on this blog, with a new article dropping every 2-3 days. Obviously the nearly 300K followers the company has on Seeking Alpha play a role in that frenzy of coverage. Writers write to be read, and an article on CVX is sure to attract some eyeballs.

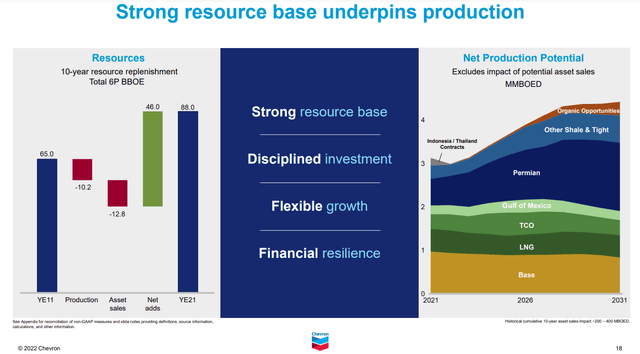

The modern day Chevron is the surviving entity of some of biggest oil companies of the twentieth century. Gulf Oil, Texaco, and Unocal all were considered major, integrated (upstream, midstream, downstream) oil companies with global footprints. There is a purpose in my pointing out the modern Chevron’s heritage, because it plays a role in the advantage the company holds today. That purpose will become clear a little later. Chevron today is a colossus with only one real peer in its category, and has the expectation of growing daily output by a third over the next eight years to over 4 mm BOEPD. Most of that growth will come from a single area. The Permian, and in particular from a deeply buried patch of dirt called the Wolfcamp. We will discuss the Wolfcamp at length in this article.

In my last article on CVX with the price at ~$100 per share, I called them, The Number One Energy Stock For Your Retirement Portfolio. I was right. In the 15 months that have elapsed since that article was published-

- the stock has risen 75%.

- the company has paid out $7.00 per share in dividends-continuing an unbroken 34 year history without a miss,

- repurchased $60 bn in shares, and

- plan to continue doing this at $15 bn a quarter, and

- reduced debt by nearly half to ~$23 bn.

- Doubled cash to $12 bn.

If there’s a box unticked on the retiree’s investment dream portfolio… I honestly don’t know what it would be.

In this article we will take a closer look at the upstream engine of the company’s future revenue and profitability growth, the Permian basin. Chevron derives ~1/3 of its global production of ~3.1 mm BOEPD, from the U.S. Currently they produce about 700K BOEPD from the Permian with a plan to ramp that up to 1.5 mm BOEPD by 2030 (What is it about 2030? Everybody wants to do everything by then. What’s wrong with 2031?)

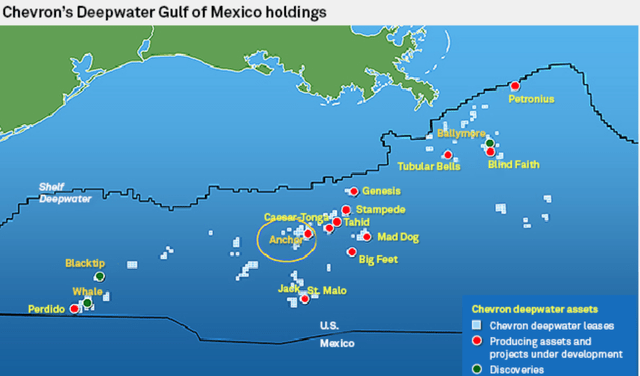

The company is also a major player in the international arena with major projects in the Gulf of Mexico-GoM, Australia, Khazakstan, West Africa, and Asia. In the GoM they have a robust presence with a number of hubs and discoveries to keep them busy. This includes Anchor-an ultra HPHT project getting underway next year with the arrival this fall of the Deepwater Titan, and the recently FID’d Ballymore (The discovery of which I wrote in an article.)

