vchal

For years, patients with transthyretin amyloidosis (ATTR) have had limited treatment options. ATTR is a rare genetic disease where a mutation in the TTR gene causes the liver to produce a misfolded protein called transthyretin, which can build up in body tissues resulting in polyneuropathy and cardiomyopathy. Today, there are multiple companies developing revolutionary treatments that hold the potential to drastically improve the quality of life for these patients. In this article, I’ll highlight the race between Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY) and Intellia Therapeutics, Inc. (NASDAQ:NTLA) to develop the gold-standard in care.

Alnylam’s Success

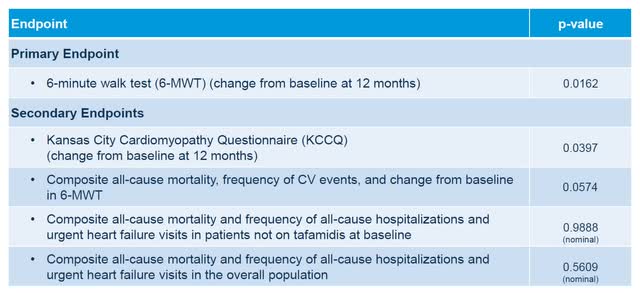

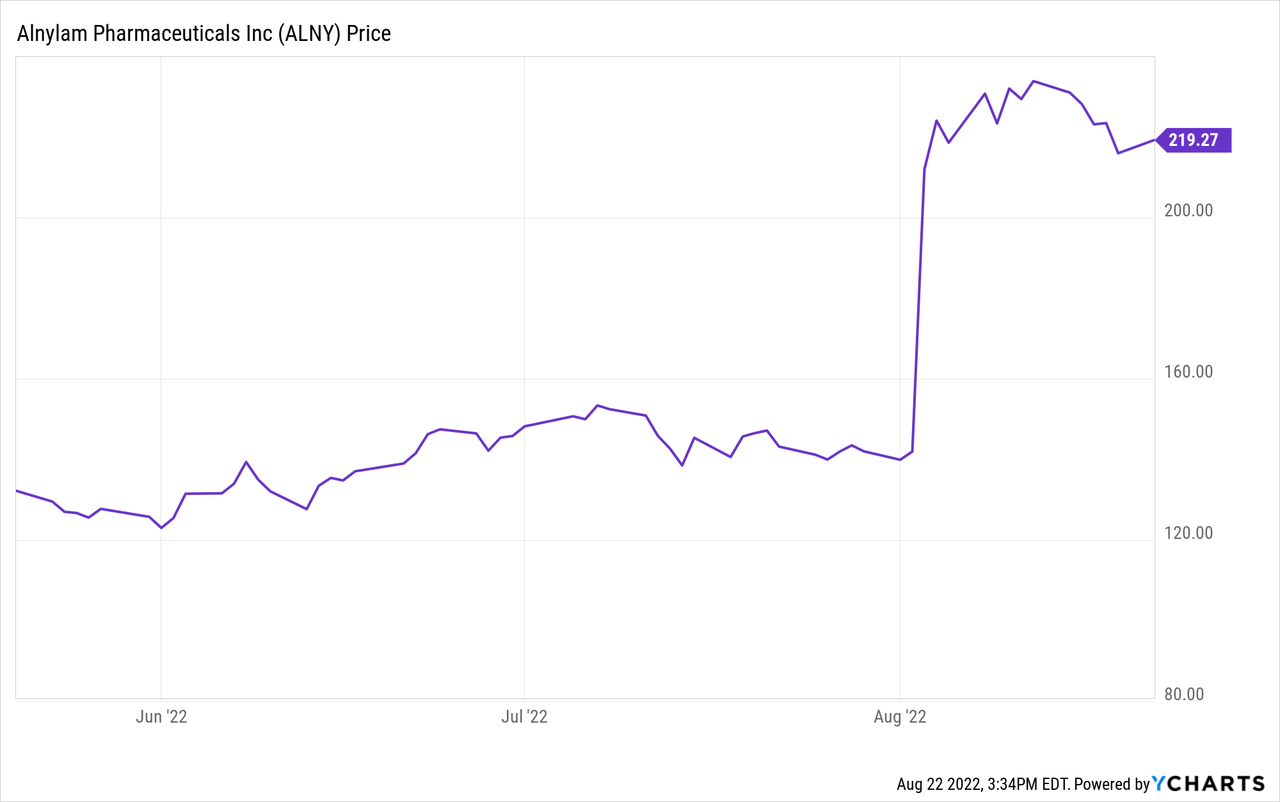

On August 3, 2022, Alnylam Pharmaceuticals reported positive topline results from its much anticipated APOLLO-B Phase 3 trial of patisiran in patients with cardiomyopathy. While patisiran has already been approved for patients with hereditary ATTR with polyneuropathy and has been wildly successful with nearly $550 million in trailing 12-month sales, the biggest potential market is in ATTR patients with cardiomyopathy. The company reported the APOLLO-B trial met its primary endpoint with a statistically meaningful improvement in the 6-minute walk test compared to placebo at 12 months. The trial also met its first secondary endpoint in quality of life as tested by the Kansas City Cardiomyopathy questionnaire, compared to placebo at 12 months.

The market rewarded Alnylam with a roughly 50% appreciation in the stock price, which added around $10 billion to its market cap. While the full set of data (including TTR knockdown) from the phase 3 trial is expected to be presented at the 18th International Symposium on Amyloidosis on September 8, 2022, the company has already presented quite a bit of data from its HELIOS-A trial