Diy13/iStock via Getty Images

Introduction: Why Is Philip Morris Stock Down?

Philip Morris International Inc. (NYSE:PM) released Q3 2022 results on Thursday (October 20), announced an agreement to retake U.S. IQOS rights from Altria (MO), and raised its bid for Swedish Match (OTCPK:SWMAY) (referred here as “SWMA”). Both Philip Morris and Altria shares finished the day down, by 1.7% and 2.5% respectively.

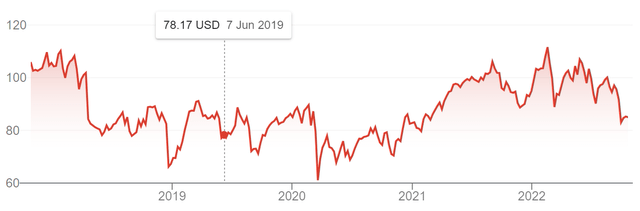

We initiated our Buy rating on PM in June 2019. Since then, shares have gained 30% (including dividends), though the share price has fallen 24% from the mid-February peak that it reached just before Russia invaded Ukraine:

|

PM Share Price (Last 5 Years)  Source: Google Finance (20-Oct-22). |

PM’s Q3 results showed stable volume trends and good pricing power, with IQOS continuing to dominate the Heat Not Burn category worldwide. EBIT margin shrunk slightly, partly because of temporary costs in rolling out the new IQOS ILUMA. 2022 outlook has been kept largely unchanged. However, the costs of PM’s re-entry into the U.S. market appears to have risen significantly, with PM agreeing to pay Altria $2.7bn to regain U.S. IQOS rights, raising its SWMA bid by 9% to a “best and final price”, and intending to build its own U.S. platform should the bid fail (as seems likely).

We believe Philip Morris will still be able to achieve a 9%+ EPS CAGR over time, regardless of the outcome in the U.S. PM shares are currently at 16x 2022 Pro Forma Adjusted EPS and offer a 6.0% Dividend Yield. Our forecasts indicate a total return of 57% (16.6% annualized), highly attractive in our view. Buy.

Philip Morris Buy Case Recap

PM combines a strong cigarettes business and a broad-based and growing Reduced Risk Products (“RRP”) franchise.

We expect PM’s cigarettes business to be stable, except where cannibalized by its own RRPs.

We also expect PM’s IQOS to continue its dominance of the Heat-Not-Burn (“HNB”) category, by far the largest RRP category globally for existing tobacco companies. PM has also launched proprietary e-vapor products in 2020, and has entered the nicotine pouch market with its own products on a limited scale.

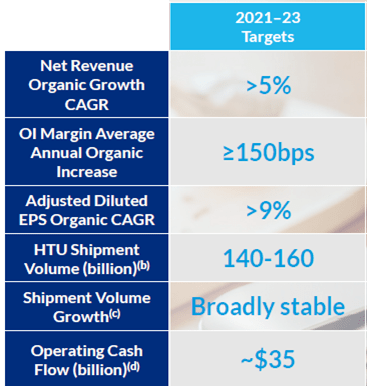

We believe PM can grow its Adjusted EPS at a CAGR of 9%+. Historically, PM targeted an (ex-currency) Adjusted EPS CAGR of 8-10%. 2021-23 targets, announced at the February 2021 investor day, include a revenue CAGR of at least 5%, an average annual EBIT margin uplift of 150 bps or more, and an EPS CAGR of at least 9% (excluding currency):

|

PM Medium-Term Financial Targets  Source: PM investor day presentation (Feb-21). |

With the loss of earnings from Russia and Ukraine following the conflict there, PM now expects to achieve the same 2021-23 growth rates but on rebased earnings that exclude these countries.

PM launched an offer in May 2022 to acquire Swedish Match, and the offer was recommended by the SWMA board. Swedish Match is predominantly an oral tobacco provider, selling snus, moist snuff as well as nicotine pouches. Two thirds of its sales are in the U.S., where its sells the category-leading ZYN nicotine pouch, mass market cigars (about 25% of group sales) as well as moist snuff and chewing tobacco. This original offer was opposed by key investors, and we had expected it to fail.

