Fly View Productions/E+ via Getty Images

Cullinan Oncology (NASDAQ:NASDAQ:CGEM) is a biopharmaceutical company developing product candidates for the treatment of deadly diseases such as non-small cell lung cancer, relapsed/refractory acute myeloid leukemia, and advanced tumors. Despite the persistence of the worrisome situation associated with rising inflation and the subsequent increase in the Fed interest rate, Cullinan Oncology’s business continues to successfully cope with these difficulties through partnerships with industry leaders such as Zai Lab (NASDAQ:ZLAB), Taiho Pharmaceutical. The company’s lead product candidate CLN-081 continues to show stunning efficacy and safety profile data in the treatment of NSCLC patients with EGFR exon 20 insertion mutations. Given the proven efficacy and safety of the company’s product candidates in preclinical studies, the high level of cash and short-term investments, and the ability of the company’s management to achieve its goals, Cullinan Oncology could be an excellent choice for long-term investors.

Company’s Financial Position

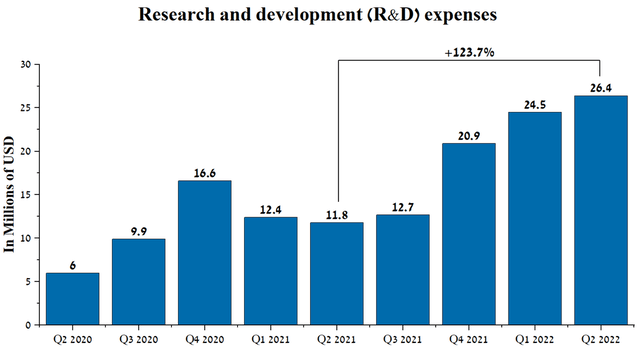

When analyzing pharmaceutical companies that do not have approved medicines, it is first necessary to take into account spending on research and development, which accounts for the majority of the company’s total expenses. Cullinan Oncology’s R&D spending was $26.4 million in Q2 2022, up $14.6 million from Q2 2021 due to increased patient numbers in two Phase 1/2 clinical trials and expansion of CLN-617-related clinical activities.

Source: Author’s elaboration, based on Seeking Alpha

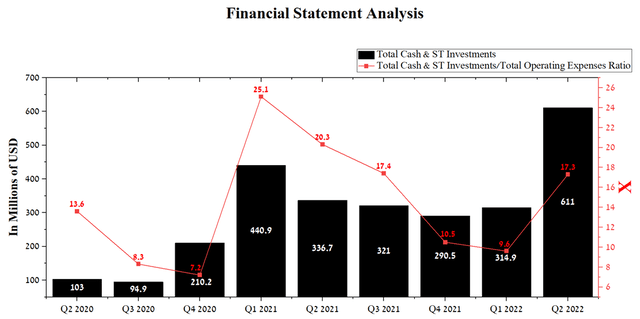

In my estimation, the rate of increase in R&D spending will continue in the near future due to the start of a phase 3 clinical trial in the 2nd half of 2022, the purpose of which will be to confirm the shown effectiveness of CLN-081 in a proof-of-concept study. Development costs for the upcoming clinical trial will be shared equally with Taiho Pharmaceutical under a partnership agreement concluded in May 2022. Under this agreement, Cullinan Oncology received a payment of $275 million and is eligible to receive an additional $130 million upon reaching certain milestones. Moreover, Cullinan Oncology will retain the ability to co-commercialize the company’s product candidate with Taiho Pharmaceutical and earn 50% of potential sales of CLN-081 if approved by the FDA. As a result of this strategic agreement, the company has high levels of cash and investments, which amounted to $611 million at the end of Q2 2022, up 74.8% from the previous year.

Source: Author’s elaboration, based on Seeking Alpha

With the current level of costs and without additional cash payments from Taiho Pharmaceutical and Zai Lab, the company’s current level of cash will last until at least 2026. As a result, this will allow Cullinan Oncology’s management to actively expand the company’s developments and invest in promising oncological assets, without the need to sell the company’s shares to raise capital, which reduces the risks associated with stock dilution.

