DNY59/E+ via Getty Images

“The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

– Federal Reserve issues FOMC statement, December 14, 2023

This familiar statement was an appropriate way to start another hawkish monetary affair from the Federal Reserve. The main message: the Fed is not done. The main implication: the Fed remains focused on maintaining restrictive monetary policy until it sees substantial evidence that inflation is going down in a sustained way. Given the market’s celebration the previous day over another pleasing CPI report, the stock market reacted to its disappointment with surprising constraint. Of course, the post-Fed fade and the fade of the fade remain ahead.

Fresh Dissonance

The typical cat and mouse between financial markets and the Federal Reserve consists of the Fed signaling where it wants the market to go and then the Fed executing as the market expects. These rules of the game minimize the potential for surprises at Fed meetings. This year’s cycle of monetary tightening has featured some of the typical games but also some interesting divergence. The Fed has found it necessary to go to extremes with rate hikes and hawkish statements to convince the market that it is serious about fighting inflation or that inflation is even a problem requiring Fed action. The market’s consistent disbelief has forced the Fed to over-correct for inflation. The December announcement on monetary policy created a fresh moment of dissonance. The Fed increased its projection for the top interest rate next year. However, the market, in the form of fed fund futures, responded by slashing rate expectations for next year.

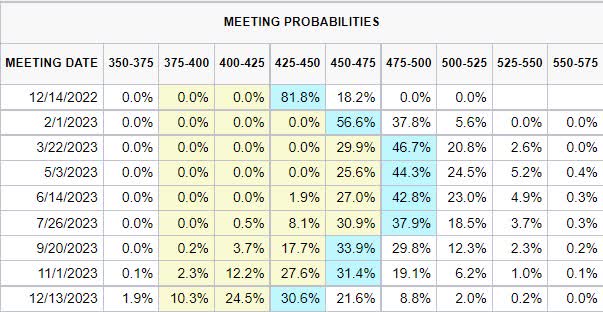

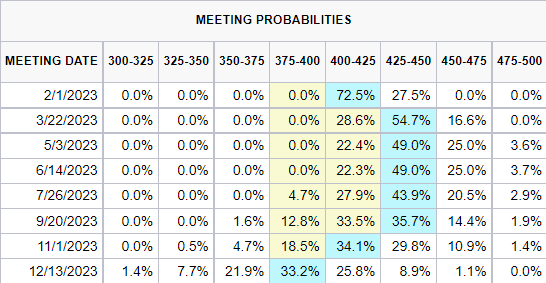

Per the CME Fed Watch Tool, here is the before and after landscape for rate expectations through 2023:

THE BEFORE: Meeting probabilities hours before the Fed’s December release on monetary policy. (CME FedWatch Tool)

THE AFTER: Meeting probabilities hours after the Fed’s December release on monetary policy. (CME FedWatch Tool)

The futures took the peak rate down 50 basis points point (bps) from 4.75% – 5.00% in March 2023 down to 4.25% to 5.00% also in March 2023. The first rate cut stayed in September. This reaction happened despite Powell pointing out in the Q&A period that the SEP shows 17 of 19 respondents are now above 5%; respondents have increased rate expectations at each SEP this year. Two respondents are even now at 5.65%! The resulting median is 5.1%. Powell also emphatically stated the Fed is “not focused on rate cuts next year” (I think he almost said “not thinking about, thinking about”). Powell also pointed out that the SEP (the quarterly survey of economic projections) does not project rate cuts in 2023.

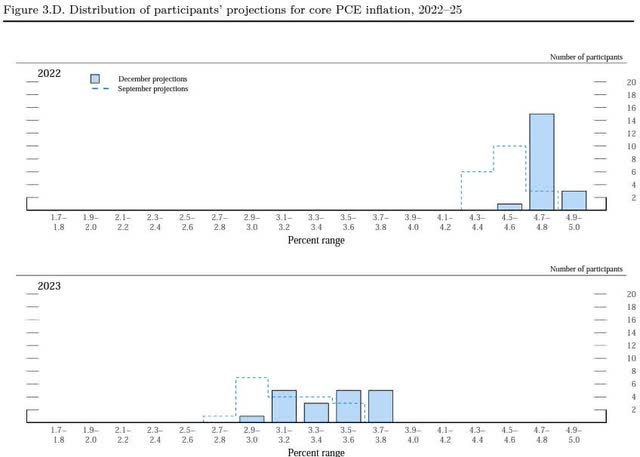

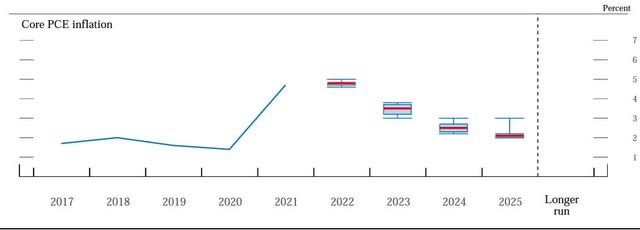

The SEP also shows participants nudged their inflation expectations for 2023 upward from the September projection (the snapshot below is truncated).