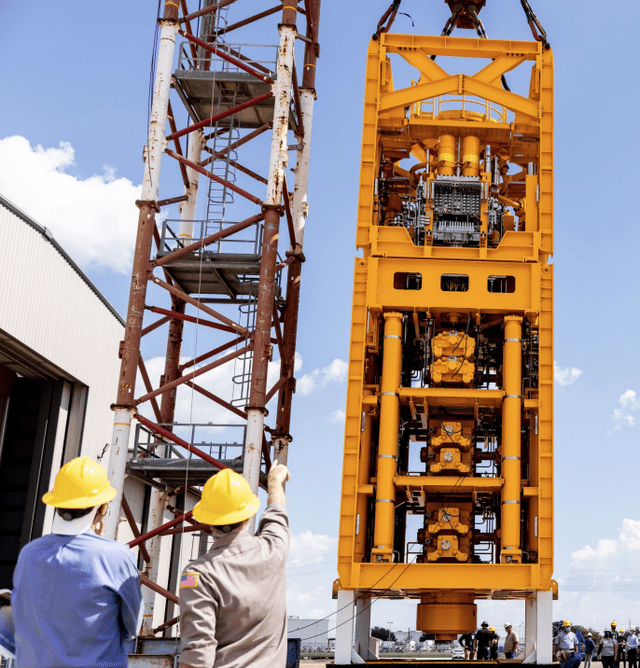

Anchor Subsea 20K psi BOP (Chevron) CVX GoM Footprint (CVX)

Deepwater production though is likely to remain static, as older fields-Jack, Genesis, and Tahiti are on tertiary recovery. Many of these legacy GoM fields are nearing their 10-12 year life span, assuming a 6% decline rate.

Chevron also has a downstream portfolio of refining and chemical assets around that contribute to revenues and profits. We are going to bypass them in this article to hone in on our key area of interest, the Permian and its primary target-the Wolfcamp B.

Analysts are moderately bullish on CVX with an overweight rating and price targets from $150-$210 per share. As we close out this article we will take a look at the pathway toward $210, which would imply 25% growth. Noting as well the dividend is likely to increase from share count reduction and quarterly increases, providing a substantial revenue stream for lucky stockholders.

The Wolfcamp A & B: The catalysts for growth

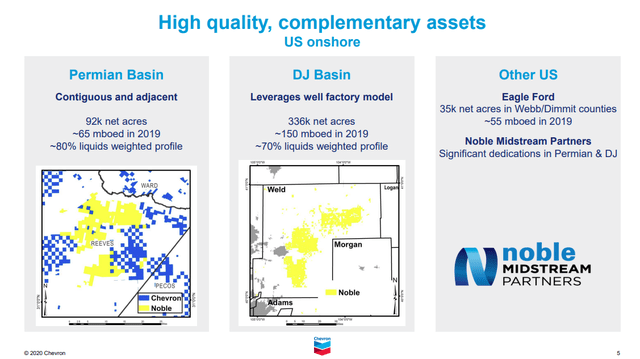

The acquisition in 2020 of Noble Energy was timely as it enabled CVX’s U.S. production to increase about 20% over the last couple of years, while international output has declined about 10%. Overall, the company’s daily output remains flattish at just over 3 mm BOEPD, for the three year period.

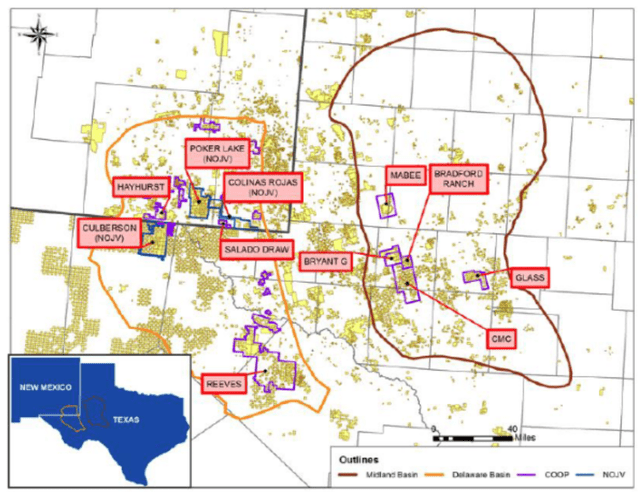

As per Jay Johnson, EVP of Upstream, CVX will keep a dozen rigs active in the Permian. Altogether CVX has 2.2 mm acres under lease and owned outright as shown in the graphic below. Chevron has a massive footprint in the Delaware segment of the Permian basin. What is noteworthy is about 85% of this acreage is royalty free-meaning they own it. Joe Biden can’t deny them a lease or withhold a permit because less than 10% of CVX’s acreage is on federal land. That brings a substantial cost advantage and relative assurance of access to their resource base.

