Dan Kitwood

When I was very young – before I started kindergarten – my family lived next door to another family with some kids my age, and we became fast friends for a while, and even kept in touch for a time after both families moved to different neighborhoods. I didn’t really think about it as a preschooler, but my childhood friend’s mother got around with the aid of a walker. At the time, I simply assumed she was older than my own mother, just a child’s perspective, but as I got older, my own mother explained to me that she had multiple sclerosis, a disease that could make it difficult for her to walk. It has been decades since I would have seen her, so I have no idea how her health is today, but she was the first person I thought of when I read about Ekso Bionics (NASDAQ:EKSO) getting the FDA clearance for the use of its EksoNR exoskeleton for therapeutic treatment of people with MS.

I have not chimed in with any update on the nano cap med-tech company Ekso Bionics since I last wrote about it near the end of January, and there are definitely sufficient changes to merit taking a fresh look. To layout a quick sketch, Ekso Bionics is an American designer of robotic exoskeleton suits that are used primarily in a rehabilitation setting to help qualified patients be able to walk better. The FDA has approved the company’s primary product, the EksoNR, for use with patients having suffered spinal cord injury, brain injury, and now the multiple sclerosis indication as well. Ekso Bionics also has smaller division, supplying an enhanced vest for those doing physical labor in which they must keep their arms elevated. The vest is intended to help prevent injury to the workers from fatigue or strain.

Update on Developments at Ekso Bionics

The additional FDA approval for multiple sclerosis is a significant expansion from the original approval for spinal cord injury granted in 2016, and the approval for brain injury given in 2020. The opportunity here is considerable, as multiple sclerosis affects around 1 million patients in the United States, many of whom live with the slow degeneration that can accompany the disease over a span of decades. Physical therapy can be part of the ongoing treatment over that span, attempting to keep the body from succumbing any faster. For Ekso Bionics, I expect that in a short amount of time any marginal cost associated with sales efforts on the MS indication will be outweighed by the sales results.

The other change is the growing evidence that the sales approach flexibility is bearing some fruit. Prior to late 2020, sales of the EksoNR to rehab facilities were essentially capital purchases, which was sometimes an impediment to sales given a fairly stiff price tag for an exoskeleton. When Ekso Bionics began offering the devices either as a capital purchase or on subscription, it was not clear if that strategy would make a major difference in improving overall sales volumes, and the answer seems to be emerging that it does help. For evidence, Q2 of 2022 the company placed 17 units, broken down as 5 subscription and 12 capital purchases, enough of a mix to be worthwhile, and there are several quarters now with similar metrics to support the change.

If there has been one area that has failed to grow again as hoped, it is the Ekso Works division, with its EVO upper-body support vest. This product line, intended to assist people whose jobs may require keeping their arms elevated for extended periods, would seem to have all sorts of advantages for Ekso Bionics. The EVO is not a medical product, so it has lower regulatory hurdles; its use cases and benefits are pretty clear, and it is not as complex or expensive a machine as the EksoNR. Yet whether it has been under-resourced in terms of getting an internal focus on sales growth or for some other unknown set of reasons, the EVO still lingers around 10% of the overall revenue picture.

Finally, it is certainly worth noting that 2022 has brought considerable turnover in C-suite level positions at Ekso. Jack Peurach, the previous CEO, left the firm in January, followed by William Shaw, the chief commercial officer in March, and lastly John F Glenn, the CFO, left in June. I cannot evaluate another person’s motives for leaving, but I don’t think it is either a good look or a helpful to the stability of the company. In Ekso’s case, board member and previous board chair Steven Sherman has taken the reigns as CEO, and Jerome Wong received an interim appointment as CFO. From what I can see on the company’s website today, there is nobody listed as a chief commercial officer.