Fed participants are more bearish about inflation despite the current peak in inflation. (Federal Reserve December Summary of Economic Projections (SEP))

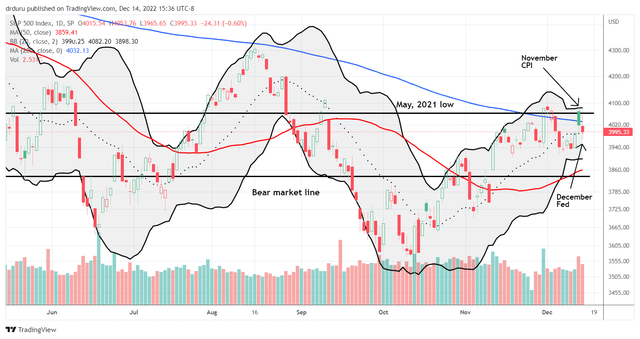

Given the market’s contrary drop in rate hike expectations, I would have expected the market to rally in its typical trigger-happy fashion. Instead, the S&P 500 (SPY) ended the day down 0.6%. The move confirmed the end of a brief 200DMA (the blue line in the chart below) breakout in the wake of the November CPI report. The index even finished reversing all of those day’s gains.

The S&P 500 (SPY) quickly lost all the excitement from the November CPI report. (TradingView.com)

The Economic Pressure

One way to interpret the somber tone is to look at the economic discussion. The Fed significantly reduced its forecast for 2023 GDP from September’s forecast 1.2% to 0.5%. A lower GDP print increases the odds that the Fed will actually be forced to stand down sooner than it currently expects. That is, the Fed now has less room to remain planted in hawkishness.

Powell reiterated that the Fed is perfectly willing tolerate this further slowing in the economy: “reducing inflation is likely to require a sustained period of below-trend growth and some softening of labor market conditions.” A reporter asked why the Fed raised its projection for the unemployment rate. Powell explained that the peak rate expectations went up. In other words, the Fed expects to lean harder into the economy, trading off economic conditions for keeping a lid on inflation. In response to another reporter, Powell matter-of-factly proclaimed that “there isn’t a painless way to restore price stability.”

Inflation’s Downtrend

The Fed’s behavior may seem counter-intuitive, even counter-productive, given inflation has peaked and a downtrend has begun. Indeed, some critics either want the Fed to end monetary tightening now or do not even see the need for aggressive Fed action in the first place. The Fed’s longer-term projection does have inflation gliding down to 2% by 2025. However, the Fed sees this decline as assisted by the Fed’s vigilance. Powell noted that the risks to inflation remain to the upside. Moreover, “it will take substantially more evidence to give confidence that inflation is on a sustained downward path.” The risk management framework requires hawkishness given these conclusions.

The Fed expects a gradual return to the 2.0% target….but not until 2025. (December SEP)

This disagreement over how to interpret the fate of inflation is a central push and pull in the way the market responds to CPI reports and Fedspeak.

The Trade

As long as the Fed is hawkish, it is hard to get excited about the upside prospects for the general stock market. It is also hard to get excited about the general market when it rallies on economic weakness in anticipation of the Fed extending mercies. Like many others, I am left staring at the CME Fed watch tool to guesstimate when the pressure might be off the market. With peak rates at March 2023, I suspect the market can bottom sometime around then.

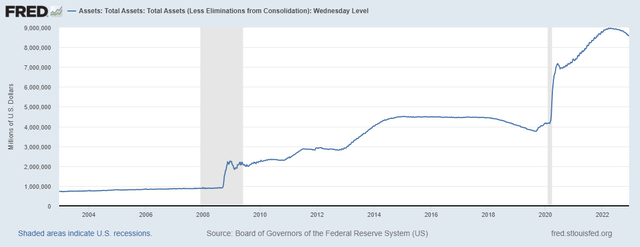

The impact of the ongoing reduction on the balance sheet is harder to gauge. Does normalization of monetary policy require a return to pre-pandemic levels? It is very possible the balance sheet is even more important than interest rates. If so, then, as the Fed cautions, there could be a long way to go before the weight on the market ends.

Fed assets remain too high? If so, normalization is forever from current levels. (Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets (Less Eliminations from Consolidation): Wednesday Level [WALCL], retrieved from FRED, Federal Reserve Bank of St. Louis; December 14, 2022.)

Be careful out there!

Be the first to comment