Q3 2022 results showed PM’s operational performance has continued in line with our investment case.

Philip Morris Q3 Results Headlines

PM’s Q3 2022 results showed stable volume trends and good pricing power, though its EBIT margin shrunk slightly.

|

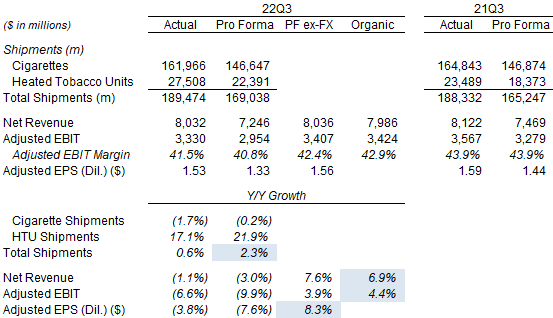

PM Key Volumes & Financials (Q3 2022 vs. Prior Year)  Source: PM results release (Q3 2022). |

Year-on-year comparisons are distorted by the exclusion of earnings from Russia and Ukraine in 2022 (with the Russian business to be divested), acquisitions (of Vectura and Fertin Pharma in 2021) and currency. Management’s preferred “Pro Forma Adjusted” figures (highlighted in blue above) exclude all of these factors.

On “Pro Forma Adjusted” figures, PM’s total shipment grew 2.3% year-on-year in Q3, with its cigarette volume being flat-ish (down 0.2%) and Heated Tobacco Units (“HTU”) volume growing 21.9%; Total Net Revenues grew 6.9%, driven by a positive mix shift towards HTU and good combustible pricing (4.9% as of Q3); Adjusted EBIT grew 4.4%, less than revenues, with Adjusted EBIT margin shrinking 100 bps organically; Adjusted EPS grew 8.3%, more than EBIT, thanks to a lower interest expense, financial leverage as well as a 0.5% reduction in the share count.

Including currency (the “Pro Forma” column), Net Revenues fell 3.0%, Adjusted EBIT fell 9.9% and Adjusted EPS fell 7.6% year-on-year, due to the strong USD. Including Russia and Ukraine (the “Actual” column), Adjusted EPS only fell 3.8%, as Adjusted EPS attributable to the two countries grew by a third (from $0.15 to $0.20).

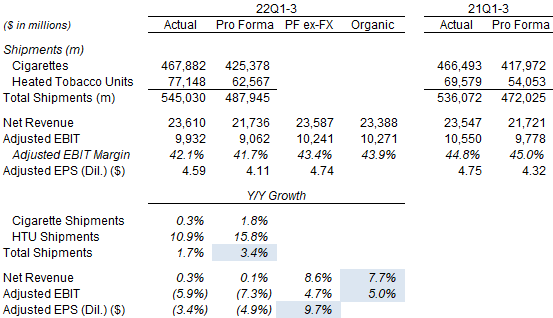

The picture for PM’s year-to-date results is similar, with “Pro Forma Adjusted” total volume growing 3.4%, Net Revenues growing 7.7%, Adjusted EBIT growing 5.0% and Adjusted EPS growing 9.7%:

|

PM Key Volumes & Financials (Q3 YTD 2022 vs. Prior Year)  Source: PM results release (Q3 2022). NB. Net Revenues exclude $246m Saudi Custom Assessment impact in Q2 2021. |

Even including both currency and the exclusion of Russia/Ukraine earnings (the “Actual” column), one-off headwinds that do not reflect operational performance, PM’s year-to-date Adjusted EPS has fallen by just 3.4% – an example of PM’s underlying earnings power, given the magnitude of the one-off headwinds.

Philip Morris’ Temporary Cost Headwinds

PM is well-placed to deal with cost inflation, with its recent EBIT margin shrinkage partly the result of temporary cost headwinds related to the roll-out of new IQOS ILUMA products.