treating polyneuropathy patients. Alnylam has developed 2 separate RNAi therapeutics to treat ATTR with the 1st generation drug, patisiran, and the 2nd generation formulation, vutrisiran. Both RNAi therapies work by silencing TTR gene expression, which directly reduces the circulating TTR protein.

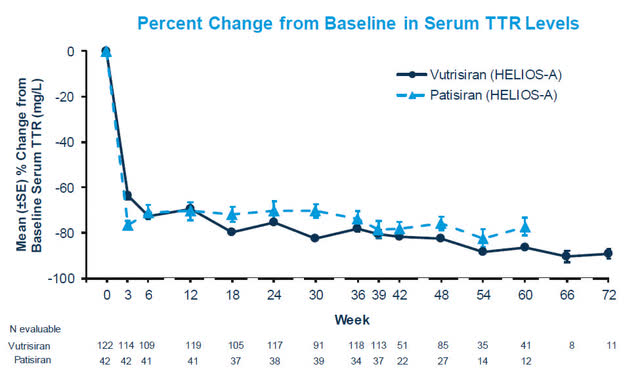

Patisiran TTR Knockdown (HELIOS-A Phase 3 Results)

As you can see from HELIOS-A trial, both patisiran and vutrisiran results in an impressive TTR knockdown, which is sustained well past the one-year mark. The reduction in the misfolded TTR protein reduces and helps prevent additional amyloid build-up in body tissue. This study proved that reducing the circulating TTR results in significantly improved clinical outcomes. While we’ll have to wait until early September to get the official TTR knockdown from cardiomyopathy patients in the APOLLO-B trial, it’s a logical assumption it will be very similar to the HELIOS-B (patisiran) data above given the large number of patients dosed.

The TTR knockdown is especially important in cardiomyopathy patients, because this misfolded TTR protein continues to accumulate in the heart which manifest as heart failure and is often not diagnosed until the patient is presenting with advanced stages of heart failure. Alnylam proved with APOLLO-B that patisiran can successfully treat and improve the lives of these patients with cardiomyopathy. However, Intellia is also pursuing ATTR and should be presenting their phase 1 data in cardiomyopathy within the next few months.

Intellia

Intellia takes a slightly different approach than Alnylam to treat ATTR. Intellia uses a lipid nanoparticle (LNP) as a delivery mechanism to “knockout” the TTR gene with CRISPR/Cas9 and therefore eliminate the toxic protein production from circulation. The company has released impressive, albeit, early data in patients with polyneuropathy.