Cullinan Oncology Pipeline

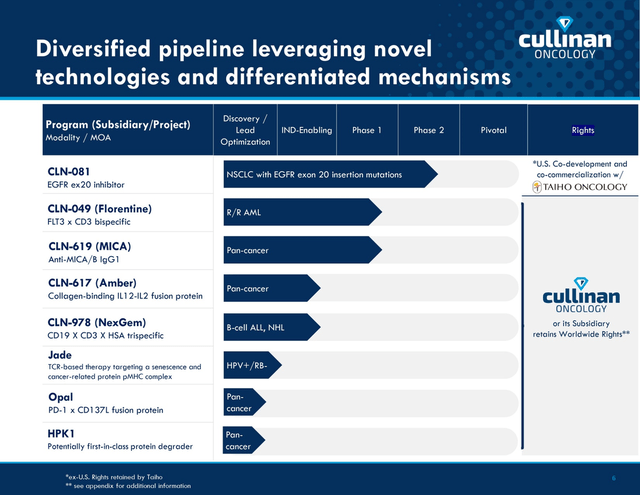

Cullinan Oncology has an extensive pipeline of 8 product candidates, three of which are already in clinical trials with human participants. In this article, I will present an analysis of two of the company’s key product candidates that continue to show promising results and are able to improve the quality of life of patients suffering from terminal illnesses.

Cullinan Corporate Presentation

Cullinan Oncology’s Leading Product Candidate

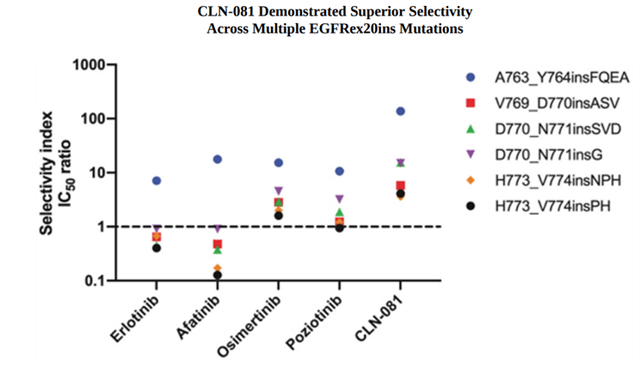

CLN-081 is the company’s lead product candidate as an irreversible inhibitor of EGFR for the treatment of non-small cell lung cancer (NSCLC) patients with EGFR exon 20 insertion mutations. The American Cancer Society estimates that lung cancer is one of the most common cancers, with 130,180 deaths in the United States. The company estimates that each year approximately 2000-5000 patients in the US and approximately 1000 to 3000 patients in the EU5 develop NSCLC with EGFR exon 20 insertion (EGFRex20ins) mutations. Remarkable results have been shown in preclinical studies, which are necessary to model the biological effect of a product candidate, determine its preliminary efficacy and evaluate various types of toxicity associated with taking a medicine. The aim of one such study was to evaluate the in vitro selectivity profile of CLN-081 compared to competing EGFR inhibitors, namely Roche Holding’s erlotinib (OTCQX:RHHBY) (OTCQX:RHHBF), Boehringer Ingelheim’s afatinib, AstraZeneca’s osimertinib (NASDAQ:AZN), Spectrum Pharmaceuticals’ poziotinib (NASDAQ:SPPI). In this study, the selectivity index was equal to the ratio of the half-maximal inhibitory concentration (IC50) value for cells expressing wild-type EGFR compared to the IC50 value for cells expressing exon 20 insertion mutant EGFR. As shown in the graph below, the selectivity index of CLN-081 was not only higher than that of the compared medicines but also greater than 2, thus indicating a high efficiency of inhibition of EGFR with exon 20 insertion mutations by Cullinan Oncology’s product candidate.