Inflation in PM’s Costs of Goods “remained mid-single-digit” in Q3, not far from the 4.9% pro forma pricing achieved for combustibles in the same quarter. While it is possible that PM’s cost inflation will rise to the same high-single-digits seen currently in general inflation in many countries, management is confident that it can “react with price increase”.

Part of the margin shrinkage in Q3 was also due to one-off factors, as CFO Emmanuel Babeau explained on the call:

As previously communicated, (the operating margin decline) reflects the recovery in (lower-margin) device volumes, the investments in launching ILUMA including initially higher unit costs, the impact of supply chain disruption notably due to the war in Ukraine and increasing global inflationary pressures”

The use of air freight to overcome supply chain disruption alone is expected to cost $300m (it already cost $80m in Q2), approximately 90bps in full-year Adjusted EBIT margin. This is clearly temporary.

Management still expects relative stability in full-year 2022 Adjusted EBIT margin, from flat to down 50 bps (was flat to up 50 bps), including a rebound in Q4 (though smaller than before and partly due to prior-year investments).

IQOS’s Continuing Dominance

PM’s IQOS is continuing to dominate the Heat Not Burn category worldwide.

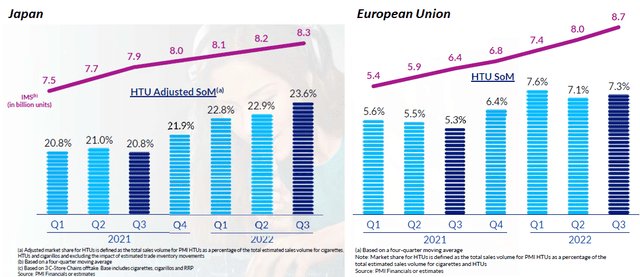

PM’s reported HTU shipment volumes were up 21.9% in Q3 and 15.8% year-to-date, while its In-Market Sales (“IMS”) volume showed a more consistent growth of 18.2% in Q3 and 19.2 year-to-date. Management reported that IQOS’ share of the HNB category “has remained stable since the start of the year at around 75% and grew sequentially in the third quarter”. IQOS HTU grew both its IMS volume and share of the tobacco market sequentially in Japan and the European Union, the share growth a particular achievement given the seasonality that historically meant weaker Q3 shares.

|

PM HTU Share of Tobacco Market & Volume –Japan & the E.U.  Source: PM results presentation (Q3 2022). |

The new ILUMA device is credited with driving strong growth in Japan, Spain and Switzerland, and ILUMA was also launched in Greece in June and in Portugal in October.

IQOS is also making progress in Low & Middle-Income Markets, where it had $2.5bn in IMS volume and 2.8% of the tobacco market in Q3. A new HNB device, with a simpler and more affordable proposition “especially relevant” to these markets, is expected to see city launches in Columbia and the Philippines in Q4.

In e-vapor, there were no updates on either VEEV, the closed system device present in 10 markets as of Q2, or on VEEBA, the new disposable product launched in Canada in Q2.

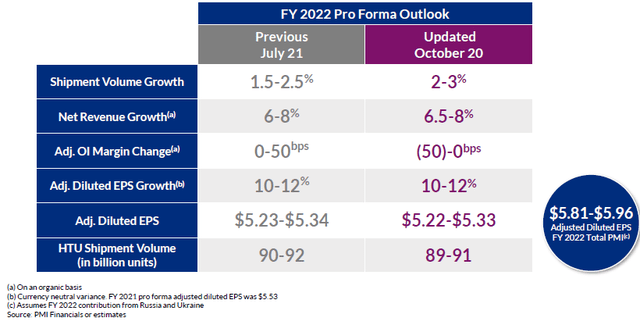

2022 Outlook Largely Unchanged

PM’s full-year 2022 outlook has been kept largely unchanged, with Adjusted Pro Forma EPS at $5.22-5.33, one cent lower due to currency, while ex-currency Adjusted Pro Forma EPS growth is unchanged at 10-12%:

|

PM 2022 Outlook (New vs. Previous)  Source: PM results presentation (Q3 2022). |

Total volume growth has been raised slightly (from 1.5-2.5% to 2-3%) while HTU volume has been reduced slightly (from 90-92bn to 89-91bn). Net Revenue growth has been raised slightly at the low-end (from 6-8% to 6.5-8%), while Adjusted EBIT margin outlook is slightly worse (from “flat to up 50 bps” to “flat to down 50 bps”).