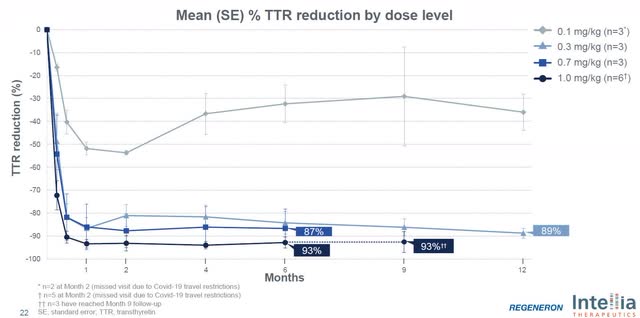

Intellia NTLA-2001 Knockdown (Corporate Overview August 2022)

Intellia has shown their NTLA-2001 therapy results in a rapid and deep reduction in TTR at day 28 and is sustained out to 12 months at the second lowest dose. Here is where Intellia may be able to outperform Alnylam. Alnylam’s patisiran shows an initial steep TTR drop off but the TTR knockdown fluctuates in the 70-80% range until around 9 months, when it then starts to see a steady knockdown around 80%. Even 2nd generation therapy, vutrisiran, doesn’t see a sustained reduction below 80% until week 36. Now, Alnylam has shown that its treatment does, in fact, significantly improve patient outcomes, but the question Intellia hopes to answer is whether a deeper and more rapid reduction provides additional benefit. Remember, this misfolded circulating TTR protein can continue to build-up or hinder amyloid clearance. Intellia management believes this rapid reduction could be key in treating patients with cardiomyopathy since it is a progressively debilitating and fatal disease.

In the APOLLO-B data, Alnylam didn’t meet a secondary endpoint (p-value 0.0574) of composite all-cause mortality, frequency of cardiovascular events and change from baseline in the 6-minute walk test. Alnylam management believes it will likely meet this endpoint as the study progresses past 12 months, but it does open a lane for Intellia to potentially show its rapid and deeper TTR reduction provides better clinical outcomes, especially in cardiomyopathy.

Intellia’s Path Forward

On the most recent conference call, the company announced all patients in the cardiomyopathy phase 1 arm have been dosed and they’ve selected a fixed dose based on the 0.7mg/kg data they’ve seen. In addition, the company also disclosed that cardiomyopathy patients dosed at 0.7mg/kg and 1.0mg/kg have resulted in nearly indistinguishable TTR knockdown levels. The company pointed out if the one outlier, who had less than 80% knockdown, in the 0.7mg/kg polyneuropathy arm was removed that TTR knockdown was over 90% at that level and that has been consistent to what they’ve seen in the cardiomyopathy arm. Importantly, the cardiomyopathy arm has dosed 15 patients, so the company likely has data on 3x more patients at the 0.7mg/kg level than in the polyneuropathy arm.

Intellia has announced they will present data from their NTLA-2001 cardiomyopathy arm in the 2nd half of 2022. It’s likely the cardiomyopathy data Intellia presents will show a greater than 90% knockdown in their preferred 0.7mg/kg dose. This rapid, deep reduction is why management believes NTLA-2001 has the potential to outperform both Alnylam’s both patisiran and vutrisiran. On the latest conference call, Chief Medical Officer, David Lebwohl, stated;

We’re seeing the Alnylam study sort of as a wind to our back to figure all this out. We’re going to see the results of that and help us really understand what we need to do to see an outcome study. And again, we have this advantage that by getting deeper reductions, we can anticipate a better result than what they’ll see with that – with any of the agents because none of them achieved the type of TTR reduction that we can achieve.

Takeaway

There’s no doubt, Alnylam is the current leader with their approved therapeutic, patisiran, in ATTR – polyneuropathy and its likely approval for ATTR – cardiomyopathy. The latest positive topline results from the APOLLO-B trial help de-risk the platform, as is clearly seen by the market’s reaction to the stock. However, Intellia is hot on their heels with the initial data they’ve presented. Since Alnylam has proven the reduction in circulating TTR results has improved clinical outcomes, it reasons to believe that a deeper and more rapid reduction in TTR, provided by Intellia’s NTLA-2001, could yield additional benefits, especially in cardiomyopathy patients suffering from heart failure.