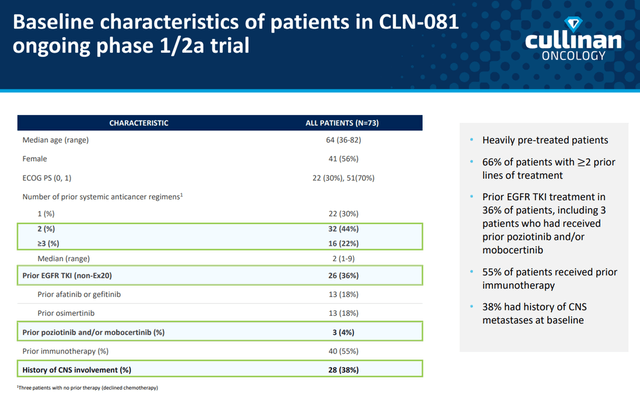

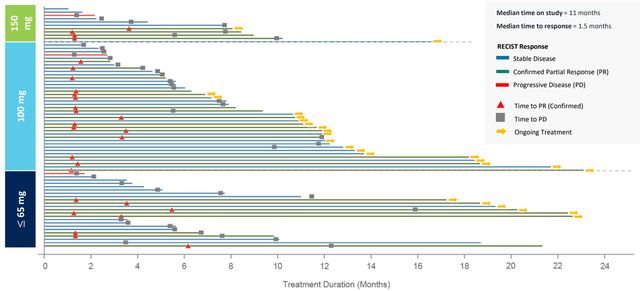

In late 2019, a phase 1/2 clinical trial was initiated to determine the pharmacokinetics, preliminary efficacy, and safety of CLN-081 in adult patients. A total of 73 NSCLC patients with EGFRex20ins mutations were enrolled in different cohorts at dose levels ranging from 30 to 150mg to determine the optimal dose of the medicine. However, after enrollment of 11 patients in the group taking CLN-081 at the dose level of 150 mg twice daily, recruitment of new participants in this group was discontinued due to an unfavorable clinical profile at this dose level. Although this study was not pivotal, the company’s management conducted it in various parts of the world, namely in the USA, Singapore, the Netherlands, Taiwan and Hong Kong. Thus, the results obtained on the efficacy and safety of the drug were more objective due to the presence of different groups of patients.

Cullinan Corporate Presentation

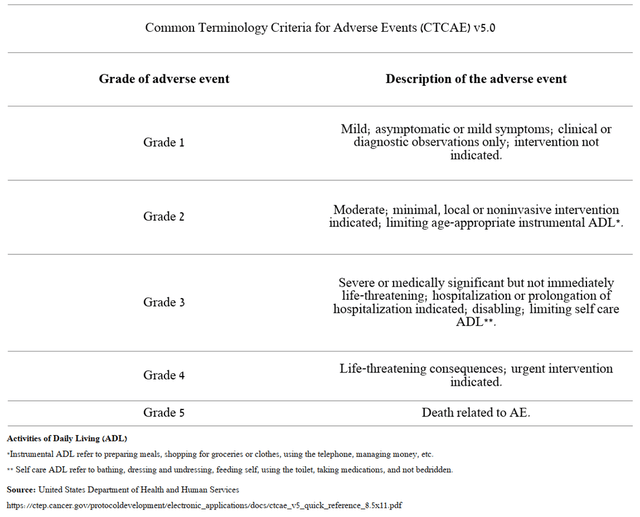

Cullinan Oncology presented updated data on side effects and tolerability of experimental treatment at the 2022 ASCO Annual Meeting. Before proceeding to the analysis of the safety profile of a company’s product candidate, it should be noted that the severity of an adverse event is characterized from grade 1 to 5 based on a guideline created by the National Cancer Institute.