Much of CVX’s prime acreage is three Texas Counties-Midland, Ward, and Loving, and two New Mexico counties-Lea and Eddy. A Bloomberg article noted the importance of these five counties-

The Permian Basin a sprawling shale patch that lies beneath Texas and New Mexico, is uniquely positioned to become the world’s most important growth engine for oil production. The bulk of that expansion will come from just five counties that make up about 15% of its total area.

The Wolfcamp A&B formations that we will discuss in detail in relation to the Noble Energy acquisition, are the thickest, and least “lensy” in these counties which drives the Pad Style Simulfrac technique now common in this basin.

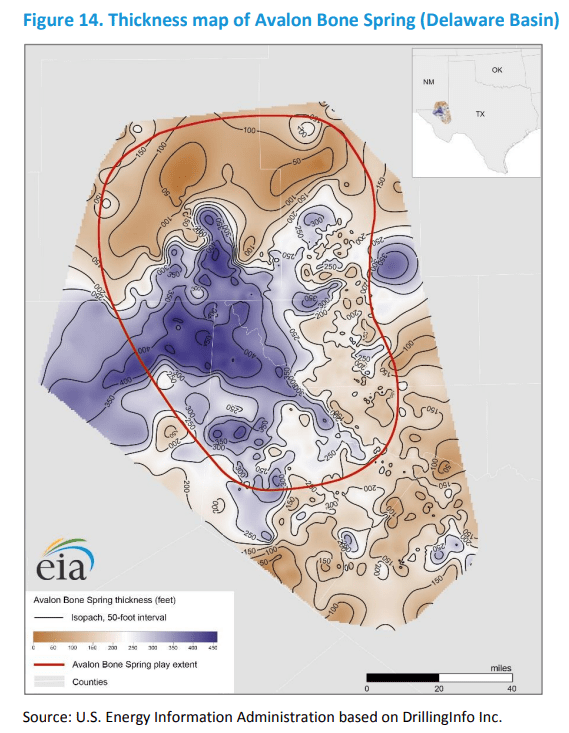

The Avalon Bonespring formation also deserves an honorable mention. Devon Energy (DVN) has been making great wells in their Poker Lake completions. The Avalon can range up to 500′ in thickness and as you see in the map below, CVX acreage in the sweet spot of this reservoir.

Avalon Bone Spring (EIA Wolfcamp map)

Noble Energy

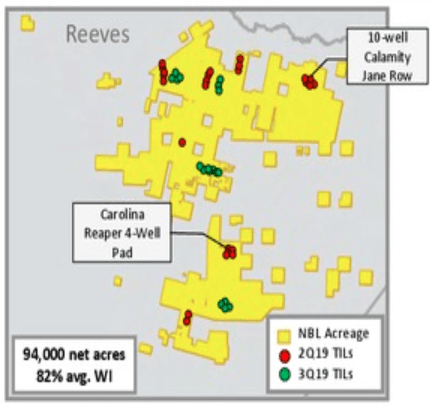

As you can see in the picture below, Noble brought only about 94K acres to CVX, but they were right where they were needed. If you look at the investor deck slide below you can see the yellow of Noble brings a lot of optionality to CVX in terms of lateral length in this section of Reeves county.

Noble completed the Calamity Jane Row in the Wolfcamp in 2019 with an Inflow Performance rate IP-30 of 1,700 BOEPD. These wells were short by today’s standards at 4,100′ lateral, and a treatment of 1,700 ppf. CVX Wolfcamp wells today are 7,500-9,500′ with treatment of over 2,000 ppf of sand. On wells on this acreage, with today’s lengths and treatment rates, you would expect IP-30’s in the 3,000 BOEPD range.