Overview of recent results

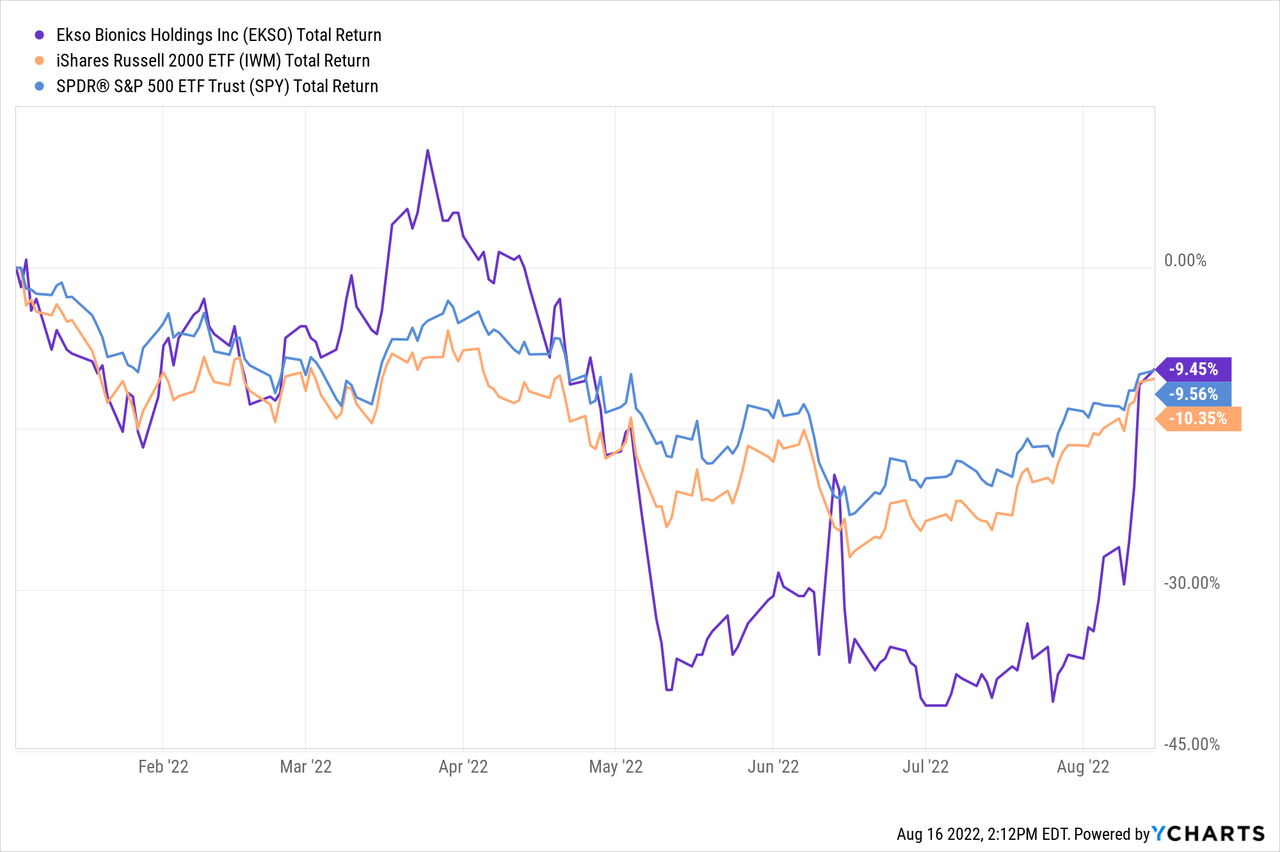

One of the more remarkable things about Ekso’s share price YTD has been its fall and recovery, although long-time observers of this company will likely be aware of its volatility. After spiking up in March, then dropping rapidly in May and staying low through most of the summer, shares have now turned back up again in August, and the shares are currently trading in the same range as near the start of the year.

But even if the share price is the same, there are plenty of new developments over the last few quarters, so I will start with a general update.