Source: Author’s elaboration, based on National Cancer Institute

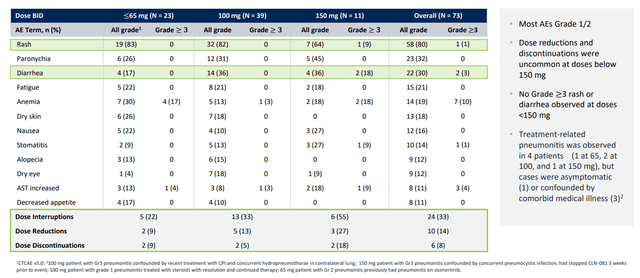

None of the 39 patients in the group treated with CLN-081 100 mg experienced treatment-related rash or diarrhea of Grade 3 or higher. At the same time, 82% and 36% of patients had treatment-related rash and diarrhea of Grade 1 or 2 severity. These adverse events are treatable with conventional supportive care and are not critical to the health of the patient. The table below provides details of adverse events that have occurred in the ongoing clinical study.

CLN-081 ASCO Data Update Presentation

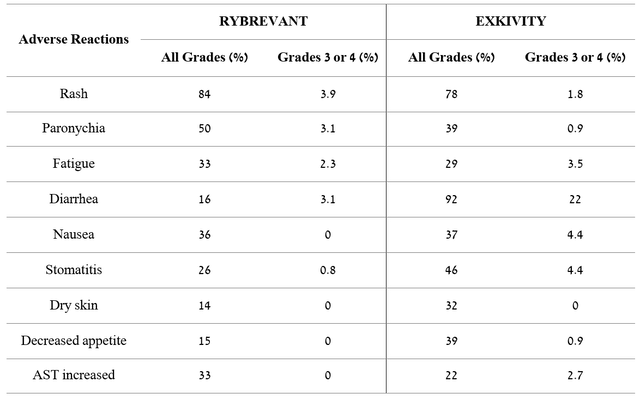

Comparing the adverse events of CLN-081 with those that occurred in phase 3 clinical trials of the FDA-approved two drugs, namely Johnson & Johnson’s (JNJ) Rybrevant (amivantamab-vmjw) and Takeda’s Exkivity (mobocertinib), it can be seen that Cullinan Oncology’s product candidate has a more favorable safety profile and tolerability, which is a significant advantage over competitors.

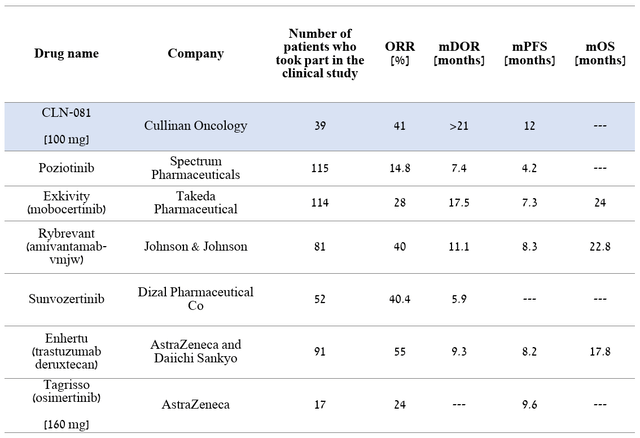

Source: Author’s elaboration, based on quarterly securities reports

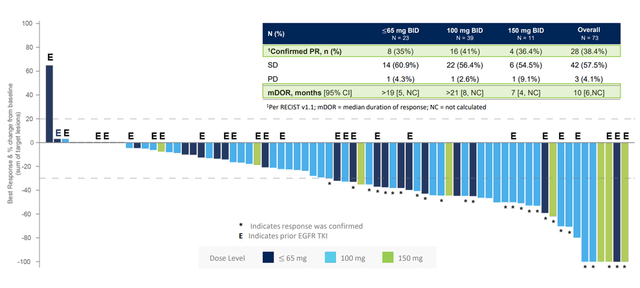

In early June 2022, Cullinan Oncology published positive results from an ongoing phase 1/2a clinical trial that, in addition to evaluating the safety profile of CLN-081, also evaluated its efficacy. Among 73 patients treated at all dose levels, 38% achieved a confirmed partial response, i.e., at least a 30% reduction in the sum of the diameters of the target lesions, relative to baseline values, and in 58% of patients the disease stabilized in according to RECIST guidelines. A higher level of efficacy was shown in a group of 39 patients with a dose of the medicine equal to 100 mg twice a day, as 41% of the participants had a confirmed partial response, and the estimated median duration of response exceeded 21 months. And one of the most important parameters, namely the median progression-free survival, was 12 months, which significantly exceeds the data on the effectiveness of already approved drugs.