To be clear, Intellia still has a number of questions to answer and is likely 2-3 years behind Alnylam in getting NTLA-2001 to market. While early data has been impressive, Intellia still has not presented clinical improvements for patients, which should come as the data progresses. In addition, Intellia has only dosed 30 patients and presented data on 15 patients to date. The company needs to replicate early success across a larger patient population, in order to rival Alnylam’s data.

The upcoming data release by Intellia for patients with cardiomyopathy will be a huge catalyst for the stock. If their cardiomyopathy data mirrors their polyneuropathy data (shown above), it sets the stage for Intellia to potentially one-up Alnylam with better clinical outcomes for those patients suffering from advanced stages of cardiomyopathy. It’s important to remember this is a progressively fatal disease, so patients are desperate for the best therapy out there.

Cash Burn & Risks

One major question for all biotech companies is their cash on hand and cash burn. Currently, Intellia is well-positioned with just over $900 million in cash, thanks to well-timed stock offerings. Even with a rapidly expanding pipeline, management expects their current cash balance will fund operations for at least another 24 months. However, investors should expect further stock offerings following positive data that results in an appreciation in stock price. The company has utilized this strategy in the past and will likely do so going forward.

Alnylam is a more advanced biotech with a mid-point revenue guidance for FY2022 of $900 million. An approval of patisiran in ATTR-cardiomyopathy would turbocharge this revenue, but it does need to be said that the company is currently losing around $250 million per quarter as the company has numerous advanced clinical trials requiring large amounts of R&D. However, like Intellia, Alnylam is extremely well positioned to sustain operations with over $2 billion in cash. At current levels, the company can fund operations well into 2024, but I’d expect the cash burn to slow significantly when patisiran gets approval for cardiomyopathy.

While these 2 stocks are both lumped into the biotech sector, they are at much different positions along their growth trajectory. Alnylam has several approved therapies bringing in revenue and with the positive top-line results in the APOLLO-B phase 3 trial, they have largely de-risked the platform and are poised for rapid revenue growth. The addressable market in ATTR-cardiomyopathy is around 3 times the size of polyneuropathy and as stated above, Alnylam has earned around $550 million in the last 12 months from patisiran in their approved polyneuropathy population. I believe the risk to Alnylam comes from Intellia’s potential superior therapy eating into their revenue in ATTR. The market has assumed approval of patisiran in cardiomyopathy and added around $10 billion to their market cap as a result. If Intellia shows a rapid TTR knockdown of 90% results in improved patient outcomes, Alnylam will lose its status as the clear leader in ATTR.

Intellia has a much more volatile path forward than Alnylam does. To date, Intellia has only shown results from a single phase 1 trial. The risk to Intellia comes from a potential stumble in clinical outcomes or safety concerns from their treatments. While Intellia is well off their 2021 highs of $180/share, it could fall much further if safety issues creep up. However, the upside potential in the stock is much higher from current levels.

Conclusion

At this point, Alnylam is the safest pick in the space, but Intellia has the potential to be a best-in-class therapy with huge upside. These stocks likely attract investors with much different investment strategies. Alnylam has proven therapies and a large pipeline of promising therapies. At around $215/share, Alnylam is a great stock to buy and hold and enjoy the growth as their large pipeline continues to translate into revenue.

Intellia is a high-risk, high-reward stock at current levels under $60/share. A downturn in the market, especially in the early-stage biotech industry has left the stock down 50% YTD. However, the company is well capitalized and has a number of important catalysts in the next several months. A positive data release in cardiomyopathy would likely propel the stock price to the next level of resistance around $75/share. It could go higher, but investors should remember this is still a phase 1 trial and clinical outcomes will not be presented, only efficacy and safety data. Investors looking to establish a position in Intellia should be comfortable with volatility as there are many questions left to be answered.

Be the first to comment