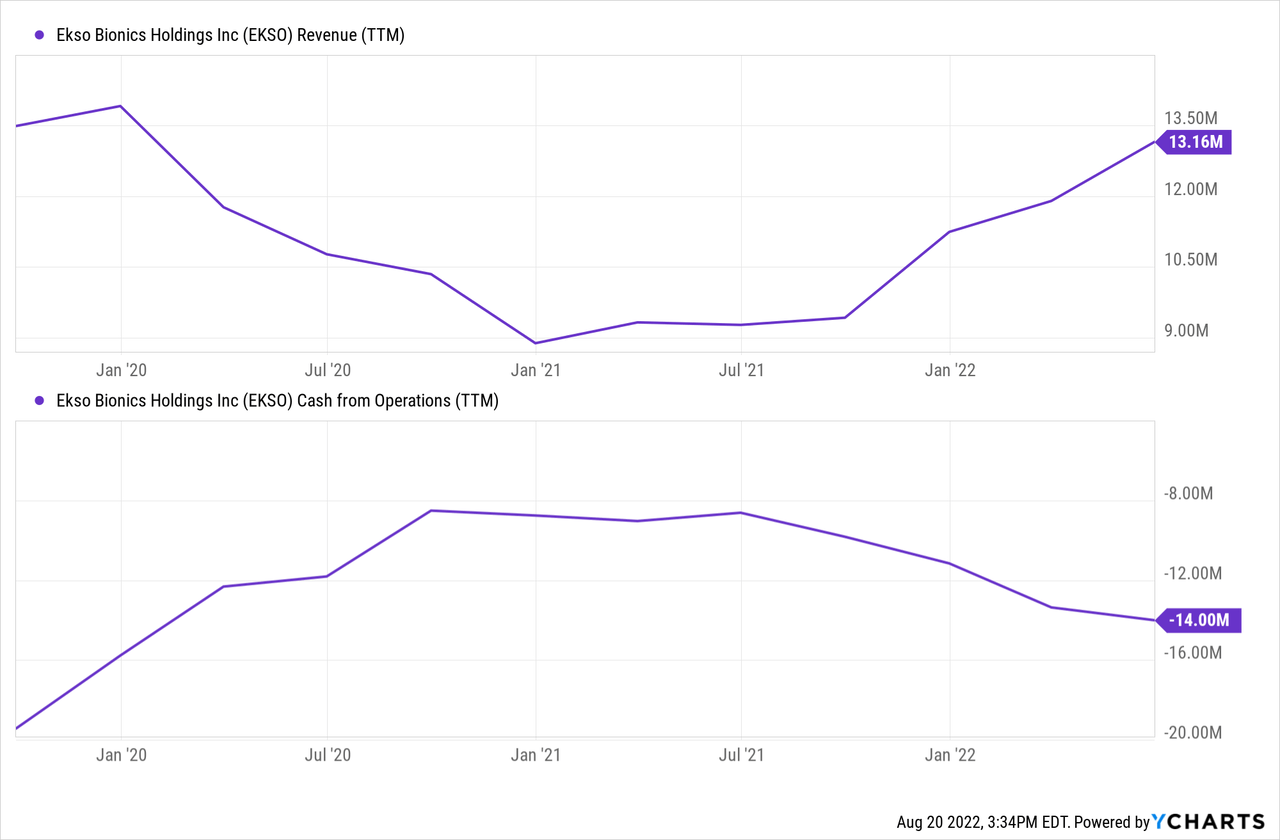

Ekso Bionics reported Q2 earnings on July 28, with clear growth trends in revenue after the difficulties of 2020, although also starting to go through use cash in operations at a higher rate again. For the quarter, sales were a total of $3.5 million, the vast majority of which came from the 17 units of the EksoNR placements at $3.25 million, and about $0.25 million for the EVO, or about 7% of sales. In addition to the sales recognized within the quarter, there is an additional $1.14 million in current deferred revenues from the subscription model sales, and nearly an identical amount in long-term deferred revenue that should flow in over the coming quarters (it won’t really flow to the asset side of the balance sheet, but more or less shift over from liabilities to retained earnings / shareholder equity, all else remaining equal on the asset side of the ledger from the cash received in advance).

With some higher inflationary pressures and supply chain disruptions, the company did pre-order component parts at a higher rate than in previous year, leading to an increase in inventories of $1.0 million compared to year-end of 2021, contributing some to the overall uptick in cash burn from operations.

Having raised $40 million in cash in February 2021 with additional shares issued, the balance sheet health remains relatively solid. Cash burn is continuing, but for the moment there is plenty of runway, with around $30 million net cash as of 6/30/2022 ($32 million cash, $2 million in notes payable). With a cash burn average historically around $3 million per quarter, there’s around 10 quarters of buffer, or more if the cash burn slows down.

Thoughts on Valuation

Estimating a fair value on a company like Ekso Bionics is a challenge due to the high degree of uncertainty as whether or not it will ever become profitable. To my knowledge nobody disputes the value of technology nor its ability to legitimately help people through a recovery process, but shareholders have to separate out those questions from the economic value. So increasingly in this particular industry at this juncture in its development, I have been starting with the cash on hand per share relative to the market price of the shares.