Noble Energy Investor deck (Seeking Alpha)

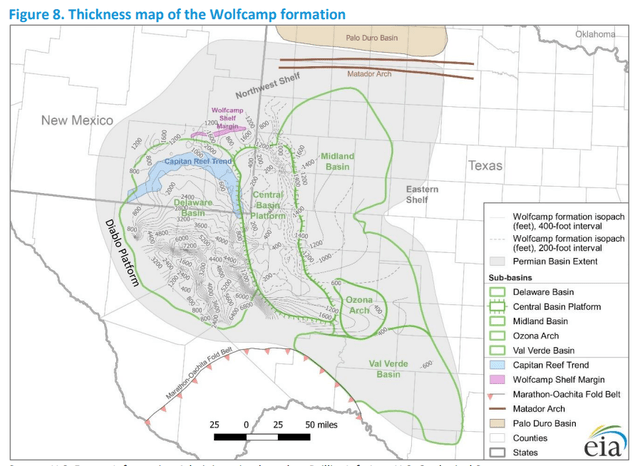

The EIA map taken from their 2019 report on the Wolfcamp formation is illustrative of the potential for CVX’s Reeves county acreage. Their footprint in the Wolfcamp is right in the sweetspot of the formation. The Wolfcamp consists of two primary targets, the A & B.

