Ivan-balvan

Investment Summary

The aesthetic and constructive surgery market has been a growth sector over the past 5 years to date and is poised to continue along this trajectory. The global market was valued at a range of $46-$67 billion in FY21, with research estimating CAGR of 11.6% into FY30. Contrary evidence alludes to a slower 3.6% geometric growth into FY28, and these numbers form a solid bedrock for Establishment Labs Holdings Inc (NASDAQ:ESTA) to build upon into the coming years.

Despite the market growth, ESTA has yet to deliver on its growth front in terms of profitability and earnings. With these trends forecast to continue into FY24 at least, I’ve rated ESTA a hold. Note, I do not discuss ESTA’s product offerings in detail here [feel, use, efficacy, etc.]; however, I do note there is key differentiators within its products that have been identified by the sell-side. Instead, I’ve taken a hard data approach in order to make some more objective decisions.

Fair view of fundamentals

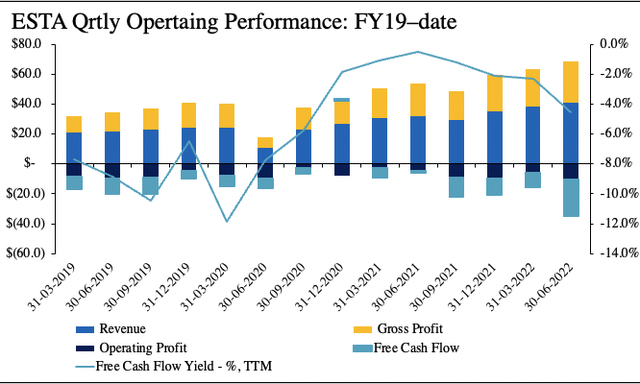

Since listing, the company has demonstrated a series of ongoing operating losses and remains unprofitable. As seen in Exhibit 1, each of revenue and gross profit have lifted on a sequential basis since FY19. However, this hasn’t been carried to the bottom line, with operating profit and free cash conversion both equally as light over this time. The result has been a retained deficit of $249mm since listing, up from $206mm the same time last year.

Exhibit 1

Data: HB Insights, ESTA SEC Filings

Meanwhile, realized FCF yields have remained equally have remained in the red up until date. Whilst there’s been some uplift in FCF yields this has occurred on a widening FCF deficit. This would actually be preferential, the negative FCF prints, if the company were generating a positive return on this invested capital, or turning a profit from its already existing investments/assets.

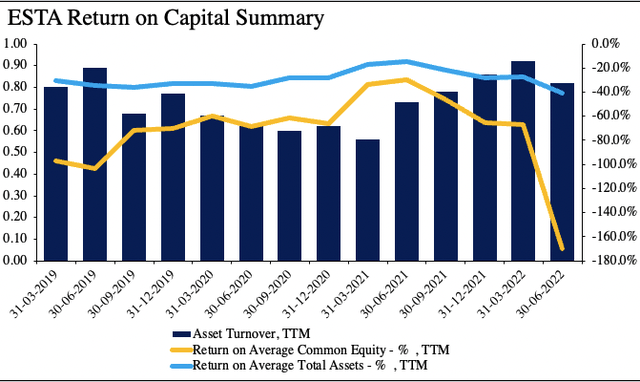

However, as seen in Exhibit 2, this hasn’t been the case. The company has recognized deep, ongoing losses from its ongoing investments. In terms of profitability, ESTA doesn’t pass the litmus test that I’m placing it against – one of either steady, or growing return on capital. Instead, the loss on capital investments continues to widen, and this weakens ESTA’s fundamental momentum coming into the forward-looking economic climate.

Offsetting these pressures is the fact the company generates $0.80 in revenue for every $1 invested into its asset base, suggesting that it is managing its current investments well. This is something to be considered in the investment debate, because whilst it’s important to gauge a company’s return from its invested capital, it’s also equally valuable in understanding how it’s managing its existing investments.

As the cost of capital continues to increase, and liquidity for funding dries up, it is these features that will help ESTA continue on its upwards trajectory, in my estimation, in that it won’t be forced into raising additional capital to fund further investments – it’s generating anywhere from $0.80-$1.00 for each dollar invested anyways.

Exhibit 2. Return on ongoing investments not an appealing feature, but turnover from existing capital is

Image: HB Insights, Data: HB Insights, ESTA SEC filings

ESTA Q2 earnings exhibit growth trends

The company came in with a mixed set of numbers last quarter, beating consensus at the top-line but missing at the bottom. Revenue of $41.2 million (“mm”) was a YoY growth of 28.7% with a c.500bps Forex headwind reflected in this result. Direct sales formed the bolus of turnover with 41% attributed to this channel, whereas Europe was the major jurisdiction with 32% of sales and APAC with 33%. Brazil was the standout market for the company with 16% of sales from this single domain.