CLN-081 ASCO Data Update Presentation

The swimmer’s chart, which is a descriptive way to demonstrate the patient’s response to CLN-081 treatment over time, is shown below and also indicates that the optimal dose of CLN-081 is 100mg twice daily.

CLN-081 ASCO Data Update Presentation

Comparing CLN-081 with other medicines, the company’s product candidate currently has one of the highest efficacy rates relative to competitors. As a result, the FDA awarded CLN-081 breakthrough therapy status, which once again indicates its ability to demonstrate an improvement in clinically significant endpoints compared to current treatments for a deadly disease.

Author’s elaboration, based on quarterly securities reports

CLN-049 is the company’s second key product candidate

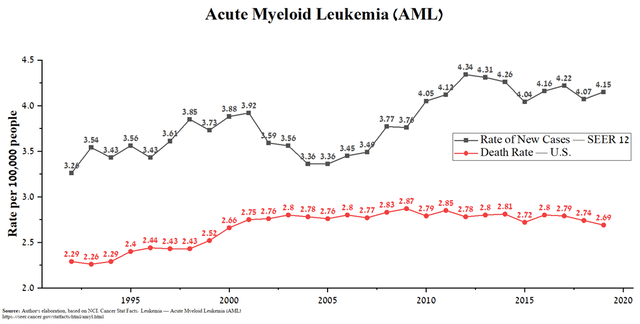

CLN-049 is the company’s second product candidate, a humanized bispecific antibody that has been developed for the treatment of acute myeloid leukemia (AML), which affects the blood and bone marrow. In December 2021, the company began a phase 1 clinical trial to evaluate the pharmacokinetics and safety of CLN-049, with the first results expected in mid-2023. According to the National Cancer Institute, 20,050 new cases of AML and approximately 11,540 deaths from this disease are expected in the US in 2022.