PM’s Rising U.S. Entry Costs

The most significant announcements on October 20 were related to PM’s plans to re-enter the U.S. market, including:

- PM to pay Altria $2.7bn to regain the U.S. rights to IQOS after April 2024

- PM making a SEK 116 “best and final” offer for SWMA, from SEK 106 before

- PM to build its own U.S. sales & distribution if its SWMA bid were to fail

Together these steps represent a serious plan by PM to tap into the U.S. tobacco profit pool, with IQOS as the leading product. As CFO Emmanuel Babeau stated on the call:

We have ambitious plans for the full-scale launch and rapid expansion of IQOS in the U.S. market … We see IQOS as the primary vector for establishing a leadership position in the U.S. smoke-free industry and it will be followed by the other products in our smoke-free portfolio.”

PM estimates the size of the U.S. tobacco profit pool as $20bn, and expects IQOS to take a 10% volume share in U.S. cigarettes and Heat Not Burn by 2030.

The agreement with Altria guarantees PM will be able to sell IQOS in the US itself after April 2024, ending a previous dispute on whether Altria could renew its license until 2029, at the cost of $1.0bn paid immediately and $1.7bn (plus interest) to be paid by July 2023. PM confirmed on the call that US IQOS sales are still expected to resume in H1 2023 with domestic production to circumvent the current ITC import ban (and PM’s job listings show they are actively hiring for manufacturing jobs in North Carolina). PM also plans to file a PMTA (Premarket Tobacco Product Application) with the U.S. FDA for ILUMA in H2 2023, and stated that ILUMA will not be affected by the current ITC, being “in a completely different path”. In any case PM stated it has been winning patent cases against British American Tobacco (BTI), whose claims instigated the ITC ban, including the invalidation of “one of the family of patents” they used.

The ”best and final” offer for SWMA represents a 9% raise from the original bid. PM stated that it “will not further increase the price” and, under Swedish takeover law, it is now legally prohibited from doing so. We do not believe even the higher offer will attract the 90% shareholder acceptance that it needs, though much will depend on activist investor Elliott Management with its 7.25% stake. PM may decide to waive the 90% acceptance threshold, but this would prevent a squeeze-out of non-accepting shareholders and complicate any use of SWMA’s platform to sell IQOS. We believe the most likely outcome is that PM ultimately walks away from SWMA. (The current acceptance deadline is November 4)

PM intends to build its own U.S. sales and distribution for IQOS if its SWMA bid were to fail. To quote their CFO again:

In the case of failure we have a clear path forward for IQOS and the rest of our smoke-free portfolio. Indeed, the most critical parts of the IQOS commercial model center on converting adult smokers, rather than distribution. In addition, the U.S. has an established distribution and retail landscape, with a clear route-to-market. We therefore also have concrete plans to proceed autonomously in building fully controlled and managed U.S. sales and distribution capabilities over the next 18 months leading up to April 2024”

During the Q&A session, CEO Olczak acknowledged that such an effort would involve losses “in the initial years” and that an analyst’s speculated figure of “a few hundred million dollars of losses in the first few years” is “directionally” right.

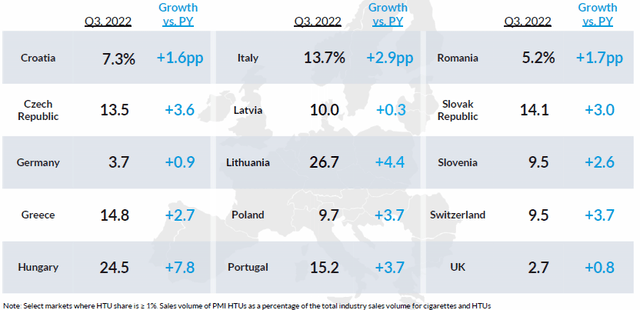

We believe PM will succeed in building a significant IQOS business in the U.S. The success of IQOS so far, including in multiple countries with different local tastes and market characteristics, provides strong evidence for this:

|

PM HTU Offtake Share in Selected E.U. Countries (Q3 2022)  Source: PM results presentation (Q3 2022). NB. The U.K. is reported in PM’s E.U. region. |