In the case of Ekso Bionics, as it happens, the shares are essentially valued in the market as being equal to the company’s cash on hand per share. With around 13 million shares and $30 million in net cash, the cash per share is on the order of $2.30. With the caveat that as the cash burn continues the market value and cash per share values will likely diverge in the future, as for the moment the market is awarding no present value whatsoever to the operations. One’s opinion on whether or not that is a credible assumption about the future is what ultimately makes a market, but I think there are certain trends worth noting.

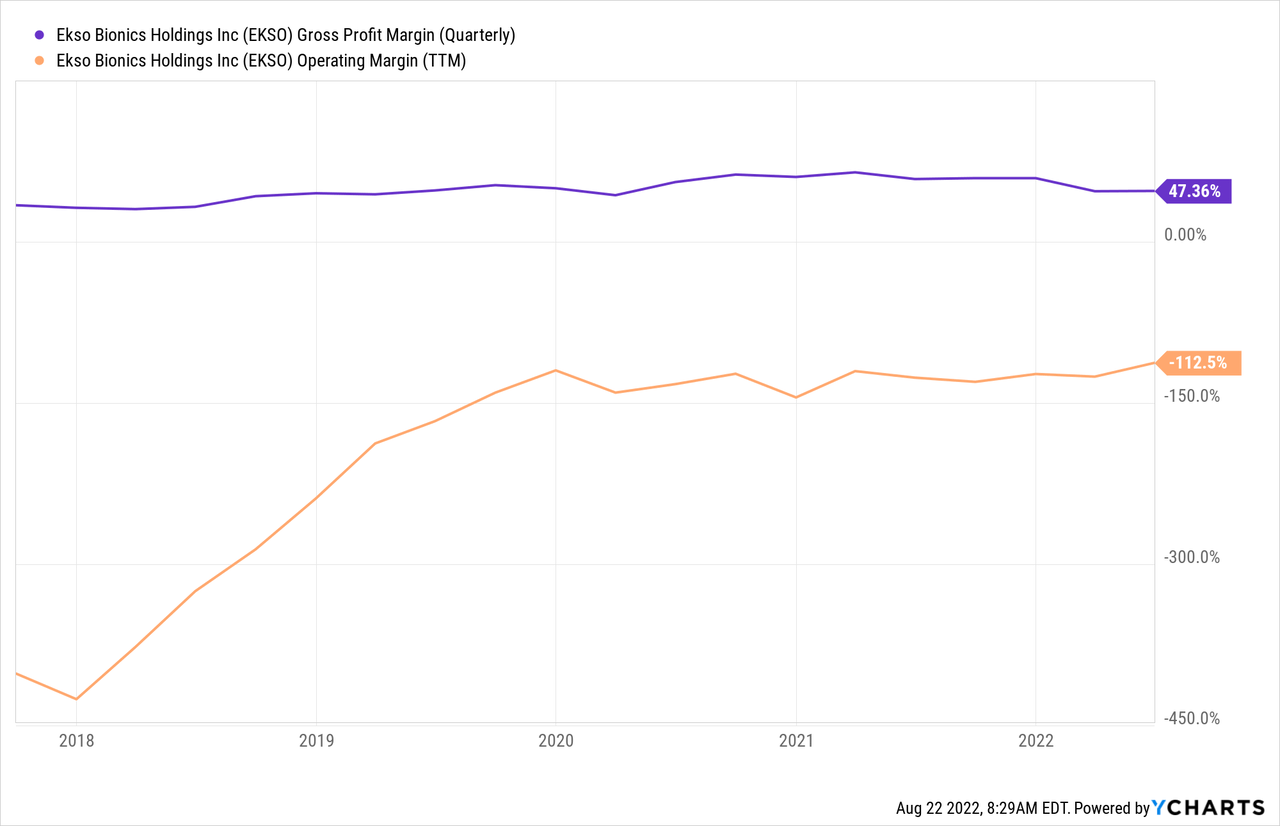

The fundamental unit economics on the company’s products as high-end technology has been quite stable over a durable period, shown in the ~47% gross margin over five years, with minimal variation, and I would not expect to see major improvements there developing quickly. However, the operating margin shows quite a different history over the same period, massively improving (though still negative) between 2018 and 2020, before settling in around -110%. With the onset of Covid-19 around the same time that things started leveling off for operating margin, while the company has certain fixed costs to deal with, I think there is opportunity here to start to see if the trajectory of operating margin can resume its previous course.