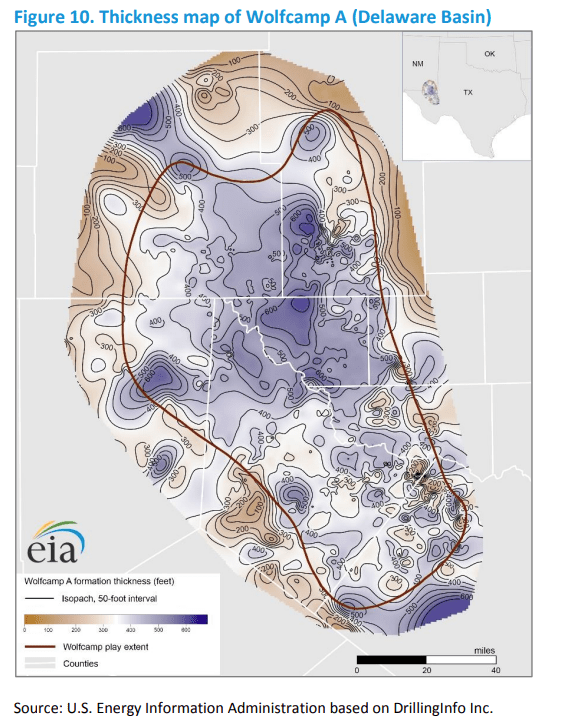

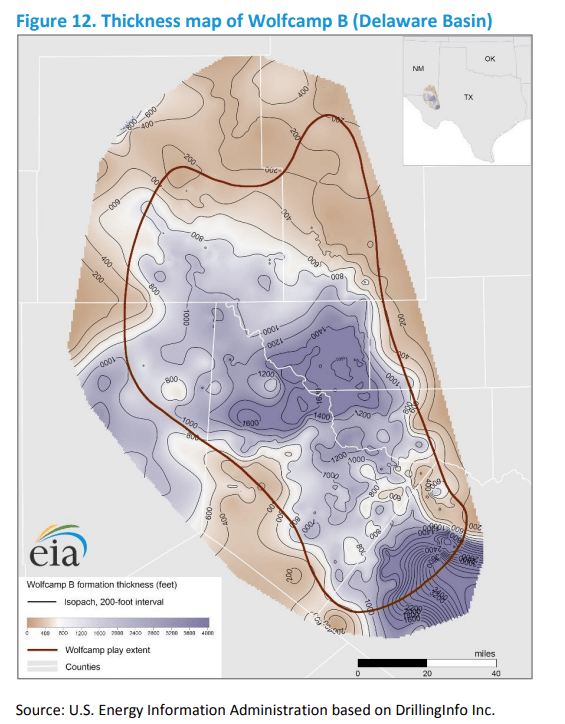

The EIA constructed the Wolfcamp A thickness map from subsurface point measurements from 1880 wells that include both depth to the top and to the base of the Wolfcamp A bench. Thickness ranges from about 100 feet to more than 700 feet thick in the Delaware Basin Wolfcamp B thickness map based on stratigraphic picks from 1193 wells that include both depth to the top and to the base of the Wolfcamp B bench. Thickness ranges from about 150 feet to more than 1800 feet thick across the Delaware Basin, with the exception of the southeast area, where thickness of Wolfcamp B is more than 4000 feet.

And where is CVX’s acreage in relation to these thicknesses?

Thickness map of Wolfcamp (EIA)

It appears to be in some of the best Reeves county has to offer, which is fair to good. As you can see the Wolfcamp A is very lensy, meaning it thins out rapidly. Much of the CVX acreage is in the 400-600 section of the “A” denoted by mid-purple shading.

Wolfcamp A (EIA)

In the Wolfcamp “B” they miss the monster 4,000′ thickness in some parts of Reeves county, but have ample horizontal run in the 1,000-1,500′ section of the map.

Wolfcamp B (EIA)

In summary, CVX has some world class acreage in the most productive counties of the Permian basin. The rock quality here gives assurance of their being able achieve the production growth their share price demands.

Risks to the bullish thesis

Obviously the bullishness about CVX in this article is tied to the present price regime fluctuating between the high $80’s to $110 per barrel. I’ve written quite a bit recently supporting the notion that prices will begin to rise back toward $100 per bbl, and I am sticking with that thesis. If I am wrong shares of CVX will sag.

Political, regulatory and legal risk is always with us in the petroleum arena. Just this week a federal appeals court ordered that state lawsuits against the oil majors, CVX, XOM, Shell could proceed for climate liability. This is a relatively new risk, and one that can’t be quantified at this point. It’s worth noting that the cigarette companies faced the same kind of litigation 30 years ago and they are doing just fine. Usually, lawsuit of this kind do not intend to kill the beast, just tap into a revenue stream. Investors should be aware of this before investing.

Your takeaway

Chevron is trading at a low cashflow multiple, even at its lofty price. With their capitalization of $300 bn and their debt of $22 bn, less their cash of $12 bn, the EV of the company is $310 bn. Using their cashflow-OCF, from Q-2 of $13 bn on a one-year run rate you get a 5.9X. For reference peer, Exxon Mobil, (XOM) trades at a slightly lower 5.2X.

On a flowing barrel basis CVX is trading at $102K per barrel of daily output. XOM trades at $111K per barrel.

If CVX should see their production grow as forecast, hitting 3.5 mm BOEPD in 2025, the increased cash flow would add about $8 bn annually to OCF using $95 as a price for WTI. Using the same numbers the OCF multiple would drop to 5.35X. To keep it in the same range 5.8-5.9 the share price would need to rise to $195. A nudge higher toward XOM’s OCF multiple and we are at that outlier $210 valuation. Share count reduction should boost it even further, although that’s more a theoretical association than a direct cause and effect relationship.

I think CVX is attractive for investors with a moderate risk tolerance who accept the notion the oil prices in the hundred dollar range are here for the foreseeable future. I freely acknowledge that a stock priced at $158 per share is expensive on a cash basis and may not be appropriate for all our readers. That said, we have seen in the past where a $175 dollar stock became a $275 stock in just the environment we visualize for the final months of this year. I am talking about Pioneer Natural Resources (PXD) of course.

Obviously I would wait for a down day in the market before plunging into CVX. With the volatility we have seen in the market recently better prices could present themselves. Nor would I take a huge chunk of the company at the current price. Downside risk is always with us. If some tumultuous event – new pandemic, China nukes Taiwan, Biden nationalizes the oil industry… something like that, took the company south toward the $130 level, I’d would probably have my finger on the buy button.

Be the first to comment