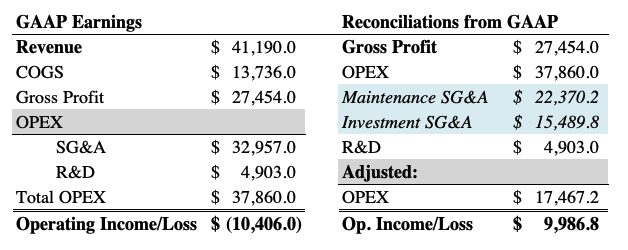

Gross margins tightened by ~160bps YoY to 66.7% and lead to a gross profit of $27.5mm, up ~28% YoY. Meanwhile, the company saw 50% headwind at the SG&A line with an $11mm YoY increase to $33mm, but this was also a reflection of investment into the Mia launch.

Of this amount of SG&A, I estimate ~47% or ~$15.5mm was in marketing investment vs. expenditure based on language used in the company’s 10-Q. I’d also re-classify the company’s R&D expenditure of $4.9mm to be an investment vs. expenditure as well. Therefore, whilst OPEX for the quarter came in ~45.2% higher YoY at $37.9mm, when adjusting for these figures, OPEX comes in at $17.5mm, as seen in Exhibit 3.

Moving down the P&L, it brought this down to a net loss of $10.4mm or a loss of $1.52 per share, versus the $4.6mm loss / $0.22 per share from last year. However, after the adjustments I made to OPEX above, the loss is $16.7mm.

Exhibit 3. Adjustments from GAAP earnings to recognize investments the company made during the quarter that are treated as expenditure

Note: Adjusted figures contain capitalized investments from SG&A and R&D under IFRS stipulations. (Image: HB Insights. Data: HB Insights, ESTA SEC Filings)

Technical factors

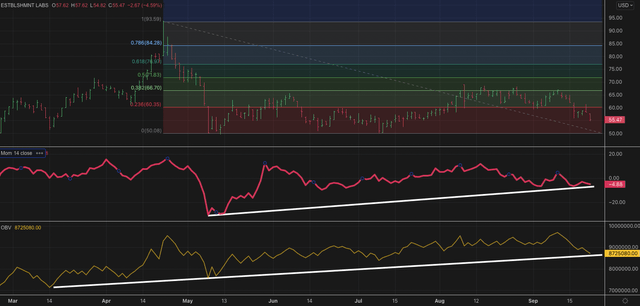

On the charts, shares have been trading in sideways territory for the good part of 2022. As seen below, when drawing the fibs down from the May highs to the June/July lows, shares had reclaimed at least 38% of the move before turning back to the downside. It had tested the $65 mark as shown below 4 times and was rejected each time. It is now looking to test the $60 mark and needs to gather support at these ranges in order to retrace a target of 50% of the previous down-leg, and this would sit at approximately $70.

In support of this, long-term trend indicators have been worming higher across the entirety of 2022, and there is now a dislocation in the direction of these indicators to the evolution of the ESTA share price. As seen below, this convergence of both trend indicators to the upside is creating a squeeze on the share price from the bottom, and may serve as buying support with a pullback to range. In my estimation, shares trading sideways with increasing momentum and volume is indication of long-term bullish support.

Exhibit 4. Tested $65 x4 before rejecting to the downside. Long-term trend indicators rising with sideways price distribution = bullish support in my estimation

Data: HB Insights, Refinitiv Eikon

Forecasts and conclusion

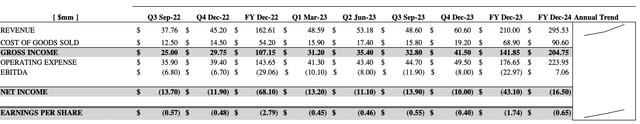

Into the coming years, I believe ESTA will remain unprofitable as it reinvests heavily back into its pipeline and growth operations. I’ve forecast top-line growth at CAGR 22% into FY24 and see earnings stretching up to a loss of $0.65 per share by FY24 from a loss of $2.79 per share in FY22. It’s not unreasonable to foresee ESTA printing a gross profit of $107mm in FY22 and this lifting to $204mm over the forecast period shown.

It then becomes a question of whether the market will continue rewarding unprofitable names with cash flows priced out into the future from FY22 and beyond. Sure, over the past 5-10 years this has been the case, where investors have paid exorbitant multiples for unprofitability, however, this trade has exhausted itself in 2022. Looking ahead, I believe the company’s lack of profitability to be a key risk and have opted to sit on the sidelines for this reason in ESTA, preferring to buy names that are generating sufficient return on investment and growing earnings further into the black.

Exhibit 5. ESTA forward estimates, FY22-FY24, quarterly and annual

Note: All figures presented in GAAP format with no reconciliations. (Data: HB Insights Estimates)

Net-net, I’ve rated ESTA stock a hold right now on lack of cash earnings and profitability. Whilst there are numerous strengths in the company’s individual product offerings [not discussed here], after taking a hard data approach to examination, it appears there may be more selective opportunities elsewhere in this domain. On this basis, and due to the unpredictability of the company’s cash flows into a weakening economic climate and increasing discount rate, I do not provide a price target at this point.

Be the first to comment