However, IQOS’ trajectory in the U.S. may not be a smooth one, just as it was not in its first scaled market in Japan. The costs of building a new U.S. platform may put pressure on PM earnings in the near term, especially when coinciding with a strong U.S. dollar, a potential recession in Europe, and macro weakness in Emerging Markets.

Philip Morris Valuation

At $85.03, PM stock is trading at 15.4x 2021 Pro Forma Adjusted EPS ($5.53). Relative to the mid-point of its 2022 Pro Forma Adjusted EPS outlook ($5.22-5.33), the P/E is 16.1x.

The dividend is $5.08 ($1.27 per quarter), representing a 6.0% Dividend Yield. The dividend was raised by just 1.6% in September. The implied Payout Ratio, relative to the mid-point of guided 2022 Pro forma Adjusted EPS, is 96%, but expected to return to PM’s 75% target over time as EPS grows.

Relative to 2022 cashflow guidance ($10.5bn Operating Cash Flow and $1bn CapEx), PM stock is at a Free Cash Flow Yield of 7.2%.

Net Debt / EBITDA was 1.58x at the end of Q3 2022. Share buybacks have been suspended after the announcement of the SWMA offer in May.

Adjusted for the $2.7bn cost of the new agreement with Altria, Net Debt / EBITDA would be a still low 1.77x. The interest expense associated with the $2.7bn is not material relative to PM’s last-twelve-month Adjusted EBIT of $13.3bn.

The original SWMA bid would have given PM a pro forma Net Debt / EBITDA of “around 3x” and is expected to be EPS accretive from year 1 before synergies. Because USD/SEK has risen by 13% since the original offer, the 9% increase in the SEK offer price means the dollar value of the offer has not changed materially; however, with the USD rising against all currencies in the same period (including by 8% against the Euro), the dollar value of PM’s entirely non-U.S. earnings has shrunk, which means the higher bid would still be worse for PM’s leverage ratios. Including the 0.2x increase from the payment to Altria, we believe PM’s pro forma Net Debt / EBITDA with SWMA may be closer to 3.5x.

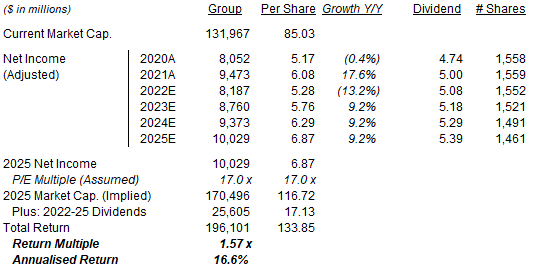

Philip Morris Stock Forecasts

While our base case is that PM will walk away from SWMA and build its own U.S. platform, we expect management to still target a “more than 9%” organic Adjusted EPS CAGR, as it did for 2021-23.

We are maintaining our PM forecasts on a standalone basis for now, except two small changes in 2022:

- 2022 EPS of $5.28 (was $5.29)

- From 2023, Net Income grows at 7.0% annually

- Share count to be 1,552m in 2022

- Share count to fall by 2% annually from 2023

- 2022 dividend of $5.08 (was $5.00)

- From 2023, dividends to grow 2% annually, so the Payout Ratio falls to 77% by 2025

- P/E at 17.0x at 2025 year-end

Our new 2025 EPS is virtually unchanged from before ($6.88):

|

Illustrative PM Return Forecasts  Source: Librarian Capital estimates. |

With shares at $85.03, we expect an exit price of $117 and a total return of 57% (16.6% annualized) by 2025 year-end.

Should PM successfully complete the Swedish Match acquisition, we expect to increase our forecasts significantly.

Is Philip Morris Stock A Buy? Conclusion

We reiterate our Buy rating for Philip Morris stock.

Be the first to comment