Management knows it needs to keep as tight a lid on operating expenses as possible, and there are some signs that it is actively making some adjustments. For example, during Q3 the company is changing its physical location, moving into a more size and cost appropriate headquarters. There was no specific guidance provided or reaffirmed with the Q2 results, but rather management expressed broad confidence for continuing sales growth with multiple unit orders and a strategy to implement for getting the EVO product line unstuck. With much of the operating margin tied to fixed costs that won’t necessarily scale up in a linear relationship with sales, eventually revenue growth could be sufficient to generate enough operating margin to turn profitable.

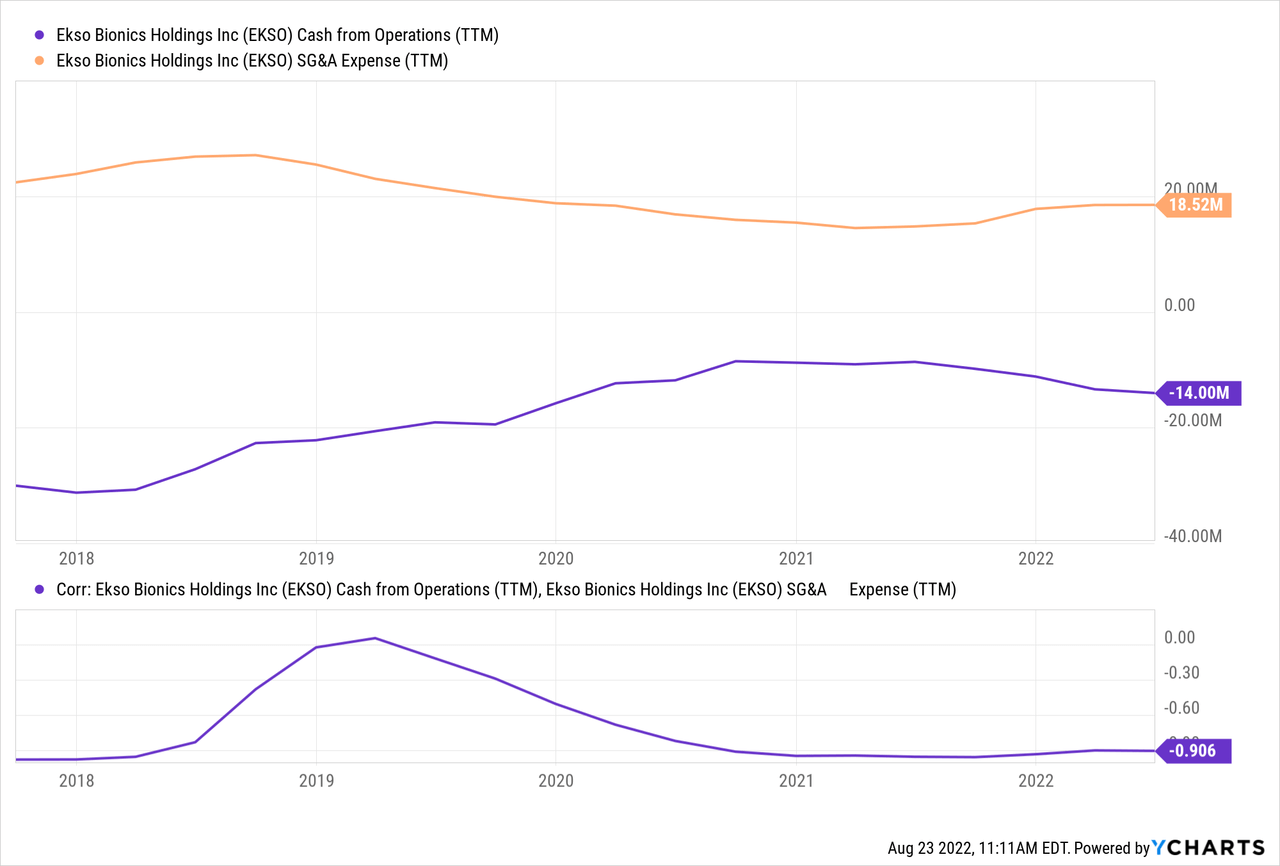

That challenge is a tall order, as SG&A expenses currently cost the company 40% more than revenue alone, with $8.4 million in SG&A compared to $6.0 million in revenue over six months. On the one hand, a portion of these is “non-cash” stock-based compensation to management, on the order of $1 million through the first half of 2022. However, plenty of cash is tied up in operations, as the cash flow statement shows $8.45 million used in operations, in line with the SG&A expenses from the P&L statement, with about a 90% correlation between the two since 2021.

However, I expect there to some synergies in sales efforts related to the MS indication, as any extra cost related to presenting the EksoNR use for treating MS patients is incremental to the existing costs of presenting the units for spinal cord injury and brain injury. While there may well be different medical staff involved it the treatments of the different patient groups even within the same facility, ultimately there is overlap between the facilities that serve these patients, often allowing for a single sales call that covers all three use cases. An analyst specifically picked up on this line of questioning, and COO Scott Davis made sure to answer clearly:

There is crossover. For some patients who have acute spells of [MS], certainly inpatient rehabilitation is an area that they would use it, but this expands our reach into outpatient rehabilitation. We have crossover into outpatient right now, but this is effectively bringing us down the continuum of care into outpatient as well.

Picking up additional sales to account for the MS indication will take some time. I do not necessarily see this making a major impact on revenues for the remainder of 2022, but there could be some benefit, with likely greater clarity on the significance of this starting in 2023. Regardless of the timing, the broader point is that is that for sales happening to account for MS are likely to happen alongside sales that happening for spinal cord and brain injury, lowering the overall cost related to the sales.