Source: Author’s elaboration, based on NCI

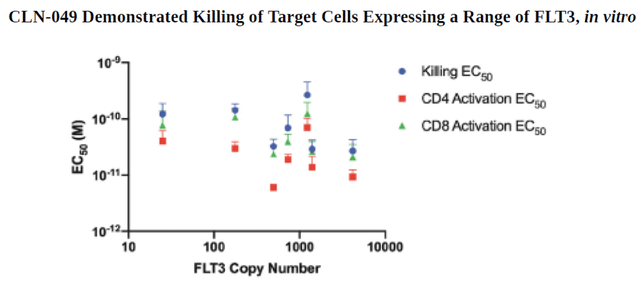

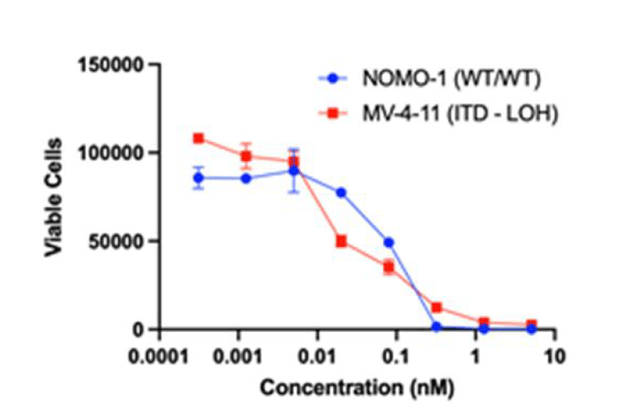

CLN-049 can simultaneously bind FLT3 on the extracellular domain of target leukemic cells with CD3 on T cells and thereby destroy the target cancer cells responsible for the development of the deadly disease. The company estimates that Cullinan Oncology’s product candidate has the potential to affect about 80% of AML patients, thereby providing an opportunity to treat a large group of people and increasing the chances of its commercial success if approved by regulatory authorities. One of the first tasks in preclinical studies, which was set for the company’s employees was to determine the killing potential of CLN-049 in numerous cell lines expressing different levels of FLT3. As can be seen in the graph below, the company’s product candidate does this effectively by killing cells in vitro in the AML cell lines analyzed.

In a preclinical study, CLN-049 has been shown to be effective in killing acute myeloid leukemia target cells even at low levels of FLT3 expression, both wild-type, and mutant origin. As a result, this increases the likelihood of achieving a more sustained response in clinical trials, with the potential to treat more subgroups of patients suffering from the disease.

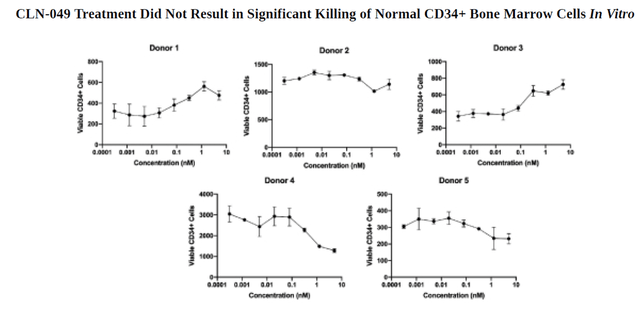

During the use of CLN-049 in vitro, the decrease in CD34+ cells in the bone marrow was insignificant, and thus this indicates that the company’s product candidate retains normal cells and mainly kills FLT3-expressing leukemic cells.

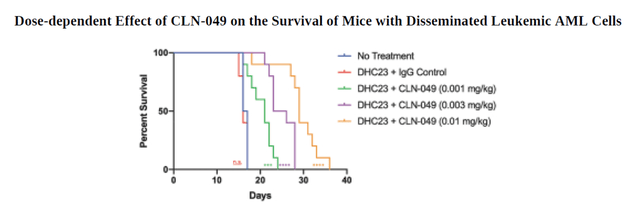

Moreover, in a study conducted on humanized mice implanted with human AML cell lines, CLN-049 increased their survival rate, and this indicator improved with increasing the dose of the drug. This suggests that the company’s product candidate contributed to the destruction of AML target cells, demonstrating the justification for using CLN-049 in clinical trials involving patients suffering from AML.

In addition to Cullinan Oncology, Amgen (NASDAQ:AMGN) is evaluating the efficacy and safety of AMG 427 in a phase 1 clinical trial, which, like CLN-049, is a FLT3/CD3 bispecific antibody. And while clinical data on CLN-049 is not yet available, the fact that Cullinan Oncology is moving in the same direction as a major pharmaceutical giant increases the likelihood of positive results from this program.

Conclusion

Cullinan Oncology is a biopharmaceutical company developing eight next-generation product candidates targeted at treating patients suffering from diseases such as B-cell acute lymphoblastic leukemia, non-small cell lung cancer, relapsed/refractory acute myeloid leukemia, and advanced tumors. Cullinan Oncology’s management continues to pursue a business model that includes both self-development of product candidates and partnerships with pharmaceutical industry leaders to reduce R&D spending and strengthen the company’s balance sheet. Given the results of the phase 1/2 clinical trial in which CLN-081 continues to show excellent efficacy and safety data in the treatment of NSCLC patients with EGFR exon 20 insertion mutations, an extensive pipeline, high level of cash and short-term investments that exceed the company’s current capitalization, then Cullinan Oncology can be a great choice for long term investors. However, given high US inflation, against which the Fed has not shown convincing progress, I expect the company’s stock to correct to $11/share, followed by an increase to my target price of $20/share.

Be the first to comment