Is top-line growth on track again? The first half of 2022 results are showing some promise. H1 sales were up 46%, on a revenue run rate of $12 million for the year. However, that does not account for any H2 potential for incremental sales from the multiple sclerosis indication, or getting the EVO back on track. I’ve previously criticized the lack of clarity on plans for the EVO, and there still isn’t a depth of detail on the plan, but I think management is pushing harder. Scott Davis addressed it this way in his remarks:

We’re making inroads with several large customers with sizable employee head counts who can benefit from significant workplace productivity and safety features that EVO provides. We continue to see demand primarily emerging in the automotive, aerospace and solar energy verticals. Our current strategy is geared towards developing larger customers, which can result in a longer sales cycle like it did this quarter. . . As construction, general manufacturing and green energy ramps up across the country, we remain committed to educating and expanding customer access of EVO to a wider number of industrial verticals.

Though Ekso has previously gotten a bit of a toe-hold with its workplace product line on factory floors for manufacturers like Ford (F) and Boeing (BA), these seem to have been on a small scale trial without leading to major orders. Based on the Mr. Davis’s comments, I take him to mean that Ford, Boeing, and other employers in those industry sectors are still leading candidates for generating sales leads. However, I am mindful that both of these particular firms have their own issues at the moment, with Ford announcing layoffs of 3,000 contract and white-collar employees as it tries to pivot to a sharper focus on electric vehicles. The process of getting in deeper with such clients is understandably a slow one, but with proper support, the EVO could have a promising spurt of growth on the horizon.

One difficulty to recognize here is that the sales costs associated with the EVO may well offset any benefit from the synergies of the MS use case, at least in the short-term. Selling industrial worker vests requires an entirely different pitch than selling machines to rehabilitation facilities.

Conclusion

I have previously considered Ekso Bionics to be a hold at best, either due to concerns over dilution, or not having a clearly defined path for moving forward (or a failure of the management to communicate its strategy). I think that is changing somewhat on both counts – shareholder dilution is off the table for the immediate future unless valuation really jumps, and overall sales are trending back towards the growth line that had been evident before Covid-19. While I do not see a break-even point happening anytime over the next two years, at this stage in the company’s evolution, it is more about re-establishing the clear trend again of growing sales at a rate faster than the rise in SG&A / use of cash in operations. With other recent positive developments, I am shifting to consider Ekso Bionics as a suitable speculative buy on overall growth prospects not being fully factored into its current valuation.

Be the first to comment